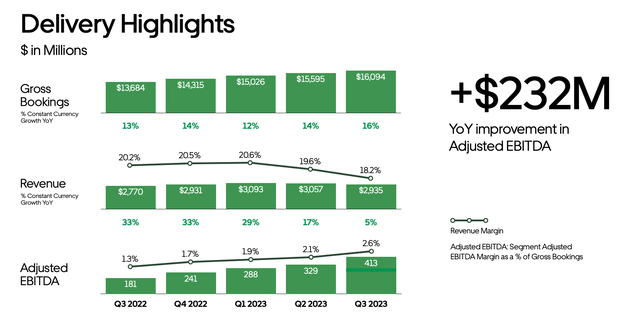

Let’s face it: a lot of things are going right for Uber (NYSE:UBER) right now. Rideshare demand continues to soar, delivery demand is growing even after the pandemic bump, and Uber’s stock just got added to the S&P 500. It’s the perfect storm of powerful catalysts that has fueled a ~140% rally in the stock since the start of the year.

The bull case for Uber shines bright, especially as it continues to edge out Lyft

The question many investors are asking now is: is the party about to end for Uber, or is there still upside left in this rally?

I last wrote a bullish opinion on Uber in September, when the stock was trading closer to $45 per share. Since then, Uber has rallied more than 40%: yet I’m still holding firm to my position and reiterating my bullish point of view. I continue to be impressed at Uber’s market share growth in the U.S., as well as the progress that it’s making across each of its lines of business. Uber is starting to truly show economies of scale.

At the same time, since September, both Uber and Lyft have reported third-quarter results: and it’s a tale of two entirely different companies. Despite its substantially larger scale, Uber also continues to grow at a faster pace – while also managing a number of segments outside of pure rideshare.

Here’s a refresher on what I view to be the core bull thesis for Uber:

- Huge $13.8 trillion TAM and “other bets” to support continued expansion. Mobility and Delivery each carry $5 trillion market opportunities, and nascent Uber Freight is another massive $3.8 trillion market that is heavily underserved and ripe for tech disruption. Grocery, package delivery, and the potential release of task fulfillment are other nascent ways in which Uber is expanding its dominance.

- Formidable market leadership. In most of the markets that Uber operates in, the company has a leading market share, and usually by a substantial margin. The company has selectively exited markets where it lost share to a local incumbent (Grab in Singapore is a good example), so it can focus on turf where it has the advantage. And in Freight, Uber’s profitable lines of business can support weaker enterprise freight demand while specialist rival Flexport declines.

- The sharing economy is gradually taking precedence over ownership. Even pre-pandemic price inflation caused many to rethink buying cars, many consumers were already questioning the wisdom of car ownership over rideshare. Owning a car comes with maintenance costs, insurance costs, and in urban areas, often hefty parking costs. Gradually, I expect car ownership to decline and for rideshare to become the preeminent form of transportation.

- Uber One. Uber introduced a $10/month subscription membership that offers, among other benefits, free deliveries on Uber Eats and 6% cash back on rideshare. In my view, this move will help to boost rider loyalty and frequency on top of generating a new subscription revenue stream.

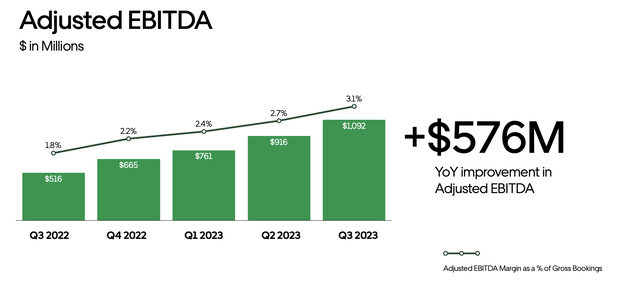

- Massive adjusted EBITDA and above GAAP profitability threshold. Driven by the uptick in rideshare volumes plus higher take rates in both the rideshare and delivery businesses, Uber is driving tremendous Adjusted EBITDA growth. In addition, the company recently crossed into profitability from a GAAP perspective, something very few tech companies achieve.

In my view, Uber is still in the early phases of capturing a tremendous market opportunity across its verticals – stay long here and keep riding the upward momentum.

Q3 download

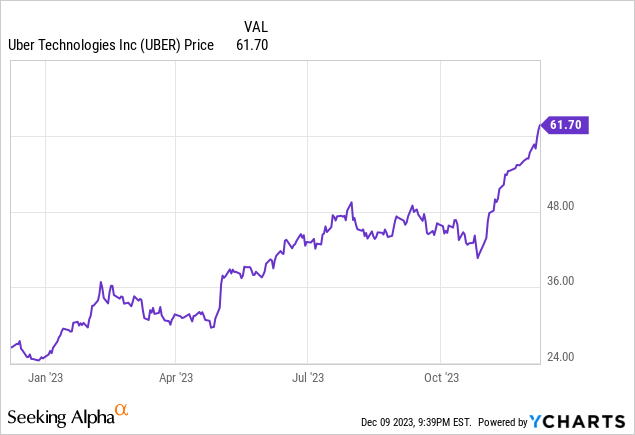

Let’s now go through Uber’s latest quarterly results in greater detail. In my view, the most impressive stat from Uber’s third quarter is that gross bookings in both of its core segments – mobility and delivery – accelerated from the third quarter, despite tougher year-ago comps and macro pressures.

Take a look at the Mobility results first:

Uber Mobility trends (Uber Q3 earnings deck)

Gross bookings grew 30% y/y to an astounding $17.90 billion. Two reasons this is impressive: first, the company accelerated two points against 28% y/y growth in Q2; second, Lyft’s total gross bookings in the same time period rose only 15% y/y to $3.55 billion. Uber’s rideshare business is growing at nearly twice the pace of Lyft, despite being more than 4x its size when measured in gross bookings terms.

A big reason behind this, of course, is Uber’s exposure beyond the United States (whereas Lyft is a domestic company). And in overseas markets, I especially applaud Uber’s product ingenuity in driving increased business.

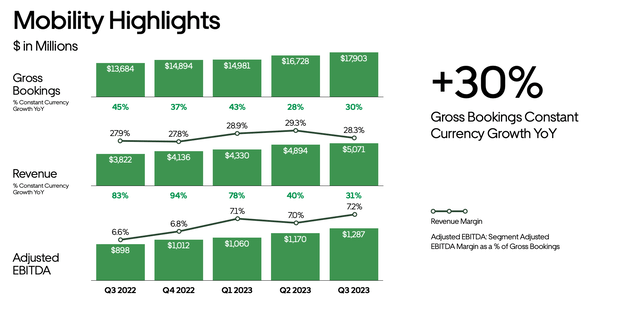

A good example of this is below: Uber Moto, the company’s cheaper motorcycle-hailing option that is most popular in Indonesia, India, and Thailand, saw a 100% y/y increase in trips.

Uber Moto (Uber Q3 earnings deck)

The company also noted that Uber Moto is an effective cross-selling tool for other Uber services. Uber’s long reach into these other countries gives it a tremendous growth pedestal and newer low-cost offerings help the company to position itself better against Southeast Asian leader Grab.

Here is some insightful commentary from CEO Dara Khosrowshahi’s remarks during the Q&A portion of the Q3 earnings call, detailing the company’s international growth levers:

So in terms of Q3, listen, the quarter was strong across the board in every single geography, pretty much in every single product. But a couple of geographies to call out are the Asia Pacific regions and the LatAm regions. These areas accelerated pretty substantially on a year-on-year basis between Q3 and Q2 on big absolute numbers.

And some of those countries were very early in penetrating. So, for example, in Japan and South Korea, our penetration rate is miniscule compared to where we are in the rest of the world, and some of the newer products that we’re building out, for example, Hailable Taxi are very large parts of the marketplace again in Japan and Taiwan and Hong Kong and South Korea.

Then we got products like Moto, which are two-wheelers that are growing very, very quickly in Latin America as well in Brazil and a number of other LatAm markets. So while the growth was pretty broad, I do think that the APAC and LatAm markets, in particular, were super strong, partially because of some of the newer products that we’re rolling out.

And then if you look more broadly, we had a very, very strong summer augmented by travel. As you know, travel has been absolutely booming. Leisure travel and Uber has a very high penetration of all the travel consumer. And then what we’re seeing now back-to-school is also going very, very strong. So that absolutely added to our Q3 strength and acceleration that frankly surprised us in terms of its strength.”

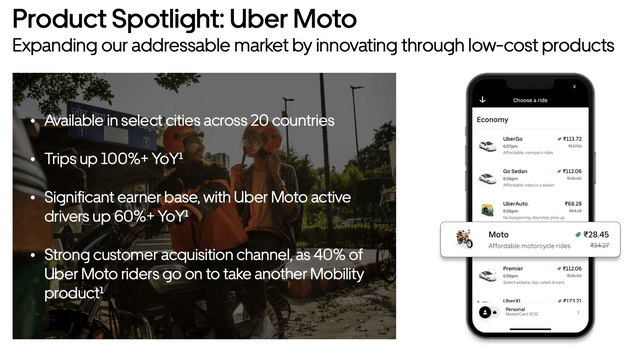

Meanwhile, in Uber’s delivery business (which many onlookers thought would decline post-pandemic), the company also managed to accelerate gross bookings to 16% y/y, up from 14% y/y in Q2:

Uber Delivery trends (Uber Q3 earnings deck)

Operating leverage in the delivery business (which used to be a large loss-leader in the pre-pandemic era, as longtime Uber investors will painfully remember) has also helped the company to drive substantial adjusted EBITDA growth, which more than doubled y/y to $1.09 billion.

Uber adjusted EBITDA (Uber Q3 earnings deck)

As a percentage of bookings, this increased by 130bps y/y to 3.1%; but as a percentage of revenue, which most investors would think of as “true” adjusted EBITDA margin, margin increased 560bps y/y to 11.8%.

Note lastly that even the beleaguered areas of Uber’s business are seeing improvement. Freight, Uber’s third major segment and a ~15% contributor to revenue (though less than 5% of bookings, as take rate in this segment is higher), declined -27% y/y – three points better than -30% y/y in Q2. As many investors are aware, this is the most macro-impacted portion of Uber’s business that has suffered from lower enterprise demand and softer shipping rates.

I’d argue, however, that this freight situation may be a long-term benefit to Uber from a competitive standpoint. While main rival Flexport, a Silicon Valley darling during the pandemic, is suffering (having recently announced a layoff of ~20% of its staff), Uber has its two other very profitable segments to tide over its freight operations until macro conditions clear up.

Key takeaways

It’s difficult for me to envision a future in which Uber doesn’t continue to dominate the mobility and delivery markets. Its recent inclusion in the S&P 500 is a leading indicator of a business that has become and will continue to be, a core facet of modern life. Stay long here.

Read the full article here