UiPath (NYSE:PATH) has been one of the most hyped IPOs of the COVID bubble and has since dropped over 80% to its lows until it recovered in 2023, now down 62% since IPO. The company operates in a high-growth market, so let’s take a look without further ado.

Robotic Process Automation Industry

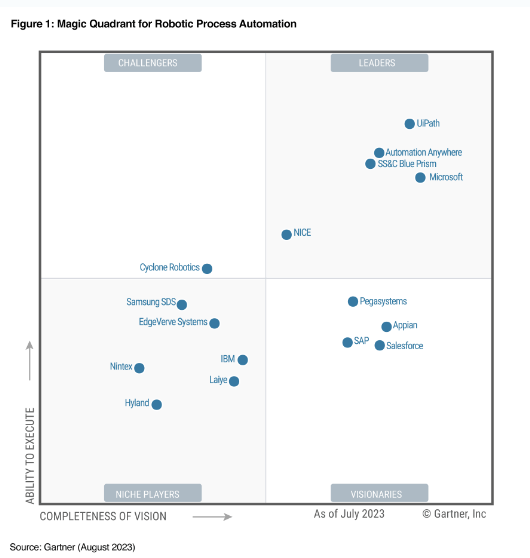

UiPath operates in the Robotic Process Automation (RPA) industry and is a market leader. RPA aims to automate simple workflow processes, like inputting data and navigating through a form. RPA is still an industry in its infancy and several research firms, like Grand View Research, expect it to grow at over 35% CAGR through 2031. According to Gartner (IT), UiPath is leading in the industry. Still, with a market growing as rapidly as RPA is, new entrants are always coming in. Microsoft (MSFT) is already a leader, according to Gartner and Salesforce (CRM) is on a good way to get there, too. While UiPath is the leader, I expect increased pressure from these big players, as they already have customers inside their ecosystem and can gain market share even with an inferior product. I wouldn’t count on PATH matching the industry growth rate; rather, it may lag it a bit.

Gartner Magic Quadrant RPA (Gartner)

The large SMB opportunity

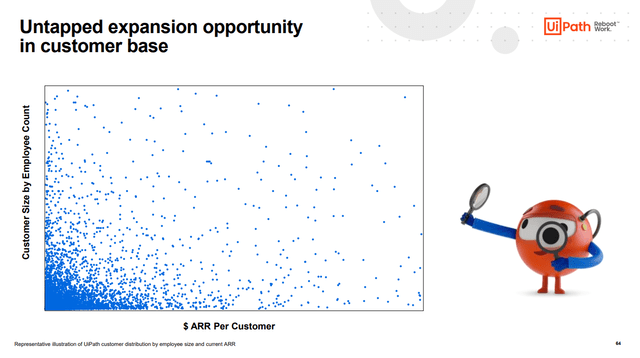

UiPath is transitioning to a platform model where they are looking to upsell customers effectively by suggesting opportunities for high ROI process and task improvements with its technology through process and task mining. Once opportunities are found, they want to engage the customers and implement the solution. This should be a win-win situation, as the customer frees up valuable employee time and can use it for tasks with higher value creation. UiPath grows with its customers, so they can accelerate scaling the existing customers by finding new high ROI automation opportunities for them.

Growing existing customers (UiPath Investor Day)

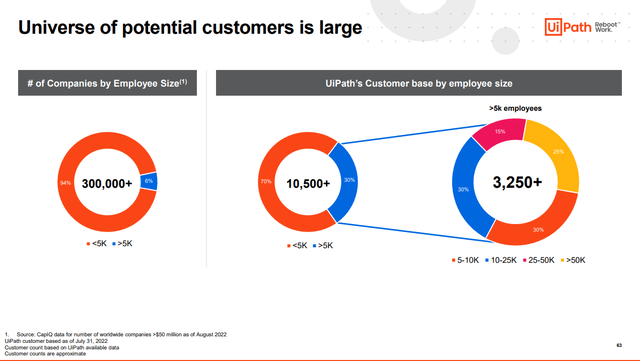

The research report above suggests that small and medium businesses (SMBs) are the fastest-growing segment in RPA. Often, when a new technology goes mainstream, it is first adopted by large corporations and eventually adopted by small businesses with smaller budgets. We can see below that UiPath has a disproportionally high number of large customers compared to the overall number of businesses. A way to push these solutions out to smaller customers is through partners. PATH is partnered with five distributors and 5000+ value-added resellers.

Disproportionally high large enterprise customers (UiPath Investor Day)

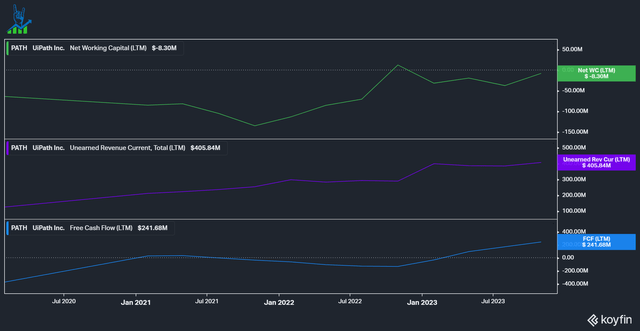

Due to the nature of the business, most sales are recurring, driving negative net working capital. This can be a strong driver of cash flows for SaaS businesses and is an opportunity for PATH to optimize.

Negative net working capital (Koyfin)

Risks

The most significant risk I see for PATH is larger-scale players taking a share in the market. Microsoft and Salesforce especially are a threat due to the long-standing customer relationships and ability to bundle up RPA services into existing contracts.

AI also could pose a threat, as it could enable new competitors to develop solutions faster. While I don’t think this will have too much of an impact, and UiPath can leverage AI as well, it could make the battle for low-hanging fruit (easy automation jobs) tougher. These low-hanging fruits are often a way to get a customer relationship going and upsell them.

Valuation

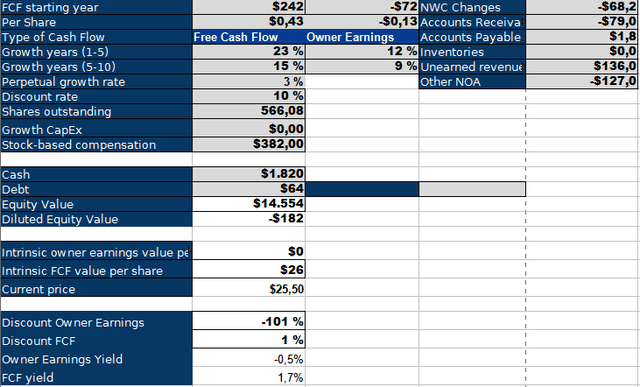

To value UiPath, I’ll use my usual inverse DCF model and think about future margins. UiPath is issuing a lot of stock-based compensation to its employees and management, as most SaaS companies do. This makes my owner’s earnings negative and unusable. Based on a pure Free Cash Flow DCF model, UiPath must grow 23% for the next five years, followed by 15% for the next five.

UiPath Inverse DCF Model (Authors Model)

Below is a table with the long-term margin expectations (all are non-GAAP). PATH sees tremendous cost-saving potential in S&M and I believe is likely lowballing gross margin (I expect them to stay in the high 80s). I hate that only talking about non-GAAP metrics leaves out the tremendous stock-based compensation expense, which far exceeds operating profit and free cash flows. Based on the long-term outlooks, we could see operating margins between 18% and 31%, potentially higher if the gross margin exceeds 80%. As the business scales, they will hopefully scale back stock-based compensation, but even if they don’t, they will eventually become GAAP profitable, probably around a 10% margin. This is a pet peeve I have with most high-tech companies; pretty much all of them do this. I believe that SBC should be seen as an expense because it is diluting the shareholders. Even though SBC as a percentage of revenue is high, it only led to a 10% dilution since the IPO due to the high valuation UiPath has.

| Last Quarter | Long-term expectation | |

| gross margin | 87% | 80%+ |

|

sales & marketing |

46% | 30-35% |

| research & development | 16% | 12-18% |

| general & administrative | 10% | 7-9% |

| operating margin | 13.4% | 20%+ |

| stock-based compensation | 29% | no information |

| GAAP operating margin | -17% | no information |

Conclusion

I’ve been debating whether or not to give PATH a buy or a hold rating, but I ended up with a hold. PATH is operating in a fast-growing market with significant operating leverage, which it can unlock by managing S&M as it scales. This should allow them to grow by the required growth rate in my FCF inverse DCF model. I am, however, unsure about the dilution, especially as the company matures and the multiple will come down. Due to this uncertainty, I will leave it at a hold rating.

Read the full article here