Ulta Beauty (NASDAQ:ULTA) has proven resilient despite the large number of headwinds it has faced. Despite increasing e-commerce penetration, intensifying competition, and the Covid pandemic, the company has been able to keep growing and delivering higher earnings per share.

Part of this resilience comes from its broad diversification across cosmetics, fragrances, skin care products, and beauty services. The company also reduces risk to changing consumer preferences by working with roughly 600 well-established brands, some of which target the mass consumer and others the more affluent customers that prefer prestige brands. The company has proven very adaptable, launching its own private label as well, and selling products using an omni-channel strategy. Ulta Beauty currently has around 1,350 stores, mostly in off-mall locations, 421 Ulta Beauty stores inside Target (TGT) after opening 62 stores through this partnership last quarter, and it sells digitally through its website and app. Importantly, the company is increasingly fulfilling ecommerce orders from ~400 strategically-located stores, which has enabled faster and more cost-effective delivery. This is a smart way to leverage its store footprint, which the company has said remains key to its strategy as more than 75% of their customers buy only in stores, despite many of them using the digital platforms to browse products.

Q3 Preview

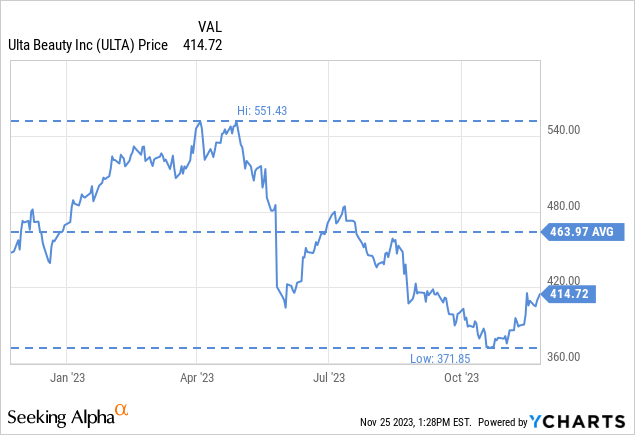

Despite a recent bounce from a 52 week low, shares remain below the price they were at one year ago. We believe this is the result of several headwinds that have impacted the company and its customer base. Many of these headwinds were mentioned during the last earnings call, where the company also made it quite clear that Q3 results are likely to be weak, with EPS likely down by a high single digit percentage.

In the prepared remarks, the company made clear that 2021 and 2022 had seen an unsustainably low promotional environment, which is likely to start normalizing, affecting gross margins. Ulta said that it expects comps to moderate to the low single digits in the second half of 2023. On the positive side, the company remains on track to open 25 to 30 new stores, and to renovate or relocate 20 to 30 stores this year. In any case, the company was very straightforward that the operating margin is very likely to decline in Q3, with CFO Scott Settersten saying the following:

For modeling purposes, we expect third quarter operating margin will be meaningfully more pressured than what we saw in the second quarter as we lap greater pricing benefits in the third quarter last year, as well as a shift of investment spending from Q2 to Q3. As a result, we expect earnings per share for the third quarter will be lower than last year.

During the Q&A session an analyst asked if EPS could be down by a high single-digit percentage, to which Scott Settersten replied that he didn’t want to quantify it, saying:

Yes. We don’t want to — into quantifying it specifically, Adrienne. But I’d say directionally, you’re in the right zip code. So yes, on the SG&A side, that’s roughly the shift back into the third quarter on some of the IT spend. And yes, operating margin is going to be down meaningfully versus what we saw earlier this year, and that’s going to result in negative EPS growth year-over-year for the third quarter.

Weakening Consumer

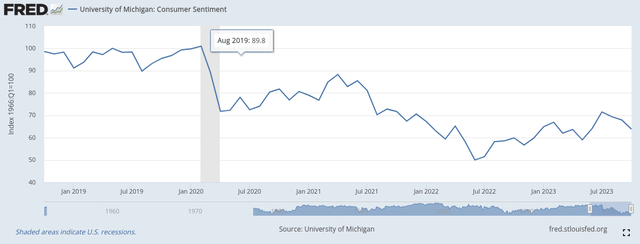

The company seems to be right that there are risks to reduced overall spending, including higher household debt servicing costs, student loan repayments restarting, and weak consumer sentiment in general. Federal student loan interest resumed on September 1, 2023, and payments restarted in October 2023.

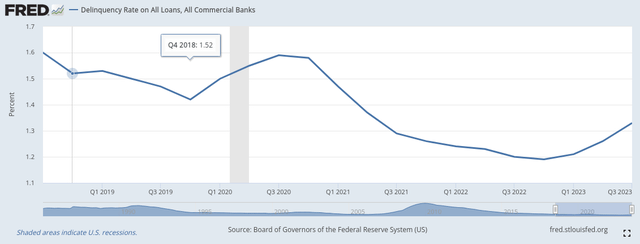

Despite being still at a relatively low level, there has been a recent uptick in loan delinquencies, which is likely to keep increasing as the effects of higher interest rates propagate through the economy.

FRED

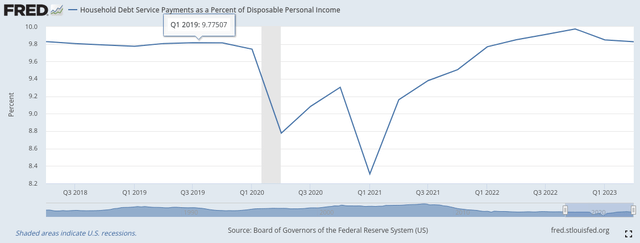

Household debt service as a percentage of disposable personal income, and it is likely to increase further as refinancing becomes more expensive as a result of the rapid and aggressive FED interest rate increases.

FRED

It is therefore not surprising to see consumer sentiment still at very low levels, and significantly below pre-Covid numbers.

FRED

Financials

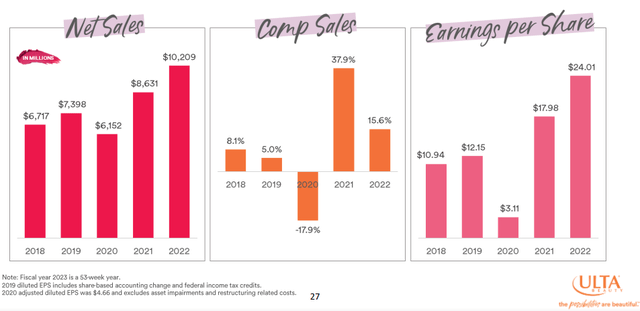

To the company’s credit, they have managed to grow the company and adapt to changing environments quite successfully. It even managed to post a profit in 2020, and its sales are ~50% higher compared to pre-Covid.

Ulta Beauty Investor Presentation

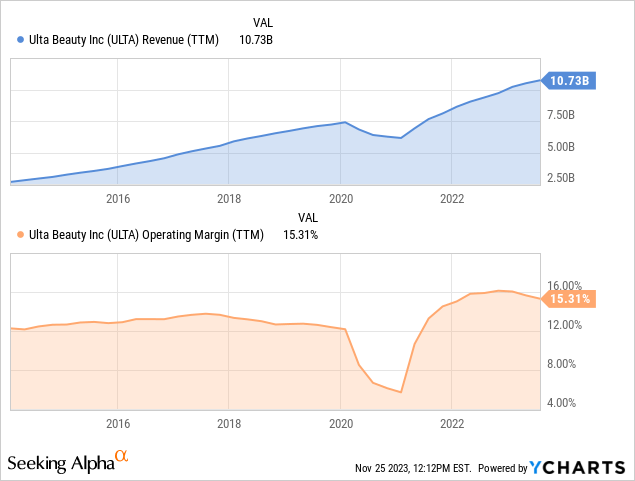

Looking at the revenue chart for the last ten years, it appears the company is back to trend, with the worst of the Covid period as just a bump in the road regarding its growth. The company was able to increase its operating margin above pre-Covid levels, partly as a result of a lower promotional environment, but that seems to have started normalizing.

After reaching ~16%, the company is now expecting operating margins for the year to be between 14.6% and 14.8%, with deleverage to come from gross margins and SG&A. The company is facing higher levels of shrink, which is a fancy way of saying product theft, and higher promotional activity and supply chain costs.

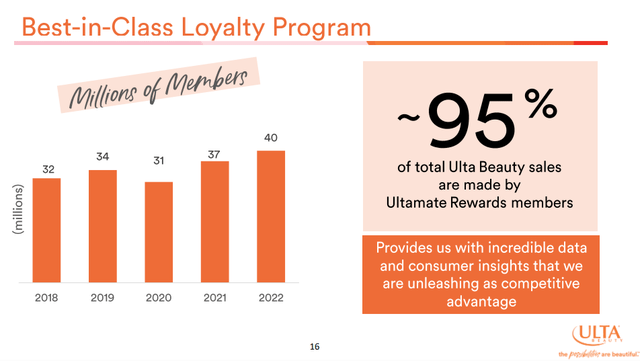

The Crown Jewel: The Loyalty Program

One key data point for us in analyzing the health of the company is the number of active members in its loyalty program. It reported ending last quarter with 41.7 million active members, 9% higher when compared to last year. The average spend per member also increased thanks to higher shopper frequency. This program gives Ulta Beauty a competitive advantage by increasing switching costs, and giving it more insights into its consumer preferences. Something that was particularly impressive was that the Diamond and Platinum tiers increased roughly 30% compared to the same period last year. Platinum members are those that spend over $500 per year, and Diamond members spend over $1,200 per year.

Ulta Beauty Investor Presentation

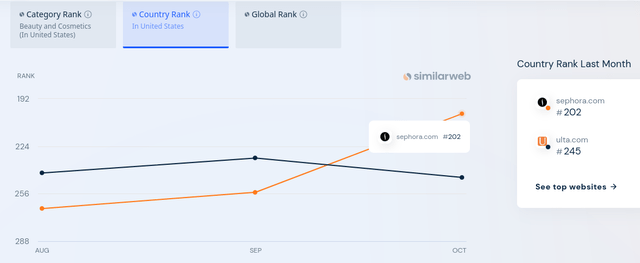

Intensifying competition

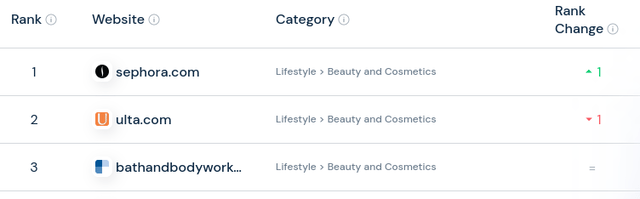

However competitors are not standing still, and some like Sephora are increasingly posing a threat to Ulta Beauty. Sephora is part of the luxury group LVMH (OTCPK:LVMUY) and has been aggressively growing in the US, and it appears its website now gets more visits than Ulta Beauty’s website.

SimilarWeb.com

According to SimilarWeb, Ulta is now in second place in the US for its category, below Sephora but still ahead of Bath & Body Works (BBWI).

SimilarWeb.com

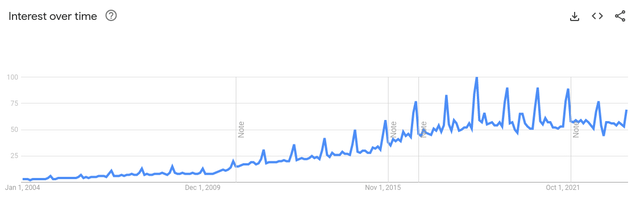

Looking at the search interest for Ulta using Google Trends, we see that it has stagnated in recent quarters. This is one more reason to moderate growth expectations for the company going forward.

Google Trends

According to the company, it is still taking market share overall from competitors. During the last earnings call Q&A session an analyst was very direct asking if the company is losing share, to what CEO Dave Kimbell replied that they anticipate gaining share for the year, even if there is a general slowdown.

Michael Baker

Thanks. I’m just curious, you said you expect the beauty industry to grow mid-single digits, yet you’re only expecting comps to be up low single digits. And even if you add in store growth, you’re still expecting to grow maybe up, but seemingly below the industry. I don’t suppose you guys think you’re losing share, so I’m just wondering if you can help flesh that out a little bit?

Dave Kimbell

Yes, I’d say, yes, we do anticipate continuing to gain share. We’ve done so through the first half of the year, and that is our outlook. The commentary is really as we look into the second half of the year, we see some strength. Engagement continues to be high. Certainly, our business is performing very well. We’re attracting new members. We’re growing across all key categories, both and then in both e-com and stores. But we also see some uncertainty as we get in later into the year. So while we’re confident in the category, we’re just incorporating into our outlook some full — some of that. And for the full year, we’re looking at revenue in the plus 8% to 9% range, so we anticipate gaining share for the year being ahead of the total category growth.

Shareholder returns

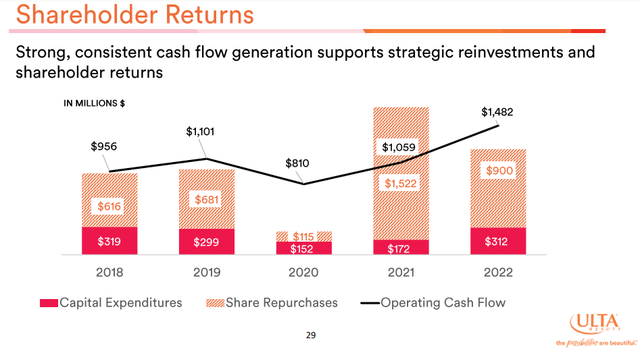

Unfortunately Ulta does not pay a dividend, but it still has been quite generous with shareholders with significant buybacks.

The company has been buying back around $1 billion per year recently, which puts the shareholder yield at ~5% given the ~$20 billion market cap. Despite the significant amounts used for this purpose, the company retains a strong balance sheet with $388.6 million in cash and cash equivalents at the end of last quarter, and basically no long-term debt.

Ulta Beauty Investor Presentation

Valuation

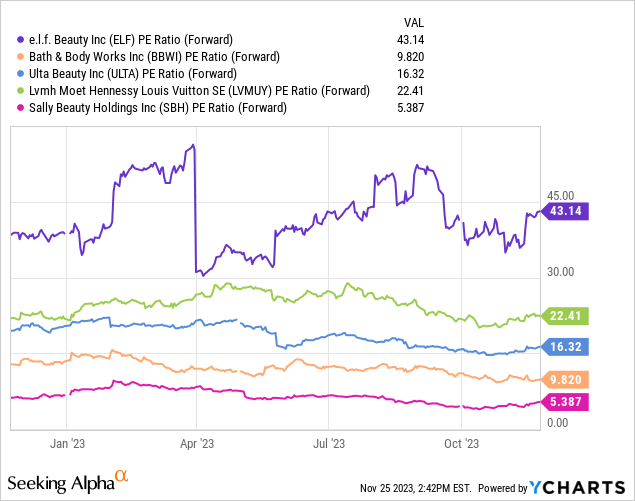

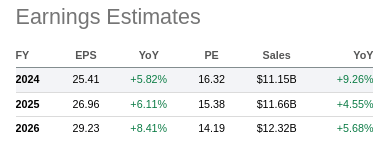

Compared to competitors like e.l.f. Beauty (ELF), Bath & Body Works, LVMH, and Sally Beauty (SBH), shares of Ulta Beauty are trading in the middle of the pack. Its forward P/E ratio of ~16x seems reasonable to us for the kind of growth the company is currently delivering.

Analysts are expecting relatively low earnings growth in the coming years, which we think is completely reasonable given the number of headwinds already discussed. Still, even if earnings growth moderates, we believe the forward p/e ratio already reflects some of this deceleration. At current levels we believe shares to be fairly valued.

SeekingAlpha

Risks

We believe in the short to medium term the biggest risk for Ulta Beauty is a potential recession, which the inverted yield curve has been predicting for some time now. In the long-term we believe the bigger risk is intensifying competition from the likes of Sephora.

Conclusion

Ulta Beauty is likely to report weak third quarter results next week, which should not come as a surprise to investors given the number of warnings the company gave in the previous earnings call. Earnings per share are likely to experience a high single digit decline compared to the previous year’s quarter. The headwinds the company is experiencing include a more promotional environment, higher shrink, supply chain issues, and a weaker consumer. It will be particularly interesting to see if the company mentions noticing an effect from the resumption of student debt payments restarting. Still, the current valuation already seems to reflect lower growth ahead and we view shares as fairly valued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here