Introduction

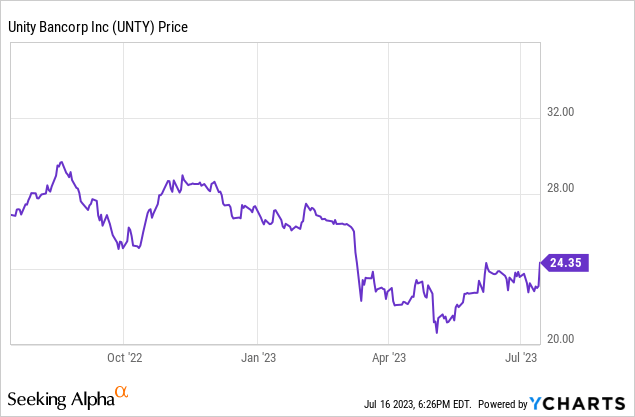

Unity Bancorp (NASDAQ:UNTY) is a New Jersey based regional bank with 21 branches (after opening its newest branch in Morris County) while working towards opening its 22nd branch this summer. With a total asset base of around $2.5B, this bank is in a good position to benefit from the economic resilience of its home state. The bank has historically had little exposure to investment securities and this has helped Unity to get through the March crisis relatively unharmed which allowed the bank’s management team to retain its focus on the net interest margins.

The net interest income in Q2 only decreased marginally

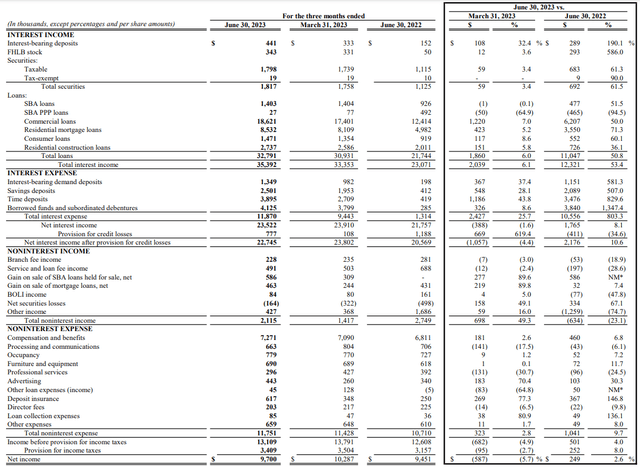

All eyes were on the net interest income in the second quarter of this year. And Unity Bancorp did relatively well as its interest income increased by around 6% to $32.8M but the total interest expenses increased by about 25% to $11.9M, and this resulted in a small decrease of the net interest income. It wasn’t too bad as the NII decreased by less than 2% to $23.5M.

Unity Bancorp Investor Relations

The bank also saw an increase in its non-interest income which jumped by approximately $0.7M due to the sale of SBA loans and mortgage loans with a profit. The total amount of non-interest expenses also increased, but by just $0.3M which means Unity Bancorp reduced its net non-interest expenses from $10M to $9.6M. The bank reported a pre-tax and pre-loan loss provision income of $13.8M which was pretty much in line with the $13.9M generated in the first quarter of this year.

That’s fine and although we should be mindful of the contribution from the sale of loans, it also is a good signal to the market that buyers are (in some cases) willing to pay a premium price for the mortgage loans on its books. The bank recorded a $0.8M loan loss provision in the second quarter resulting in a pre-tax income of $13.1M and a net profit of $9.7M. Considering there are approximately 10.1M shares outstanding, the EPS was $0.96 in the second quarter which is only slightly lower than the $0.98/share generated in the first quarter. The explanation is quite straightforward: as Unity Bancorp continues to buy back its own shares, the net income has to be distributed over fewer shares. The weighted average share count in the second quarter was approximately 4% lower than the 10.5M shares outstanding in the first quarter of this year and that helps to explain why the EPS decreased by just 2% although the net income (expressed in dollars) decreased by in excess of 5%.

The loan book: a high exposure to commercial real estate

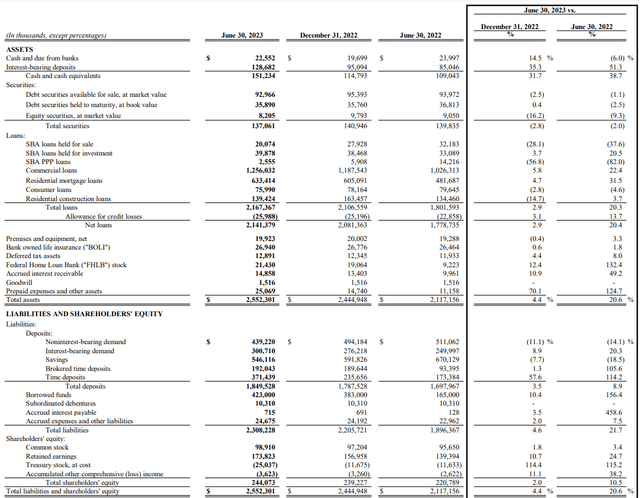

I wouldn’t read too much into the sharp increase in the loan loss provisions on a QoQ basis. And although the bank still has to publish its detailed quarterly report, it has provided us with an updated balance sheet.

As you can see below, the total amount of assets increased to $2.55B (an increase of almost $100M compared to the end of 2022) and the bank has elected to keep a relatively low amount of its assets in cash and securities. As of the end of Q2, the bank held $151M in cash and $137M in securities for a total of $288M which is approximately 12% of the total asset base and about 15.5% of the total amount of deposits. That’s a 120 bp increase compared to the 14.3% as of the end of last year, so it looks like Unity understood the danger associated with a lack of liquidity which caused a few banks to collapse earlier this year. It’s also important to see below that about 30% of the total amount of deposits are time deposits.

Unity Bancorp Investor Relations

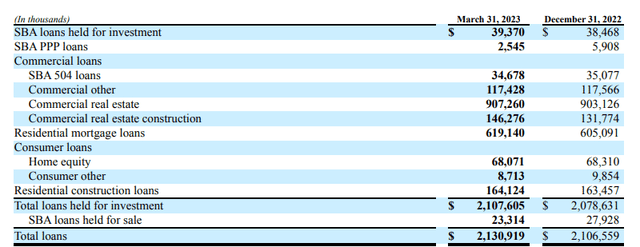

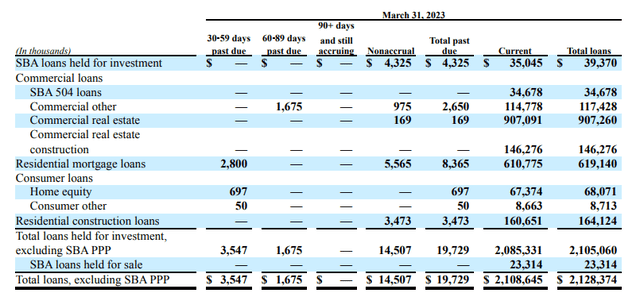

The bank hasn’t provided an updated breakdown of its loan book yet, but if we have a look back at the situation as of the end of Q1, we see the majority of the loans consists of commercial loans, mainly in the commercial real estate segment. It will be interesting to see if the bank made some tweaks to its breakdown.

Unity Bancorp Investor Relations

The $0.8M loan loss allowance on a $2.13B portfolio sounds pretty low but as of the end of Q1, only $14.5M of the loans were no longer accruing and a total of $19.7M were past due. Surprisingly, only $0.2M of that amount was related to commercial real estate and the majority was related to residential mortgage loans.

Unity Bancorp Investor Relations

It is a pity the bank has not disclosed and does not disclose the breakdown of its commercial real estate portfolio as I would be very interested in seeing the exposure to offices and the LTV ratios of that portfolio. And considering the residential mortgages appear to be the ‘problem child’ here, I would have loved to see some more details, especially as Unity Bancorp mainly underwrites mortgages to customers that would not qualify for conventional financing.

I’m not worried about the SBA loans and the SBA 504 loans. The latter are backed by real estate and the former are guaranteed by the SBA by up to 90% (and generally around 75% at origination).

Investment thesis

I understand Unity Bancorp is a small bank and doesn’t want to invest too much time and money in investor relations but providing a simple slide deck with some more details on the loan portfolio would have been helpful to decide whether or not a long position is warranted. The stock does not appear to be expensive at just around 6.5 times earnings and trading at its tangible book value, but the loan book is just a bit too much of a black box for me. Combine this with the decreasing net interest margin (4.04% during Q2, down from 4.19% and 4.47% in the two preceding quarters on a tax-equivalent basis), and I don’t think Unity Bancorp is the right stock for my portfolio.

Read the full article here