Universal Corporation (NYSE:UVV) sources leaf tobacco from the farmers and sells it to the global tobacco companies. Universal is a dividend aristocrat and operates in an oligopolistic market position. The stock has practically no analyst following and it’s likely that the stock is thrown into forbidden investments due to the connection to tobacco and agriculture.

Although its core market is in a secular decline, the market could dismiss the fact that it can still grow by increasing market share and by providing additional services. The company is also in the process of building another non-tobacco operating segment. Besides, less than 5% of cigarettes are consumed in the U.S. Universal has capabilities to supply its customers with nicotine for the NGPs, new generation products, which is a rapidly growing category.

Currently the stock is trading around its fair value, but the volatile stock price could present an opportunity to grab shares in a company that pays high and growing dividends. The stock is an interesting addition to a dividend income portfolio to boost yield.

Leaf tobacco trader is diversifying

Universal Corporation is an intermediary between tobacco manufacturers and farmers. Universal, established in 1918, buys, processes, and sells tobacco leaves. The revenues are derived from selling tobacco leaf to customers and processing the tobacco leaf owned by the customers. In the last fiscal year, ending in March, the company had revenues of $2.6 billion and employed over 28 000 people, of which 40% are full-time. 20% of the revenues are derived in the U.S., but leaf tobacco trade is conducted in dollars.

Universal’s strategic alternatives. (Company presentation)

The business is primarily conducted under fixed price contracts and shipping costs are included in the transaction price. Since the company primarily sells an agricultural product and seven customers bring in 60% of the revenue, it’s safe to assume that Universal doesn’t command much of a pricing power. On the other hand, Universal is one of the two major independent tobacco leaf suppliers, which could mean that its customers are dependent on the volumes Universal sources and processes.

In addition to the tobacco business, Universal has been diversifying into a segment the company calls Ingredients Operations, which business consists of fruit and vegetable processing services and extract, flavor and food ingredients products. Ingredients brought in approximately 11% of the total revenues in 2022.

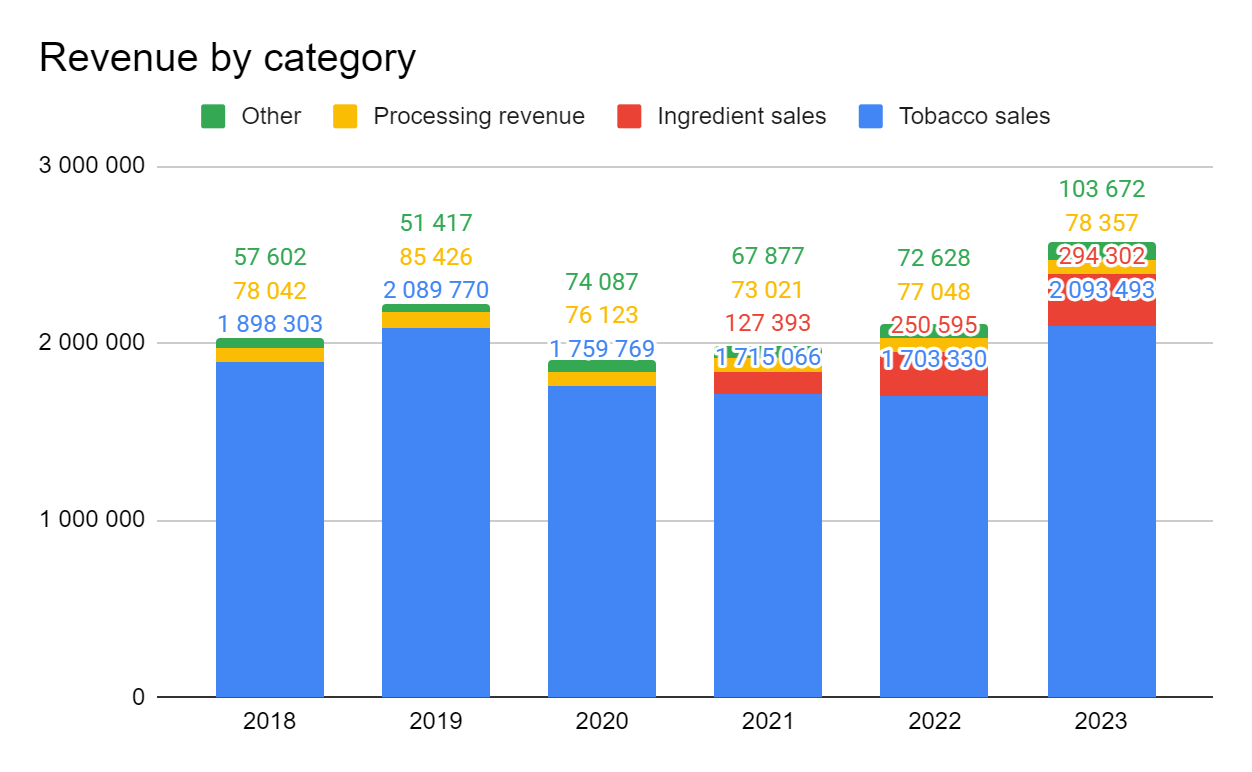

Revenue development by category. (Author, Universal 10-Ks)

The growth strategy of Universal is to strengthen its core business and provide increasingly services to its customers. Although the sales figures of processing revenue and other categories are small, they have been growing during the past three years. Unfortunately there’s no clear trend visible which would give indication that the company is successfully executing on its strategy. The revenue development is rather lumpy.

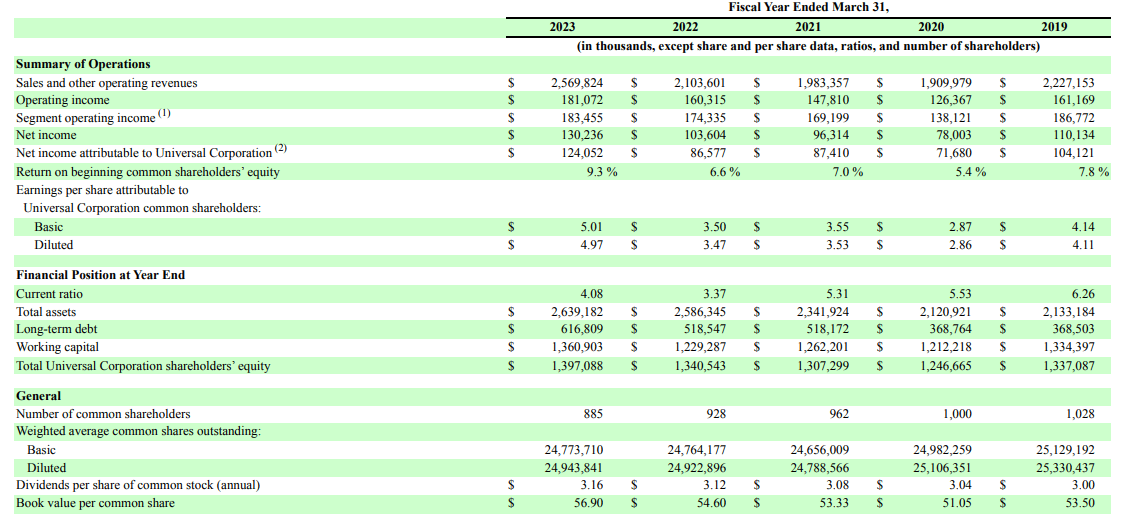

Financial development. (Universal 10-K.)

Long-term risks could be overestimated

Tobacco volumes are in a structural decline. According to Statista the global tobacco sales has declined from 5900 billion pieces in 2014 down to estimated 5320 billion in 2023. Tobacco companies have been revitalizing their business with new generation products, which don’t include tobacco but nicotine in other forms.

According to the company, consumption of American-blend cigarettes has declined at a compounded annual rate of 1.8% in the past five years. The declining tobacco volumes and rapidly growing new generation categories are clearly one of the largest threats to Universal, but there’s still decades to milk the cow.

Universal has a subsidiary called Ameri-Nic, which manufactures nicotine to be used in new generation categories. Ameri-Nic is mentioned three times in the latest 10-K without substance, which indicates the unit is rather small and might not do meaningful business in the growing market segment. Another, potential segment for Universal is cannabis, in a case of federal legalization, but that’s not where the investment case relies on.

Universal has been pursuing to de-risk its business profile out of the tobacco industry with a series of acquisitions. Universal acquired two companies in 2020 and one in 2021. Although the business has been growing well, in fiscal 2023 the operating income of the segment was lower than the year before. According to the management the decline was due to corporate overhead allocation and increase of sales and R&D resources. In May Universal announced a $30 million expansion project at Shank’s, which was acquired in 2021.

As a result of the acquisitions and increased inventory the net debt of Universal has increased significantly – almost doubled compared to fiscal 2019. Net debt to EBITDA currently stands at 3x. The outstanding debt has an average interest rate of 6.3%. The company has no long term debt maturing before 2028.

In fiscal 2024 the company expects to spend $65 to $75 million on capital expenditures, which is $10 to $20 million higher than in fiscal 2023. The company needs to release cash from its inventory and operating assets in order to fund the capital expenditures and a dividend payment of approximately $80 million. On the positive side, the increase in capital expenditures is used to grow the Ingredients business.

Safer buy zone is slightly lower

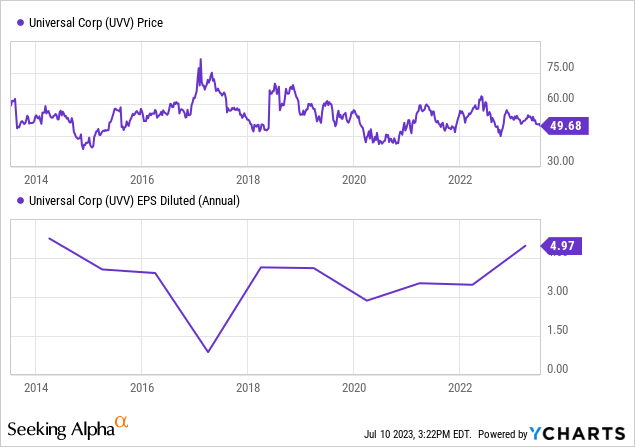

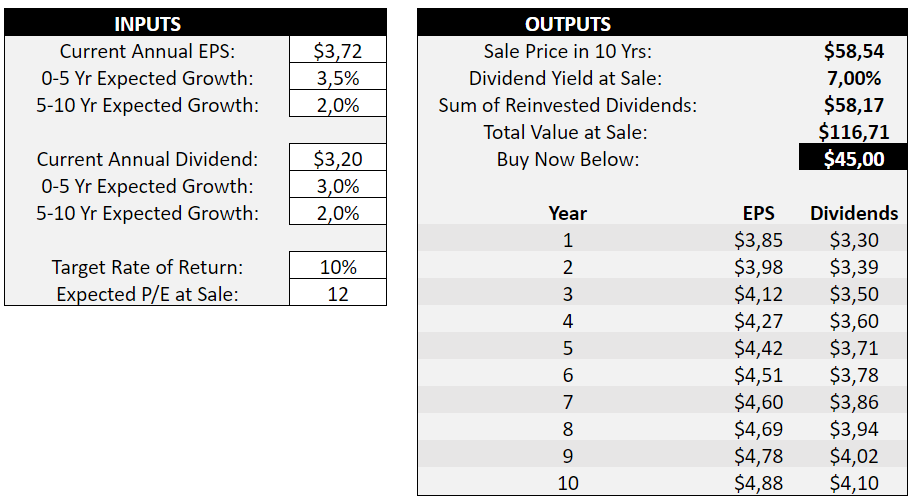

Universal has been producing relatively stable earnings per share over the years. Its 10-year average EPS is $3.72. Due to higher revenue and non-recurring items, in particular the favorable tax ruling in Brazil, the net income in fiscal 2023 was abnormally high and the company reported EPS of $4.97. This is unlikely to repeat and to ensure enough margin of safety the better starting point is the aforementioned 10-year average.

If we assume an EPS growth rate of 3.5% for the first five years and 2% growth rate for the following five years and dividend growing along with the earnings, the fair value of Universal would be $45 per share. Here we apply a 10% discount rate and terminal multiple of 12. The average 5-year EPS growth rate has been the same 3.7%, however the dividend has been growing faster.

Fair value calculation. (Author)

Due to lack of growth and rather low returns on capital, the stock probably doesn’t merit higher multiples in the current interest environment. The low returns on capital are a result of the high capital intensity. First, the company pays advances to the tobacco farmers, then stores the tobacco and delivers it to the customers that most likely have long payment terms.

The stable margin profile, rising dividend and a 5-year average P/E of 15, should justify an assumption of P/E 12 in the above fair value calculation. Applying a P/E of 15 would result in a fair value of $50.6. Therefore a profitable buy zone would be between $45-$50.

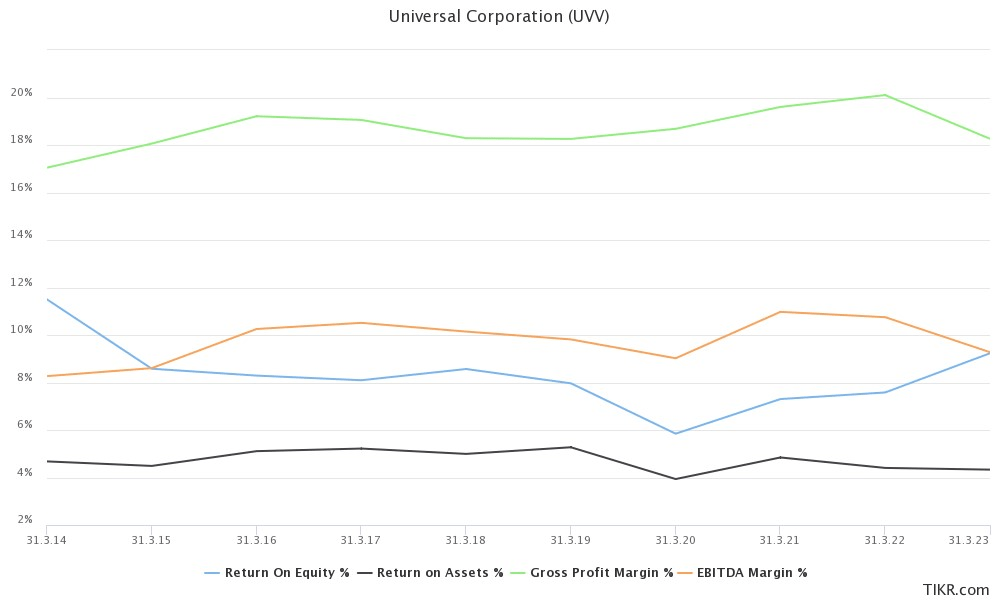

Margin profile and returns on capital. (Tikr)

According to Tikr the tangible book value per share is $45, which is another good sign post for opening a position in Universal.

High dividend but the room for growth appears limited

Universal has increased its dividend for 53 years. The 5-year dividend growth rate is 5.8%. The forward annual payout is $3.2 per share translating to a dividend yield of 6.4% The annual payout is 65% and 86% against the average EPS for the past 10 years. A dividend growth investor would rather see a lower payout ratio. If the company doesn’t succeed to grow the Ingredients business profitably the dividend growth is likely to slow down from historical pace.

The company has currently a $100 million share repurchase authorization in place, approximately 8% of the market capitalization. During the fiscal 2023 the company bought back only 66 124 shares at a cost of $3.4 million or $52.15 per share. Due to the ongoing investments into Ingredients business, it’s likely that Universal won’t be buying back shares in a meaningful way.

Conclusion

Universal Corporation is a mediocre candidate to boost the average yield of a dividend portfolio. Most likely investors overestimate the risks of the company and don’t bother carrying the risks. Universal has been producing rather stable earnings and margins, which is a good starting point for a high yield investment. To increase margin of safety an investor could pursue to take advantage of the fairly volatile share price and aim to open a position closer to a price of $45 per share.

Read the full article here