Introduction

It’s time to talk about a somewhat unusual dividend growth stock. The Kroger Co. (NYSE:KR) isn’t just one of America’s oldest grocery store operators, employing more than 430,000 people, but it is also a dividend growth stock with strong double-digit growth in the past decade.

The company, which is currently trying to merge with Albertsons (ACI), comes with a 2.2% yield and an undervalued stock price.

While the company is struggling a bit with consumer weakness, its financials remain healthy, supporting high dividend growth, debt reduction, and buybacks further down the road.

While the stock isn’t an outperformer or a strong wealth compounder, I believe the KR ticker is trading below its fair value, which opens new opportunities.

So, let’s dive into the details!

Stuck in the Middle?

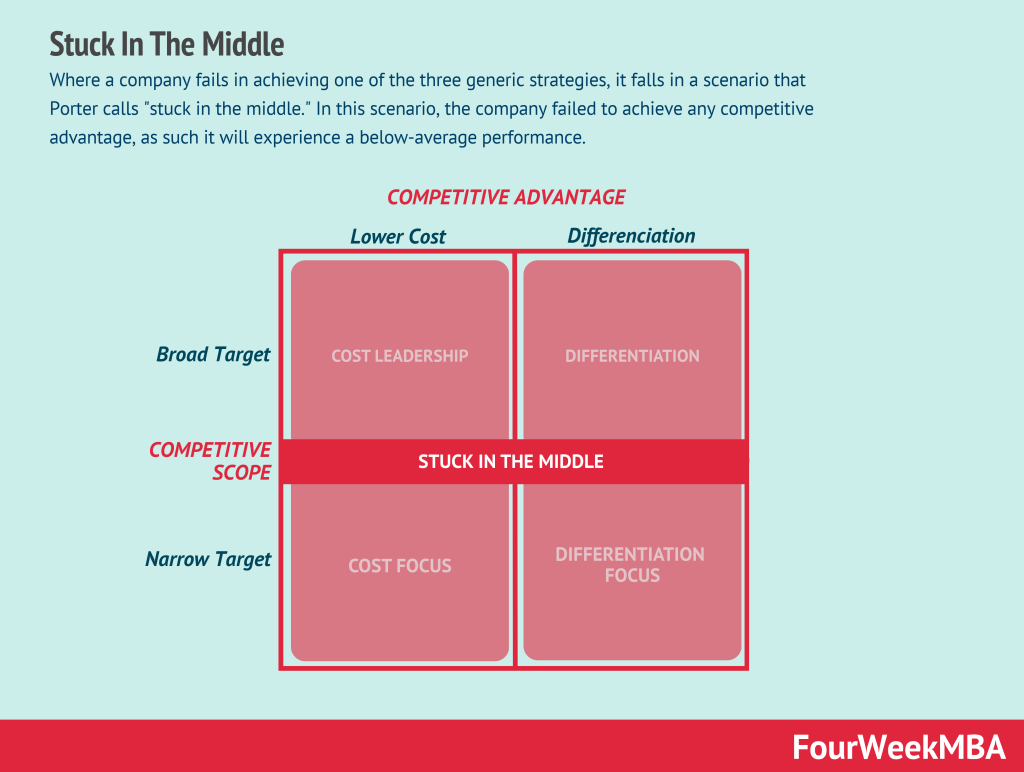

My first year as a university student started with a breakdown of different business strategies based on multiple scenarios. Porter came up with the overview below, which shows a number of strategies based on cost and differentiation.

FourWeekMBA

Essentially, if you’re offering superior products, it’s encouraged to have higher prices.

When offering less competitive products, prices need to be adjusted. For example, German luxury cars sell at much higher prices than Japanese mass-market cars.

A problem arises when companies aren’t competitive and unable to find the right pricing strategy. At that point, their products and services do not become appealing.

I’m not just bringing this up because it’s interesting info but also because of a headline that caught my attention.

Wall Street Journal

As reported by the Wall Street Journal, Kroger, positioned in the middle of the grocery market, offers neither very cheap options nor differentiated premium products.

According to BofA Research, Kroger’s prices have been approximately 9% higher than Walmart’s on average so far this year. In comparison, Sprouts Farmers Market and Whole Foods have prices around 30% higher than Walmart.

During its 1Q23 earnings call Kroger mentioned that it has seen increased business from higher-income customers who are migrating from specialty retailers.

However, when comparing sales growth, Kroger’s performance falls behind that of both value-focused and premium grocers. Walmart (WMT) US witnessed a more than 10% rise in comparable grocery sales in its quarter ended April 29 compared to the previous year, while Family Dollar (part of Dollar Tree (DLTR)) saw a 9.8% increase in consumables sales during the same period.

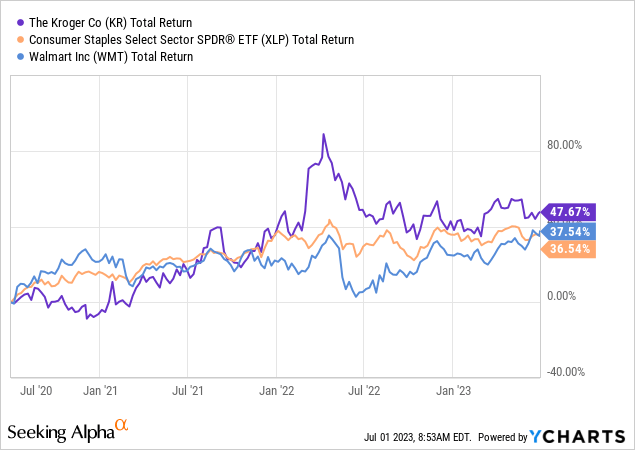

With that in mind, Kroger isn’t doing poorly at all. This Cincinnati-based grocer has returned 48% over the past three years, beating the Consumer Staples ETF (XLP) and Walmart (WMT) by a not insignificant margin. This performance also includes a drop of roughly 25% from its all-time high in early 2022.

This brings me to the next part of this article.

Kroger’s Shareholder Value

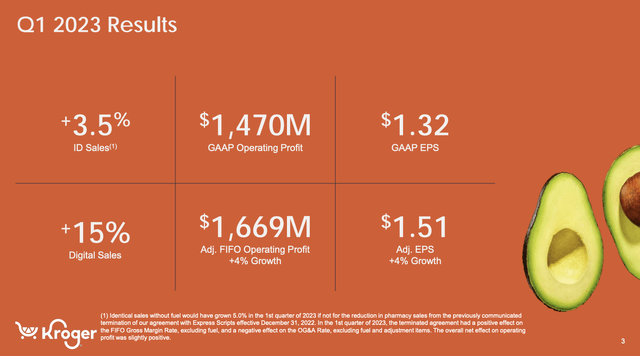

Despite the undeniable fact that Kroger did, indeed, become a bit stuck in the middle in this pricing environment, the first quarter was everything but weak.

According to the company, investments made in the value creation model over recent years are yielding positive results, enabling the company to deliver value for customers, invest in associates, and provide attractive returns for shareholders.

Identical (same-store/organic) sales without fuel, a key growth component, achieved a growth rate of 3.5% during the quarter, or 5%, after adjusting for the termination of the agreement with Express Scripts.

The Kroger Companies

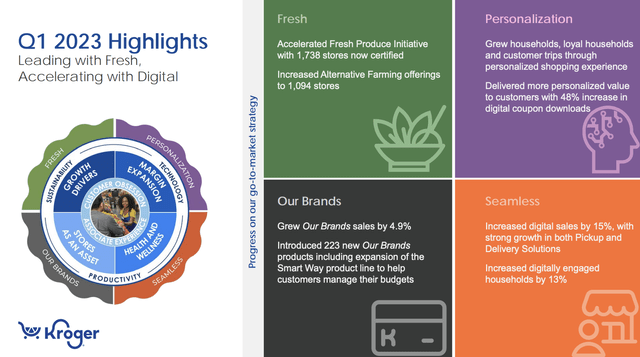

The company’s go-to-market strategy played a significant role in driving growth during the first quarter. Brand sales grew by 4.9%, with Kroger’s brands offering quality and value to customers and contributing to higher margins compared to national brands.

The Kroger Companies

Additionally, the merchandising team optimized the brand portfolio, launching the new Smart Way opening price point brand and focusing on continuous improvement and innovation.

As a result, digital sales grew by 15%, driven by an 11% increase in Pickup and a 30% increase in Delivery Solutions.

Furthermore, Kroger’s partnership with Ocado improved the efficiency of its Customer Fulfillment Centers (CFCs), leading to lower costs per order. Kroger expects digital to continue driving growth with double-digit sales increases for the remainder of this year.

Ocado Group

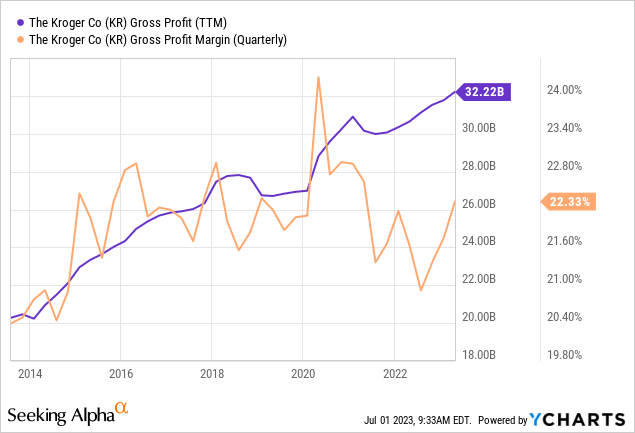

With regard to profitability, Kroger achieved a gross margin of 22.3% of sales during the first quarter, with a 21 basis points increase in the FIFO (first in, first out – related to inventory management) gross margin rate, excluding fuel, compared to the same period last year. The improvement was attributed to strong performance in Kroger’s own brands, sourcing benefits, lower supply chain costs, and the effect of the terminated agreement with Express Scripts.

However, higher shrink (a politically correct way of saying people are stealing more) and increased promotional price investments partially offset these gains.

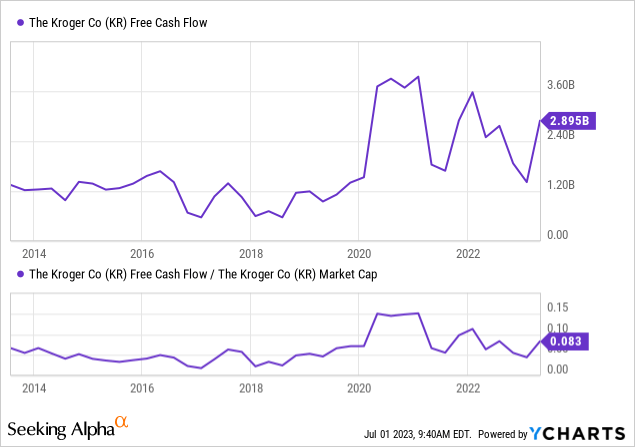

Based on that context, the company Kroger generated strong free cash flow during the first quarter, leading to a reduction in net debt compared to the same quarter last year.

The company expects adjusted free cash flow for fiscal year 2023 to be in the range of $2.5 billion to $2.7 billion. This would be in line with elevated post-pandemic levels.

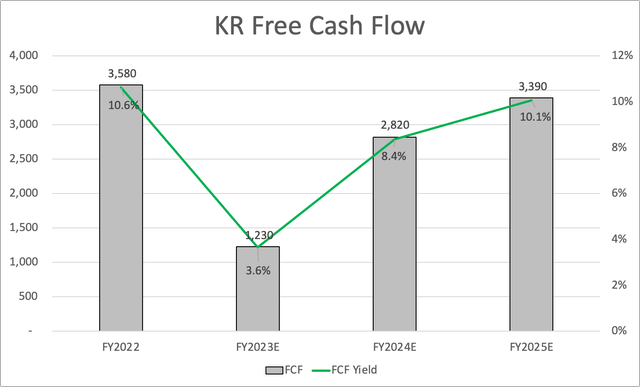

Going forward, analysts expect free cash flow to exceed $3.3 billion, which would imply a double-digit free cash flow yield.

Leo Nelissen

Thanks to debt repayments and higher free cash flow, Kroger’s net debt ratio reached a record low of 1.34x, below the target range of 2.3x to 2.5x EBITDA.

Hence, the company intends to continue paying quarterly dividends, potentially increasing them over time.

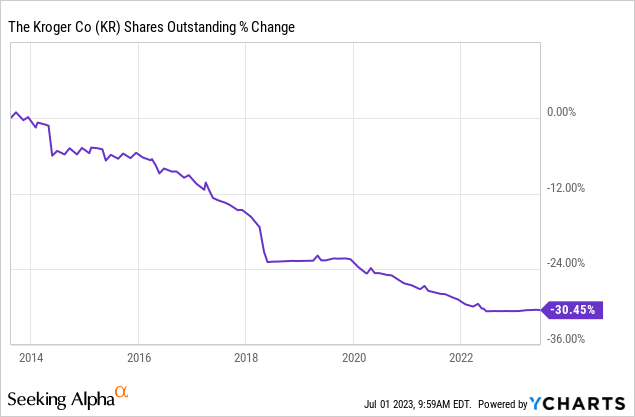

However, the share repurchase program has been paused to prioritize deleveraging the balance sheet following the proposed merger with Albertsons.

Unfortunately for KR, this merger seems to be on thin ice right now, as J.G. Collins wrote in an article in May. If (not when) the merger is rejected, I expect the company to quickly return to buybacks.

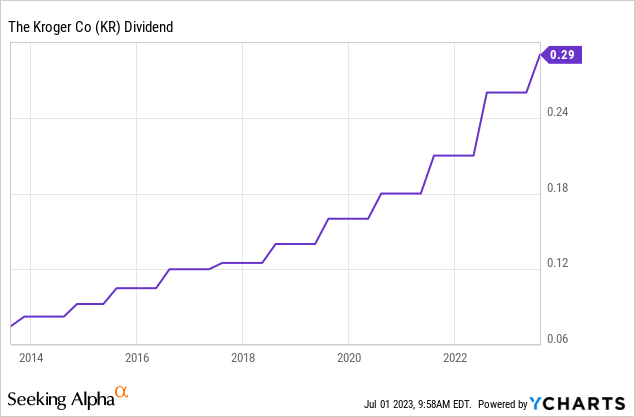

Speaking of buybacks and dividends, KR has a fantastic track record.

- The company currently yields 2.5%.

- KR has hiked its dividend for 16 consecutive years.

- Over the past five years, the average annual dividend growth was 15.8% per year.

- The payout ratio is just 24%.

- Using the aforementioned free cash flow estimates, the company has a cash payout ratio of less than 25% (based on fiscal year 2025 estimates).

With regard to buybacks, the company has repurchased more than 30% of its shares.

Another important issue to mention is its valuation.

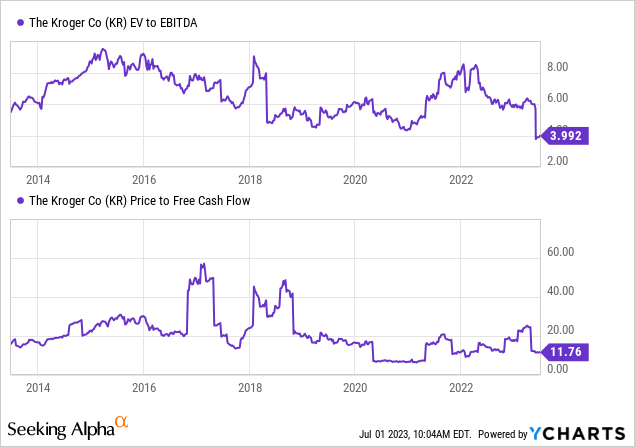

Valuation

Kroger is attractively valued. Using fiscal year 2024 estimates, the company is trading at roughly 5.5x EBITDA. This includes roughly $400 million in pension liabilities. This is one of the cheapest valuations of the past decade. The same goes for free cash flow. KR is trading at 12x FY2024E free cash flow, which is close to the lower bound of the 10-year range.

While a big part of this discount is due to merger-related uncertainties, I believe that KR is undervalued – regardless of whether the merger succeeds or not.

The current consensus price target is $51, which is 8.5% above the current price. The most recent price target came from North coast, which upgraded KR shares from neutral to buy (PT $60).

I agree with that. I believe that KR shares should trade at no less than $60, which implies a 27% upside potential.

The only reason why I do not own KR is that I am currently looking to buy more aggressive compounders and companies at different stages of the grocery supply chain.

Nonetheless, I believe that KR is in a good spot to maintain strong dividend growth and eventually resume aggressive buybacks.

While its yield isn’t very high, the total return is good. Hence, I think KR will continue to outperform its peers, including a company like Walmart, which has a lot more growth already priced in.

Takeaway

Kroger presents an attractive opportunity as a dividend growth stock with a risk/reward profile worth considering.

Positioned in the middle of the grocery market, it faces challenges in a competitive pricing environment, but its financials remain healthy, supporting high dividend growth, debt reduction, and potential buybacks.

The company’s value creation model and go-to-market strategy have yielded positive results, with solid growth in sales and margins.

Its partnership with Ocado and focus on digital sales are expected to drive future growth.

With a track record of 16 consecutive years of dividend hikes and a low payout ratio, KR’s attractive valuation and potential for strong dividend growth make it an appealing dividend stock.

Although I’m currently seeking more aggressive compounders, I believe KR has the potential to outperform its peers, making it a solid addition to any income-focused portfolio.

Read the full article here