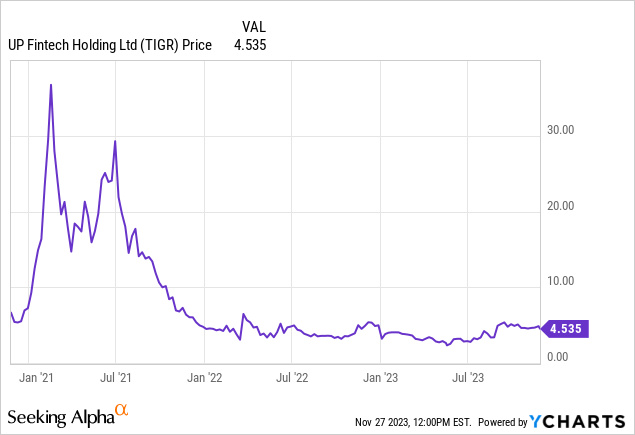

Last week we outlined a play on Futu Holdings Limited (FUTU), an Asian online brokerage house that we have previously traded with great success. A reader of that column asked us for commentary on another online brokerage, UP Fintech Holding Limited (NASDAQ:TIGR) which has just reported Q3 earnings. This ticker is far more speculative, but the company is in growth mode, despite having issues with mainland China. Both FUTU and UP Fintech pulled their apps from China, which led to concerns over the hit that would come to earnings. However, the stock has pulled back, yet the company remains in growth mode. We view it as a speculative trade.

Shares bottomed out this summer, but the question now becomes whether the stock can break back out. We think it is likely to remain rangebound, but with this range of $3-$6, one could set up a trade on today’s significant pullback. Here is a suggested play from our team:

Target entry 1: $4.20-$4.30 (25% of position)

Target entry 2: $3.90-$3.95 (35% of position)

Target entry 3: $3.50-$3.60 (40% of position)

Stop: $2.75

Target exit: $5.00 if one leg, $4.75 if two legs, $4.40 if 3 legs.

Discussion

We view UP Fintech as a speculative trade that comes with risk, but the company is indeed in growth mode. There was some added uncertainty with this earnings release, as the Chief Compliance Officer left her position. However, management noted that it was not related to performance or any disagreements with the company. However, sudden management shifts almost always add uncertainty, so today’s selloff seemingly reflects this development, and less so on the earnings report for a forward view.

The earnings were positive overall from our investigation, which gives confidence to buying some of this dip for a trade.

Results were better than consensus, and revenues were particularly strong. The top line hit $70.1 million, rising 26.6% from $55.4 million in the year-ago quarter. This is strong, and surpassed estimates handily. However, trading volume was down, so commissions were $23.2 million, a decrease of 5.4% from last year.

However, other key metrics were extremely positive in our opinion, and reflect the growth initiatives and expansionary efforts the company has undertaken. Total account balances increased 45.7% to $18.9 billion from last year, while the total number of customers with deposits on hand was up 14.8% to 865,500. Despite lower trading commissions, total margin financing and securities lending balances were up a whopping 41.0% to $2.2 billion. This latter increase led to interest income jumping to $38.3 million, an increase of 54.4% from $24.8 million last year.

However, costs continue to rise. The company has debt, and with rising rates, interest expense was $12.1 million, an increase of 182.1% from last year. But with the revenue growth, we were pleased as traders to see operating costs only rising 3.1%. Total operating costs and expenses were $48.8 million, a slight increase of 3.1% from a year ago, despite the spike in revenues. More promising is that clearing and stock execution expenses dropped 26.4% from last year to just $2.4 million, though the company is paying more for market data, spending 16% more than a year ago at $7.6 million. All things considered, these expense lines were impressive given the top-line growth.

Net income hit $13.2 million, tripling from $3.3 million a year ago. On a per ADS basis, earnings were $0.083, rising from $0.021 a year ago.

Moving forward, the company is expanding into new markets and adding new features. For our trade, we are focused on increasing revenues and earnings primarily, but future revenues will benefit from new offerings. One such offering is the recent launch of the “Trading Sparks” feature within the Tiger Community, allowing users to follow the best-performing traders on the Tiger platform. Further, the company now added U.S Treasuries to the Tiger wealth management platform and continues to host corporate IPOs.

Overall, we think UP Fintech Holding Limited shares are a speculative buy, but we would be legging into it on this weakness, and getting out on the next wave higher. Then move the trading gains into some of your core longer-term holdings.

Read the full article here