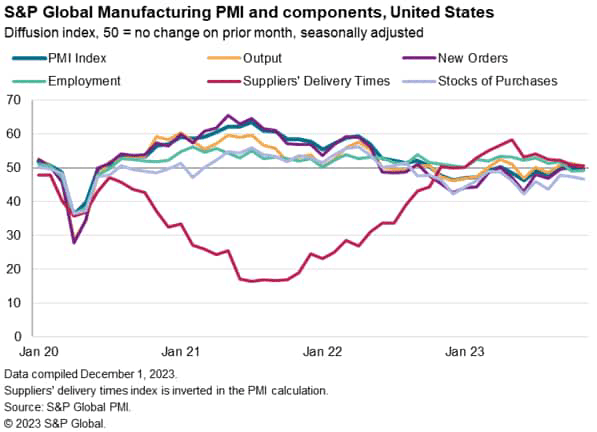

US manufacturing business conditions worsened in November, according to S&P Global’s PMI data. Output was largely stagnant as new order inflows deteriorated, meaning backlogs of orders become increasingly depleted.

While there are some encouraging signs of the inventory cycle acting as a lesser drag on the goods-producing sector, the overall worsening demand situation prompted manufacturers to cut payroll numbers for a second month in a row – the first such back-to-back drop in employment seen since 2009 if the early pandemic months are excluded.

From an inflation perspective, the weak demand environment and reduced wage pressures emanating out of the manufacturing sector, combined with recent oil price falls, led to lower input cost and selling price inflation in November, with both rates well below pre-pandemic averages.

Falling demand

US manufacturers reported yet another tough month in November according to S&P Global’s US PMI survey. Output barely rose as inflows of new work showed a renewed decline.

The headline PMI – a composite index based on five survey sub-indices – fell from 50.0 in October to 49.4 hinting at little – if any – contribution to fourth quarter GDP from the goods-producing sector.

Orders have in fact only risen in three of the past 18 months, reflecting a prolonged period of subdued post-pandemic demand, in turn linked to consumers switching their spending to services such as travel and recreation, and business customers reducing excess inventories which had been accumulated during the supply concerns of the pandemic.

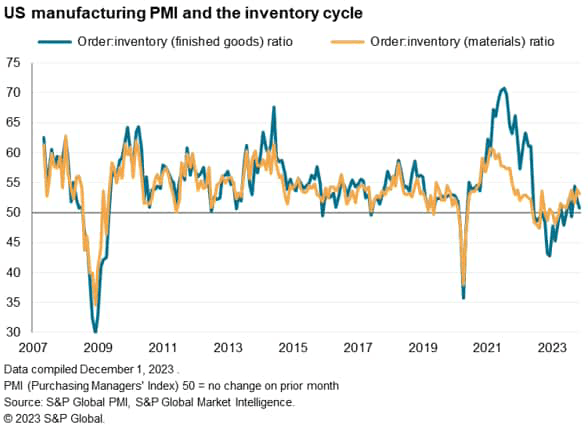

Inventory drag eases

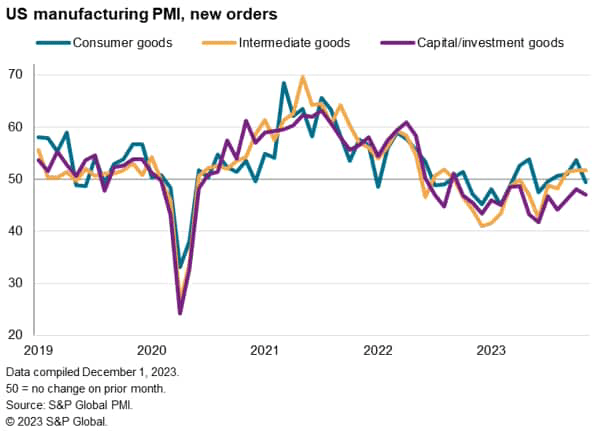

More encouragingly, there are some signs of the inventory cycle starting to turn, with producers of intermediate goods (inputs supplied to other firms) now reporting modest order book growth.

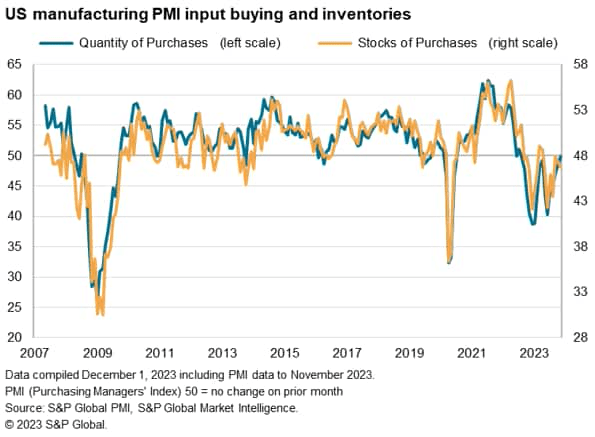

The survey’s order to inventory ratios also send some signals that the drag from the inventory cycle has peaked, especially when looking at the comparison of new orders to inventories of purchased inputs.

Digging further into the detail, we can see that the increased demand for intermediate goods largely reflects stronger export sales (exports of intermediate goods rose in November at a rate not seen for one and a half years). While foreign factories may be showing tentative signs of restocking, US producers continued to focus on cutting inventories. Stocks of inputs fell across US manufacturing for a fifteenth straight month in November, and at an increased rate. However, even in the US manufacturing sector there are signs of the inventory drag easing, as firms’ purchases of raw materials came close to stabilizing for the first time since mid-2022.

Employment falls for second month running

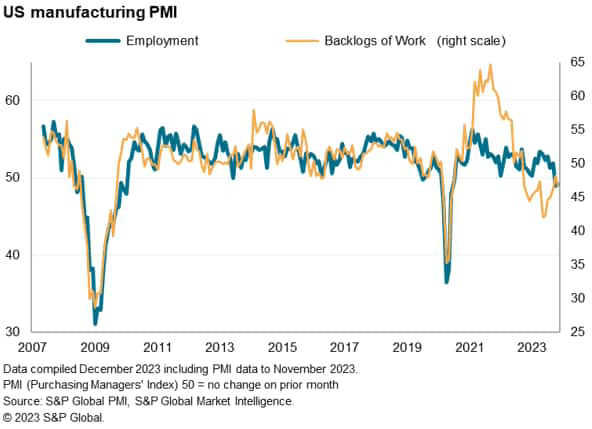

An overriding concern among many manufacturers, however, is the degree to which current operating capacity is running higher than needed given the order book situation. Backlogs of orders fell sharply again in November, down for a fourteenth consecutive month and at an increased rate. This continual erosion of order books, in the absence of net new order inflows, has led manufacturers to trim workforce numbers in each of the past two months.

Barring the early months of the pandemic, the survey has not seen such a back-to-back monthly fall in factory employment since 2009.

Lower price pressures

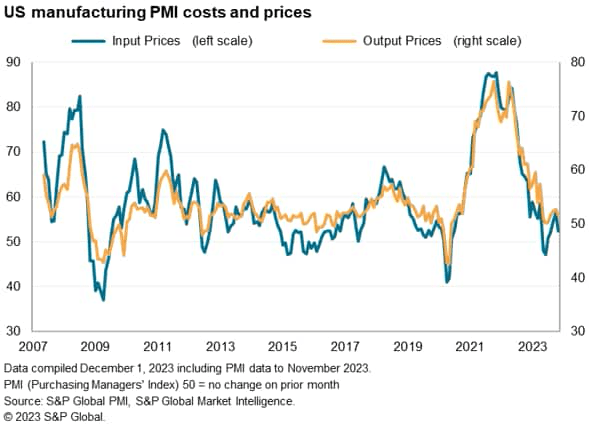

While the decline in employment could feed through to weaker consumer spending, from an inflation-fighting perspective it will also reduce wage bargaining power.

Lower wage pressures, combined with a marked cooling of raw material input cost inflation, have already fed through to a lowering of average factory selling prices for goods to a rate below the average seen in the decade prior to the pandemic. The rate of increase in fact dipped in November to help further lower consumer price inflation in the months ahead.

Similarly, supply chain delays remain uncommon, meaning suppliers typically have muted pricing power. Input cost inflation consequently also cooled in November, dropping sharply amid an added impact from lower oil prices to a rate well below its pre-pandemic ten-year average.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here