US Foods Holding Corp. (NYSE:USFD) is one of the largest U.S. foodservice distribution companies with an estimated ~11% market share.

USFD shares currently represent a rare combination of a high-quality defensive business, above market near-term EPS growth potential, an attractive valuation, and positive momentum. For this reason, I believe USFD is an attractive investment at current levels.

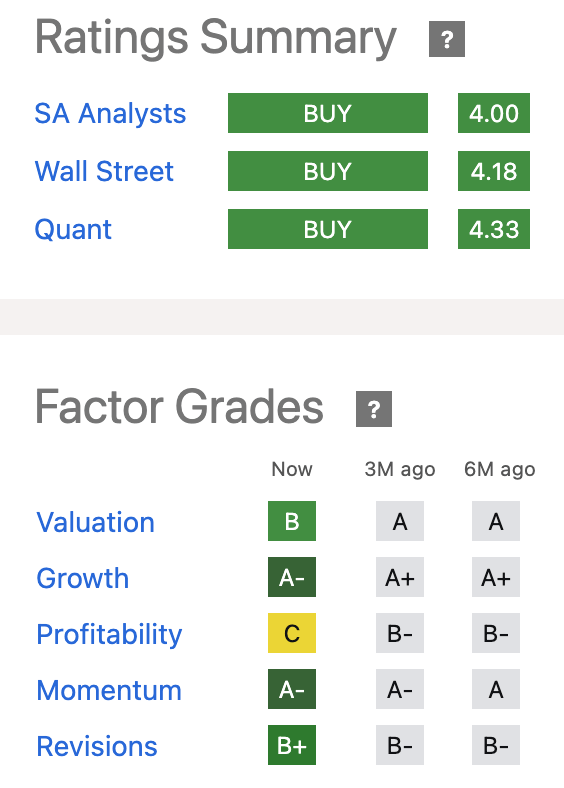

Additionally, the stock is currently rated as a buy by Seeking Alpha analysts, Wall Street analysts, and Seeking Alpha quant ratings.

Seeking Alpha

High-Quality Defensive Business

USFD is one of the largest broadline U.S. food distribution companies with an estimated ~11% market share. Industry leader Sysco has an estimated 17% market share. Other key players include Performance Food Group and Gordon Food Service Inc. Aside from these large players the food distribution market is highly fragmented with smaller local and regional-based players.

USFD’s customer base is very diverse and for FY 2022 no single customer accounted for more than 3% of sales. USFD has ~250,000 customer locations worldwide including restaurants, healthcare facilities, education facilities, and other customers. The company is also very diversified in terms of suppliers as the company purchases from ~6,000 individual suppliers with no single supplier accounting for more than 5% of all purchases.

The highly fragmented nature of USFD’s customer and supplier base is a positive attribute of the business as low customer and supplier concentration results in reduced negotiating power for each party relative to USFD.

Another positive attribute of USFD’s business is the importance of scale. Large distributors have an advantage relative to smaller players in terms of purchasing power with suppliers and distribution efficiency. Large firms tend to have a higher route density which allows them to serve customers at a lower cost per delivery. The result of this has been a constant push towards industry consolidation with bigger firms getting larger.

In 2020, USFD acquired Smart Foodservice from funds managed by Apollo for $972 million. In 2013, Sysco announced plans to acquire USFD for $3.5 billion (at the time USFD was owned by KKR and Clayton, Dubilier & Rice.) The deal was ultimately abandoned in 2015 after the FTC was granted an injunction to block the deal on antitrust grounds. The FTC argued that the combined entity would account for ~75% of sales to national customers of broadline services and that the two parties were the only firms with a truly national footprint.

The food distribution business also has fairly high barriers to entry as any new industry player would need to develop relationships across many suppliers and customers to have any hope of competing with existing players.

In addition to these benefits, the food distribution business is also fairly recession resilient as food consumption is a necessity. However, the company does have significant exposure to restaurants which resulted in a very challenging 2020 as the company generated a net loss per share of $0.11 due to the covid-19 pandemic. That said, I would expect USFD to perform better than most companies during a more traditional recession.

EPS Growth Story Driven By Market Share Gains and Margin Improvement

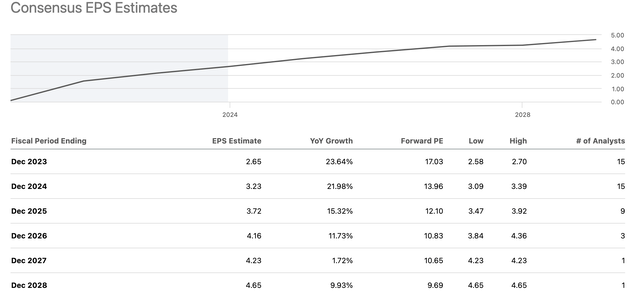

Consensus estimates currently call for USFD to achieve FY 2024 EPS growth of nearly 22%, FY 2025 EPS growth of 15.3%, and FY 2026 EPS growth of 11.7%. Over the same time period, revenues are expected to only grow by mid-single digits each year.

Revenue growth will be driven by a combination of inflation, increasing demand for food, and market share gains vs smaller players.

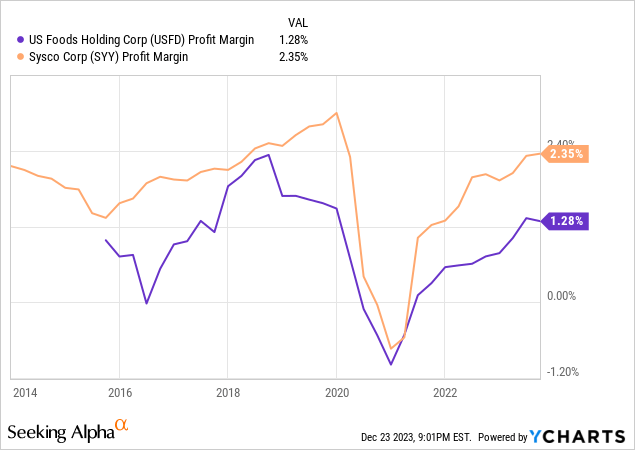

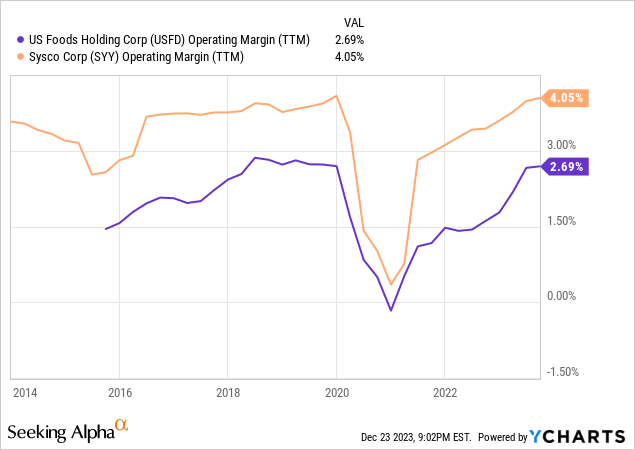

Thus, the real driver of USFD’s expected EPS growth in the coming years is margin expansion. Currently, USFD has profit margins and operating margins which are ~46% and ~33% lower than Sysco’s margins. Thus, I believe that USFD has further room for margin improvement from current levels. Moreover, USFD was able to achieve profit margins above current levels in 2017 and 2018. Given the significant 2020 acquisition of Smart Foodservice, I believe USFD should be able to achieve even better margins than were historically the case due to the benefits of increased scale.

Seeking Alpha

USFD Investor Presentation

Share Repurchase Program

During Q3 2023, USFD repurchased 727,000 shares for a total of $29 million at an average repurchase price of ~$39.88 per share. Thus far during Q4, USFD has repurchased an additional $20 million worth of shares which leaves $237 million remaining under the current repurchase authorization.

Based on the current share price, the remaining authorization represents ~2% of shares outstanding. I believe the company is poised to allocate more capital to share repurchases going forward as the balance sheet has improved.

USFD’s net leverage ratio has improved from 3.7x in Q3 2022 to 2.9x as of Q3 2023. The company has identified 2.5x – 3.0x as a target leverage range. Given the fact that the company is now within that range, I expect the focus to shift from deleveraging to returning capital to shareholders over the next few years.

CEO David Flitman added additional commentary on repurchases during the Q3 conference call:

In terms of your question around share repurchases, we’re obviously under trading our potential and hugely undervalued in my view. You’ve seen us ramp up our share repurchases. I think we’ll be thoughtful about that going forward. Returning capital to shareholders is important. After we do the things we need to make sure we’re growing and supporting our customers well. Obviously, more to come on that through the course of time. But we’ve been leaning in hard on share repurchases, and we’ll continue to do that.

Attractive Valuation

USFD currently trades at 14x consensus FY 2024 EPS and 12x consensus FY 2025 EPS. Comparably, the S&P 500 trades at ~21x consensus FY 2024 earnings. In addition to trading at a below-market multiple, USFD is also expected to grow earnings at an above-market rate over the next 3 years.

Over the long term, I believe USFD can grow EPS at mid to high single digits which is roughly in line with the historical earnings growth rate of the S&P 500. Moreover, I also view USFD as a more defensive business compared to the broader market.

For these reasons, I view USFD as fairly undervalued currently vs the broader market.

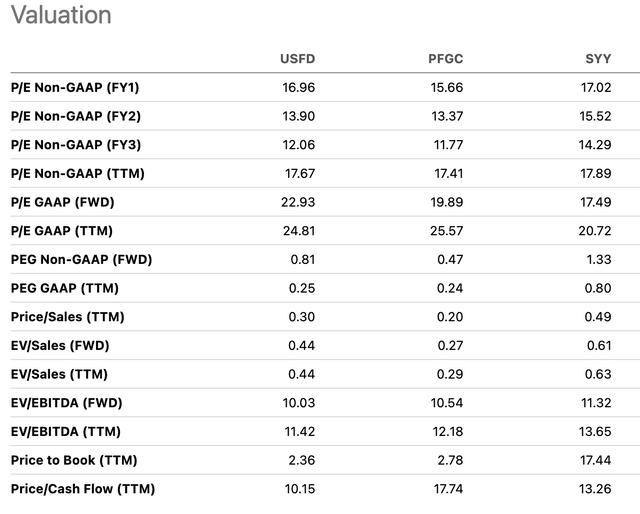

In regard to peer valuation, USFD is trading at a modest discount to Sysco Corp (SYY) and mostly in line with Performance Food Group (PFGC). I do not view the discount to SYY as warranted since USFD is expected to grow earnings at a much faster rate over the next few years. While SYY is larger and has more scale, USFD’s smaller size may allow it to grow more rapidly and benefit more from smaller tuck-in type acquisitions compared to SYY.

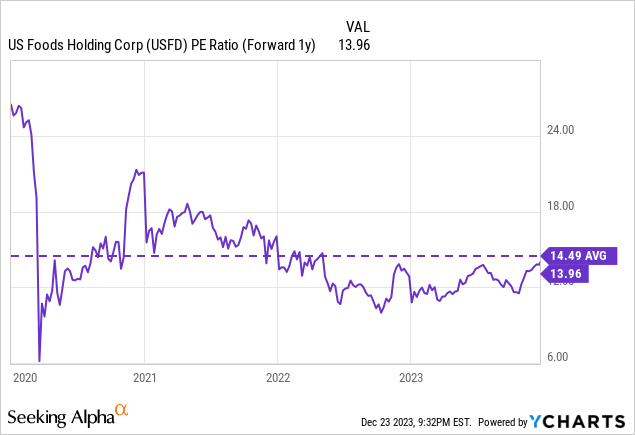

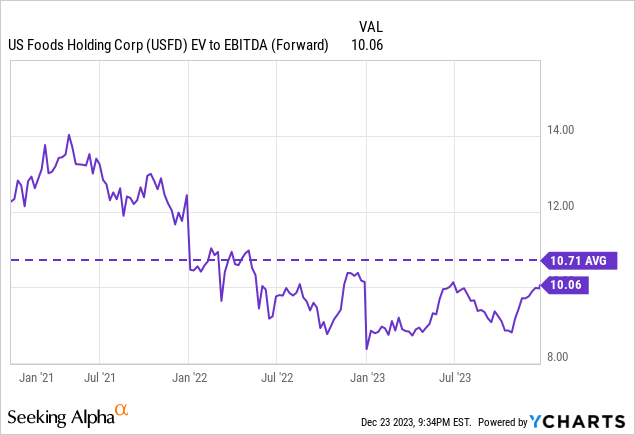

In addition to trading at an attractive valuation relative to the broader market and its closest peer, USFD is also trading at a fairly attractive level relative to its own historical valuation range.

Based on these metrics, I believe a conservative but reasonable forward 2024 P/E multiple for USFD is 17x (which represents a slight premium to SYY due to superior earnings growth potential and a discount to the S&P 500 forward P/E of 21x.) Assuming 17x consensus FY 2024 EPS of $3.23 per share I believe USFD is worth ~$55 per share which represents a 22% premium to the current share price.

Seeking Alpha

Positive Momentum

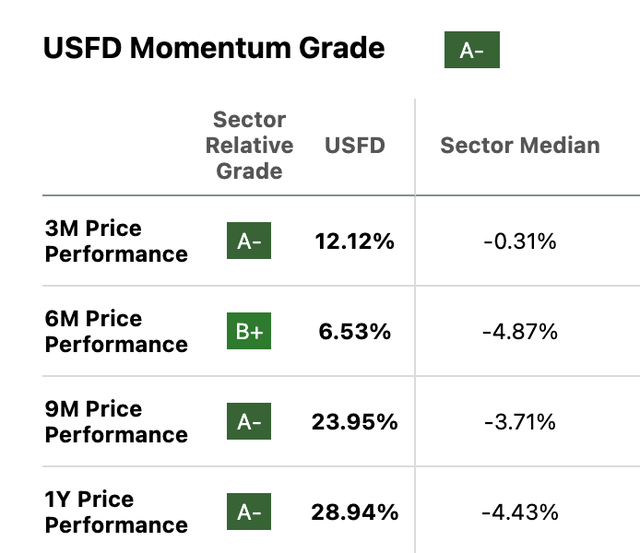

USFD currently receives a momentum grade of A- from Seeking Alpha quant scores. I agree with this characterization and believe the stock’s recent positive momentum is a positive.

I view bullish momentum signals as particularly relevant when looking at stocks that are attractive on a fundamental valuation basis as well (as is the case for USFD).

Seeking Alpha

Risks To Consider

One key risk that investors should consider is that USFD is not able to drive margin improvement over the next two years. If the company fails to improve margins, I believe it will fall short of current earnings estimates. That said, given the fairly low level of margins currently relative to peers and historical levels I am confident that USFD will deliver. Furthermore, the company showed impressive margin improvement during Q3 2023 as Adjusted EBITDA margins improved to 4.4% a 48bps improvement from the same period a year ago.

Another risk to consider is a potential sharp increase in interest rates. While USFD has improved its balance sheet, the company remains fairly highly levered and has $2.38 billion worth of fixed rate debt maturing between 2028 and 2032. Much of this debt carries attractive coupon rates which are below what the company would be forced to pay in the current environment. The company also has $1.83 billion worth of floating rate debt.

While I do not view a modest increase in interest rates as a big problem for the company, a substantial increase in interest rates would serve as a major headwind. However, I do not expect interest rates to move sharply higher from here given the recent inflation trajectory.

Conclusion

USFD represents a rare combination of a high-quality defensive business, above-market near-term growth prospects, an attractive valuation, and strong momentum.

For these reasons, I believe USFD represents a highly attractive investment at current levels.

I am initiating the stock with a buy rating and would consider upgrading to a strong buy if the valuation picture were to improve further and the company is able to deliver sustained margin improvement. Additionally, I would view a substantial increase in the share repurchase program as a potential reason to upgrade the stock.

I would consider downgrading the stock if the company fails to deliver continued margin improvement or interest rates move sharply higher from here which may put pressure on the company’s balance sheet.

Read the full article here