Credit Suisse X-Links Crude Oil Shares Covered Call ETNs (NASDAQ:USOI) is a unique product for investors looking to speculate on the price of Crude Oil. It does so by buying the front month futures and selling covered calls as described below.

The Credit Suisse Nasdaq WTI Crude Oil FLOWSTM 106 Index (the “Index”) seeks to implement a “covered call” investment strategy by maintaining a notional long position in Reference Oil Shares while notionally selling call options on that position on a monthly basis that are approximately 6% out-of-the-money (i.e., strike price is 106%). The notional net premiums received (if any) for selling the calls are paid out at the end of each monthly period as a Distribution. The Index’s strategy is designed to generate monthly cash flow in exchange for giving up any gains beyond the 106% strike price. The Index’s strategy provides no protection from losses resulting from a decline in the value of the Reference Oil Shares beyond the notional call premium received, if any.

Source: USOI

The “yield” on these products tends to be high, but whether you make total returns or not depends on a lot of other factors. The fees are modest at 0.85% annually and investors must remember that this is an ETN so there is a slight credit risk of the originator. The notes were originally guaranteed by Credit Suisse and now are the responsibility of UBS (UBS). So with the fund basics out of the way, let us look at what really determines whether you make money or not in these funds and that is the macro. It is in that macro that we find four reasons to be modestly bullish here.

1) The Strip

Unlike buying a stock, commodity futures have to constantly contend with a “roll”. This roll involves selling the current month and buying the next or a further out month (depending on ETF or ETN rules). This creates problems when there is a contango. For those unfamiliar, contango is a condition where further out months are way more expensive than the current expiring month. What you land up doing is buying high and selling low, over and over again. The current strip is flat. You can note that there is very little difference between February 2024 and September 2024.

CME Group

Rolls are likely to be less problematic. The current state of inventories around the globe also means that if there is contango, it is unlikely to be steep. This creates a situation where owning this product is at least not an immediate money-losing setup. So that is reason number 1.

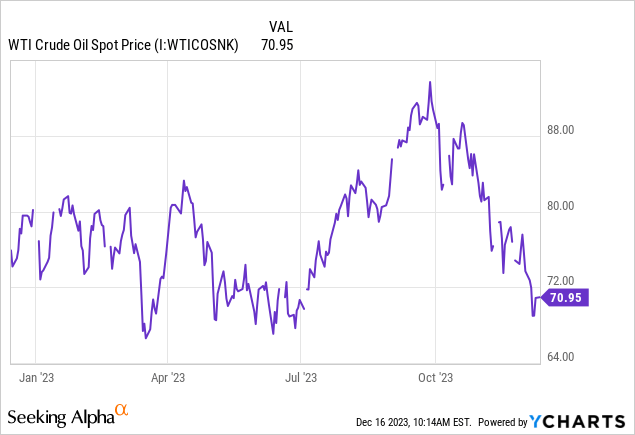

2) Washout in Oil

It seems like yesterday that Crude Oil had rallied to $90 on geopolitical tensions. That has gone and the commodity has been floored to $70/barrel.

In general, regardless of the covered call protection, you want to only speculate on the long side for commodities after washouts. Well, we have one now and it dramatically improves your odds of success.

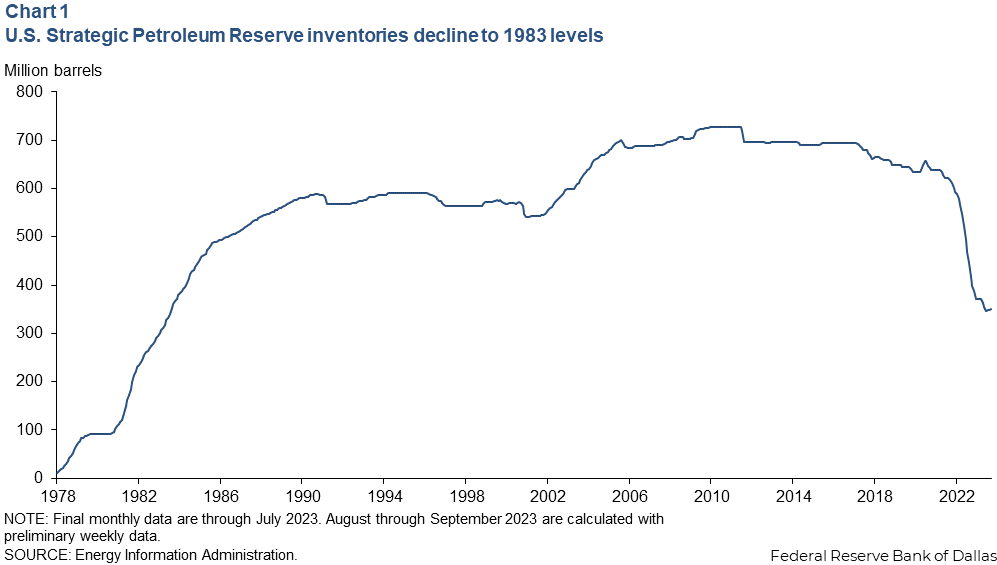

3) Refilling The SPR

One of the biggest stories of 2022 was the draining of the strategic petroleum reserve. This drain, while heavily criticized, prevented a large spike in oil prices.

EIA

The Biden administration turned out to have some excellent oil traders in their mix and they are now looking to buy low what they sold while they were high.

The Department of Energy, Strategic Petroleum Reserve Project Management Office (SPRPMO), located at 900 Commerce Road, East, New Orleans, Louisiana, has a requirement to conduct a purchase of up to three (3) million barrels of United States produced sour crude oil for March 2024 delivery. You are invited to submit a proposal. You are to base your proposal for this requirement on the information provided in the attached Request for Proposal (RFP), 89243524RCR000011. Submission of proposals will only be accepted via email. The proposal preparation instructions are described in Part IV, Section L of the RFP and must be received not later than 11:00 a.m., Central Time (CT), on December 18, 2023. The proposal shall be valid until 4:00 p.m., CT, on December 28, 2023. The Government may finalize awards at any time prior to proposal expiration in accordance with Paragraph B.5. In order to participate in Federal procurements, potential offerors must be registered and have an active account in the System for Award Management.

Source: Department Of Energy

We think this is a progressive move and the lower the oil falls, the more aggressive will be the purchases. This likely creates a hard floor in the next 6 months near $65/barrel if not higher. So your odds of making money are now quite high.

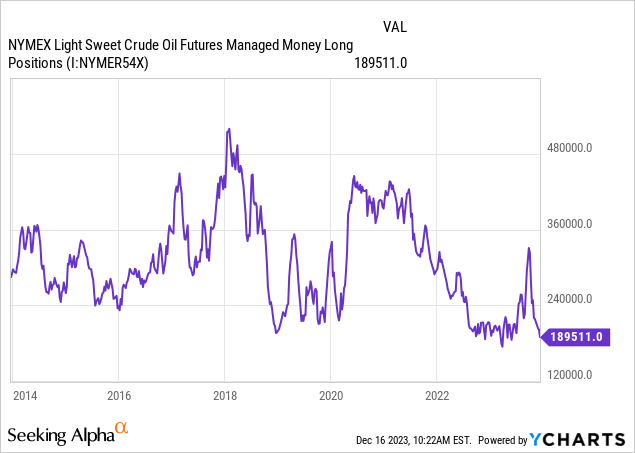

Managed Money Wash Out

The final reason here is that managed money which chased the geopolitical tensions higher has given up and we have a washout in sentiment there as well. Below you can see the long positions and they are lower than at the depths of COVID-19.

Verdict

Covered call ETNs are not for everyone but based on the assets in this ETN, we think that a lot of people enjoy speculating on them. The calls here alongside the washout in Crude Oil, the strip setup, and the SPR purchases, offer a very good risk-reward setup. You also want to speculate when Crude Oil is hated and at least the managed money long positions support that. We rate this a buy and think investors likely get 20% annualized returns (10% total) over the next 6 months. The real risk here is if Crude Oil is reflecting the wheels falling off the global economy, but so far other signs don’t point that way. Even in that case, the SPR filling should limit the downside.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here