Viasat Selloff Is Out of This World

Viasat (NASDAQ:VSAT) is a prominent player in the rapidly evolving world of satellite communications and broadband services. Investing in Viasat’s stock offers a unique opportunity to tap into the ever-growing demand for connectivity and data services, both in established markets and emerging regions. The stock has rebounded as a value play in recent months following a large selloff due to the failure of their VS-3 satellite project (Figure 1). In this article, we will explore the compelling reasons why considering an investment in Viasat Inc.’s stock could be a wise and rewarding decision, for high risk – high return investors.

Viasat About Us

Figure 1. ViaSat-3 has the potential to compete with SpaceX’s Starlink backed by Viasat’s fundamental revenue streams

Viasat Inc. has been making noteworthy headlines as it continues to shape the future of satellite communications and broadband services. Recent developments highlight the company’s commitment to innovation and growth:

-

Global Expansion: Viasat has been actively expanding its global footprint, bringing high-speed internet connectivity to underserved and remote areas worldwide with their Viasat-3 developments. This expansion not only addresses the digital divide but also opens up new markets and revenue streams for the company.

- In The Air or Overseas Connectivity: Viasat has become a leading provider of in-flight connectivity solutions for both commercial and government aircraft. Recent partnerships with major airlines have reinforced the company’s position in this high-demand market segment. Maritime is a major revenue stream for the company as well and should not be overlooked.

-

Government and Defense Contracts: Viasat’s government and defense contracts have seen growth, with a focus on secure and resilient communication solutions. These contracts offer stability and growth opportunities, given the importance of reliable communication in these sectors. VSAT has millions in government contract backlogs slated for 2024.

-

Next-Generation Technology: The company continues to invest in research and development to stay at the forefront of technology. Advancements in next-generation satellite technology and communication platforms keep Viasat competitive in the rapidly evolving industry. This combination of steady operating margins and potential for future growth make VSAT a high upside opportunity following the pullback.

These recent developments not only showcase Viasat’s dedication to innovation but also underscore its pivotal role in providing connectivity solutions that bridge digital divides, enhance in-flight experiences, and serve the communication needs of governments and commercial entities. We believe the market is severely discounting VSAT’s stock, by not taking into account the stability of their core business. Much of the Viasat-3 failure will be able to be written off or covered by insurance, and therefore as long as VSAT succeeds in upcoming launches we still see a nearly $40 price target as a reasonable valuation for the stock.

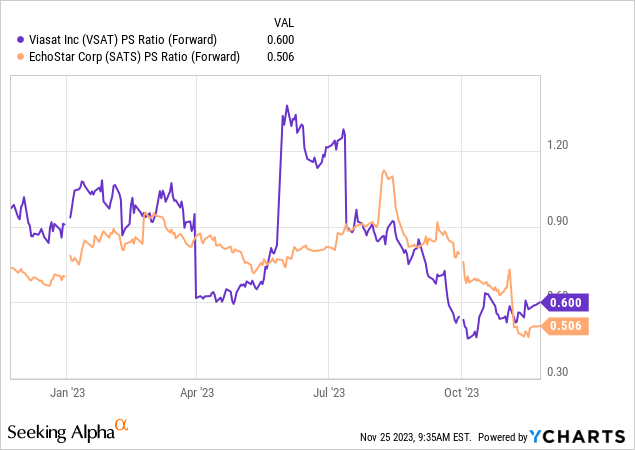

Assessing Valuation

Evaluating the valuation of Viasat Inc. entails a comprehensive analysis of financial metrics, industry trends, and growth prospects. The stock trades extremely discounted in comparison to historical averages and peers due to the recent pullback following the Viasat-3 failure. VSAT trades at a price to sales ratio of ~0.6x revenue, around half of what they have historically traded at. A rebound to historical averages is warranted in our opinion which would place the stock around $40. Furthermore if the company is successful in their Viasat-3 projects, we believe the stock has significantly further long-term upside.

Figure 2. Competition is heating up with multiple internet businesses making the push towards global satellite internet all at lowered valuations

The global demand for high-speed internet connectivity, especially in underserved and remote areas, is on the rise. Viasat’s unique satellite communication solutions position it to capture a significant share of this growing market. Competition is tough with EchoStar (SATS) & SpaceX appearing to be ahead of VSAT following the recent setback. EchoStar’s upside may be limited by their potential merger with DISH (DISH), which is why we prefer VSAT here. Success for Viasat’s stock is dependent on how quickly they can rebound profit margins after barely breaking even in 2023. Diverse Revenue Streams do benefit VSAT’s rebound. Viasat serves both commercial and government sectors, as well as airlines and maritime services offering a diversified revenue stream. This diversification can enhance its resilience to macroeconomic fluctuations and sector-specific challenges. We believe if both 2024 Viasat-3 launches are successful the stock will recover from its pullback and reach analysts’ price targets of $37+, for the stock to again trade alongside historical averages.

Risks

Investing in Viasat’s stock comes with a number of risks that merit careful consideration. Regulatory Challenges are ever present in the satellite communication industry. The sector is subject to regulatory changes and licensing requirements from the FAA. Adherence to these regulations is crucial, and changes can impact Viasat’s operations and timelines. Competition in the satellite communication sector is fierce, with established players and startups vying for market share. Viasat must continuously innovate to maintain its competitive edge. Their biggest advantage in our opinion is their diversification and the company should be open to passing on their first mover advantage to prioritize core businesses in our opinion. Ensuring profit margins targets are attained will help dive investment to future growth opportunities in a way SpaceX or even EchoStar/Dish cannot.

Macroeconomic downturns can affect demand for satellite communication services, particularly in sectors that may reduce spending on connectivity solutions. High interest rates can affect the course of VSAT’s stock with over $7.7 Billion in debt. This should be monitored going forward closely. Political change could have an adverse effect on the stock as well with upcoming elections. While government contracts offer stability, they can also be subject to budgetary constraints and political changes that may affect revenue in an unforeseen way.

Overall, with the high number of risks downside is still there for VSAT’s stock. Another unsuccessful launch of Viasat-3 could spell doom for the stock. We believe two successful launches in 2024 would bring the stock price back to the high $30 even low $40 range if macroeconomic conditions are favorable as well. Another failed launch could cut the stock price in half and VSAT would lose their high growth potential which is why we believe this is a very speculative high risk – high return option for investors and should not be a large portion of ones portfolio if they choose to invest.

Indubitable Information

“In God we trust. All others must bring data” – Robert Hayden

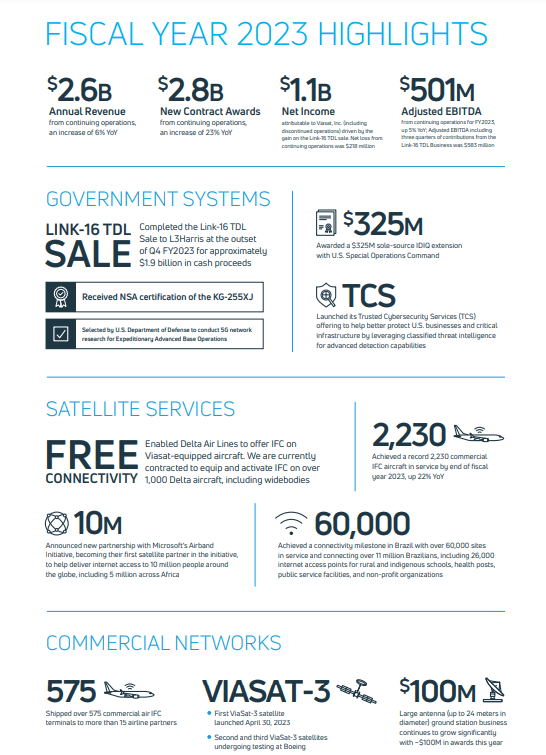

Viasat Annual Report

Figure 3. Commercial Airline and Government contract growth were both up 22 & 23% respectfully in 2023

Overall Summary

In conclusion, Viasat Inc. represents an enticing investment opportunity for high risk investors seeking to be part of the future of satellite communications and broadband services. Recent developments with Viasat-3 underscore the company’s dedication to innovation and expansion, solidifying its position in the fast-growing global connectivity market. Diversification should allow for this stock to maintain operating margins while they expand into high growth opportunities making it one of our favorite plays in the space.

Nevertheless, like any investment, potential investors should conduct thorough due diligence, considering both the inherent risks and the robust growth potential of the satellite communication industry. Viasat’s valuation should be evaluated in light of its technological leadership, diversified revenue streams, operating margins, and global reach in comparison to competition. Downside risk is high and dependent primarily on the upcoming 2024 launches. As the world continues to rely on high-speed internet connectivity, in-flight communications, and secure government and defense solutions, Viasat’s innovative offerings position it to play a crucial role in shaping the future of global communication. Careful analysis and a long-term perspective can lead to informed investment decisions in this dynamic and ever-evolving sector. We believe upside could be as high as $40 (~100% return) by the end of 2024 if all goes as planned, and downside could be as low as $10 barring another unsuccessful satellite launch.

Read the full article here