In late December, I recommended Vir Biotechnology, Inc. (NASDAQ:VIR) as a speculative Buy due to its long-term cash availability, experienced management team, collaborations with significantly large commercial companies such as GSK and progressing pipeline. The company has recently released its Q2 2023 earnings report. Biotechnology firm stocks are hugely sensitive to news updates rather than the results of earnings reports. Over the last month, we have seen the stock price drop to a three-year low due to its recently failed mid-stage flu trial; the earnings release hardly made a dent in comparison.

Five year stock trend (SeekingAlpha.com)

Investors considering Vir Biotechnology should exercise caution despite the apparent buying opportunity the setback presents. The company’s financial performance may not be sustainable due to the decreasing demand for COVID-19-related products. Furthermore little information is available on the next revenue driver and when it will occur. Therefore I recommend a wait-and-see-hold approach until there is a clearer understanding of the company’s ability to expand its commercial prospects.

Company updates – the good

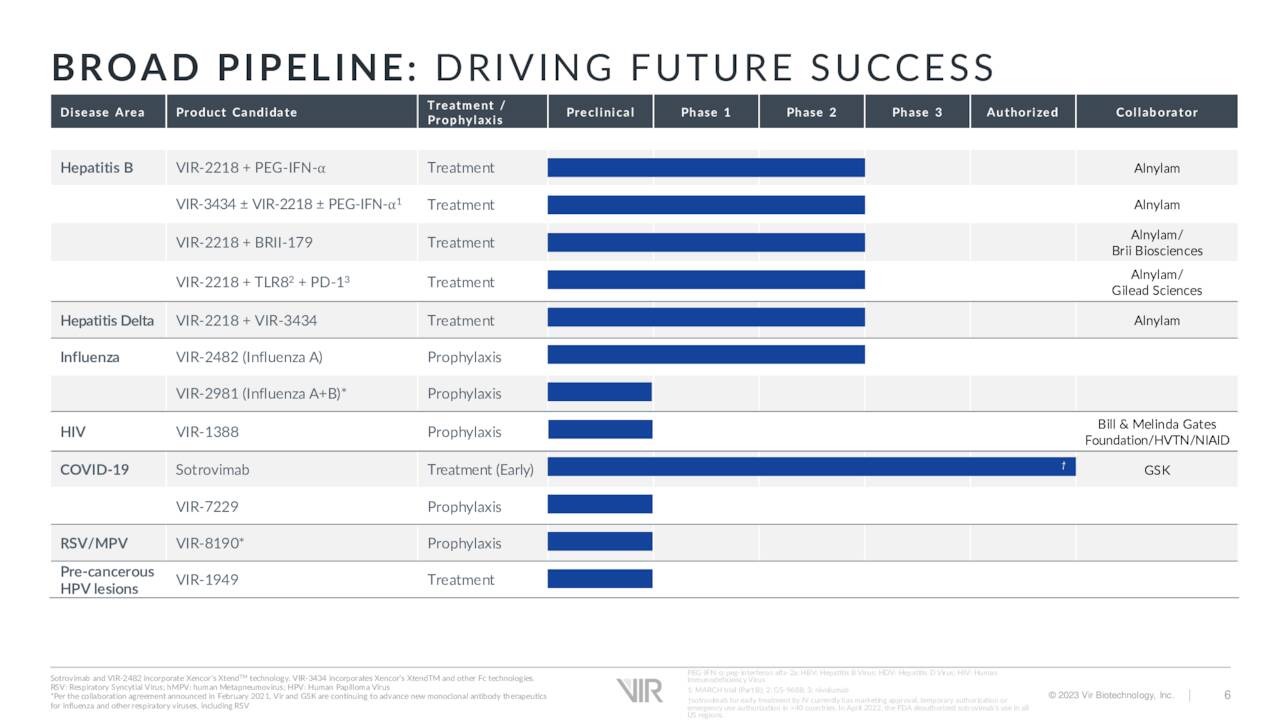

The previous article gives an overview of the company. Vir Biotechnology is part of multiple collaborations in various research phases and benefits from significant financial backing. It has a diverse clinical pipeline focused on infectious diseases such as the flu, HIV, and hepatitis and respiratory conditions such as RSV and COVID-19. The company’s efforts span monoclonal antibodies, siRNAs, and T-cell vaccines. In the most recent earnings call, the company reaffirmed its ability to respond to global health threats, such as discovering neutralising antibodies for COVID-19 and Ebola.

Pipeline progress (Investor presentation 2023)

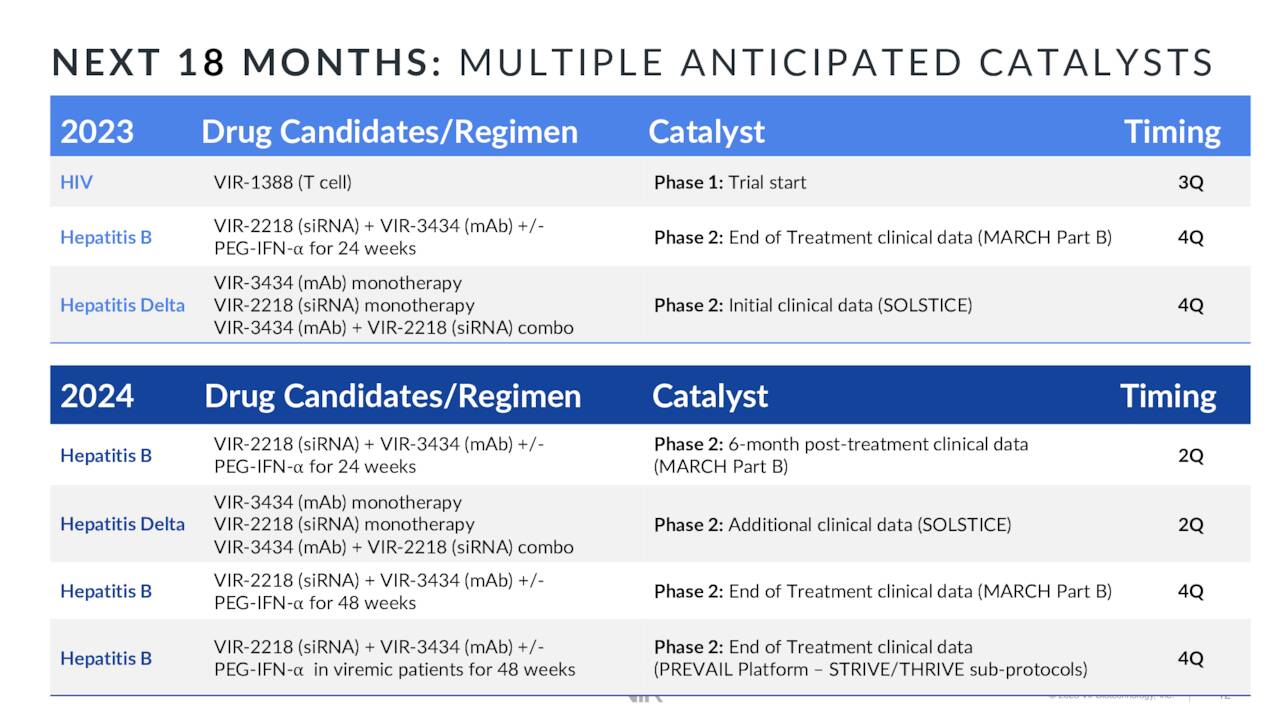

Furthermore, the company is progressing on its pipeline with a particular focus on chronic hepatitis B and hepatitis Delta through reliable partnerships. The upcoming 24-week on-treatment data from the combination of VIR-2218 and VIR-3434 aims to demonstrate effectiveness in achieving seroclearance and assessing the potential of these therapies.

Pipeline with catalysts 2023 and 2024 (Investor presentation 2023)

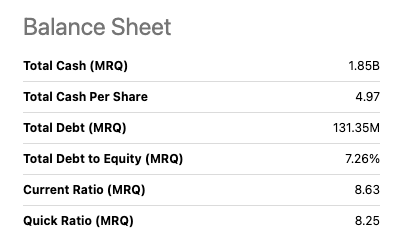

Vir Biotechnology is currently in a robust financial position, boasting $1.85 billion in cash and a low level of debt. This gives them the ability to focus on their hepatitis B and delta programs and potentially move them forward in their clinical stages. Additionally, their strong financial standing puts them in a good position to explore the possibility of acquiring external assets that align with their expertise and strategic objectives. This could further bolster their pipeline of offerings.

Balance sheet overview (SeekingAlpha.com)

Company updates – the bad

The company’s future performance is facing increased uncertainty due to several recent developments. Primarily, the setback of the Phase 2 trial evaluating VIR-2482 for flu prophylaxis has significantly dampened investor sentiment, leading to a substantial drop in share price, the lowest in three years. The trial’s failure to meet its primary endpoint, with a non-statistically significant reduction in influenza illness in the highest dose group, has raised concerns about the drug’s efficacy. Consequently, the Phase 3 trial will not be pursued, as achieving transformative effectiveness beyond traditional vaccines was deemed complex. This outcome has prompted Vir Biotechnology to reevaluate its strategic priorities.

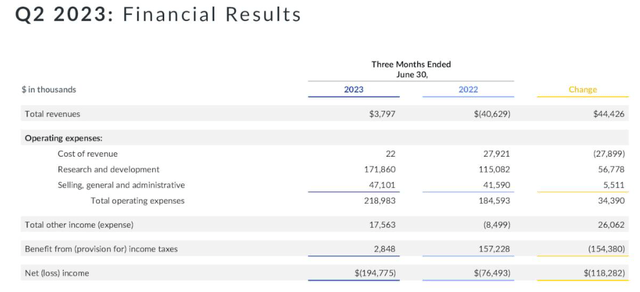

Additional concerns revolve around the collaboration revenue from the sotrovimab treatment for COVID-19, which is anticipated to decrease and could negatively impact the company’s financials due to continued investments in supporting the drug’s marketing authorisation. Due to the ongoing decline, we already see the YoY decline in bottom-line performance.

Q2 2023 versus Q2 2022 (Investor presentation 2023)

Moreover, the company’s choice to discontinue its small molecule platform may affect its financial performance.

Valuation

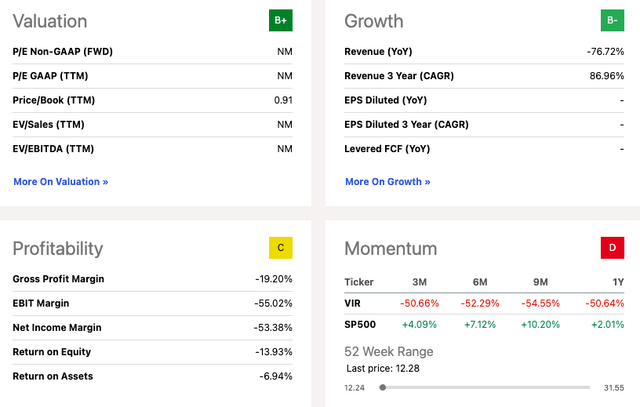

In my previous article, I compared VIR to two other biotechnology peers taking on serious infectious diseases, AN2 Therapeutics, Inc (ANTX), whose market cap has since grown from $192.28 million to $331.22 million and Appili Therapeutics Inc. (OTCQB:APLIF) whose market cap has remained around $4.88 million. One of VIR’s key strengths remains its significant access to cash which opens up opportunities such as acquisitions to grow its pipeline, investments into trials and the possibility to reward investors. According to Seeking Alpha’s Quant rating, the stock maintains a valuation of B+. However, the recently failed trial, the decline in top and bottom line revenue and the significant drop in share price alongside no major upcoming potential growth catalysts make the stock less attractive than a few months prior.

Quant rating (SeekingAlpha.com)

Risks

Investing in biotech firms can be risky since it involves predicting future outcomes rather than relying on historical financial performance. The recent trial setback has raised concerns about the company’s future success. Additionally, regulatory hurdles, competition, and alternatives could affect the company’s prospects. The fact that the company has a multi-candidate pipeline means that any failures in one program could impact its overall success. It’s also worth noting that the company is currently under investigation for potentially misleading information, which could affect its financial performance.

Final thoughts

Investing in biotechnology firms can be a risky venture, as their stock tends to fluctuate based on news updates rather than financial performance. Recently, Vir Biotechnology experienced a setback in its Phase 2 trials, causing its stock to lose momentum. However, the company has many collaborations, a diverse pipeline, and substantial capital. While their balance sheet looks promising, it’s uncertain which product will become their next commercial hit. Therefore, I recommend waiting and seeing how the company navigates through the ever-changing biotech landscape before making any investment decisions.

Read the full article here