Investment thesis

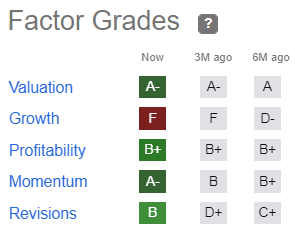

Vishay Intertechnology (NYSE:VSH) could have been one of the stars in the Seeking Alpha Quant rating, but the stock has the lowest possible growth grade. Indeed, my analysis suggests that the revenue has been compounding at low single digit over the last decade and the trend is expected to continue.

Seeking Alpha

Profitability metrics are indeed solid, and the capital allocation policy is friendly to shareholders with consistent dividends and share repurchases. But I have a feeling that the company made the wrong choice between reinvesting in growth and making shareholders happy over the short term. I think so, because the below 2% dividend yield does not look serious, especially when T-Bills offer much higher yield at the moment. The dividend growth also looks weak and I cannot call VSH a value stock neither. That said, I do not recommend to invest and assign the stock a “Hold” rating.

Company information

Vishay Intertechnology is a global manufacturer of electronic components and semiconductors. End markets include automotive, industrial, computing, consumer, telecommunications, military, aerospace, and medical markets. According to the latest 10-K report, the company had 57 manufacturing locations across the world as of the FY 2022 year-end.

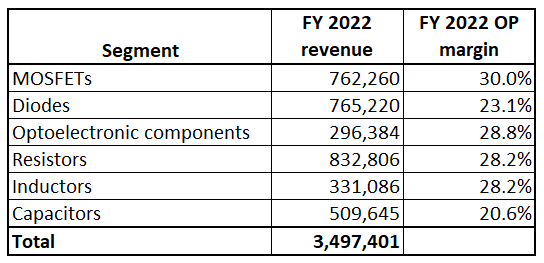

The company’s fiscal year ends on December 31. VSH operates in six segments based on product functionality: MOSFETs [Metal-Oxide-Semiconductor Field-Effect Transistors], Diodes, Optoelectronic Components, Resistors, Inductors, and Capacitors. In FY 2022, less than 30% of the company’s sales were generated in the Americas.

Compiled by the author based on the latest 10-K report

Financials

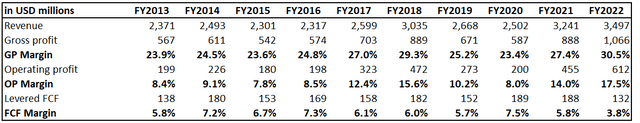

Over the past decade VSH delivered a steady revenue growth with solid profitability metrics expansion. Revenue compounded at the 4% rate over the past ten years. The gross margin expanded from 24% to 31% and the operating margin more than doubled. However, the free cash flow [FCF] margin did not improve much and has been consistently in mid-single digits.

Author’s calculations

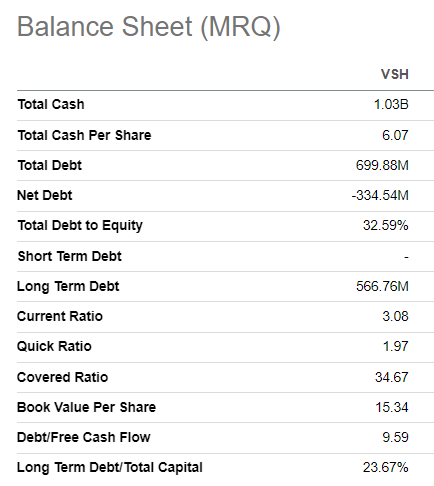

Despite the relatively narrow FCF margin, the company has been consistently paying out dividends and buying back shares. The business is capital intensive meaning that the significant part of the operating profit is reinvested in capex. Despite a high capital intensity of the business and consistent payouts to shareholders, VSH maintains a healthy balance sheet with very low leverage and substantial liquidity ratios.

Seeking Alpha

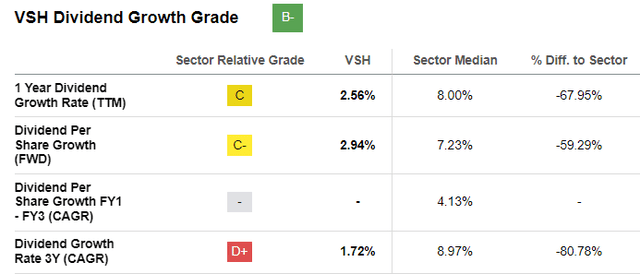

I could have said that the company’s capital allocation approach is excellent, but maybe VSH should have better reinvested in growth rather than paying out dividends. I think so, because the company neither delivers stellar revenue growth nor it demonstrates above peer’s dividend growth rate. Three-year dividend CAGR of VSH is much lower than the sector media.

Seeking Alpha

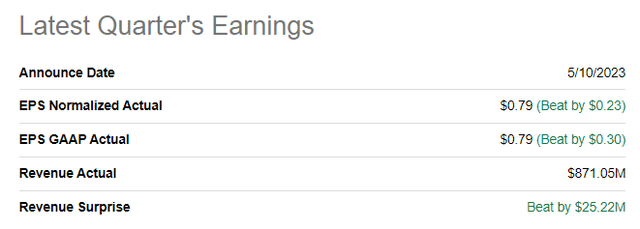

VSH reported its latest quarterly earnings on May 10, beating consensus estimates. Revenue 2% YoY growth was notably below the historical average and the EPS expanded slightly. The gross and operating margins expanded slightly YoY as well. The strength in quarterly profitability metrics was mainly achieved by the improved pricing and input cost efficiencies. The positive effect was offset by weaker demand.

Seeking Alpha

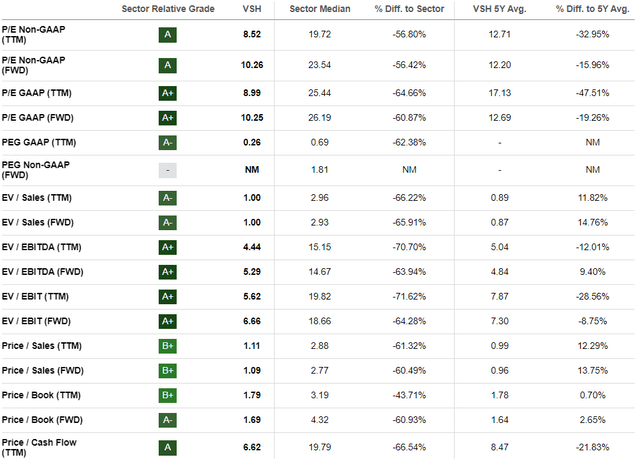

The upcoming quarter’s earnings are scheduled on August 9, and the topline is expected to demonstrate about 2% YoY growth again. The EPS is projected to shrink from $0.82 to $0.63. According to the management’s guidance, the gross margin is expected to shrink YoY from 31% to 28%.

Seeking Alpha

Overall, it is good that the company demonstrates revenue growth even amid the current challenging environment for the end markets. Profitability metrics delivered by VSH are also impressive, but I do not like that the company’s historical revenue growth significantly lagged the overall semiconductor industry. That said, the company seems to be failing in capturing favorable secular trends in full.

Valuation

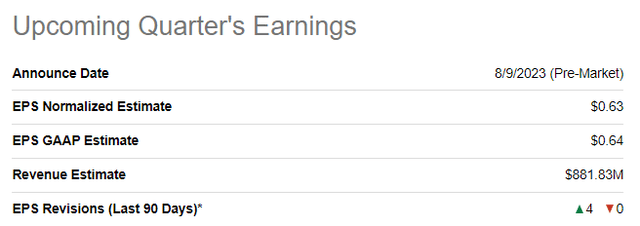

The stock outperformed the broader U.S. market this year, with a 28% year-to-date rally. Seeking Alpha Quant assigns the stock a high “A-” valuation grade thanks to the low multiples compared to the sector median and the company’s historical averages.

Seeking Alpha

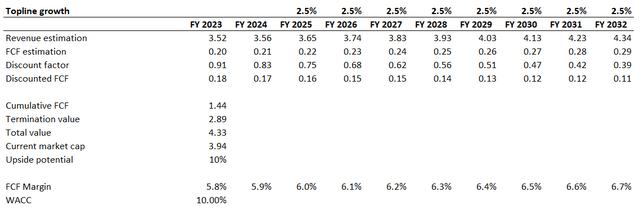

Let me proceed my valuation analysis with the discounted cash flow [DCF] approach. I implement a 10% WACC as a discount rate for VSH. I have consensus revenue estimates for the upcoming two fiscal years and for the years beyond I project the top line to compound by 2.5% yearly. I use 5.8% for the FCF margin, which is the past five year’s average. I expect the FCF margin to improve by 10 basis points yearly.

Author’s calculations

The stock looks about 10% undervalued under my conservative assumptions which might look decent. On the other hand, for the two upcoming years consensus estimates forecast no revenue growth and the EPS stagnation. The discount for a stagnating company might be fair because there are a lot of more attractive growth opportunities in the stock market.

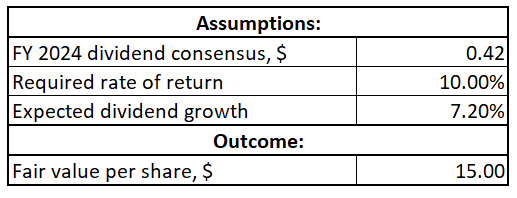

To get more evidence for my valuation exercise, I want to proceed with the dividend discount model [DDM]. Consensus dividend estimates forecast FY 2024 payout at $0.42 per share. For the dividend growth I use 7.2% which is the company’s past five years’ CAGR. I use the same 10% discount rate for the DDM as well.

Author’s calculations

From the DDM perspective, the stock looks substantially overvalued with a $15 fair value. To prove the stock’s current price to be fair, dividend should compound at 8.5% annually, which is notably higher than the company’s historical performance. That said, VSH has a very limited [if any] upside potential, according to my analysis.

Risks to consider

The company generates substantial portion of its sales outside the U.S. meaning that VSH faces significant risks related to international trade. Vishay faces significant foreign exchange risks meaning that unfavorable fluctuations on foreign exchange markets will adversely affect the company’s earnings. Having more than 70% of sales generated outside the U.S. also means high vulnerability to geopolitical risks and potential adverse changes to international trade regulations and tariffs. Apart from the revenue side, the supply chain also might be disrupted by adverse geopolitical events.

VSH operates in the semiconductor industry which is rapidly evolving and there is a high risk of technology obsolescence. Product lifecycles are relatively short as product innovations emerge rapidly. That said, existing products might become obsolete earlier than they pay off the invested capital in capex and intellectual property. VSH should also effectively protect its intellectual property to sustain its competitive advantages.

Bottom line

To conclude, VSH is a “Hold”. Of course, the company demonstrates a slight revenue growth and profitability metrics resilience in the current harsh environment and it is impressive. But the revenue is expected to stagnate in the upcoming years, according to consensus estimates. The dividend yield is low given the current high Federal Funds rates and the upside potential based on the DCF analysis does not look attractive as well.

Read the full article here