Recommendation

It has been a nice home run of near 100% gain since my initiation post on Vita Coco (NASDAQ:COCO), in fact the stock has surpassed my target price. Just to give a brief overview, This is the first U.S. company to market bottled coconut water under its own name and has established an asset-lite global supply chain for coconut beverages. Health-related drinks are becoming more popular, particularly as the pandemic has prompted the public to focus on the importance of having a balanced diet. With its hybrid GTM strategy and opportunities for further penetration, COCO is able to expand its market reach across the Americas while leveraging its win-win partnerships with other countries such as the Philippines, Indonesia, and Brazil. Since it has been a while (6months), I figured I’d share my current thoughts on the company and the stock. I’m keeping my Buy recommendation on COCO stock as the company’s strong earnings beat the consensus estimate thanks to rising revenue and normalization of COGS.

Consequently, management has increased its forecast for FY23 net sales growth to 9%-12% and its forecast for adj EBITDA to $54-$59 million. There were many encouraging signs in the latest report, but the 8% increase in volume was especially noteworthy given the current market conditions, where one might expect volume to be weak and growth to be driven primarily by price increases. The reasoning goes like this: consumers are reducing their discretionary spending, and businesses are growing solely as a result of price increases (to counteract cost inflation). Despite the weak consumer spending environment, I see clear evidence that demand for COCO’s products remains healthy. Further, I note that the volume growth was despite two price increases last year on branded products. From this, I infer that COCO’s product might still be relatively cheap to its alternatives, as such I don’t see a reason why volume would fall from here. Instead, it tells me that management still has room to increase prices.

Margin

COCO’s first-quarter gross margins were 30.7%, a significant increase of nearly 1100 basis points from the same period in the prior year. The favorable conditions in ocean freight and domestic transportation costs, as well as the lingering impact of price adjustments implemented the previous year, have all contributed to this significant improvement. As ocean freight rates stabilize, it is promising to see COCO actively participating in the spot market, which should further improve gross margins in the future. In addition to the freight cost leverage, I believe there is room for growth in COCO’s product mix. In particular, thanks to COCO’s strategic efforts to broaden the availability of its multi-pack offerings, I expect the branded business to grow at a faster rate than the private label segment. In the long run, this is good news for the company’s profit margins. On the flipside, what could be a headwind to margin expansion is COCO significant marketing reinvestment planned this year to support long-term growth initiatives. I am net positive on this as this is a move to grow the business, and I would expect management to be sensible in allocating S&M resources throughout the year to ensure it doesn’t fully overwhelm the gross margin expansion.

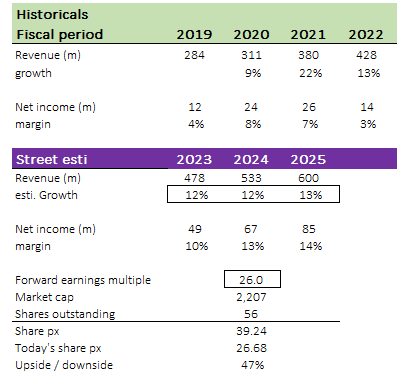

Valuation & model

I believe the upside remains attractive for COCO. I expect growth momentum to continue, and especially with the improvement in gross margins due to lower logistic costs and product mix, earnings growth should grow faster. That said, I note that the multiple that COCO stock is trading today is not sustainable at 36x forward P/E. I expect multiples to compress over time as earnings growth subdues (short-term tailwind from freight cost normalization will go away eventually), as such I modeled COCO to be valued at 26x forward P/E (which is its average). The concern here might be how fast multiples contract back to 26x. My expectation is that earnings will gradually slow down over the next few years. However, the risk is COCO missing expectations, not because it is not performing well, but because the market is expecting too much. In that instance, we might see a sharp contraction that could hurt new shareholders.

Own calculation

Risks / Concerns

Coconut drinks could be just another trend

Similar to all other trendy products, the consumption of coconut could be a passing trend. If that is the case, COCO could face a severe decline in demand. Given that a large portion of revenues and profits are contributed by sales of coconut water, COCO might not be able to pivot to another product category successfully as well.

Summary

I maintain my Buy recommendation for COCO based on its strong earnings and growth potential. The company’s ability to beat consensus estimates, increase its forecast for net sales growth, and improve gross margins demonstrates its resilience and market position. Despite a weak consumer spending environment, COCO’s products continue to show healthy demand, supported by volume growth even after price increases. This indicates that there is potential for further price increases, suggesting that COCO’s products are still relatively affordable compared to alternatives. Additionally, COCO’s participation in the spot market and strategic efforts to expand its multi-pack offerings bode well for future gross margin improvement and faster growth in the branded business. While marketing reinvestment may pose a headwind to margin expansion, prudent resource allocation by management should ensure a balanced approach to sustain long-term growth initiatives.

Read the full article here