A lot of people like to think of the world in terms of black and white. Something is either good or it’s bad. But the fact of the matter is that there is a lot of grey in the world as well. And this can take many forms. For instance, when a company reports financial results for a quarter, the financial picture can be rather complicated, with some aspects of what the business reports looking positive while other data comes in negative. The picture for investors becomes especially complicated when the firm in question has a history of financial volatility. A great example of this can be seen by looking at Walgreens Boots Alliance (NASDAQ:WBA).

Shares of the enterprise plunged as much as 11.7% on January 4th after management reported financial results for the first quarter of the 2024 fiscal year. Some of the results provided by management were undeniably positive. But others were certainly negative. Clearly, the market perceived the picture in a more negative light, and in most respects I would agree with that. However, even the market was not sure exactly how negative the situation in its entirety was. I say this because, despite how far shares fell initially, the stock closed down only 5.1% for the day.

Even with this decline, it doesn’t necessarily make the enterprise a bad investment. Back in November of 2023, I wrote a bullish article in response to shares plunging almost 43% from the start of the year through the time that article was written. Some of that drop was certainly warranted, but on the whole, shares looked attractively priced. Management was making some progress in some areas of the operation. But it definitely was not a riskless opportunity. I ended up rating the company a ‘buy’ and, since then, even with the stock closing down on January 4th, shares are still up 15.1% compared to the 3% seen by the S&P 500. In the long run, I would argue that the picture for shareholders is not exactly great. But the deep value investor in me believes that shares are cheap enough still to warrant a bit of upside.

A mixed picture

When it comes to headline news, the picture regarding Walgreens Boots Alliance was definitely mixed. Consider revenue for starters. Sales for the first quarter came in at $36.71 billion. In addition to representing a roughly 10% increase over the $33.38 billion the company reported the same time one year earlier, revenue came in about $807 million higher than what analysts anticipated. What’s really exciting about this is that the company benefited across all three if it’s operating segments.

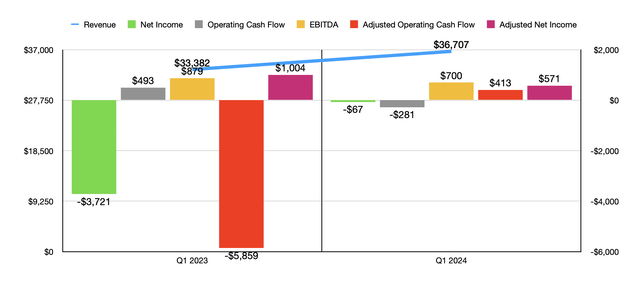

Author – SEC EDGAR Data

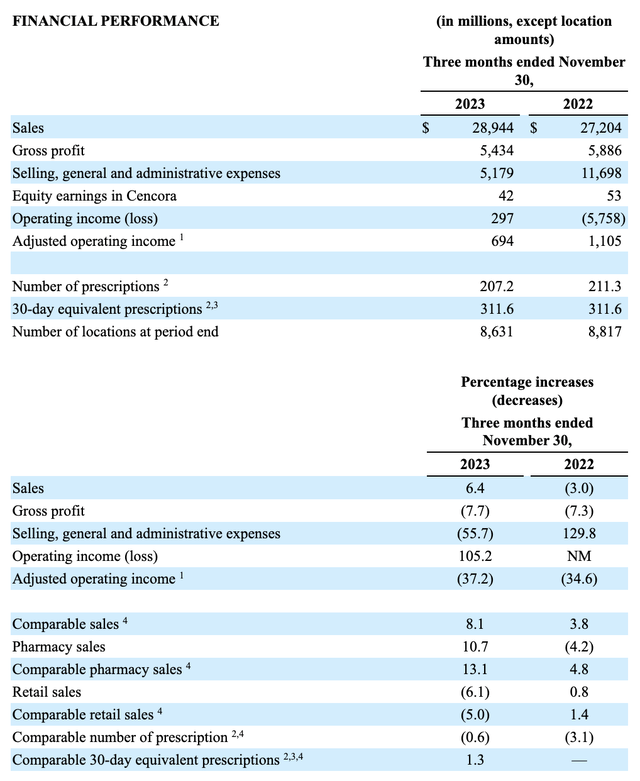

For starters, during the quarter, the U.S. Retail Pharmacy segment of the company reported revenue of $28.94 billion. That’s comfortably higher than the $27.20 billion generated one year earlier. According to management, this sales increase of 6.4% was driven by an 8.1% rise in comparable sales that management attributed almost entirely to comparable pharmacy sales. Those managed to jump 13.1% thanks to higher branded drug inflation and certain initiatives that management did not disclose publicly when it comes to the firm’s pharmacy services. Some of the improvement also involved a 1.8% rise in comparable prescriptions on a year over year basis. However, with a decrease in store count from 8,817 locations in the first quarter of the 2023 fiscal year to 8,631 the same time this year, the total number of 30 day equivalent prescriptions remained flat at 311.6 million.

Walgreens Boots Alliance

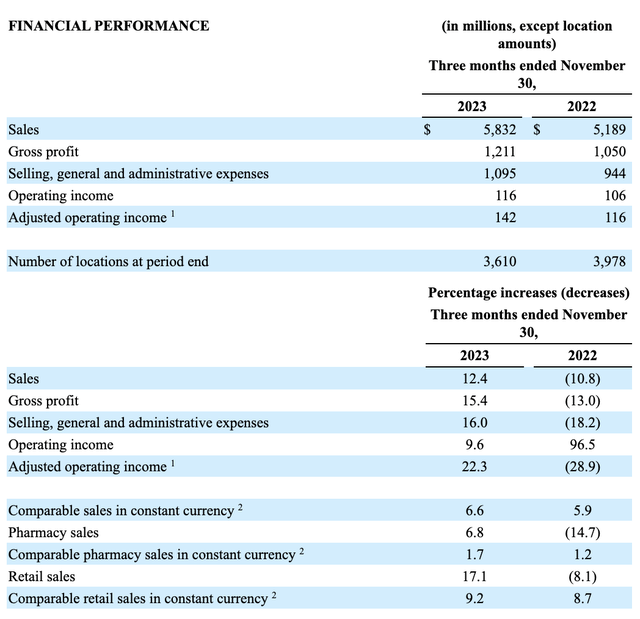

International operations posted even stronger growth of 12.4%, with revenue climbing from $5.19 billion to $5.83 billion. When it comes to these particular operations, the company was hit by a decline in the number of locations from 3,978 to 3,610. However, Comparable pharmacy sales on a constant currency basis grew by 1.7%, with overall pharmacy sales up 6.8%. In comparable retail sales on a constant currency basis jumped 9.2%. This, management said, was driven by robust growth associated with the Boots UK brand.

Walgreens Boots Alliance

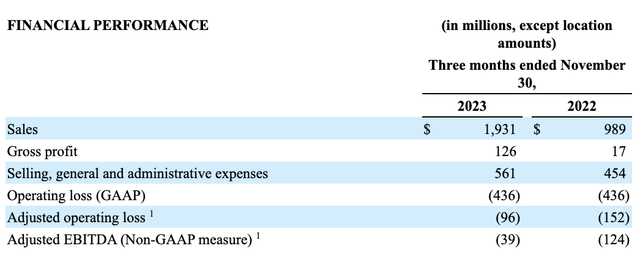

Lastly, there is the U.S. Healthcare segment. For those not familiar, this is the part of the company that involves a collection of businesses under the parent business, such as the firm’s majority ownership in VillageMD. Revenue under this segment skyrocketed 95.2% from $989 million to $1.93 billion. Acquisition activities, combined with contract wins and general organic growth, were responsible for this upside.

Walgreens Boots Alliance

On the bottom line, the situation was different, and in a not so pleasant way. According to management, the company generated a loss per share of $0.08. While that’s a big improvement compared to the $4.31 per share loss reported for the first quarter of 2023, it’s $0.68 per share lower than what analysts were hoping for. Even if we make certain adjustments, we see year over year pain. The adjusted earnings per share for the company came in at $0.66, which was $0.30 per share lower than what analysts thought and it was below the $1.16 per share generated the same time one year prior. Overall, the company went from generating a net loss of $3.72 billion to generating a loss of only $67 million. But on an adjusted basis, it went from a profit of $1 billion to a profit of only $571 million. We should also, of course, pay attention to other profitability metrics. Operating cash flow, for starters, went from $493 million to negative $281 million. On an adjusted basis, however, it went from negative $5.86 billion to positive $413 million. And finally, EBITDA pulled back from $879 million to $700 million.

When you put all of this on a single page, it looks very messy. The value investor in me generally eschews from these kinds of prospects. However, there are some things about the business that are drawing me in. For starters, management is still forecasting adjusted earnings per share for 2024 of between $3.20 and $3.50. That’s unchanged from prior guidance. So despite this bottom line pain, management seems optimistic about the current fiscal year. Even if the company does report the adjusted earnings that have been forecasted, that would be below the $3.98 per share on an adjusted basis that was reported for the 2023 fiscal year.

In addition to maintaining guidance, there are some other things that have me feeling positive. The increase in revenue across the board is one such example. However, there is also some other data that management has come out with that investors should look upon in a favorable light. Management believes that they are currently on track to achieve $1 billion worth of cost savings. They are targeting $600 million in capital expenditure reductions and $500 million in working capital improvements. Despite the bottom line issues for the quarter, the company says that it is also on track for the U.S. Healthcare segment to more or less break even on an EBITDA basis for this year. That would mark a nice improvement over the $376 million of negative EBITDA reported for the 2023 fiscal year. Seeing as how this is the growth engine of the enterprise in the long run, getting to the point where it can eventually generate positive cash flow should be a top priority.

Another thing that I found myself enthusiastic about that I am sure most investors would think I’m crazy regarding involves the distribution. You see, when management reported results for the first quarter, they also stated that they were cutting the distribution by 48%. That should bring the distribution down to $0.25 per share each quarter. I understand how people feel about their distributions, but I would much prefer a business that is investing in itself. With $8.47 billion in net debt and bottom line issues that necessitate significant cost cutting, I think every penny that the firm can allocate toward improving results should be looked upon in a favorable light. You see, prior to this distribution cut, the firm was allocating around $1.66 billion toward distributions each year. That number is now being reduced to $863.2 million. That’s a lot of capital that is now being freed up in order to invest for the long haul.

Given all the problems that Walgreens Boots Alliance has, I would not be interested in the firm if the stock were not very cheap. If we assume that the year over year decline in adjusted earnings is reflective of how much both adjusted operating cash flow and EBITDA will decline, then we should anticipate net profits on an adjusted basis of $2.89 billion, adjusted operating cash flow of $5.04 billion, and EBITDA of approximately $6.36 billion. The adjusted operating cash flow and EBITDA figures are based on some special adjustments I made based on 2023 data to try and strip out a lot of the one-time events and other volatile figures.

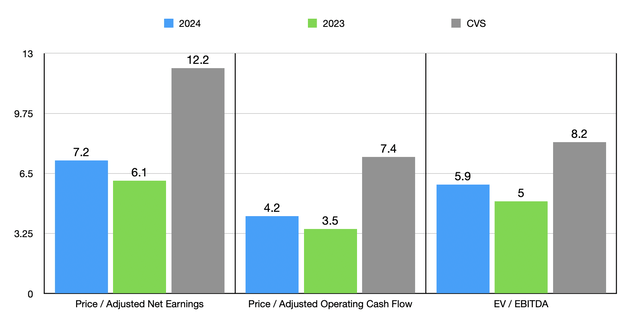

Author – SEC EDGAR Data

As you can see in the chart above, shares do look more expensive on a forward basis. But with trading multiples in the mid-single digit range, the stock is still very cheap. I also included in that analysis a comparison to rival CVS Health (CVS), though I would argue that while the two companies are the closest possible in terms of being comparables, they are still radically different from one another. I would also argue that, in general, CVS Health deserves higher trading multiples than Walgreens Boots Alliance does. So I wouldn’t expect to see Walgreens Boots Alliance appreciate enough to close that gap entirely.

Takeaway

Based on all the data provided so far, I can understand why the market was initially angry about what occurred. But to me, some of these moves, such as the reiteration of guidance and the rapid growth of the U.S. Healthcare segment, are major positives. The distribution cut is certainly going to be one of the most controversial changes amongst investors. However, I champion the move. While the stock has increased significantly since I last rated it in a favorable light, the stock is still cheap enough, especially given the improvements that we have seen, to maintain that ‘buy’ rating for now.

Read the full article here