Listen on the go! Subscribe to Wall Street Breakfast on Apple Podcasts and Spotify

Trump SPAC DWAC on watch after indictment in classified documents case (00:27). EVs made by General Motors (GM) will be able to use Tesla’s (TSLA) Supercharger network (01:26). Sientra (SIEN) rockets ~75% after hours on FDA approval for tissue expander (02:40).

This is an abridged transcript of the podcast.

The Trump SPAC is on watch after the former president is indicted in a classified documents case. Tesla’s Supercharger network has, in a sense, become even more powerful and Sientra skyrockets after an FDA approval.

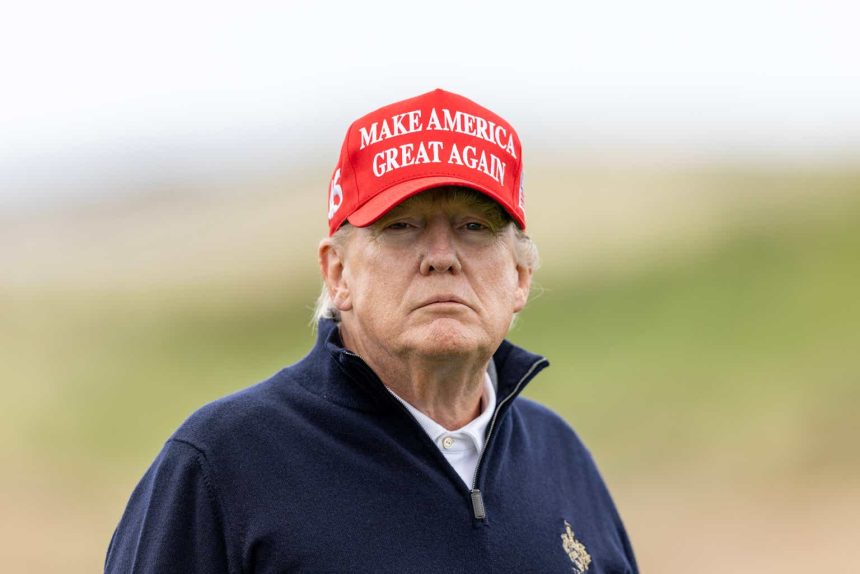

Adding to the latest drama surrounding the 2024 presidential race, Donald Trump has been indicted on seven counts in a criminal case brought by the Justice Department.

This marks the first time a former president has faced federal criminal charges.

The counts are said to include willfully retaining classified documents under the Espionage Act, as well as conspiracy, false statements and obstruction of justice.

Trump was already indicted in a separate case back in April.

He will appear in court in Miami on Tuesday.

Digital World Acquisition (NASDAQ:DWAC), the firm seeking to merge with Trump’s media company – that owns the TRUTH Social app – will be on watch today.

Any big headlines surrounding the former president has generally led to movement, though DWAC did receive a delisting notice last month from the Nasdaq.

General Motors (NYSE:GM) announces a collaboration with Tesla.

The Tesla Supercharger Network will be open to General Motors (GM) electric vehicles starting in 2024. The EVs will initially require the use of an adapter.

But beginning in 2025, the first GM EVs will be built with an NACS inlet for direct access to Tesla Superchargers without an adapter.

NACS stands for North American Charging Standard which is the charging port used by Tesla.

GM will also integrate the Tesla Supercharger Network into its vehicle and mobile apps to allow drivers to easily find, pay for and initiate charging at available Tesla Superchargers.

This collaboration will expand access to charging for General Motors (GM) EV drivers at 12K Tesla Superchargers starting next year. The release says that number will grow.

GM CEO Mary Barra and Elon Musk held a Twitter Spaces event Thursday following the announcement.

Premarket GM is up 3.8% and Tesla is up 4.7% after closing Thursday 4.6% higher.

Tesla has pushed higher for ten consecutive trading sessions.

Shares of micro-cap Sientra (NASDAQ:SIEN) on Thursday soared nearly 75% in extended trading.

Premarket SIEN is up more than 78%.

This happening after the breast implant maker got an FDA medical device approval for its tissue expander.

The company said it had received a so-called 510(k) clearance for its Tissue Expander.

The product removes 95% of the metal traditionally associated with tissue expander ports, thus making it compatible with an MRI.

According to Sientra, the product was the only tissue expander cleared in the U.S. for exposure to MRI.

Other headlines to look out for on Seeking Alpha:

Roku names former Amazon media leader to board

DocuSign jumps 14% on double-digit revenue gain, boosted cash flows

Gold recoups losses as dollar, yields drop after jobless claims data

Meta plans launch of Twitter rival via Instagram – report

Certara slips as CFO cites negative outlook

Edgio to cut 12% of its workforce to reduce cost

In the catalyst watch for the day, NIO (NIO) reports earnings today before the opening bell. The Nasdaq will release its short interest report today and the go-shop period expires on the management buy offer for Franchise Group (FRG).

Now a look back at where the market ended on Thursday then a look at the premarket.

Stocks ended higher on Thursday.

The Dow (DJI) climbed 0.50%. The Nasdaq (COMP.IND) settled 1% higher and the S&P 500 (SP500) added 0.6%.

Of the 11 S&P sectors, seven ended in positive territory, led by Consumer Discretionary and Tech. Real Estate and Energy topped the losers.

The 10-year yield (US10Y) was down 7 basis points to 3.71% while the 2-year yield (US2Y) was down 4 basis points to 4.51%.

Initial jobless claims rose by 28K to 261K, significantly above expectations of 235K and its highest reading since October 2021.

Now let’s take a look at the markets as of 6:20 am. Ahead of the opening bell today, Dow, S&P and Nasdaq futures are mixed. The Dow is down 0.2%, the S&P 500 is down 0.1% and the Nasdaq is up 0.1%. Crude oil is down 0.2% at more than $71 a barrel. Bitcoin is up 0.6%.

In the world markets, the FTSE 100 is down 0.3% and the DAX is down 0.3%.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here