Listen below or on the go on Apple Podcasts and Spotify

This is an abridged transcript of the podcast.

Our top story so far in today’s session:

Sometimes the market gets what the market wants – and what it expects.

Fed doves and equity bulls are cheering a June CPI that showed inflation coming down more than anticipated, putting a second rate hike this year in serious doubt.

By the numbers:

Headline CPI rose 0.2%, with the annual rate coming down to 3%.

More closely watched by the markets, core CPI, which excludes food and energy, also rose 0.2%. That was the smallest monthly rise since August 2021. The annual rate dropped below 5% to 4.8%.

Pantheon Macro simply says “Core inflation is falling fast, with more to come.”

The market reaction was swift.

Stock index futures rallied and bond yields sank. Fed swaps immediately priced in a lower chance that the Fed would hike again after it raises rates in the July meeting.

Right now the Nasdaq (COMP.IN) is up about 1.3%, leading the S&P (SP500) and Dow (DJI), which are also rallying.

The 2-year Treasury yield (US2Y), most closely tied to the fed funds rates, is near 4.7% The 10-year yield (US10Y) is around 3.9%. Last week the 2-year had topped 5% with the 10-year above 4%.

Shelter accounted for 70% of June’s rise. But strategist Charlie Bilello noted that after 25 consecutive increases, year-on-year Shelter CPI has moved down for 3 straight months, from 8.2% in March (the highest since 1982) to 7.8% in June.

SA Investing Group Leader Lawrence Fuller says CPI “should give the Fed enough reason to end its rate-hike campaign, and strongly support the uptrend in stock prices.”

Among stocks to watch, sticking with the inflation theme, keep an eye on food stocks as food prices rose just 0.1% in June. Food inflation is still at 5.7% annually, though. Among elevated categories are cereals and bakery products (+8.8%), bread (+11.5%), frozen fruits and vegetables (+12.5%), and candy and chewing gum and margarine (+13.2%).

Meat prices were only up 0.6% year-over-year, with pork prices actually dropping by 3.8%. Milk prices were also down 1.9% from a year ago egg prices were down 7.9% when compared to a year ago.

The Invesco Dynamic Food & Beverage ETF (PBJ) is up a little.

Airline stocks are also in focus, with fares down 18.9% compared to a year ago. Analysts said the downward trend in fares is due largely to lower fuel prices and a healthier overall cost basis for carriers, with booking demand remaining strong.

The U.S. Global Jets ETF (JETS) is lower.

Other stocks in the spotlight included ZIM Integrated Shipping Services (ZIM), which lowered full-year earnings guidance. That was due primarily to continued weakness in freight rates across all the company’s trades, particularly in the Transpacific, now expected to continue during the second half of the year.

Domino’s Pizza (DPZ) rallied after striking a global agreement with Uber (UBER). The deal allows U.S. customers to order Domino’s products through the Uber Eats and Postmates apps with delivery via drivers from Domino’s and its franchisees.

And Cathie Wood’s ARK Innovation ETF (ARKK) shaved its Coinbase (COIN) position on Tuesday, selling about $12 million worth of shares as the stock popped 10%. That was ARK’s first sale of the crypto exchange’s stock in almost a year.

In other news of note, oil prices continue to rally, with WTI (CL1:COM) up around $75.50 per barrel and Brent (CO1:COM) topping $80. That’s despite the IEA reporting a big rise in weekly U.S. inventories of nearly 6 million barrels.

WTI is up by more than 10% in the past two weeks.

The Energy Information Administration now expects the global oil market to tighten this year, reversing its forecast and more closely aligning with bullish estimates by OPEC and the IEA.

Technical strategist Kim Cramer Larsson says WTI and Brent have bullishly broken out of their week-long rangebound pattern and he sees upside potential of 5% to 10%.

In the ongoing Microsoft (MSFT)/Activision (ATVI) saga, Bloomberg reports that the UK’s antitrust authority may need to do a new probe of the deal if the companies restructure it. The report comes after the Competition and Markets Authority and Microsoft agreed to stay litigation in the UK’s attempt to block the merger.

But Microsoft bull Dan Ives says the decision by a federal court to reject FTC’s move to block the deal is a “trophy moment.” Wedbush analyst Ives, who has an outperform rating and price target of $375 on Microsoft, said Activision is a “key asset” for the tech giant and should “catalyze its consumer franchise.”

In the Wall Street Research Corner –

With all the bullish sentiment, let’s not forget that the bears aren’t hibernating.

After calling last-year’s equity weakness, Morgan Stanley strategist Mike Wilson remains a stalwart bear despite the tech-driven rally. And he says liquidity should be a concern for bulls.

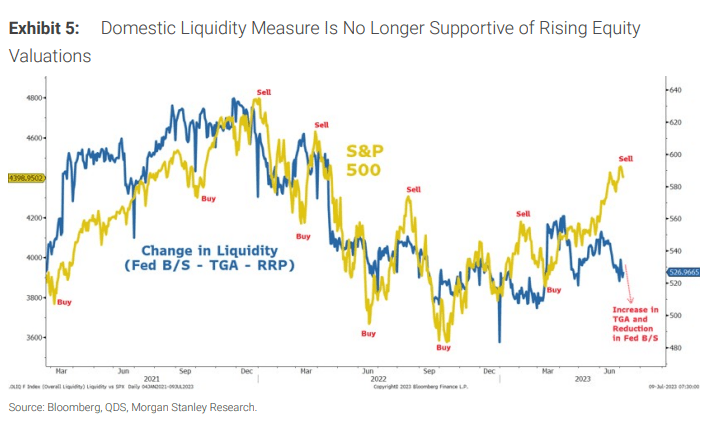

Morgan Stanley’s quant and derivatives strategy team highlights the combination of the Fed’s balance sheet, the Treasury’s general account and the reverse repo facility.

Wilson says “This gauge has also been closely aligned with the price of the S&P 500 until recently. For most of the past year, this relationship has held fairly well, but over the past month it has started to diverge quite meaningfully.”

In the past these divergences have signaled good times to buy or sell.

Wilson says now the divergence – and therefore the sell signal – is “as wide as we’ve witnessed in recent history.”

Read the full article here