Warner Music Group Corp. (NASDAQ:WMG) is not likely to go through a Napster moment. People aren’t going to make their own generative AIs. Making a generative model can be done with a Python notebook, but the data and computing is a problem if you’re going to make a good model. The tools will be centralized, and those platforms will abide by the law (which should be easily enforceable in this case), with record companies getting their dues for the recordings, that they almost invariably own, for all AI generated music using their content.

The economics are going to be a question, but the record companies are going to win out over big artists whose catalogues they can leverage, if they indeed can leverage those catalogues. With the potential for AI performers, big artists lose a lot of bargaining power if AI can replace them on the nth album. This is all very chaotic and multivariate, and also dependent on regulatory assertions, but we think that by virtue of the recording artists losing out, record companies could win big. Still, all very uncertain and chaotic.

Housecleaning: Q2 Comments

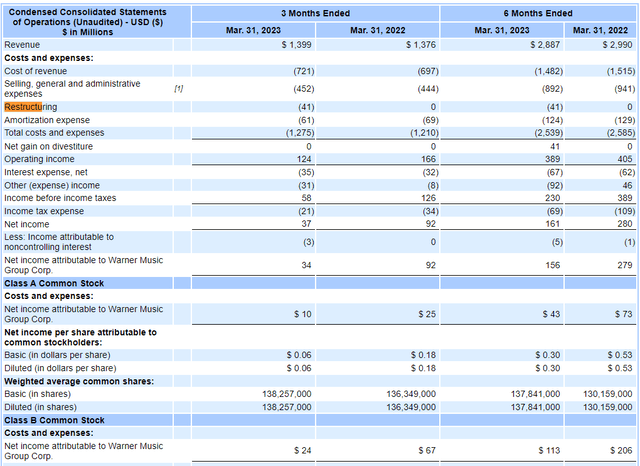

The Warner Music Q2 report was not that great. Revenues were slightly up, but they were slow this year in building up new business in the recorded music business, where releases were not as dense as hoped. Operating income is down, since there was some restructuring expenses in the current quarter. 4% of the workforce is being cut, and severance is picking up, but it’s already done, and the savings will be meaningful at around 33% of normalized EBIT.

However, this is all going to get reinvested in technology. We are interested in talking about AI.

IS Q2 2023 (WMG IS Q2 2023)

AI Comments

With a background in data science, we can make some high level comments and try to make some predictions with regards to AI in the music industry. Note that even overlooking one thing can shift conclusions dramatically, and we aren’t inclined to bet on our own predictions for this reason, but we have an opinion on the matter of how AI can impact record labels. Do keep in mind how chaotic things could be and how difficult pegging the end-point will be.

Generative AI are hard to make well. Theoretically it’s not extremely difficult, but it requires some resources that the average person is unlikely to invest in for themselves when platforms are already proliferating that will allow people to generate their own AI music using the voices of known artists. There are already lots of pretty convincing AI voice memes, and we’ve seen the Drake + Weekend AI generated song put together by Ghostwriter. People will have tools to make AI performances. The record labels may start doing this as well for their own benefit.

We think that from a regulatory perspective, things will end up being quite clear cut. The AI are trained on recordings of the artists, and mostly record labels will own those. They will be paid royalties for performances of artists generated by the AI since those performances are only possible because of training on their recordings as data. Platforms are quite likely to abide by the law, and this isn’t going to be a Napster moment assuming that the use of the platforms become quite centralized, as they are already becoming for image generation. You are not chasing after ever music pirate this time. Moreover, while AI can generate new performances with scale by using artists’ vocal likeness, enforcing IPs will also be scaled by AI that will work as classifiers, trying to identify the use of IP-covered voices in music. These models could be trained in adversarial fashion on the best generative AI out there as well. Again, not a Napster moment for the record labels – we think.

We don’t think fans will care whether a song is by the artist or by an AI version of the artist. In fact, in the case of vocal de-ageing, it is clear many might prefer listening to a young Paul McCartney over an older one, performing Sir Paul’s new songs. But in general, there is so much musical talent out there in the world, that there will be millions of ghostwriters who can create better compositions and performances with the artists’ voices and styles than the artists could create themselves. To a more commercially relevant point, record labels could just start using large artists’ catalogue to generate the next album with AI. The effectiveness of the AI kills larger artists’ bargaining power once they’ve grown big and their catalogues are extensive enough to train AI.

Risks

For smaller artists who don’t have a catalogue yet nor a name big enough to warrant interest in their vocal likeness and performance style, AI is not such a big concern. Record labels will still want to approach new talent. Although here there are risks that distributors, aka the streaming companies, will be able to cut out record labels in the presence of these new industry dynamics that would be of concern to up and coming artists. This disintermediation is a risk-factor for the record labels.

Conclusions

We don’t think this is a Napster moment for Warner Music Group Corp. It will surely complicate things, and the right strategy for record labels is not something we’ll bother to imagine. In particular, it creates some disintermediation risks. But for record labels, they gain an edge with large artists who have prominent and deep catalogues owned in large part by the record labels. While the legalities aren’t super clear, they will have this edge and be able to leverage it in better deals with large signed artists if they have the option to generate AI-generated music from their catalogues. Since the large artists matter the most for record labels, being able to take a larger share of royalties from future albums made with them, or being able to cut them out with an AI, are all meaningful opportunities.

In our last WMG article, we posited that there was an asset-value case to be made for companies like Warner Music Group based on their catalogues and the precedent valuations paid for them by private equity. We think that to the extent that this IP is a platform for far less limited development of new music and entertainment thanks to AI, these catalogues have become a lot more valuable. Importantly, composition ownership matters less than the recording ownership, and this favors the record labels meaningfully as far as the AI development goes and the potential value of their assets. Since the value of Warner Music Group stock is even lower now than when we wrote our last article, while there is a high level of unpredictability in this situation, upside should remain pretty meaningful based on the publisher’s share multiples.

We think as much as 90% technical upside is possible for Warner Music Group stock, though it will be stymied by the high levels of uncertainty. Also our predictions could be dead wrong, things may have ways of getting worse. However, in all, we definitely don’t think this is unambiguously bad for record labels, even though markets are very concerned.

Read the full article here