Thesis Summary

Waste Management (NYSE:WM) is a North American company engaged in waste management, environmental services, and comprehensive waste.

I would rate WM stock as a Buy. The reason is that WM’s business model is robust and benefits from a substantial economic moat, having unique intangible assets, namely regulatory permits for landfills, and is further strengthened by investing into new technologies like renewable energy and recycling technologies.

In this analysis of Waste Management, I will talk about the recent earnings call, the milestones achieved by the company in the previous quarter, WM financial ratios, and what the numbers tell us about the stock.

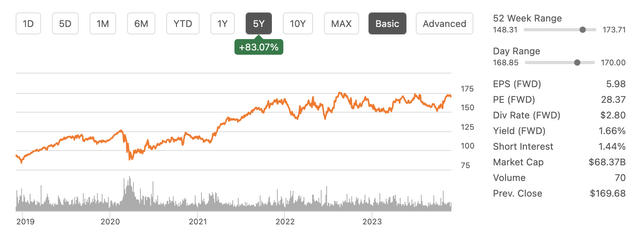

At the time of writing, WM stock was trading at $169.74, and if we look at the chart, the stock has seen a significant surge in the past 5 years. This is due to the rise of alarming global warming issues and the trend to move towards clean energy. As a result, this Clean Tech stock has seen a significant surge in my view.

Seeking Alpha

Key Business Insights

The company’s sustainability growth investments in the renewal and recycling business continued. According to the management, Waste Management is expected to gain potential adjusted operating EBITDA incremental contributions of $740 million due to its previously announced investments at the beginning of 2026. If we break it down, $500 million is expected to come from renewable energy and $240 million from recycling investments.

The company also announced that technology and automation upgrades at two of its recycling facilities were completed in the third quarter. Also, another 2 automation projects and a new market facility are expected to be finished by the end of 2023. In January, the company anticipates the launch of its seventh renewable natural gas facility, the third in its expansion program.

For 2023, WM has revised its sustainability growth capital expenditure forecast to approximately $750 million. It is a reduction from previous estimates due to rescheduling expenses over the next few quarters. Consequently, the anticipated lower capital spending has led to an updated expectation of 2023 free cash flow, now projected to be between $1.825 and $1.925 billion.

Additionally, WM published its 2023 Sustainability Report in the third quarter, which shows its sustainability commitments, strategies, and advancements toward achieving its objectives.

What Did We Learn From Q3?

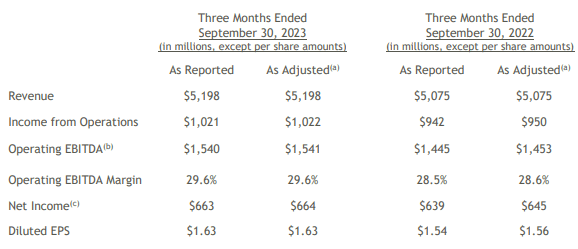

WM reported a revenue of $5.20 billion, having slightly increased by 2% when compared to the same quarter last year. Its operating expenses stood at $989 million, surging 1% YoY. WM’s third-quarter net profit is $663 million and has slightly increased by 3.7% compared to Q2 2022. Its EBITDA surged by 6.5% YoY to reach $1.54 billion, and EPS surged by 4.49% at $1.63.

This is a result of the company’s continuous investment in recycling technologies and building new plants to cater to new trends and demands, like capturing renewable energy opportunities. I believe this increases investor optimism since, apart from operating in an attractive industry with disciplined pricing and cash flow, it opens up new opportunities.

Seeking Alpha

In terms of financial health, the company’s cash position reflects a strong position, having $150 million in cash and cash equivalents. The company’s total assets remained at $31.94 billion, surging 7%. This offers WM ample buffer to invest and diversify its business from simply waste management. WM expects its CAPEX to be $750 million in 2023, which is higher than estimates, investing in energy facilities and so on.

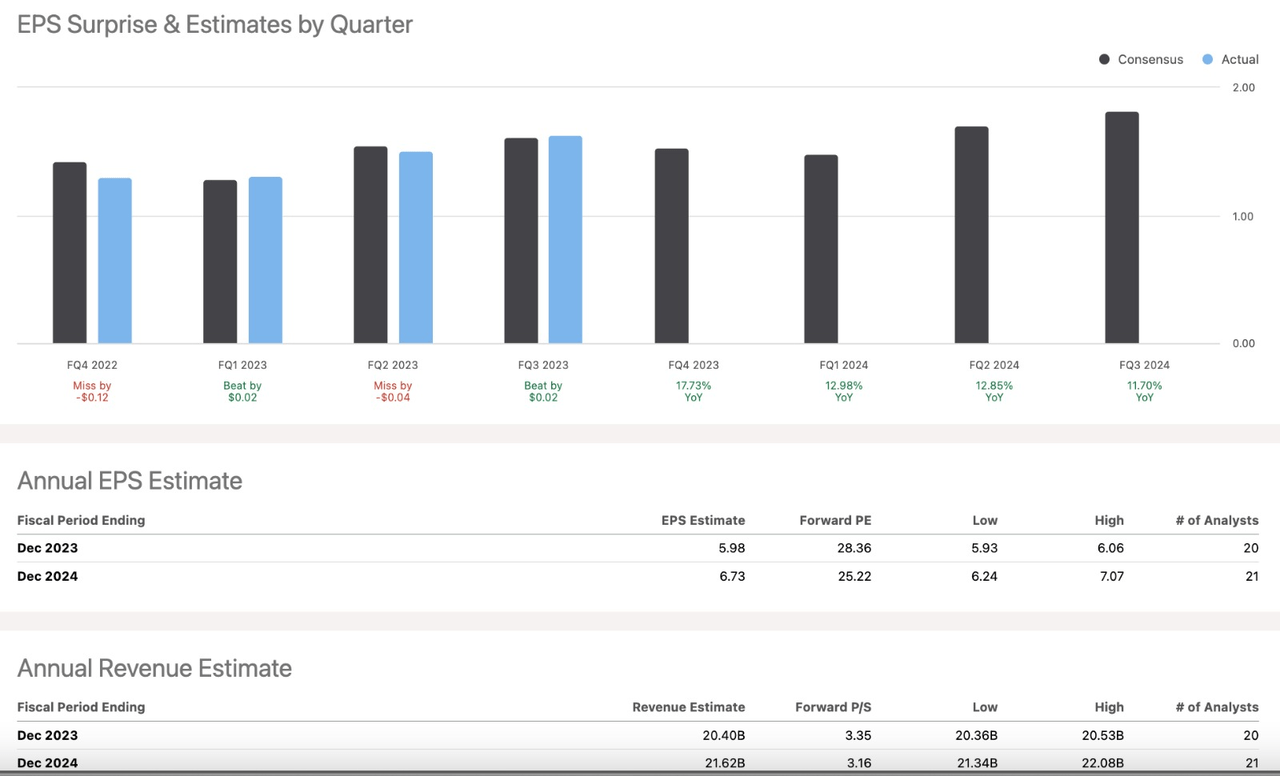

Revenue estimates for the company in 2023 are approximately $20.40 billion. In 2024, revenue is expected to reach around $21.62 billion. Similarly, its EPS is expected to be roughly $5.98 in 2023; in 2024, it is expected to reach $6.73.

Seeking Alpha

Valuation

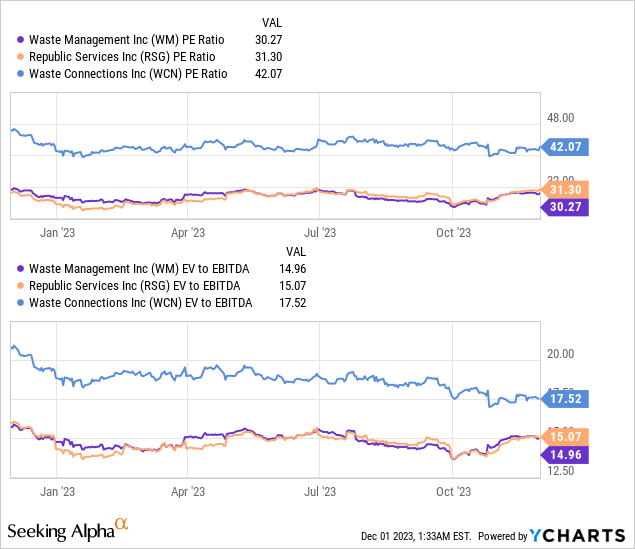

The P/E ratios of WM stock, both on a GAAP and non-GAAP basis, are 28.50 and 29.51, respectively. These figures are significantly higher as compared to the sector median of 20.51 (GAAP) and 17.61 (non-GAAP), showing that WM’s stock price is elevated concerning its earnings. WM’s EV/Sales (‘TTM’) ratio is 4.19, and the EV/EBITDA (‘TTM’) ratio is 14.82.

Given the company’s investment initiatives that give the company business opportunities in the energy sector with its specialties in the recycling industry, we expect its PE ratio and EV/EBITDA ratio to catch up with the industry average at around 35 and 16 respectively. This gives our target price in the range of $190 to $210 based on the consensus, 2025 earnings per share and EBITDA.

The reason for WM to raise its valuation multiple, compared to its waste management peers, is that the company is diverting into the energy sector that utilizes its close-to-zero cost energy input – waste. The company has pledged renewable energy investments to power over 1 million homes by 2026. Meanwhile, its peers like Waste Connections (WCN) just started such plan not long ago. The reinvestment rate and the return on such investments of WM are showing promising results, yielding higher revenue and profit.

Risks

-

Reduction in Landfill Use: As with the passage of time, society and legislative trends move towards waste reduction, recycling, and waste diversion, and the waste volume going to landfills could significantly decrease. The profitability cornerstone for the waste industry was landfills, with margins as high as 70%.

-

Environmental Concerns: Landfills are subject to environmental challenges and are often opposed by communities and environmental activists, which can limit the expansion of landfill capacity.

-

Legislative Changes: Implementing waste reduction programs, such as in France, when adopted in other regions, could impact revenue if waste volumes decrease.

-

Recycling and Technological Advancements: There is potential for significant waste diversion from landfills with growing trends in recycling and technological advancements. Therefore, it is important for WM to continue to invest, or otherwise will be negatively affected by the trend of sustainability.

Conclusion

As a Clean Tech admirer, Waste Management stands in a good position with solid assets and significant cash flow. The above risk cannot affect the company now that its near-term prospects are stable. These risk factors can have material consequences in the long run. The company contributes to achieving its sustainability goals as its market cap has nearly doubled in the past five years.

Read the full article here