Technological phenomena like the Cloud have revolutionized data science, making data storage more flexible and reducing expenses associated with fortifying physical data centers. This innovation has streamlined data flow and made collaboration and data monetization easier. However, the constant flow of data within the Cloud has also provided hackers with new targets. Improper data encryption and insufficient governance of data are widespread as many institutions are still becoming familiar with the cloud. I discuss the cloud in greater detail in my piece on the WisdomTree Cloud Computing ETF (WCLD).

Not only might data become easier to steal with the cloud, but the data itself is also becoming more valuable. Hacking is therefore becoming a more lucrative activity and has become more popular despite its legal ramifications. Ransomware attacks in particular have become quite frequent and are costing companies millions. I believe the demand for cybersecurity solutions is likely to increase as the Cloud still has a large target on its back in the eyes of hackers. For this reason, I rate the WisdomTree Cybersecurity Fund ETF (NASDAQ:WCBR) a Buy.

Hacking in the United States is only the beginning, as cyberthreats from overseas have also become more menacing in recent times. This is primarily a result of China’s murky relationship with the United States, stemming partially from competition in fields like innovative technology and defense. Espionage and cyberbreaches have become looming threats, as they could allow one to attain the data needed to pull ahead of the competition. A recent example was the Chinese spy balloon in January. On a corporate and governmental level, I think cybersecurity is well-positioned for growth in the coming periods.

Strategy and Holdings Analysis

WCBR tracks the WisdomTree Team8 Cybersecurity Index and uses a representative sampling technique. This index consists of companies that regularly profit from providing security protocols that counteract cyberbreaches toward networks, computers, and other devices. Such companies must be of at least $300mm in market capitalization and also earn at least half of their revenues from cybersecurity endeavors. This index is rebalanced semi-annually and typically consists mainly of information technology [IT] names.

This ETF consists solely of technology stocks located predominantly in the United States, the U.S. accounting for roughly 90% of the total geographical composition. Furthermore, WCBR only holds 26 stocks, the top 10 of which comprise just over half of the fund, as seen below.

Seeking Alpha

Investors are therefore relying on relatively fewer stocks to do the majority of the moving than if they invested in an alternative. A couple of WCBR’s alternatives have more than 50 holdings, making them more diverse, but less transparent. I believe that this ETF’s transparency positively distinguishes it from its peers despite the associated concentration risk. I discuss said peers in greater depth in the next section.

ETF Performance Analysis

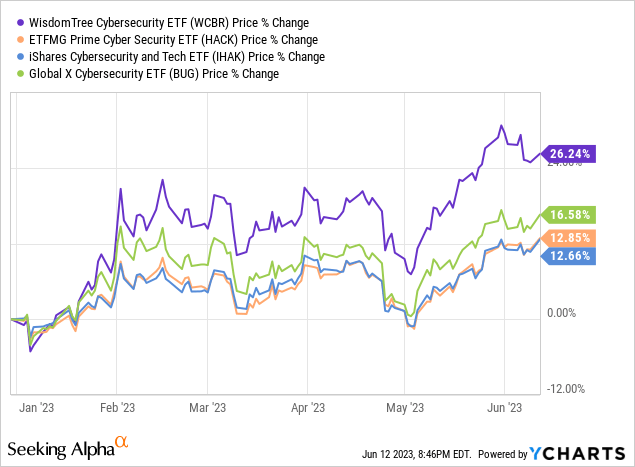

WCBR has outperformed several of its peers so far this year despite its significantly lower AUM and underfollowed status. As seen below, this ETF has even outperformed the ETFMG Prime Cyber Security ETF (HACK), which I’ve referred to as the “mother of cybersecurity funds”.

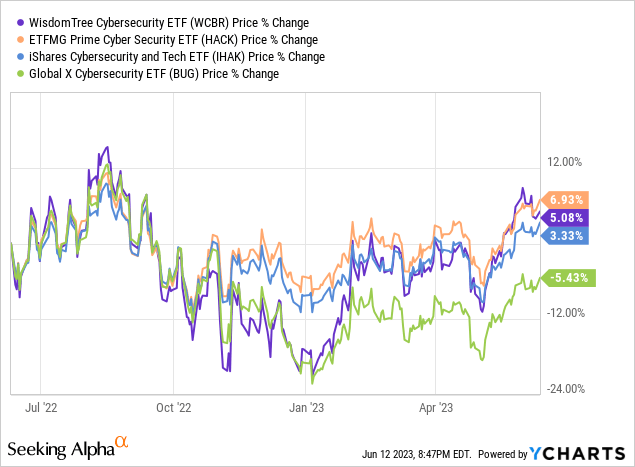

WCBR’s price fluctuations also appear larger than some of its peers with the exception of the Global X Cybersecurity ETF (BUG) when looking back one year.

This ETF might be more likely to test investors’ patience versus its alternatives, even if it’s capable of greater returns.

Where Cybersecurity Can Be Put To Use

Cybersecurity’s potential uses are becoming more numerous as businesses digitize and make use of the Cloud. However, I believe there are a few industries that will need it substantially in the coming periods.

The Military

As geopolitical tensions worsen between the United States and China, cybersecurity is likely to become key in maintaining the technological edge. Defense technology is getting more advanced with the implementation of features like artificial intelligence (AI) by companies like Palantir (PLTR). As such tech becomes more powerful, it also becomes a more promising acquisition for a hacker. Cybersecurity may also allow the United States military to protect important infrastructure like communication networks and power grids.

Healthcare

Hospitals and clinics also contain heaps of confidential patient information. Such data usually consists of medical records, patients’ payment data, and research and development data. Such information can become quite profitable in the hands of a hacker, which is why healthcare institutions have become a prime target for cyberattacks. Especially as healthcare becomes more digital, cyberbreach threats could drive the adoption of cybersecurity solutions.

Artificial Intelligence

More advanced AI is likely to drive cybersecurity growth on both offensive and defensive ends. By this, I mean that AI could become a handy tool for hackers just as it could enhance the very defenses that are meant to repel the hackers. Hackers may use AI algorithms to automate certain stages of a cyberattack like reconnaissance and scanning for vulnerabilities. Furthermore, AI’s ability to quickly analyze vast amounts of data could allow AI-powered cybersecurity systems to quickly identify potential weak spots in digital systems, and restructure accordingly.

Long-term Concerns

Workers Vs. Hackers: A Tight Race

The cybersecurity industry is currently short of talent, while hacking has become more popular than ever. Additionally, hackers are capable of developing at least as fast as the cybersecurity barriers that stand in their way. If the labor shortage continues, cybersecurity’s augmentation could decelerate, allowing hackers to more easily find ways around such systems. The persistence of This trend could threaten cybersecurity ETFs down the road.

Technological Advancements

Powerful technology like quantum computing, as well as increasingly sophisticated hacking techniques like advanced persistence threats [APT] are in their nascent stages and could become a bigger threat with time. Quantum computing algorithms like quantum annealing may be able to figure out the cryptographic algorithms that make up many cybersecurity defenses. Therefore, such technology in the hands of criminals could also allow them to bypass modern encryption methods like RSA and elliptic curve cryptography. Though quantum computing has the same potential to enhance technological defenses, hacking could still gain more momentum than cybersecurity in the coming periods. This could hurt cybersecurity funds as well as quantum funds like the Defiance Quantum ETF (QTUM).

Conclusion

A digitalizing workforce has resulted in more data circulating through electronic networks, much of which can be stolen and manipulated at this point. Cybersecurity is likely to become more of a necessity for many companies that move their operations online. Additionally, geopolitical tensions may also boost incentives for hacking overseas, furthering the need for technological defense systems. If cybersecurity’s labor shortage eases, hackers getting put in their place could do quite well for cybersecurity ETFs. Therefore, I rate WCBR a Buy.

Read the full article here