Growth and quality have been two of the leading equity factors in 2023. Not surprisingly, software and information technology services companies have thrived in this year’s market regime. There have been fits and starts along the way, however, but the WisdomTree Cloud Computing Fund ETF (NASDAQ:WCLD) has climbed to its best levels since Q2 2022 amid a late-year buying sprint.

I am downgrading the fund from buy to hold following an impressive fourth-quarter performance. I still see the portfolio as a solid choice, driven by a quantitative approach, for long-term investors to consider.

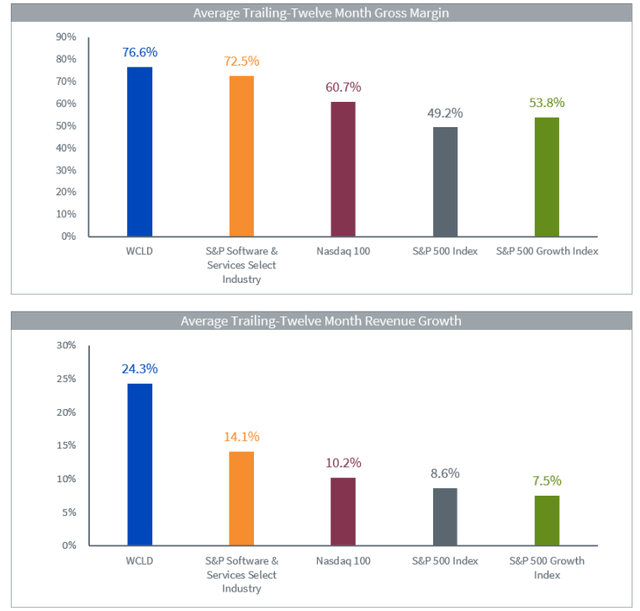

WCLD Portfolio: High Margins, High Revenue Growth

WisdomTree

For background, seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index, an index designed to measure the performance of emerging public companies focused on delivering cloud-based software to customers, according to WisdomTree. The fund is used by investors to gain targeted exposure to emerging, fast-growing U.S.-listed companies (including ADRs) that are primarily focused on cloud software and services and can satisfy the demand for prospective high-growth companies, with the potential for better sales growth, margins, and operating leverage, per the issuer.

WCLD remains a modest-sized ETF with total assets under management of $735 million as of December 18, 2023. It does not pay a dividend and the fund has a high 43x forward price-to-earnings ratio – significantly above the S&P 500’s 19x estimated operating P/E. With a 0.45% annual expense ratio, the net fee is moderate while share-price momentum is very strong, earning the ETF an A rating from Seeking Alpha’s ETF Grading system on that factor. Still, WCLD is considered a risky portfolio given a high standard deviation, short interest, and annualized turnover. With an average daily trading volume of nearly 300k shares and a median 30-day bid/ask spread of six basis points, using limit orders during the trading day is encouraged in my opinion due to the liquidity situation.

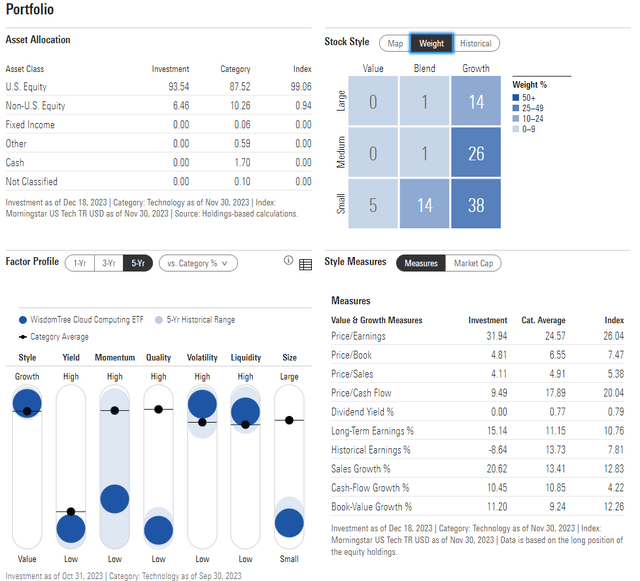

Digging into the portfolio, the 1-star, silver-rated fund has high exposure to the growth style, with significant assets considered small and mid-cap in size. You can see where WCLD gets its high-risk rating from. Changes in the macro landscape and as enterprise tech spending shifts take place, impacts may be felt among the fund’s largest holdings. With a current price-to-sales multiple north of 4, it’s to the expensive side, but its long-term EPS growth rate is also high at 15%.

WCLD: Portfolio & Factor Breakdown

Morningstar

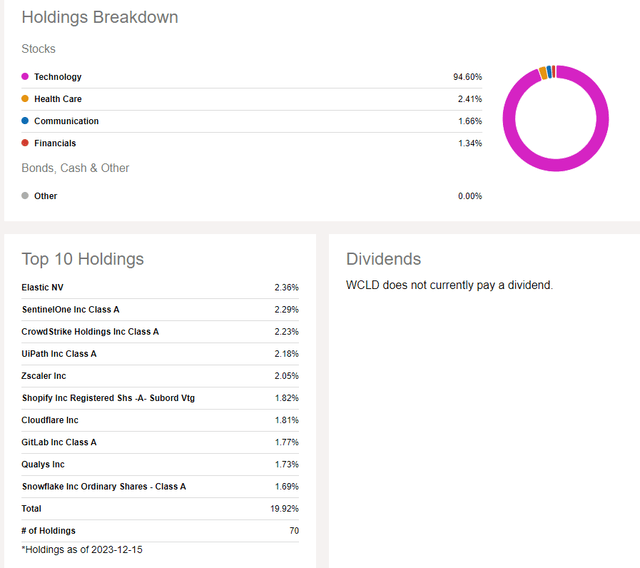

WCLD is a focused allocation in the Information Technology sector, with more than 90% of its assets found in that niche. The nearly equally weighted portfolio holds 70 positions with the top 10 stocks comprising about 20% of the portfolio.

WCLD: Holdings & Dividend Information

Seeking Alpha

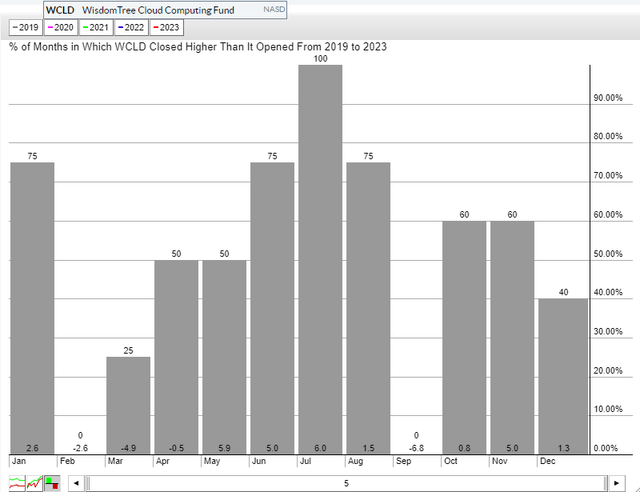

Seasonally, WCLD doesn’t have a long track record off of which to analyze. Still, according to data from StockCharts.com, January tends to be a very strong month, but February and March can be downright treacherous. Declines have taken place often from February through April since the ETF’s inception in 2019 following the usually strong Q4 period which I noted in my previous analysis.

WCLD: Bullish January Trends, Bearish February-April

StockCharts.com

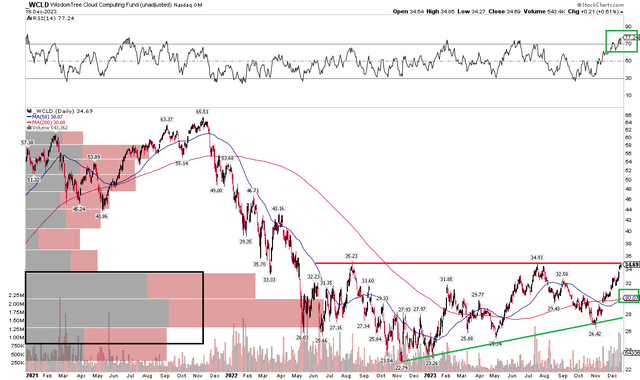

The Technical Take

WCLD has done everything it should have from a technical standpoint. Notice in the graph below that the fund has rallied right up to key resistance at the $35 level – the point I was eyeing in late September. Overall, the formation is bullish – an ascending triangle pattern. The measured move price objective of this formation would be about $37 based on the height of the triangle at its beginning. You could also make the case that a bearish to bullish rounded bottom pattern is in the works with a neckline-like feature at $35 – which would also portend a price target to the high $30s.

Still, some selling pressure could make sense here, so I am downgrading the ETF to a hold following a more than 16% advance over the past three months. Also, take a look at the RSI momentum indicator at the top of the graph – it is in overbought territory, indicating intense buying pressure. The last few weeks have featured higher-than-average volume with a golden cross (the 50-day moving average crossing above the 200-day moving average) earlier this week. These are somewhat constructive signs considering that a high amount of volume by price is seen from $25 to $35.

Overall, the chart is healthy looking long term, but a pullback at this apparent resistance point would certainly make sense ahead of bearish seasonal trends that have historically taken place to start a new year.

WCLD: Shares Reach $35 Resistance

StockCharts.com

The Bottom Line

I am downgrading WCLD from a buy to a hold following a tremendous Q4 advance. Buying on a pullback in Q1 or early Q2 is a prudent play given the strength of the portfolio.

Read the full article here