Thesis

Single-product-focused businesses are unicorns in today’s market, especially in the Consumer Goods sectors. WD-40 Company (NASDAQ:WDFC) is a brand that needs no introduction. The company has continuously increased its U.S. and global presence, building on the quality of its product, while also implementing a modernized strategy for the future. In this analysis, I look into the characteristics of the business, financial performance and valuation.

A Proven Business Model

Incorporated in 1953 under the name ‘Rocket Chemical Company’, the company’s flagship WD-40 product first appeared in retail stores selves a few years later. WDFC adopted its current name in 1970 and has been building its product range and sales reach ever since.

WD-40 is a multi-use maintenance product, used as a lubricant, rust preservative and moisture displacer. Applications range from home improvement to automotive and industrial use. While the company had relied on just one product for many decades, recently it has followed a diversification and innovation strategy, introducing new products to the market. That said, the WD-40 product family still makes up over 90% of sales and undoubtedly remains as the primary strategic focus and growth driver for the company. The formula for the product remains a trade secret.

WD-40 Company has a strong global presence in over 170 countries, marketing through hardware stores, automotive stores, industrial suppliers, grocery stores, online retailers and many others. The thing that makes WDFC’s marketing strategy successful is simply the fact that its products can be found almost anywhere. While approximately 60% of WD-40’s volumes are used by professionals, retail consumers still are a deciding factor for growth and brand prosperity.

The company has very strong brand recognition around the world and is synonymous with effectiveness and multi-functionality. WDFC is an undisputed market leader in developed markets, with the competition remaining fragmented and lacking name recognition.

Solid Growth Attributes & Expectations

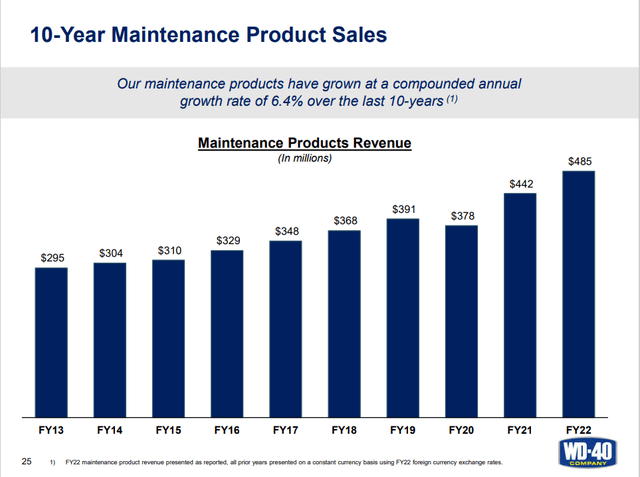

Over the past decade, the company has shown strong top-line growth performance, with maintenance product sales recording a 10-year 6.4% CAGR. In fact, revenue has grown YoY for each year since 2013, with the exception of the Covid-19 struck 2020. EBITDA and net profits have grown at mid-single-digit levels over the past 10 years.

Geographically, the Americas region accounts for almost half of total revenue (47%), followed by the EMA and Asia-Pacific regions (share of sales at 39% and 14% respectively).

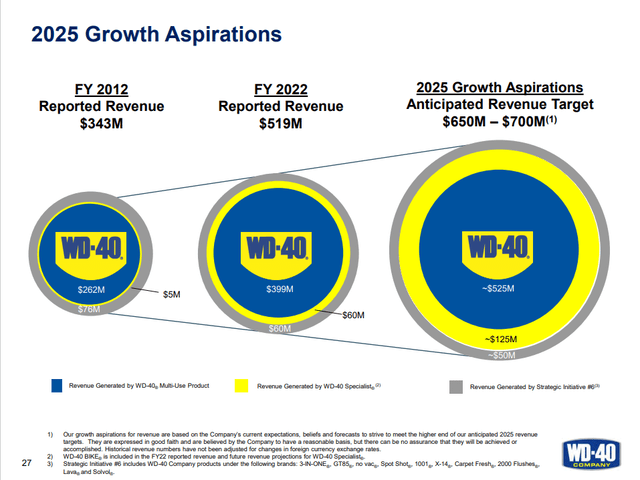

Company Presentation

For the Americas region, management targets a 5-8% annualized growth for the mid-term, while for the EMEA and Asia-Pacific regions 8-11% and 10-13% compound growth is forecasted. Overall, the company displays attractive growth prospects in the high-single-digits. For an established brand with a more consumer-defensive product range, mid-term growth aspirations are actually a surprising attribute. Given the company’s history of solid performance and the brand’s outreach, there is almost no reason to doubt that the targeted growth will be materialized over the next few years.

Company Presentation

Geographical expansion and effective penetration in the Asia market are going to be the key that might lead to more outperformance and accelerated growth in the future. Coupled with advancements in digitization and eCommerce, as well as increased product diversification, the company’s strategy for embracing the future seems comprehensive and confidence-inspiring. Management estimates the global market opportunity for the business at around $1B, indicating that a lot of room is available for further expansion.

Profitability Performance

The WD-40 company operates a profitable business on all levels of the income statement. Gross profit margins stand at 51% and EBITDA margins at 19%. Both, however, have recently fallen below the company’s 55% gross margin and 25% EBITDA margin target. Margins have contracted over the past few years, despite the most recent quarters offering recovery signs. In 2020, despite negative sales growth, gross and EBITDA margins stood at 55% and 21% respectively. Net margins have historically hovered above the 10% level. Overall, the company’s profitability metrics handily outperform the Consumer Staples sector.

Valuation is Overblown

Despite the many desirable traits of the business, it is seemingly very hard for an analyst to look around the stock’s exaggerated valuation. Despite a significant stock price pullback in 2022 (a portion of which has been reversed), WDFC trades at a 40.7x P/E, a 29.5x EV/EBITDA and 5.4x P/S multiple. It is evident that despite a stable business model and strong profitability, the growth potential is simply inadequate to deliver the long-term returns needed to justify these valuation metrics. Sector average multiples indicate that a sizable rerating for the stock might be imminent.

Dividend Performance

WDFC’s dividend history is one of steady growth and consistent distributions throughout the years. Especially, after the late 2000s, dividends have exponentially grown and are expected to keep increasing for the foreseeable future. The company has recorded 13 years of consecutive annual increases. For the trailing 10 and 5-year periods, dividends have grown at 10.37% and 9.34% CAGRs respectively.

The current forward yield of 1.65%, however, is rather low both in historical terms, as well as compared to the sector average of 2.42%. The size of WDFC’s yield is another indication of the stock’s overvaluation. Moreover, a payout ratio over 70% also raises some concerns. Overall, WDFC maintains a perfect A+ score from Seeking Alpha for Dividend Safety and Consistency.

Final Thoughts

After all things are considered, the WD-40 Company is an attractive business, promising to deliver stable, moderate, long-term growth by capitalizing on the quality of its products and undisputed brand appreciation. It is a company every investor looking for a pick in the Consumer Staples sector should add to his/hers wish list, provided, of course, that a sizable stock price pullback occurs to revert the current aggressive valuation multiples back to a more reasonable range. I would, currently, rate WDFC as a hold.

Read the full article here