The past couple of months have been truly a time of uncertainty for many investors who have capital dedicated to the banking sector. Toward the end of the first quarter, in early March of this year, there was a wave of destruction that swept the sector as certain banks collapsed. That brought the entire space down for the most part. One of the companies that experienced a significant amount of downside during this time was Western Alliance Bancorp (NYSE:WAL). Recently, however, the stock has been rebounding nicely. And what should help on that front moving forward is data that management just released covering the second quarter of the company’s 2023 fiscal year. Revenue exceeded expectations, while earnings per share came in inline with what analysts had forecasted. But more importantly, the company experienced a significant increase in deposits at a time when loans increased and debt fell. Truly, I would argue, the worst for the company is now behind us.

Some really great news

Back in the middle of May of this year, I wrote an article discussing my bullish thesis regarding Western Alliance Bancorp. At that time, the company had seen its share price spike because management reported financial data that provided a great deal of clarity when it came to the firm’s uninsured deposits and other matters. I acknowledged at that time that risk still existed for investors. But my overall opinion was that the risk profile of the company had significantly improved relative to the reward that investors could receive by buying the stock. That led me to keep the company rated a ‘strong buy’ to reflect my view that shares should significantly outperform the broader market moving forward. So far, that call has proven to be quite successful. Since the publication of that article, shares are up 38.4% compared to the 8.5% rise the S&P 500 has enjoyed.

Western Alliance Bancorp

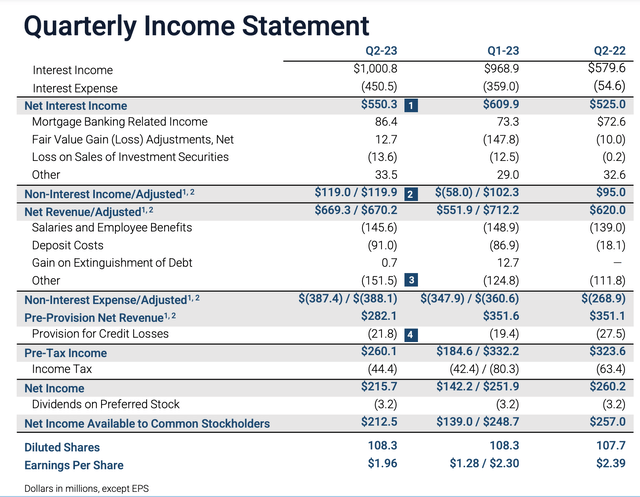

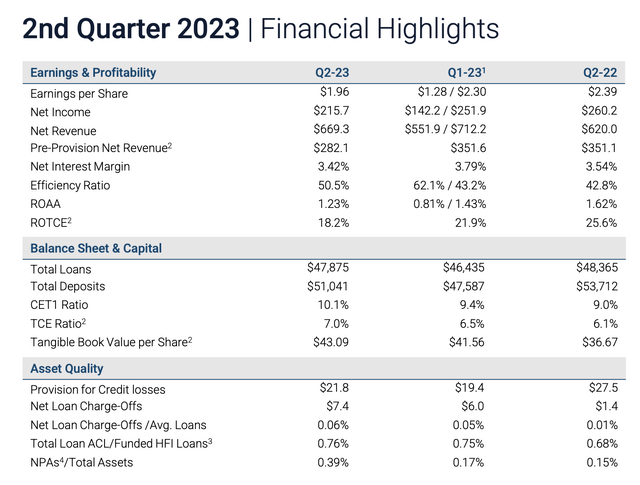

When it comes to the most recent data that management just revealed, I must say that the worst for the company appears to be over. Let’s start with income statement data. During the quarter, the company reported overall revenue of $669.3 million. In addition to coming in 8% higher than it was one year earlier, it also exceeded analysts’ expectations by $13.8 million. Net interest income for the company during this window of time totaled $528.5 million. This compared favorably to the $497.5 million reported the same time last year. You would think that part of this increase would be driven by a rise in the company’s net interest margin. But actually, we saw the opposite happen. The margin actually dropped from 3.54% to 3.42%. The increase for the company, then, was driven by the expansion of its balance sheet. But I will get to that a bit later.

Non-interest income for the company also managed to improve during this time. This metric managed to rise from $95 million in the second quarter of 2022 to $119 million the same time this year. Net income, on the other hand, was a bit of a weak spot for the company. It actually dropped from $257 million in the second quarter of 2022 to $212.5 million the same time this year. But this was largely expected from analysts. In fact, the firm matched the $1.96 in earnings per share that analysts forecasted. That’s compared to the $2.39 per share reported the same time one year ago. Most of this decline was driven by a surge in deposit costs, from $18.1 million last year to $91 million this year.

Western Alliance Bancorp

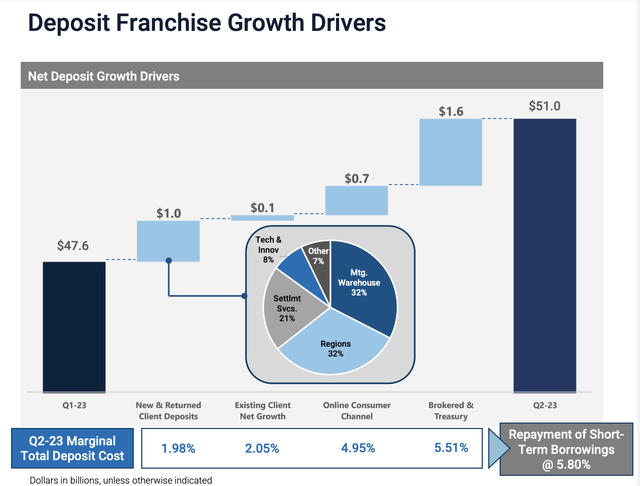

When it comes to the balance sheet, the picture was even more exciting. At the end of the second quarter, the company had deposits of $51.04 billion. That’s about $3.5 billion above the $47.59 billion reported in the first quarter. This is tremendous because the big fear that many investors had was that we would continue to see deposits come out of the banks that were troubled or that investors expressed concerns over. But this was clearly not the case. Brokered and treasury deposits added $1.6 billion to the company’s deposit base. But it also benefited to the tune of $1 billion from new and returned client deposits. This is especially positive because, with a cost of 1.98%, these deposits are the most attractive for the company. It also seems unlikely that the company will experience any further pain when it comes to the deposit picture. Because if we factor in deposits that are collateralized into the insured group, only 19% of the firm’s overall deposit base is classified as uninsured.

Western Alliance Bancorp

Management also reported a growth in the value of loans on the company’s books. Loans grew from $46.44 billion to $47.88 billion. The company continues to have limited exposure to loans associated with office based real estate. Only 23% of its commercial real estate loans, or 5% of total loans, are office in nature. On top of all of this, management also succeeded in reducing its debt to some extent. At the end of the first quarter, the business had $16.75 billion in overall debt on its books. This number dropped to $10.46 billion by the end of the second quarter. This was made possible largely because of some asset sales. During the quarter, management sold off about $4 billion worth of assets, and it has another $1.8 billion worth that it is planning to sell.

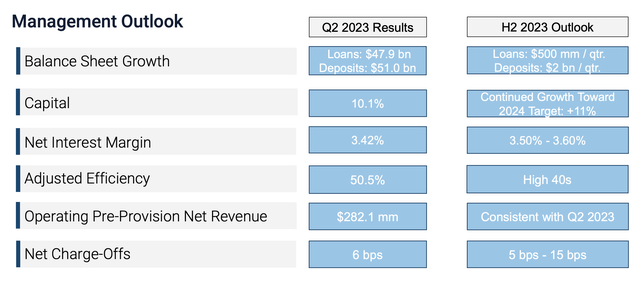

One other thing that I found to be very interesting about Western Alliance Bancorp is that management has been incredibly transparent about what they think the rest of this year might look like. They are forecasting loan growth of about $500 million for each quarter for the second half of this year. In addition to that, they believe that deposits should grow by about $2 billion per quarter during the same window of time. If the company can succeed when it comes to both of these goals, it would all but force those who are bearish about the company to change their minds. Another area that investors might be a bit concerned about would be net interest margin. Even though the company is reducing its debt, debt is rather pricey. However, management is forecasting a net interest margin for the second half of this year of between 3.5% and 3.6%. So that gives even more of a reason to be optimistic.

Western Alliance Bancorp

Takeaway

From all that I can see at the moment, Western Alliance Bancorp is doing a great job. I would not have anticipated such positive developments heading into the earnings period. With the exception of the decline in net profits, I don’t have anything that I could realistically complain about regarding the results that management revealed. Moving forward, the picture for the business also looks positive. But I don’t think that the company is as attractive as it was previously. Shares have risen considerably in recent months, and units are trading at essentially the tangible book value that the company enjoys. In all likelihood, some additional upside could still be on the table. But not enough to have the company rated a ‘strong buy’ any longer. Instead, I believe that a ‘buy’ rating is more appropriate at this moment.

Read the full article here