By Scott Bauer

At a Glance

- Prior downgrades in 2011 and 2023 had immediate market impacts but did not lead to sustained economic downturns

- The U.S., despite downgrades, remains the world’s reserve currency, and demand for U.S. Treasuries remains robust

The United States has lost its last triple A rating. In May, Moody’s downgraded the U.S. government’s long-term issuer and senior unsecured ratings from Aaa to Aa1 and revised the outlook to stable from negative. This move makes Moody’s the last of the three major rating agencies to lower the U.S. credit rating, following similar actions by Standard & Poor’s in 2011 and Fitch Ratings in 2023. The question now is: does this downgrade mark a significant shift in the global financial landscape, or is it just another headline?

The downgrade, according to Moody’s, is a reflection of the significant increase in government debt and interest payment ratios over the past decade, which now stand at levels notably higher than those of similarly rated sovereigns. The agency had been warning of this possibility since 2023, citing the U.S. government’s inability to address long-term fiscal challenges.

But what does this mean for investors and the economy? And how have equity and bond markets historically responded to U.S. debt downgrades?

Historical Market Reactions to U.S. Debt Downgrades

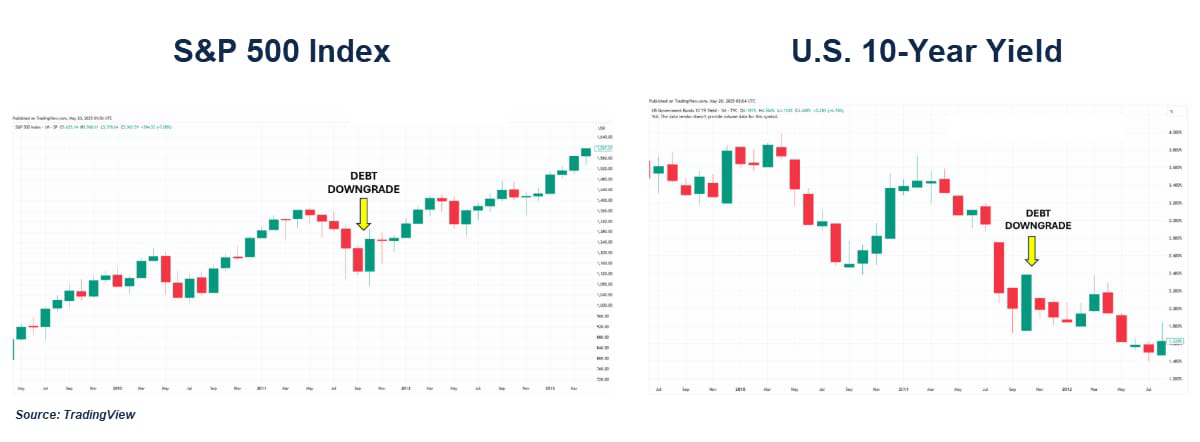

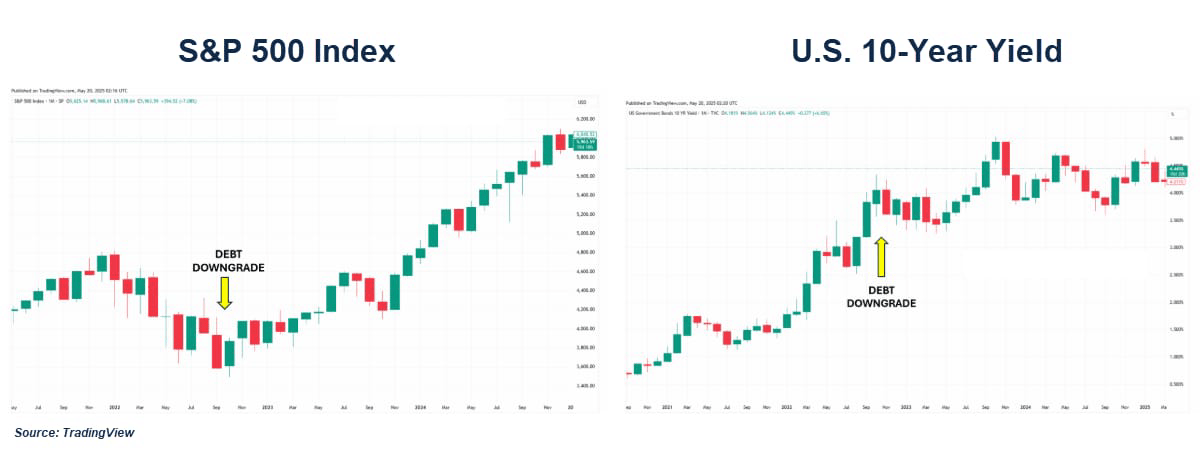

August 5th, 2011 – Credit rating agency Standard & Poor’s downgraded the United States’ credit rating, leaving the world’s largest economy without its prized AAA status.

This marked the first time in history that the world’s largest economy faced such a downgrade. The immediate market reaction was sharp and negative, with the S&P 500 dropping 6.6% in a single day.

However, this decline was not solely due to the downgrade. Other factors, such as the manufacturing shutdown in Japan and a slowing U.S. economy also contributed to the market correction. Despite the initial reaction, the market quickly recovered, and by early 2012, stocks had not only rebounded but in some cases also moved higher. The U.S.’s status as the issuer of the global reserve currency and the continued demand from central banks for Treasuries helped stabilize the bond market, with yields declining into 2012.

August 1st, 2023 – Fitch Ratings downgraded the United States of America’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘AA+’ from ‘AAA.’ The Rating Watch Negative was removed and a Stable Outlook assigned. The Country Ceiling has been affirmed at ‘AAA’.

The reasons for this action were strikingly similar to those cited by S&P in 2011, focusing on the government’s inability to manage long-term debt issues. The Treasury Department contested both downgrades, labeling the analyses as “flawed.”

In the aftermath of the Fitch downgrade, the stock market experienced a pullback of about 10% over the following three months. However, by early 2024, the S&P 500 had largely recovered. The correction was likely influenced more by the overbought conditions in the market, particularly in the AI sector, rather than the downgrade itself. The bond market also saw a temporary spike in yields, driven by accelerating inflation and a hawkish Federal Reserve, but the broader trend of declining yields continued.

The Broader Context

Since 2008, the U.S. has been relying on short-term funding measures known as Continuing Resolutions (CRs). These CRs have regularly raised the debt ceiling and led to an annual spending increase of about 8%.

So, what does the debt downgrade really mean? As we have seen in the previous two downgrades, it has historically not meant much. Almost 15 years after S&P’s downgrade of the debt, the U.S. remains the world’s reserve currency, gold has underperformed equities and the economy didn’t collapse under the weight of the debt.

However, is this time different? While downgrades can certainly shake market confidence, the historical evidence suggests that the impact is often short-lived. The Moody’s downgrade is likely to be a temporary blip, as commercial banks, pension funds, foreign governments, and other institutions continue to be robust demand buyers for U.S. Treasuries. The real question is whether this downgrade signals a structural issue or merely headline risk. Given the U.S.’s unique economic position and the ongoing demand for its debt, the latter seems more probable to me.

While the debt downgrades are a significant event, they do not necessarily signal protracted economic downturns. The U.S. has weathered such downgrades previously, with markets demonstrating resilience and the capacity to rebound. Investors should remain cautious, but also recognize that the U.S.’s economic fundamentals and the global demand for its debt continue to provide a strong foundation.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here