By Scott Welch, CIMA

Sentiment: (A) An attitude, thought, or judgment prompted by feeling (predilection); (B) A specific view or notion (opinion).

(Definition of “sentiment” from the Merriam-Webster dictionary)

Investors and market “pundits” pay a great deal of attention to “market sentiment” because, regardless of the quantitative facts on the ground, what investors believe also matters a great deal, at least in the short term. As Warren Buffett stated, “In the short run, the market is a voting machine [i.e., sentiment], but in the long run, it is a weighing machine.”

So, what is market sentiment currently telling us, and can we glean useful information from that? Let’s dive in.

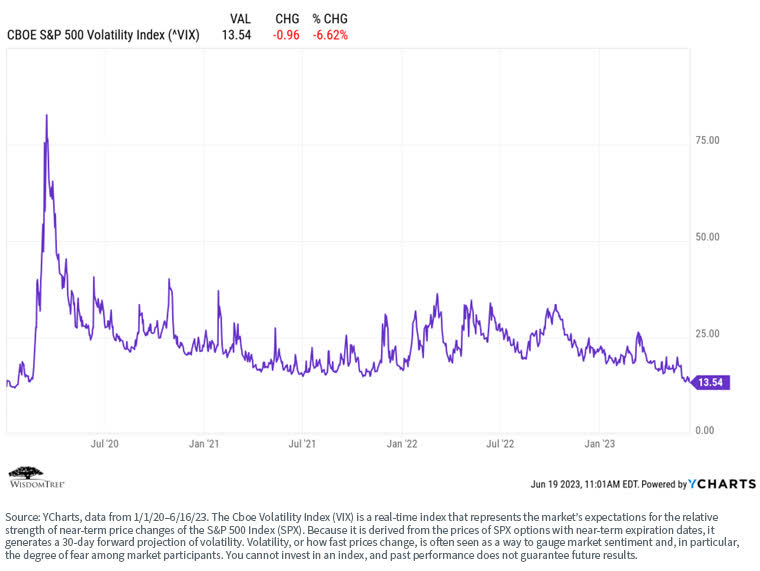

Focusing on the equity market, one measure of market sentiment is the “VIX,” which represents a measure of stock market volatility – the lower the indicator, the more “complacent” or optimistic the market is. By this measure, the market is as complacent as it’s been since pre-COVID-19 in January 2020.

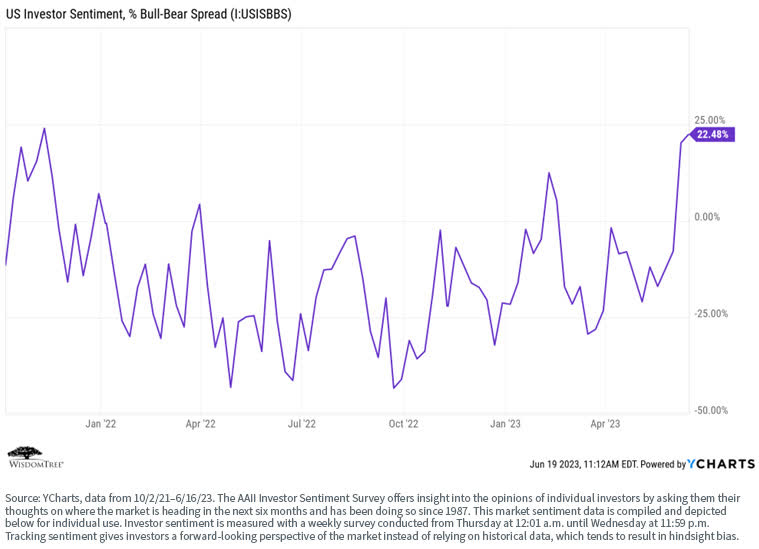

What about actual measures of investor sentiment? One common one is the American Association of Individual Investors (AAII) Investor Sentiment Survey. It seems investors are as optimistic (bullish) as they’ve been since November 2021.

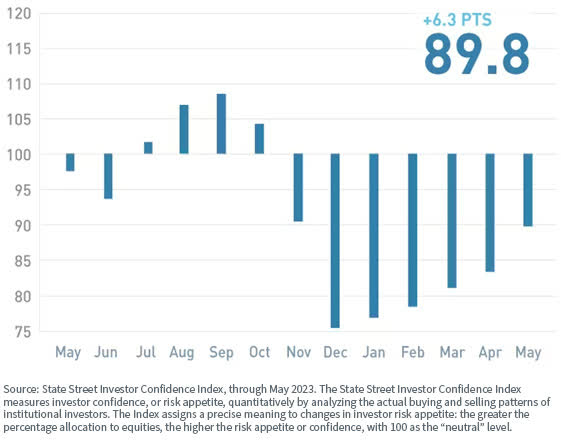

Another sentiment indicator is the State Street Investor Confidence Index, which focuses on institutional versus retail investors. Here we begin to notice some “dissonance” between the two groups – institutional investors are far less sanguine than retail investors, but the trend remains to the upside.

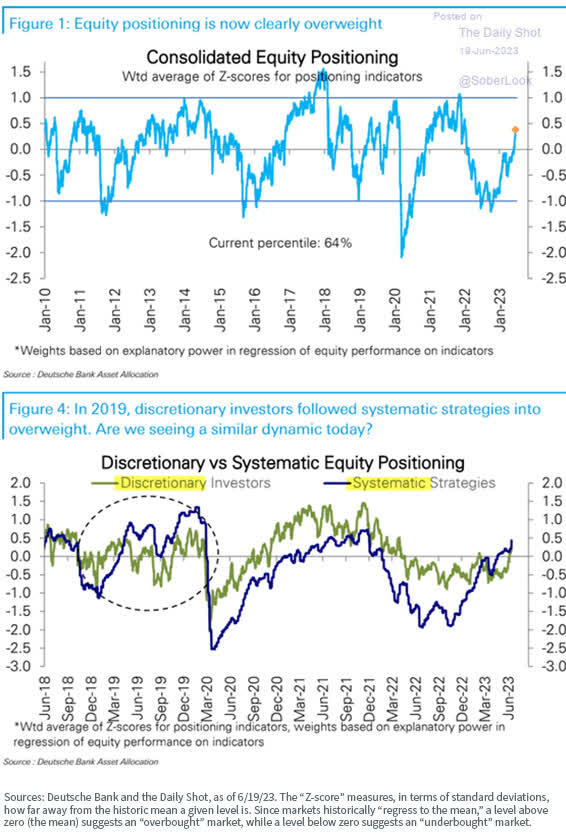

Still another sentiment indicator is the Deutsche Bank “Equity Positioning” indicator, which suggests equities currently are “overbought” by both “discretionary” and “systematic” investors – another signal of (perhaps complacent) optimism.

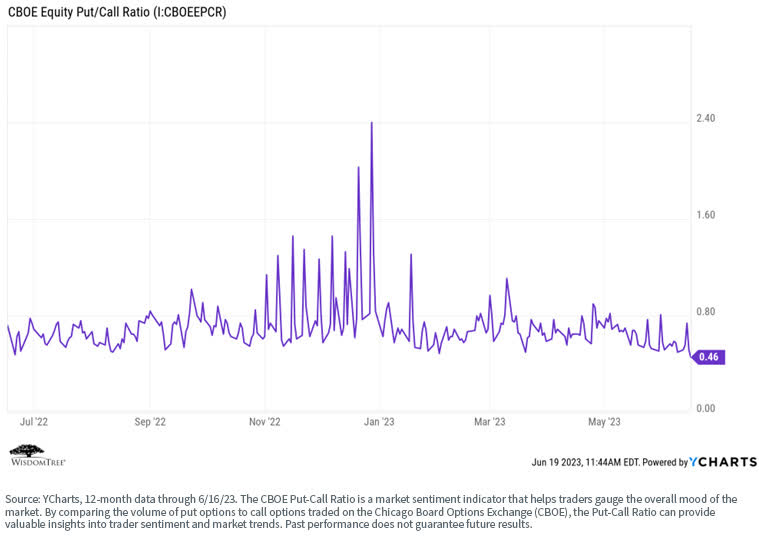

Finally, let’s look at a commonly used measure of market sentiment – the “put/call ratio.” Investors purchasing put options suggests a negative market sentiment, while purchasing call options represents a positive market sentiment.

So, the lower the put/call ratio (i.e., the more call options purchased versus put options), the more optimistic the market is behaving. While this is a highly volatile indicator, we can once again see that investor optimism, as measured by this ratio, is as high as it has been over the past 12 months.

So, What Does This All Mean?

Market sentiment, to us, seems elevated and complacent, especially considering elevated valuations (at least in some portions of the market), slowing economic growth, decelerating corporate earnings, uncertain Fed policy, still-too-high inflation and an uncertain geopolitical environment.

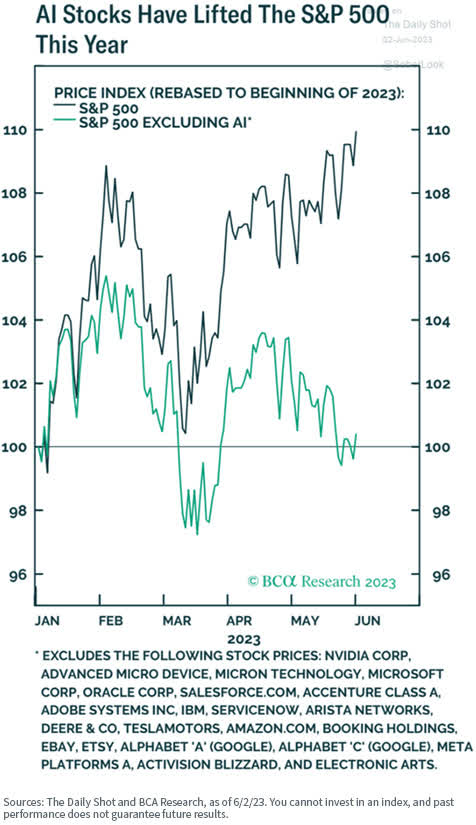

Markets determined to run higher can certainly continue to do so – momentum and sentiment can be powerful catalysts. It is also relevant to recognize that much of the market performance has been driven by this year’s “meme theme” – artificial intelligence (AI).

Historically, however, fundamentals eventually have always mattered again. We are not market timers, nor are we bearish on the longer-term performance of the stock market.

The current complacency among many investors gives us pause because most investors are notoriously poor market timers. We are not “Chicken Little” and are not claiming “the sky is falling.”

But we do suggest paying closer attention to underlying market fundamentals and not just current market momentum.

Scott Welch, CIMA, Chief Investment Officer – Model Portfolios

Scott Welch is the CIO of Model Portfolios at WisdomTree Asset Management, a provider of factor-based ETFs and differentiated model portfolio solutions. In this capacity he oversees the creation and ongoing management of the WisdomTree model portfolio solution set. He is also a member of the WisdomTree Asset Allocation and Investment Committees. Prior to joining WisdomTree, Scott was the Chief Investment Officer of Dynasty Financial Partners, a provider of outsourced investment research, portfolio management, technology, and practice management solutions to RIAs and advisory teams making the move to independence. He remains an outside member of the Dynasty Investment Committee. He sits on the Board of Directors of IWI, the Advisory Board of the ABA Wealth Management & Trust Conference, and the Editorial Advisory Boards of the Journal of Wealth Management and the IWI Investments & Wealth Monitor. Scott earned a Bachelor of Science in Mathematics from the University of California at Irvine and an MBA with a concentration in Finance from the University of Massachusetts at Amherst.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here