The past week provided a close look into the state of the consumer during the first quarter of the year. While inflation has declined from peak levels, the pricing environment remains unfavorable for most.

The monthly retail report released early in the week showed that Americans increased their retail spending in April for the first time in three months. But this spending was geared more towards the auto market and to dining as opposed to the more big-ticket purchases, such as appliances and furniture.

In addition to the monthly retail report, investors were provided with further clues on consumer spending trends via the release of several quarterly earnings reports from some of the largest retailers (XRT). Though each operates in separate and distinct lines of businesses, there appears to have been a common overall theme when assessed on a collective basis.

That is, consumers, even the higher income ones, are putting most discretionary purchases on hold and are trading down when they can. In my view, this creates an environment most conducive to off-price retailers, as well as dollar stores. And while there will always be winners and losers, I believe the performance gap between discount retailers and all others could widen as the year rolls along.

Who Are Some Of The Notable Retailers That Reported So Far?

Among the most noteworthy names who reported over the past week include Home Depot (HD), Target (TGT), Walmart (NYSE:WMT), The TJX Companies (NYSE:TJX), and Foot Locker (FL).

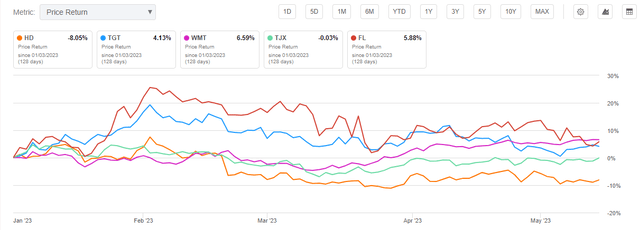

Heading into the earnings week, most were in the positive on a YTD basis through May 14, 2023, the day prior to the start of the trading week. HD and TJX were the two exceptions, with HD down about 8% and TJX slightly negative.

Seeking Alpha – YTD Returns Through 5/14/23 Of Retailers Reporting During Week Of 5/15/23

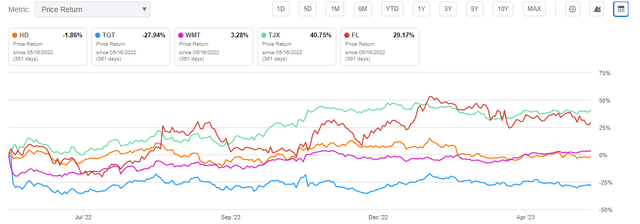

It’s worth noting, however, that over the past year, TJX has outperformed. During this period, it’s up about 40%. This compares favorably to the 28% decline in TGT over the same period. TJX, therefore, had more to prove on the eve of their earnings, at least based on the performance of their stock.

Seeking Alpha – 1-YR Returns Through 5/14/23 Of Retailers Reporting During Week Of 5/15/23

Which Retailers Performed The Strongest?

WMT impressed investors with comparable sales growth of 7.4% during the quarter. This was several turns above their earlier guidance of 4.5% to 5% growth. In addition, operating income was up about 17% YOY. This is despite 27% growth in their e-commerce channel, which typically generates lower margins. And it should also be mentioned that analysts were expecting growth here to come in at about 16%.

The better-than-expected results came as the company continued to gain market share in groceries, especially among higher-income and younger customers. On their conference call, management also indicated customers were acutely sensitive to pricing. As one example, they cited the trends seen in the sale of their beef briskets. With prices down 17%, volume was up nearly 30%. Sales of roses, similarly, were up 60% on lower relative pricing.

TJX is another that posted solid results, which in turn vindicated their share price outperformance over the past year. Comparable sales were up a healthy 3%. While that was short of estimates, it was still better than what many other retailers could do in the current environment. Importantly, the company reported strong growth in their Marmaxx unit, which includes Marshalls, their off-price department store. The gains here offset weakness in their HomeGoods division.

Which Retailers Performed The Weakest?

HD kicked off the earnings week with poor results that came in well below expectations, with comparable sales down 4.6% versus expectations of a 2.1% decline. Executives also warned that their annual sales would decline for the year. This would mark the first annual decline in over a decade.

EVP of Merchandising, Billy Bastek, noted that demand has softened across big-ticket discretionary categories, such as patio, grills, and appliances. And while a cooldown was expected, CFO, Richard McPhail, mentioned that the pullback in demand happened faster than they had expected.

These comments early in the week foreshadowed what would befall Foot Locker on Friday. While HD was down moderately following their weak results, FL declined nearly 30% after badly missing their own estimates, as well as providing a guidance cut.

Though I don’t view the significant drop as entirely warranted, the poor showing will likely negatively impact them in the near-term. Aggressive markdowns and increased promotional activity, for example, will impact their margins and earnings and may push back their planned reset, which was originally expected to be accretive in 2024. Ongoing issues relating to shrinkage further compounds their issues.

Two Retailers That Can Outperform

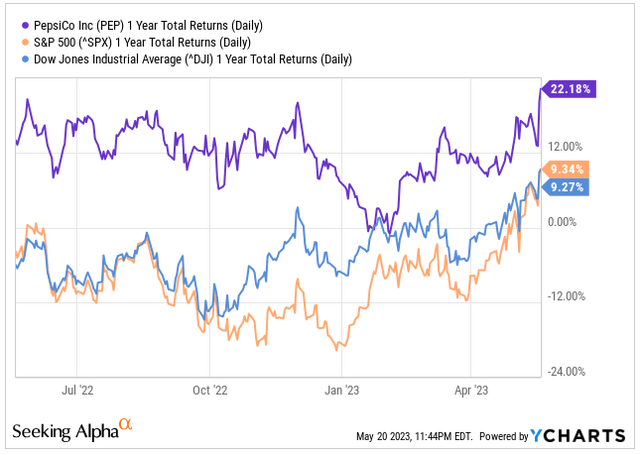

WMT continues to gain market share in groceries, which is notable since consumables appear to be the favored discretionary product class in the current market environment. Pepsi (PEP), for example, is trading at the top end of their 52-week range, due in part to a strong earnings release that highlighted continued demand for creature comforts such as chips and other snacks.

YCharts – 1-YR Performance Of PEP Compared To S&P 500 And The DJIA

WMT CFO, John Rainey, did note, however, that sales slowed as the quarter progressed due in part to cuts in SNAP benefits and lower overall income tax refunds. In addition, it was also noted that food prices are still up about 20% compared to two years ago, despite the pullback in inflation from peak levels.

Though not all was positive, WMT still remains in a formidable position to outperform. As it is, it is one of the best performing components of the Dow (DJIA) in the current year. And to see it change course following a splendid Q1 would be surprising, to say the least.

TJX is another whose outperformance can continue. They will likely see continued weakness in their HomeGoods division, but this is expected to be more than offset by Marmaxx, which is their largest unit. Margin strength in the current quarter was especially promising, as the company was able to capitalize on a more favorable freight environment.

In addition, they were also able to take advantage of the continued tailwinds in the buying environment for their merchandise. As consumers continue to shy away from more premium product offerings, as evidenced in FL’s release, I expect more inventory to be offloaded to TJX at even more favorable prices.

Consistent with my prior views on the stock, I can rationally see TJX trading up to the $100/range in the periods ahead. That would take shares to all-time highs and would represent upside potential of about 25% from current trading levels.

Who To Watch In The Week Ahead?

While there will be even more retailers reporting in the week of May 22, including Lowe’s (LOW), DICK’S Sporting Goods (DKS), and Burlington (BURL), to name a few, I view Dollar Tree (DLTR) as a key name to watch.

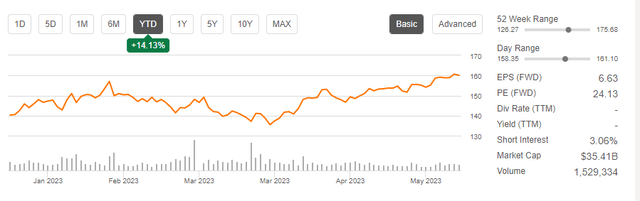

DLTR is up about 14% YTD and is up 7% on the month heading into their earnings. Much of these gains are due to the high expectations of new CEO, Richard (“Rick”) Dreiling’s transformation efforts to better compete with Dollar General (DG) and the broader big-box retailers.

Seeking Alpha – YTD Returns Of DLTR

While the stock has gained, the business is currently struggling with poor traffic levels in relation to the big-box retailers. With consumers in trade-down mode, I believe traffic figures will be closely scrutinized.

Their Family Dollar unit, in particular, is likely to be of enhanced interest since the unit caters more towards those on the lower end of the income spectrum. At present, the unit is coming off two consecutive quarters of positive traffic growth. But the end of the SNAP benefits and lower taxable refunds could impact that. In addition, increased competition from WMT could have also pulled away potential customers.

What Do Results Say About The Consumer And The Economy?

Walmart’s Kathryn McLay noted that consumers are currently very selective about where they spend their money. Given what we have seen thus far, that appears to be a succinct summary of where we are today.

HD, for example, guided for their first annual sales decline in over a decade. This is in stark contrast to the spending behavior during the COVID pandemic, when consumers were flush with government support from both a monetary and fiscal angle.

While one could attribute HD’s lower expected sales to a “pull-forward” effect from the COVID period, it’s more likely that higher pricing and borrowing rates had more to do with the weaker demand. After all, the U.S. has a surplus of old homes. And these simply will not renovate themselves.

The “choosier” spending could also be seen in TJX’s results, with the disparity between their HomeGoods division, which turned in negative results, and their Marmaxx division, which produced an offsetting positive.

Consumers aren’t only giving the cold shoulder to home improvements and décor. Foot Locker, a name that relies heavily on premium footwear, experienced a nearly 30% decline following terrible results and a subsequent guidance cut.

At the expense of these larger ticket and/or premium discretionary product offerings, necessities and creature comforts, as well as discounted merchandise are gaining valuable space in the wallets of consumers.

WMT is a case in point here. On their release, they noted continued market share gains in groceries and with higher-income and younger customers. In addition, TJX also justified the 40% run-up in their shares over the past year by demonstrating the value of their discount apparel. Upcoming, DLTR is on deck to report, and they are one to watch for further signs of consumer trade-down.

The overall economy has an adequate crutch with record low unemployment and an inflation rate on the mend. A choosier and more hesitant customer, however, does present a continued downside risk to those with highly discretionary product offerings. This should, therefore, provide discount retailers with outsized benefits. As such, I continue to expect names, such as TJX, DLTR, and, to a lesser extent, WMT, to outperform in the periods ahead.

Read the full article here