The Amplify High Income ETF (NYSEARCA:YYY) is an index ETF investing in the CEFs with the highest yields, discounts to NAV, and liquidity. YYY’s strategy has proven ineffective in the past, with the fund consistently investing in yield traps and other underperforming CEFs. These investments have led to consistent distribution cuts and capital losses in the past and will, I believe, continue to lead to cuts and losses in the future. As such, I would not invest in YYY.

YYY – Basics

- Investment Manager: Amplify ETFs

- Dividend Yield: 12.36%

- Management Fee: 0.50%

- Underlying Index: ISE High Income Index,

- Total Returns 5Y CAGR: 1.20%

YYY – Index and Benefits

Diversified Holdings

YYY is an index ETF investing in a diversified portfolio of high-yield, highly discounted, liquid CEFs. The fund tracks the ISE High Income Index, an index of these same securities. Said index first selects all applicable CEFs meeting a very basic set of criteria. Criteria is quite lax, so functionally all CEFs are included. The index then ranks the CEFs according to a blended formula which takes into consideration their yields, discounts to NAV, and liquidity. The index invests in the 45 CEFs with the highest ranks, with higher-ranked CEFs having higher index weights. There are no rules or constraints to ensure industry, issuer, or asset class diversification.

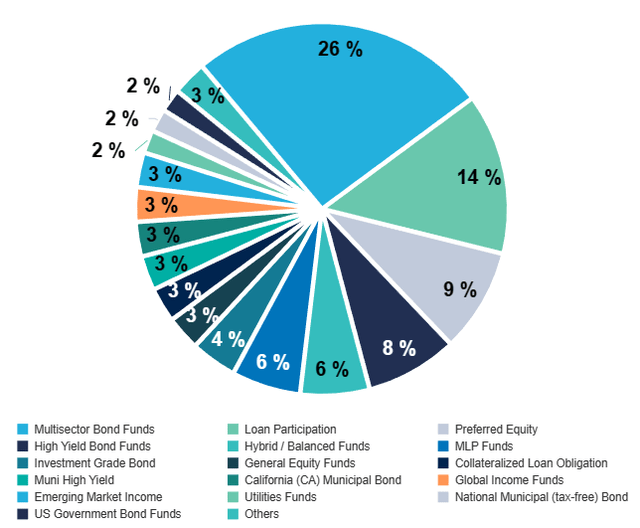

YYY’s index is quite broad, which generally results in an incredibly well-diversified fund. Asset class diversification is quite low at the moment, with the fund focusing on bonds, with a 83% allocation, versus equities, with 17%. There is, however, quite a bit of diversification within the bond space.

YYY

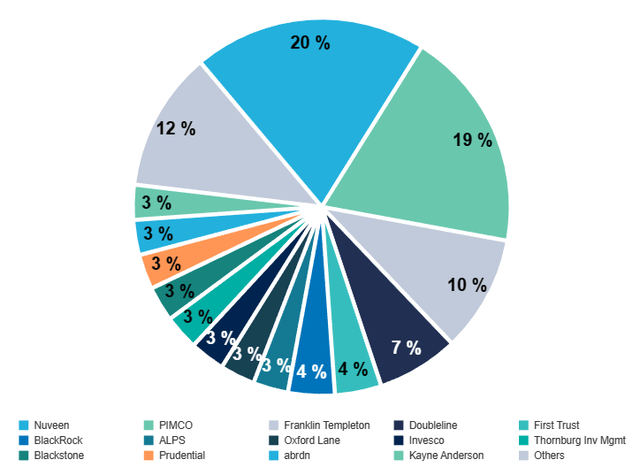

There is a lot of diversification at the issuer level as well.

YYY

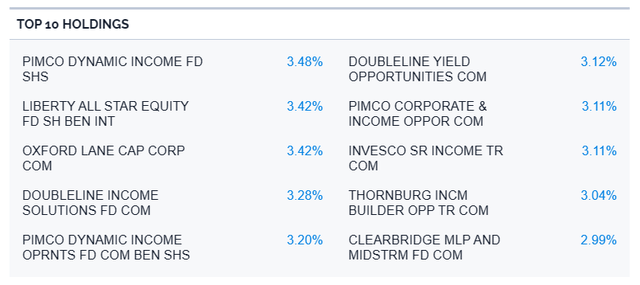

Finally, the fund does invest in 45 different CEFs, which provide exposure to thousands of (underlying) investment securities. Largest holdings are as follows:

YYY

YYY’s diversification reduces risk, volatility, and the probability of outsized losses from losses or underperformance in any specific fund, issuer, or asset class. YYY is diversified enough to function as a core portfolio holding, in theory at least.

Strong 12.2% Dividend Yield

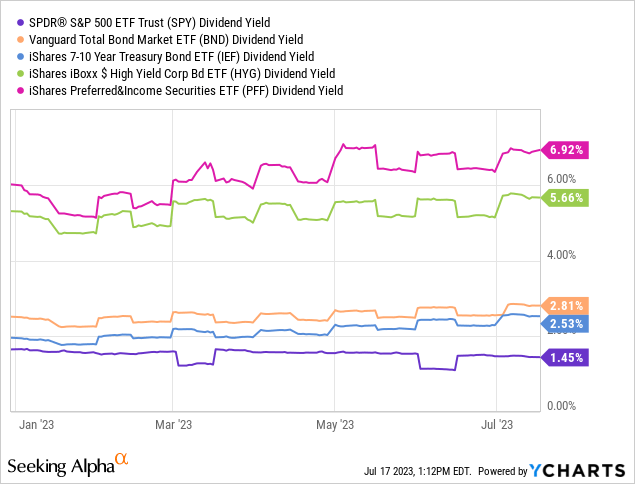

YYY invests in CEFs, which tend to sport strong distributions yields. The fund further focuses on CEFs with above-average distributions, boosting its yield to a whopping 12.2%. It is an incredibly strong yield on an absolute basis, and higher than that of most asset classes, including equities, bonds, treasuries, high-yield bonds, and preferred.

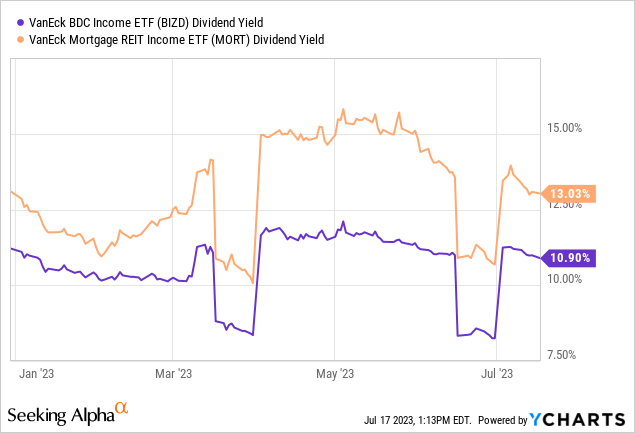

It is quite a bit higher than some of the higher income-producing asset classes too, including BDCs and mREITs.

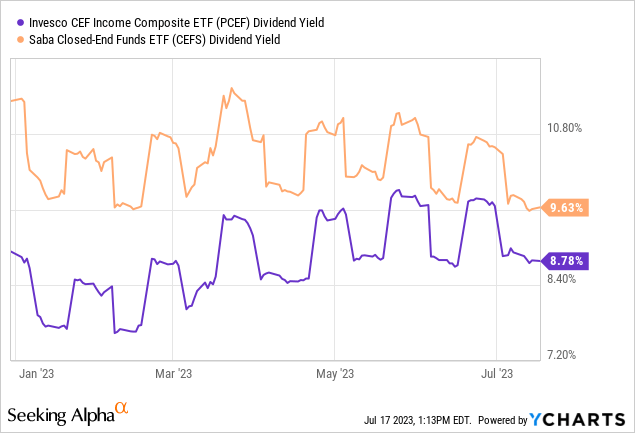

It is a bit higher than that of YYY’s closest peers as well.

YYY’s strong 12.2% dividend yield is a significant benefit for the fund and its shareholders. It is strong enough that the fund could be an outstanding opportunity for income investors, but the fund does suffer from a fatal flaw. Let’s have a look.

YYY – Risks and Negatives

Subpar Strategy, Distribution Cuts, and Capital Losses

YYY’s most significant negative its ineffective strategy, with the fund consistently buying underperforming CEFs, and selling its best performers.

Two quick examples of the above.

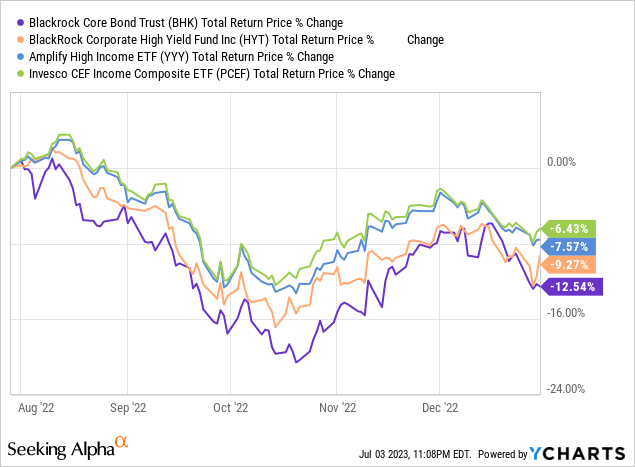

In July 2022, the fund was invested in both the BlackRock Core Bond Trust (BHK) and the BlackRock Corporate High Yield Fund (HYT). Said investments lasted until, at the latest, January 2023, during which both underperformed relative to both YYY and PCEF.

Data by YCharts

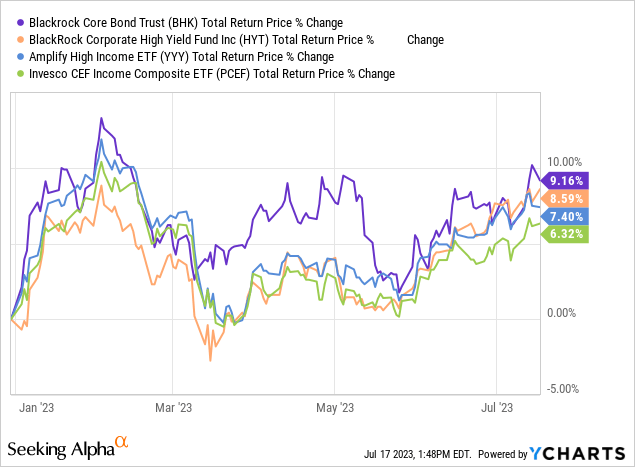

Said underperformance was temporary, with both funds outperforming YTD.

Although we don’t have exact buy and sell dates, it does seem that this specific trade lead to losses and underperformance for YYY. The fund was invested in BHK and HYT during a time period in which both funds underperformed, and the fund sold both investments just prior to their recovery / outperformance. Perhaps the fund bought and sold at just the right date, we don’t have the information to know for certain, but what information we do have available points towards an underperforming, ill-timed investment or trade. Importantly, I’ve identified several other underperforming investments in prior articles. We can’t know for certain that any of these led to losses, but as the examples pile up that does seem like the most likely possibility.

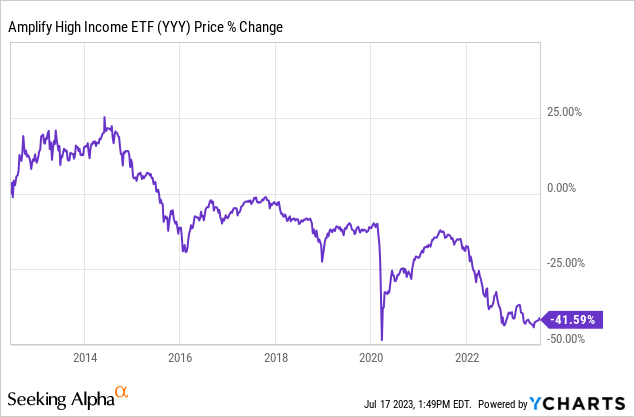

YYY’s ineffective strategy has led to significant, consistent capital losses since inception. The fund’s share price is down 42% since inception, equivalent to capital losses of 5% per year, compounded. Around half of these were due to the fund’s aforementioned strategy, with the other half being due to higher interest rates / lower bond prices.

Consistent capital losses are, of course, a significant negative for the fund and its shareholders. In my opinion, these make YYY a broadly inappropriate investment for long-term investors, who are likely to see their original investment dwindle into nothing in decades.

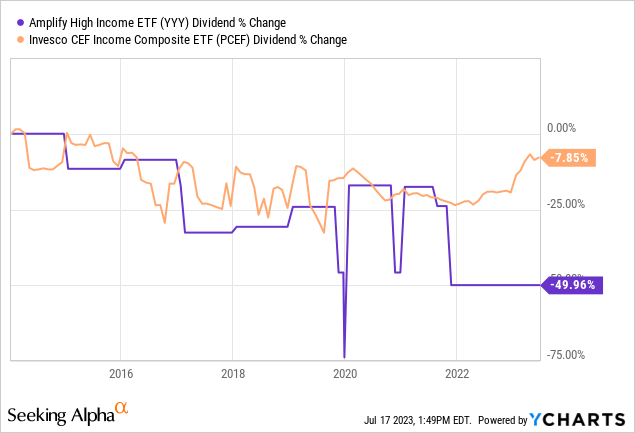

Consistent capital losses erode the fund’s asset base, leading to consistent dividend cuts. YYY’s dividends have declined by 50% since inception, a dreadful result, and much higher than that of PCEF.

YYY’s consistent dividend cuts are a negative for all investors, but particularly detrimental for long-term income investors, who receive less and less income through the years. For reference, the fund sports a 5Y yield on cost of 8.0%, and a 10Y yield on cost of 6.4%. YYY’s 12.2% dividend yield means income is strong right now, but that is unlikely to be the case long-term.

Seeking Alpha

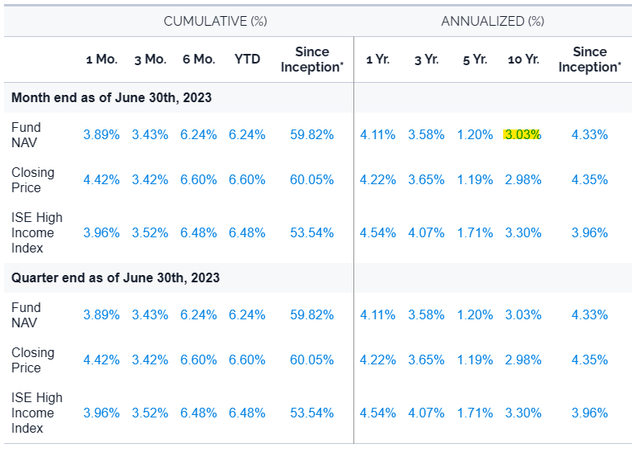

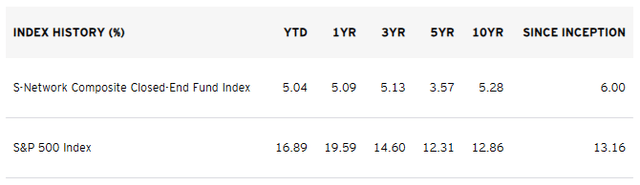

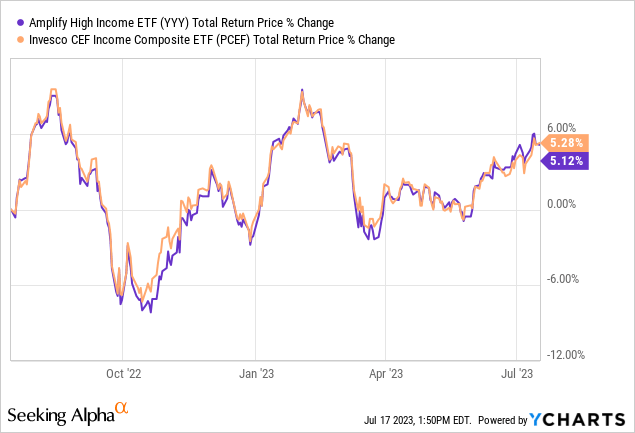

Consistent capital losses and dividend cuts lead to mediocre, below-average long-term total returns. Strong dividends do help in this regard, but these have not been high enough to counteract the fund’s negatives / lower share prices and dividends. YYY has seen annualized returns of 3.0% these past ten years, compared to 4.6% for PCEF.

YYY PCEF

On a somewhat more positive note, YYY’s returns have been a bit stronger than average since around mid-2022, due to lower turnover / fewer underperforming investments and trades. This was at least partly due to a small index methodology change in mid-2021, which increased portfolio holdings and decreased turnover.

Notwithstanding the above, YYY’s performance track-record remains subpar, at best.

Conclusion

YYY’s strategy has proven ineffective in the past, with the fund consistently investing in yield traps and other worse-performing CEFs. This has led to consistent capital losses, dividend cuts, and underperformance in the past and will, I believe, lead to the same moving forward. As such, I would not invest in the fund.

Read the full article here