For those unfamiliar, Zevia (NYSE:ZVIA) is a carbonated and non-carbonated soft drink company that operates in the United States and Canada. Its mission is to sell tasty sugar-free beverages made from stevia to prevent health problems such as obesity and diabetes. It is a very small company, about $165 million market cap, and relatively young, having been founded in 2007.

A few days ago there was the release of Q1 2023, and within this article, I will comment on its key news and outlook for 2023.

Comment on Q1 2023

Zevia Q1 2023

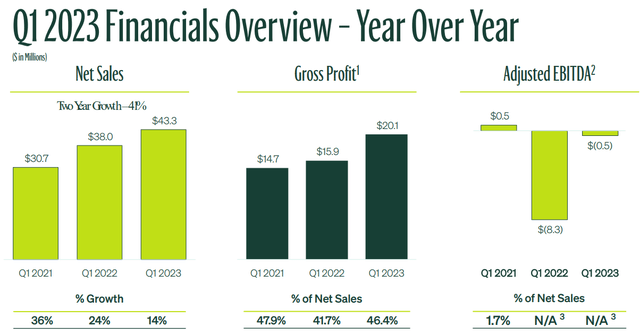

Considering the last two years, net revenue increased 41%, while compared to Q1 2022 there was a 14% growth. Gross margin, after suffering a setback in 2022, has returned to near 2021 levels. For sure, inflation has also hit Zevia hard, as well as many other companies belonging to the same industry.

Anyway, I appreciate how the company is back to having a pretty good gross margin. After all, we are talking about a very small company, which consequently cannot take advantage of the same economies of scale and synergies that historical companies in the industry such as Coca-Cola (KO) possess.

In Q1 2023, the 14% revenue improvement came mainly from price increases and the new distribution of Zevia-branded products; volumes, on the other hand, saw a 2.70% reduction.

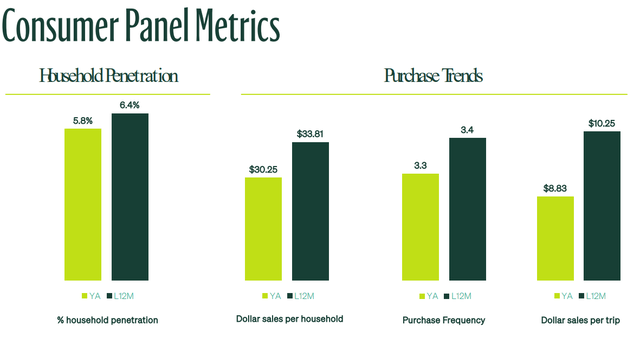

The reason volumes did not decrease much is because the company is fairly new to price increases. The first one there was only in August 2022, while a 5% price increase is expected for Q2. In short, we are not talking about sensational increases, partly because the company does not have sufficient market power at the moment. However, it would be wrong to think that there are no trusted customers already; it is more correct to assume that there are few but good ones. In fact, the data shows more customer interest in larger packages.

The consumer shift to larger pack sizes continued. Shoppers options are driving growth category-wide and also for Zevia as Apex and larger now account for more than 50% of our business in measured channels. Velocity growth is driven in part by consumer trade-up as retailers switched from the 10-pack to a more profitable 12-pack.

So, revenues have improved, gross profit as well but adjusted EBITDA is still not positive. This last figure, although important, I think in this case has to be put in context with the size of the company. At the moment, Zevia is a bet, being a young company that wants to enter an attractive but already very competitive market. So, in my opinion, it is normal that this company is struggling to generate profits. It is obvious that if this situation were to continue for a long time, it would be a problem, also because, with such high interest rates, the only viable solution to raise capital would be to issue new shares and dilute the shareholders. I would not rule out the possibility of Zevia being acquired by a beverage giant.

But how much longer will EBITDA struggle to be positive?

It is impossible to give a specific answer to this question, but what we do know is that CFO Denise Beckles has stated that EBITDA will still struggle for this year as the company is now focused more than ever on expanding its brand. FY 2023 costs will mainly be in marketing investments and then others related to the supply chain.

In particular, management is currently actively involved in advertising expenditures as we approach the summer season (the best season for Zevia) and efforts are being made to sponsor and optimize a brand refresh as much as possible. In order to do this, the company has been saving in advertising expenses in Q1, in order to have more money in Q2 and Q3.

But what will be the marketing strategy and direct message to potential consumers? This question posed by James Salera during the conference call was answered by the CEO in a very comprehensive manner:

Zevia has historically supported what I’ll call, push marketing, so retail marketing at the point of purchase, and we’ll continue that tactical support of the business to drive velocity. What’s new, however, is that we seek to support the new brand refresh and look and feel and really a new brand identity and voice with some tactics we haven’t employed in the past. So broader end-market sampling, what I’ll call, below-the-line activity, so in-market brand building, engaging with consumers, complementary social media activity, digital advertising and then some additional advertising tactics on a spot geographical basis based on what we know about, let’s call it, low BDI and CDI markets where we have opportunity. Most of these rollout after Memorial Day, some of it in the late summer. And our goal is to reach, as you say, new consumers. And you ask, what’s the message? I would say we’ve got great field good flavor. We are all about driving trial and having people experience Zevia. When a consumer tries the product, conversion rates are very high. So we know that sampling initiatives are a very high ROI attractive for us, and we’ll continue to invest in building awareness and trial, so top of funnel, especially in the back half of the year and then full 2024 when the brand refresh is fully to shelf.

Zevia Q1 2023

Advertising, therefore, will not be lacking in the coming months, and the company also expects to gain new customers through a very high conversion rate. Household penetration is on 6.40% at the moment, and management is quite confident that their products, as they are healthy and taste good, can join new American households. Personally, I am always skeptical about the expansion plans of very small companies like this, however, this time I am curious about how this will be implemented in the coming months and what results will be achieved.

Conclusion

For the next quarter, the company expects revenue growth between 5-12%, while the expected gross margin for FY2023 is around 45%. It is difficult to see that EBITDA will be positive, especially after considering expenses related to expansion plans (advertising and brand refresh).

I will personally keep an eye on this company in the coming months, but I am not going to invest in it at the moment as it does not meet my investment standards. Since Zevia is not profitable, and we cannot know exactly when it will be profitable on an ongoing basis, the valuation is very complex because future cash flows cannot be discounted. This does not mean that it is not worth investing in, but that you have to be prepared to take a big risk, which I am not willing to do.

Overall, I find the company interesting especially because of the loyal customer base that is being created, but I need continuity in profitability otherwise I cannot understand what it is worth. It would just be speculation.

It may turn out to be an excellent investment in 10 years or a disaster, there is still too much uncertainty.

Read the full article here