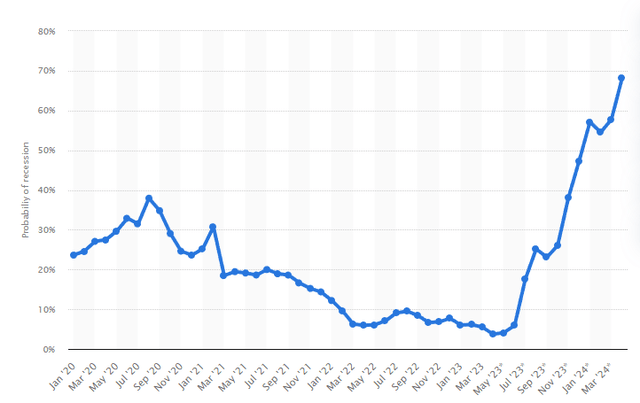

Recession odds for the U.S. economy have been going through the roof in the last few weeks, with investors now widely expecting a recession to hit in early 2024. The market now prices in a near-70% chance of a recession in 2024 which is set to put ZIM Integrated Shipping Services (NYSE:ZIM) further under valuation pressure. Shipping rates for 40-foot standard containers have fallen to a new low last week and decreased 5% week over week to a new post-pandemic low of $1,592/container. I believe given soaring expectations of a recession, earnings estimates for ZIM Integrated Shipping are set to reset sharply lower and the risk of an adjusted EBITDA down-grade has risen sharply lately. Therefore, I expect ZIM’s negative EPS revision trend to continue to be negative and expect shares of ZIM Integrated Shipping Services to make new lows in the coming weeks and months!

Recession odds have exploded lately

At the beginning of the year, the expectation was that the U.S. economy would go into a recession in 2023, in part due to the financial crisis that played out in the regional banking market, following multiple bank failures, including Silicon Valley Bank and First Republic Bank. Lately, however, expectations have shifted, and the market now seems to expect a recession to manifest itself in 2024… and the odds of a recession happening next year have exploded higher. The market expectation is now for a near-70% change of a recession in 2024… which of course would impact a cyclical shipping company like ZIM Integrated Shipping greatly.

Source: Statista

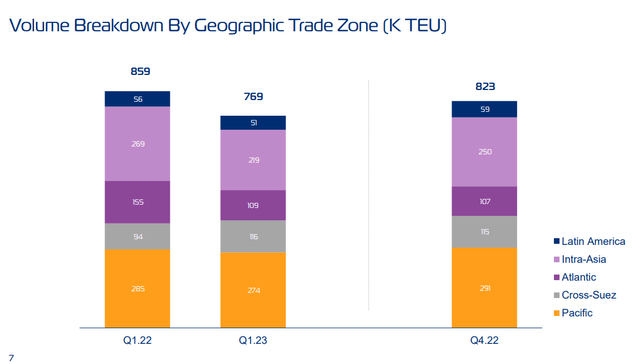

A recession would likely not add to pressure on container carriers’ freight rates, but also on the company’s (and the industry’s) container volume… which has seen a steep decline in the first-quarter. ZIM Integrated Shipping’s container volume fell 10% year over year in Q1’23 to 769 thousand containers. A recession in 2024 is likely going to lead to a further contraction in the firm’s container volume.

Source: ZIM

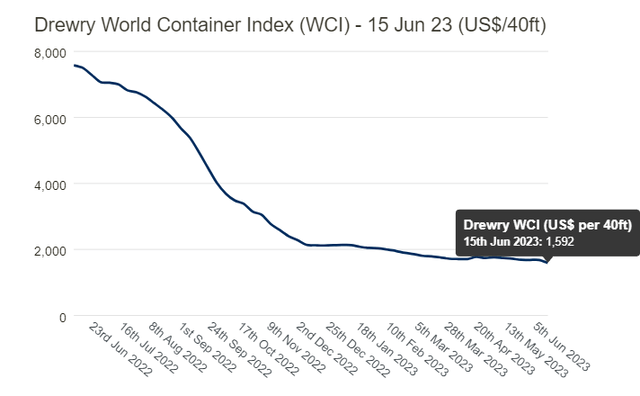

Shipping rates fall to new low, adding pressure on margins

Shipping rates made a new post-pandemic low last week as well… dropping to just $1,592 per container (as of June 15, 2023) and showing a 5% year over year drop compared to the previous week. Based on last week’s shipping data, shipping rates have now declined a massive 85% compared to a pandemic high of $10,377 per container… and freight rates may have further to fall as pre-pandemic shipping rates

Source: Drewry

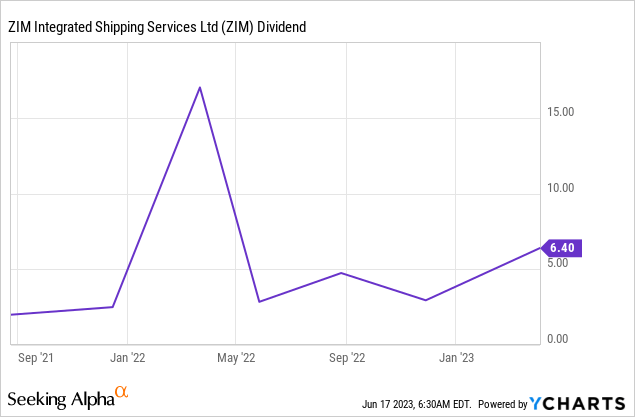

Investors must get ready to deal with a complete elimination of the dividend

What attracted many investors in the past was ZIM Integrated Shipping’s generous dividend, which is calculated on the company’s quarterly net income. In the first-quarter, ZIM Integrated Shipping has seen a dramatic deterioration of its operating condition due to low freight rates, which has been reflected in the company’s plunging adjusted EBITDA and free cash flow. As a result, the shipping company did not pay a dividend for Q1’23 and investor must be prepared to see a complete suspension of its dividend. Based off of EPS estimates, ZIM Integrated Shipping is not expected to be profitable in the next 2-3 years and since the firm pays a variable quarterly dividend based off of profitability, investors must entertain the idea that the dividend gravy train is about to stop.

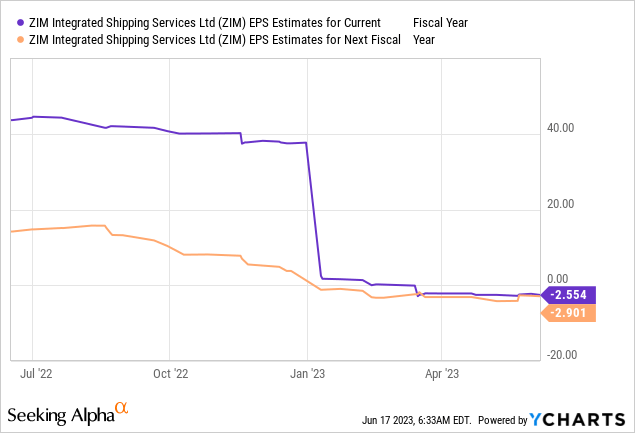

EPS revision trend set to get worse

I believe ZIM Integrated Shipping is set to receive a new round of EPS down-grades as analysts consider last week’s deteriorating in the pricing environment. It is worth noting that analysts have lowered EPS estimates broadly for all major shipping companies, reflecting deteriorating pricing environment as well as demand weakness, which has been reflected in contracting container volumes in Q1’23.

Risks with ZIM Integrated Shipping Services

There are a number of risks for ZIM Integrated Shipping Services that include a continual decline of shipping freight rates which could return to a pre-pandemic rate of around $1,000 per container. The biggest short term risk I see for ZIM Integrated Shipping Services is that the company will be forced to lower its adjusted EBITDA guidance for FY 2023 which is currently still set at a range of $1.8-2.2B. Thirdly, there is a risk that ZIM Integrated Shipping Services will continue to see a contraction in its container volumes which will further add to margin and free cash flow pressure.

Final thoughts

Give him the sharp increase in the recession odds for the U.S. economy in the last couple of weeks as well as shipping rates dropping to a new post-pandemic low of below $1,600/container, I believe that ZIM Integrated Shipping Services’ EPS estimates are set for a new round of down-grades and that shares are set to make new lows in the coming weeks and months. ZIM Integrated Shipping’s shares are already trading near 1-year lows and have not seen any positive momentum ever since the company’s presented its disastrous earnings sheet for the first-quarter which included the announcement of an eliminated dividend!

Read the full article here