Investment thesis

Many investors might be tempted to start buying Zoom Video Communications (NASDAQ:ZM) stock since it is now trading at the pre-pandemic 2019 levels when revenue was 13 times lower than in the latest full fiscal year. The company did well to absorb massive pandemic tailwinds but struggles to drive revenue growth are inevitable, in my opinion. Work-from-home does not seem to be a sustainable trend to me as businesses are seeking more efficiency from workers, especially amid the current harsh macro environment. Apart from that, the competition in the industry is fierce, and ZM will need to compete with successful IT giants with vast resources and expertise. My valuation analysis suggests that the stock is 20% undervalued, but the discount looks fair to me, given all the headwinds ZM faces. All in all, I assign Zoom a “Hold” rating.

Company information

Zoom Video is a cloud-native communication system tailored for enterprises. It is designed to enable video, voice, chat, and content-sharing across various devices and applications, such as Zoom Meetings and Zoom Phone.

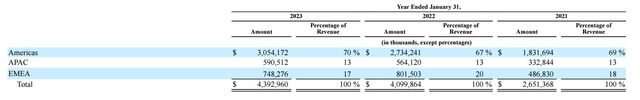

The company’s fiscal year ends on January 31. ZM operates as a single operating segment, and its revenue is disaggregated based on geographic areas. According to the latest 10-K report, 30% of sales are generated outside the Americas.

ZM’s latest 10-K report

Financials

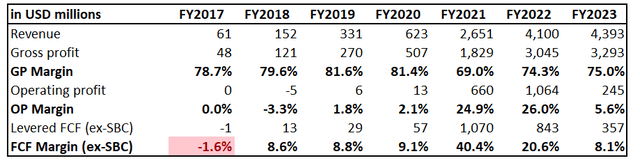

The company’s revenue grew by more than 70 times between FYs 2017 and 2013, which is a massive growth. The COVID-19 pandemic resulted in a global lockdown and was an apparent massive tailwind for ZM in 2021-2022. However, it is also crucial to highlight that the top line doubled every year before the pandemic, which is also impressive.

Author’s calculations

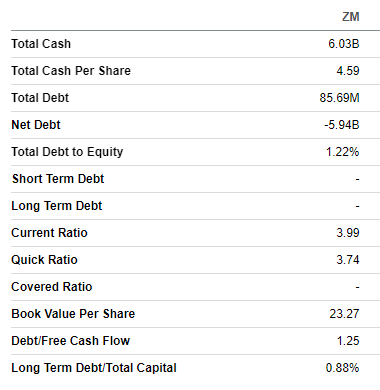

The management did well to capture the one-in-a-century opportunity and significantly improved the company’s financial position. Having an above 20% free cash flow [FCF] ex-stock-based compensation [ex-SBC] margin in FY 2021 and 2022 allowed ZM to build a massive $6 billion cash position with almost no debt and very high liquidity metrics. This cash pile is a vital asset, strategically positioning the company for future innovation and growth initiatives, in-house or via acquisitions.

Seeking Alpha

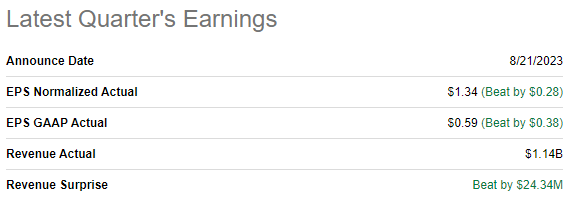

The latest quarterly earnings were released on August 21, when the company topped consensus estimates. Revenue demonstrated a modest 3.6% YoY growth. The adjusted EPS expanded YoY notably from $1.05 to $1.34.

Seeking Alpha

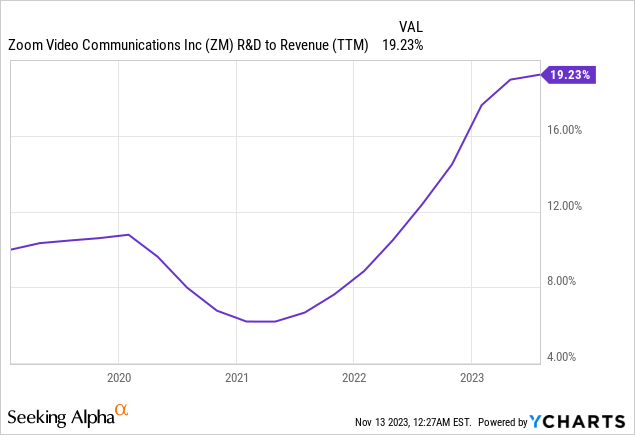

I like the fact that the EPS expansion occurred due to the company’s expansion of profitability metrics, which was notable. The operating margin expanded by around 450 basis points, which is a solid bullish sign, especially given that the R&D to revenue ratio expanded as well. It is essential to highlight that the TTM R&D to revenue ratio has been consistently growing in the last three years despite the fact that the business scaled up massively. In absolute terms, ZM invests about $200 million in R&D per quarter.

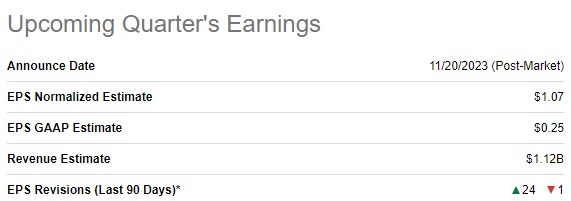

I will not focus much on the latest earnings details because the next earnings release date is approaching. The upcoming quarter’s earnings are scheduled for release on November 20. Consensus estimates forecast quarterly revenue at $1.12 billion, indicating a 2% YoY growth. The adjusted EPS is expected to be flat at $1.07.

Seeking Alpha

Revenue dynamic deceleration does not look like a surprise to me as the pandemic has cooled down, and even Zoom made the company’s staff return to offices. As recent research suggests, remote workers are, on average, less productive, which means a lot of disappointment for investors who rely on the work-from-home trend to sustain continuous growth. During the current tight macro environment of mass layoffs, businesses are seeking more efficiency, and it is likely that a larger portion of employees will be required to return to offices. I think this factor will significantly weigh on the company’s growth prospects over multiple quarters unless new revenue streams are unlocked.

But building up new revenue streams is challenging and not an overnight task, especially considering the formidable competition from industry giants like Cisco (CSCO), Microsoft (MSFT), Salesforce (CRM), and many others. These companies have much more resources and have more comprehensive offerings for businesses, which makes them a more attractive “one-stop shop” for enterprise office tools. This adds substantial risks to Zoom’s market position.

Last but not least, Zoom’s history as a public company is relatively short. The company went public in 2019, and there is a relatively short earnings history, especially under normal market conditions without extraordinary tailwinds like the pandemic. Historical financial data is important for investors since it gauges the stability and growth potential of the company. The absence of a more extended track record introduces a very high level of uncertainty regarding the sustainability of the company’s success.

Valuation

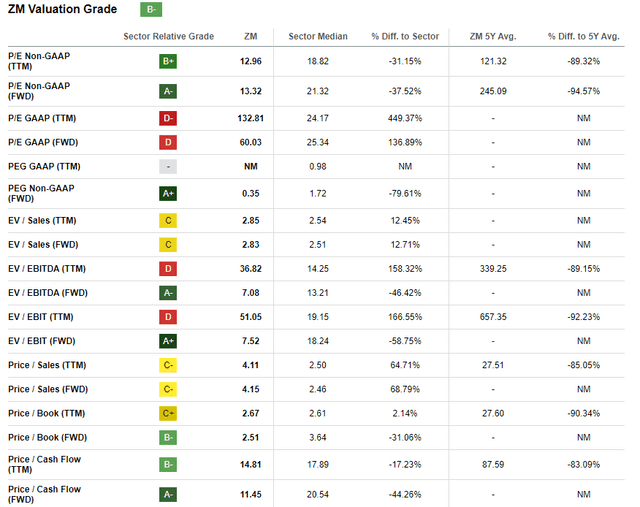

Despite a massive year-to-date rally in the technology sector (XLK), ZM’s price declined by 7%. The stock also substantially underperforms the broader U.S. market. At the same time, current valuation ratios are mostly substantially higher than the sector median. On the other hand, current multiples are 80-90% lower than the last five year’s averages across the board.

Seeking Alpha

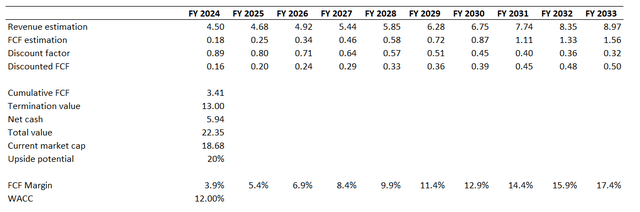

Let me now simulate the discounted cash flow [DCF] model to better understand the valuation of ZM. I use revenue consensus estimates, which forecast a fairly conservative 8% CAGR for the next decade. The current environment of high interest rates does not favor growth stocks, so I use a 12% WACC for discounting. I incorporate a 3.9% TTM FCF ex-SBC margin for my base year and expect a 150 basis points yearly expansion.

Author’s calculations

According to my DCF simulation, the business’s fair value is $22.3 billion. This is 20% higher than the current market cap, meaning there is an attractive upside potential for ZM. My fair price estimation for the stock is $75.

Risks to my cautious thesis

Investors’ sentiment plays a significant role in the short term, and currently, the stock market is cautious given the Fed’s hawkish stance. This factor mainly weighs on the valuations of growth stocks, and any signs of the Fed’s rhetoric softening might be a strong catalyst for growth stocks. In that case, ZM might also rally notably over the short term.

The company’s valuation is attractive despite facing multiple near-term and secular headwinds. That said, the company might be acquired by a prominent, reputable investor, which will also boost the stock price. While I consider the probability of this event to be low, the impact on the stock price might be massive.

Bottom line

To conclude, Zoom is a “Hold”. While the valuation looks attractive and the balance sheet is a fortress, I believe that in the foreseeable future, headwinds will weigh on the company’s financial performance. The ongoing trend of returning employees to offices, together with massive competition with IT giants, makes me cautious about the company’s growth prospects.

Read the full article here