We previously covered Zoom Video Communications, Inc. (NASDAQ:ZM) in September 2023, discussing the management’s prudent M&A activities to diversify its existing videoconferencing offerings.

We had believed that ZM’s growth story might have already been over, with the global remote work trend behind us. This was especially due to its lack of economic moat with Microsoft (MSFT) and Alphabet (GOOG) (GOOGL) offering similar capabilities, resulting in our Hold rating then.

In this article, we shall discuss how our bearish stance has panned out, with ZM’s FQ3’24 performance and FQ4’24 guidance further demonstrating its lack of growth prospects.

Despite its stable profitability and healthy balance sheet, we maintain that the stock is likely to underperform in the intermediate term until a growth driver can be found.

The Zoom Investment Thesis May Already Be Over

For now, the same lack of growth has been observed in ZM’s FQ3’24 earnings call, with revenues of $1.13B (inline QoQ/ +3.2% YoY).

This has been well-balanced by the company’s highly profitable gross margins of 76.2% (-0.4 points QoQ/ +0.8 YoY) and adj operating margins of 39.3% (-1.2 points QoQ/ +4.7 YoY).

The tailwind is most attributed to the management’s prudent cost optimizations with lower expenses of $696.35M (inline QoQ/ -8.9% YoY) and net interest income of $41.91M (+1.9% QoQ/ +762.3% YoY).

It is also apparent that ZM’s offerings remain sticky enough, with approximately 219.7K enterprise customers by the latest quarter (+0.7% QoQ/ +4.9% YoY), albeit with a deteriorating LTM Net Dollar Expansion Rate [NDER] of 105% (-4 points QoQ/ -12 YoY).

The same has been reflected in its remaining performance obligation of $3.57B (+2% QoQ/ +10.1% YoY) and growing customers of 3.73K (+1.6% QoQ/ +13.7% YoY) contributing over $100K, underscoring its ability to cross-sell to existing consumers while acquiring new consumers.

Most importantly, ZM has been able to moderately improve its balance sheet with a net cash hoard of $6.49B (+7.8% QoQ/ +25.7% YoY), thanks to its expanding Free Cash Flow generation of $453.17M (+56.6% QoQ/ +66.2% YoY) and margins of 39.9% (+14.5 points QoQ/ +15.2 YoY).

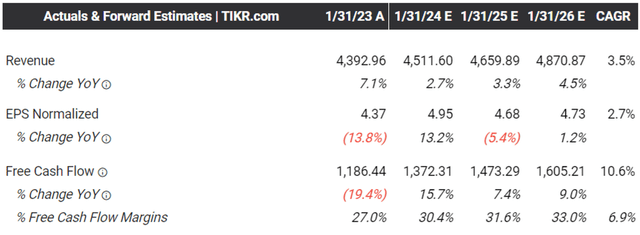

The Consensus Forward Estimates

Tikr Terminal

While these developments have been mostly great, it is apparent that ZM is no longer able to grow as it has during the hyper-pandemic period, with the consensus also estimating underwhelming top and bottom line expansion at a CAGR of +3.5% and +2.7% through FY2026.

The deceleration is highly notable indeed, compared to its hyper-pandemic CAGR of +91.8% and +132% between FY2020 and FY2023, respectively.

The only consolation is that ZM may continue generating positive Free Cash Flows ahead, implying that its balance sheet may remain healthy, while allowing the management to strategically invest in various opportunities.

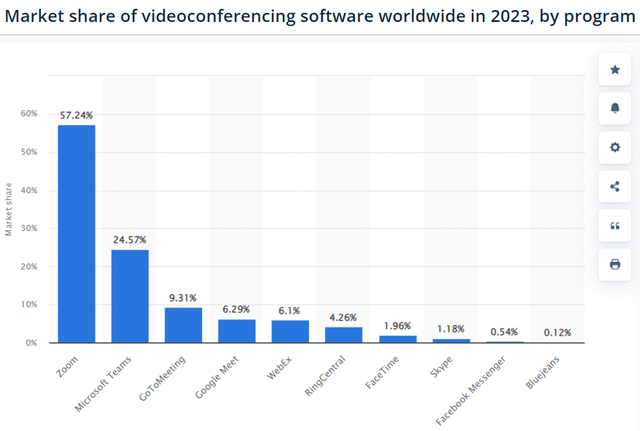

Zoom Videoconferencing Market Share

Statista

Then again, readers must also understand that while Zoom may be ubiquitous with videoconferencing in general, many other Big Techs also offer similar products such as Google Meet, Slack, and Microsoft Teams as its biggest competitor, amongst others, explaining why ZM’s top-line growth and LTM NDER have been decelerating thus far.

As highlighted above, ZM’s bottom line improvements have also been mostly attributed to the stellar cost control and interest income from the use of balance sheet at a time of elevated interest rate environment, with an upper limit likely to happen anytime soon.

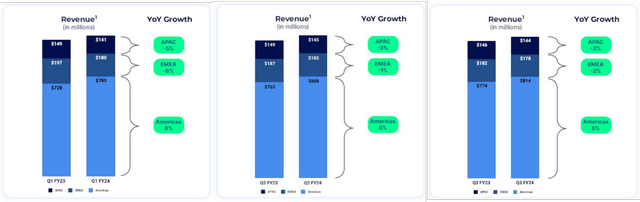

ZM’s Loss In Market Share In International Markets

Seeking Alpha

While ZM has been reporting excellent growth in the Zoom Phone and Contact Center segments, it is also apparent that this is not able to balance the ongoing loss of market share in the APAC and EMEA region over the past few quarters.

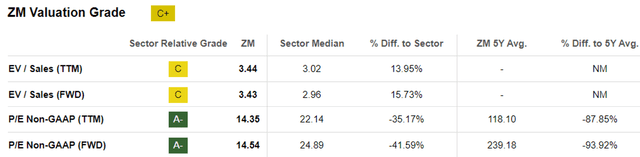

ZM Valuations

Seeking Alpha

As a result of its growth headwinds, it is unsurprising that ZM’s FWD EV/ Sales valuation of 3.43x and FWD P/E valuations of 14.54x have been massively discounted, compared to its 1Y mean of 3.27x/ 16.54x, pre-pandemic mean of 21x/ 230x, and sector median of 2.96x/ 24.89x, respectively.

On the one hand, based on the management’s FY2024 adj EPS guidance of $4.94 (+12.8% YoY) and its FWD P/E valuation of 14.54x, the stock appears to be trading near its fair value of $71.60.

On the other hand, based on the consensus FY2026 adj EPS estimates of $4.73, it appears that the ZM stock may very well trade sideways at these levels to the long-term price target of $68.70.

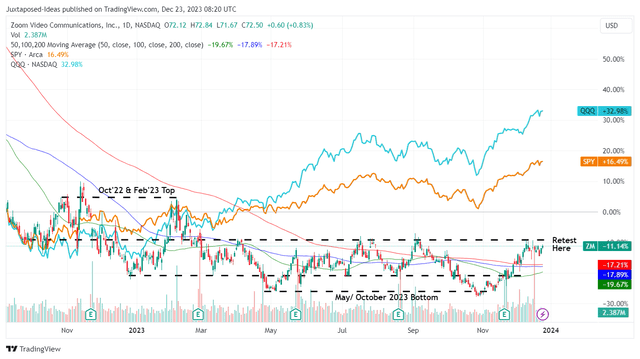

With minimal growth ahead, we can understand why the stock has been corrected drastically by -82.2% since the October 2020 peak, with it notably trading sideways since September 2022.

Combined with the intensifying market competition for remote work solutions, we maintain our previous conviction that ZM’s impacted valuations exhibit the same normalization trend in its prospects.

So, Is ZM Stock A Buy, Sell, or Hold?

ZM 1Y Stock Price

Trading View

For now, the ZM stock has been lifted by the optimistic market sentiments, with the cooling inflation triggering Powell’s dovish commentary and the ongoing discussions of a potential 2024 pivot.

The same has been observed market wide, with the SPY and QQQ ETFs similarly charting new heights after the October 2023 bottom, further exemplifying the early signs of two potential outcomes.

On the one hand, the bull run market may very well continue through 2024, with the Magnificent Seven already recording great top/ bottom lines and stock recoveries from the December 2022 bottom, thanks to the Generative AI hype.

On the other hand, the Fear and Greed Index is increasingly skewed to Extreme Greed at the time of writing, with it implying inflated share valuations and prices.

For now, ZM’s disappointing FQ4’24 revenue guidance of $1.1275B (-0.8% QoQ/ +0.8% YoY) and adj EPS guidance of $1.14 (-11.6% QoQ/ -6.5% YoY) imply that the latter may be more applicable in the near term, with the stock likely to underperform until a growth driver can be found.

With ZM neither offering growth potential nor dividend income, we prefer to prudently maintain our Hold rating here.

There are many other opportunities out there for readers to consider.

Read the full article here