After the bell on Monday, we received fiscal third quarter results from Zoom Video Communications (NASDAQ:ZM). Perhaps the biggest pandemic darling, the company has seen its revenue growth rate and stock price fall dramatic from their highs. While shares popped on the initial headline beats reported, the company continues to struggle with revenue growth. I am not ready to suggest today that investors fully buy in to the stock, but also I don’t think it’s time to be bearish right now.

For the period ending in October, Zoom’s fiscal Q3, revenues came in a little under $1.137 billion. This number was a little ahead of the average street estimate, although that consensus had come down from $1.21 billion over the past 12 months. The company usually issues okay to soft guidance (more on that later), which sets up beats down the road, as only two top line misses have been reported in the past five years.

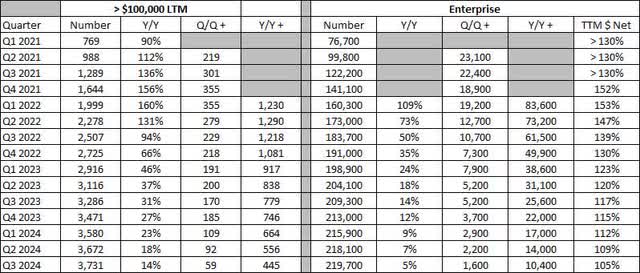

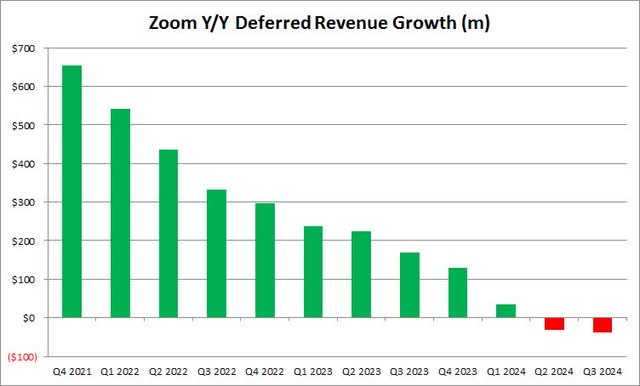

After peaking at 369% during the height of the coronavirus sales boom, revenue growth has almost hit zero. The latest quarterly figure was just 3%, and it is quite easy to see why. As the graphic below shows, a number of key metrics continue to grow at much slower rates than in the past. As I detailed in my most recent article on the name, deferred revenues have also started to decline a bit, limiting near term revenue upside.

Zoom Key Metrics (Company Earnings Reports)

The number of Zoom customers with over $100,000 in trailing twelve month revenues saw its weakest growth since the coronavirus hit. If the recent pattern continues, it is possible in a couple of quarters that this very important number may actually decline, which some investors might see as a major red flag. The growth in Zoom’s Enterprise segment also continued to trend towards the flat line, with the net dollar expansion rate also hitting its lowest point in several years.

The one positive here is that Zoom is a very profitable company, and adjusted operating margins expanded nicely by 4.7 percentage points over the prior year period. On a non-GAAP basis, Zoom delivered over $401 million in net income, up from $323 million in the Q3 2023 period. This resulted in Q3 non-GAAP EPS of $1.29, which handily beat the street by $0.21, continuing an earnings beat streak that’s more than five years at this point.

When it comes to guidance, management said total revenue for fiscal Q4 is expected to be between $1.125 billion and $1.130 billion, and revenue in constant currency is expected to be between $1.129 billion and $1.134 billion. This headline (unadjusted) guidance was a little light, as estimates were calling for $1.13 billion, and that number has of course come down quite a bit in recent quarters. While the company did raise its full year forecast, the range was only increased by about the amount it beat its Q3 guidance by. Of course, it could be setting up another beat down the line. However, I should also note that deferred revenue trends seen below aren’t looking great, so near term revenue upside seems to be limited at this point.

Deferred Revenue Growth (Company Earnings Reports)

The company has one of the best balance sheets out there, with cash and investments of about $6.5 billion at the end of the most recent quarter. Free cash flow in the first nine months of the fiscal year was over $1.13 billion, up more than 10% over the first three quarters of the previous year. This solid cash generation allowed Zoom to buy back some stock last year in an effort to offset dilution from stock-based compensation. There haven’t been any share repurchases this year, which means the share count is rising again, so it will be interesting to see if that cash pile is used for buybacks again soon or perhaps some acquisitions as a way to bolster revenue growth.

In the past, I’ve been bearish on Zoom, but I’m upgrading the name to a hold today. While revenue growth trends aren’t great, the company has not seen a major hit to profitability recently despite the top line stagnation, and it is still generating a ton of cash. Those funds will be put to use at some point, and the stock trades for about 14 times next fiscal year’s expected adjusted EPS. While you won’t get a lot of growth here, that valuation number is only about half of what the big tech names like Apple (AAPL), Alphabet (GOOG) (GOOGL), and Microsoft (MSFT) average right now.

I also think that a name like Zoom might generate more interest again in 2024. The stock soared during the pandemic, but crashed once revenue growth rates initially came down. That valuation further compressed as the Fed hiked interest rates over the last year plus, but those days seem to be in the rear view mirror. Zoom can’t really be lopped in with the “unprofitable tech” trade because it has significant profitability. With the market actually expecting the Fed to cut rates next year, Zoom’s large cash pile and decent valuation make it hard to bet against currently.

However, I will evaluate my rating again as we get more results in, because if these revenue trends completely rollover, the stock could be back in sell territory again. In the end, it was another mixed quarter for Zoom with headline beats, mixed guidance, and weakening key metrics. This name is a cash flow monster with a decent valuation. For that reason, I can’t keep a sell rating at this point, but this company is by no means on the impressive list either.

Read the full article here