Zoom’s (NASDAQ:ZM) business, although performing with slow momentum, continues to outpace investor expectations. For FY 2024, Zoom management now expects to generate about $4,495 billion in sales and $1,743 billion in operating earnings. And while the new calendar year is unlikely to bring a pivot in Zoom’s organic growth trajectory, there is little indication that suggests contracting fundamentals. On that note, I view Zoom’s EV/EBIT multiple of <9x as a “no-brainer” buying opportunity. I reiterate my “Buy” rating and revise my base case target price per share upwards to approximately $85, compared to $82 estimated previously.

For context, Zoom stock has underperformed the broad equities market YTD, especially when compared to the “Tech” benchmark. Since the start of the year, ZM shares are up slightly less than 10%, compared to a gain of approximately 24% for the S&P 500 (SP500) and a gain of close to 53% for the Nasdaq tech-heavy Nasdaq 100 (QQQ).

Seeking Alpha

3Q24 Commentary: Results constructive …

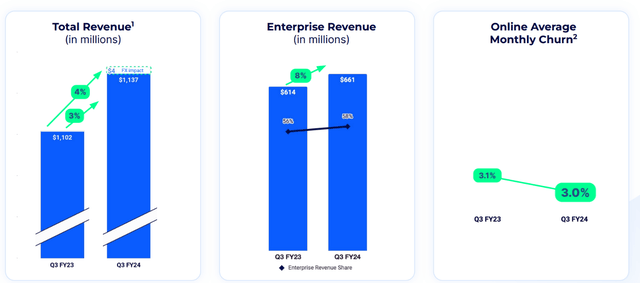

Zoom’s performance in Q3 FY 2024 was above expectations, with both revenue and operating income outperforming consensus: During the period spanning June through end of September, Zoom generated about $1,137 billion of total revenues, up 3.2% YoY, and topping estimates by about $20 million. In that context, I point out that Zoom saw significant outperformance in enterprise revenue, which was up 8% YoY, increasing to $661 million. In my opinion, investors should take note of this, because SaaS enterprise customers provide notoriously predictable revenue streams—a feature that should render a business more attractive to investors, especially in times of macro headwinds.

Zoom 3Q24 reporting

With regard to profitability, Zoom’s non-GAAP operating income increased to $447.1 million, exceeding forecasts of approximately $400 million, according to data collected by Refinitv. In my opinion, the expansion in operating profitability should be mostly a function of OPEX discipline, citing 1,300 job cuts (15% of total workforce) that Zoom management announced earlier this year, in February.

On the backdrop of supportive momentum and gradually improving macro, Zoom management revised its full-year FY24 revenue guidance upward by 0.4%. According to latest projections, Zoom now expects sales equal to $4,495 billion. Additionally, the FY24 non-GAAP operating income guidance was also raised (by 3.1% at the midpoint), now standing at $1,743 billion, and exceeding consensus estimates of about $1,690 billion.

… With Cost & M&A Likely To Drive 2024 Narrative

Going into 2024, I see operating discipline as the major driver for Zoom’s earnings story, and the ZM stock narrative more broadly. The reasoning for this thesis is anchored on the observation that enterprise IT/ SaaS budgets continue to be under pressure. Specifically, I noted Zoom management’s commentary surrounding lengthening sales cycles for new customers, as well as shorter billing cycles for the existing customer base. Moreover, although online churn slightly fell QoQ, it remains very high at 3% monthly. Similarly, I am concerned about compressing net dollar expansion rate for enterprise customers, which fell from 109% in the June quarter to 105% in the September quarter. Worse still, there is little indication that suggests headwinds to the discussed fundamentals are easing.

Related to the observation that IT budgets are under pressure, it is also suggested that software buyers are aiming to consolidate their vendors. This would support expectations that 2024 could bring a consolidation wave in the SaaS enterprise sector. That said, as interest rates fall, M&A activity in the enterprise SaaS sector will likely start to pick up momentum. On that note, I point out that Zoom has about $6.4 billion in net cash on its balance sheet. The fact that Zoom has not allocated this cash aggressively in 2022-2023, when the stock’s valuation compressed, suggests that Zoom management is likely keeping reserves for strategic growth opportunities through M&A move. The thesis of growth through acquisitions also supported by a relatively limited organic expansion outlook for Zoom.

Overall, however, I believe Zoom’s 2024 performance should be strong enough to more than justify a <9x EV/EBIT, especially considering the company’s leading competitive standing in the company’s core market for virtual communications. Moreover, I am confident that Zoom can leverage supportive momentum in emerging growth drivers like Zoom Phone, which has exceeded 7 million paid seats in the past quarter, as well as Zoom Contact Center, which has topped 700 customers, respectively. Lastly, a minor upside potential may also be anchored on AI opportunities, as AI Companion now counts 220,000 registered accounts and generates almost 3 million meeting summaries per quarter.

Target Price Update: Raise to $84.66

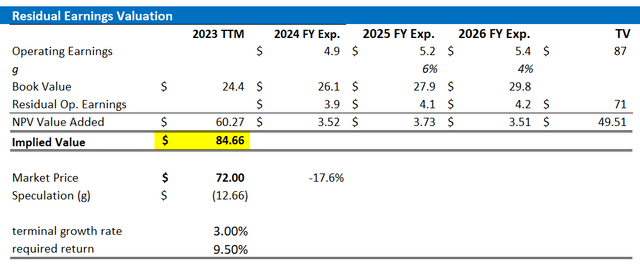

Based on an overall supportive Q2 FY 2024 report, robust guidance, and a gradually improving macro-economic backdrop going into 2024, I’ve revised my EPS projections for Zoom. According to my estimates, it is likely that Zoom’s EPS for FY 2024 could range between $4.8 and $5. My projections for FY 2025 and FY 2026 see EPS of approximately $5.2 and $5.4, respectively. Notably, my estimates quite closely align with the consensus EPS, showing a margin of approximately +/-10%, based on Refinitiv data. Moreover, although I maintaining a 3% terminal growth rate (similar to historical long-term nominal GDP growth), I lower my cost of equity requirement by about 50 basis points, mostly as a reflection of the expectations for rate cuts (which lower the cost of capital). As a result of these adjusted inputs, my fair estimated share price for Zoom now stands at $84.66, compared to $82 estimated earlier.

Zoom financials, author’s estimates and calculation

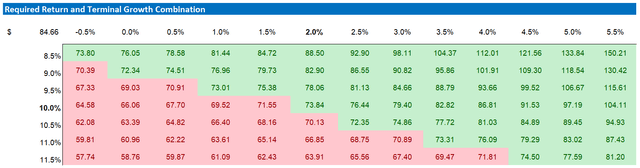

Below is also the updated sensitivity table.

Zoom financials, author’s estimates and calculation

Note On Risks

Investing in Zoom, like every investment, also comes with risks: Specifically, one potential concern is the heightened competition coming from leading tech giants such as Microsoft (Teams, Skype) and Cisco (Webex). This competitive landscape could include challenges from Zoom’s own partners, such as Meta Platforms (META). Additionally, the adoption rate of newer offerings like Zoom Phone might not match the projections seen in the past 3 years, as the post-COVID boom for virtual work and communication is fading. Lastly, I point out that Zoom’s more speculative venturing, including international market penetration, may open room for operational missteps.

However, it’s worth noting that a substantial portion of these risks seems to be factored into the current stock price. Zoom’s valuation, reflected in its enterprise value, currently stands at approximately x3.4 times the projected revenue for FY 2024. In comparison, the average valuation for Software-as-a-Service (SaaS) companies typically hovers around x5 revenue, while certain high-growth assets are priced significantly higher, at x8-10. This suggests that Zoom’s current valuation might already account for many of the anticipated risks.

Investor Takeaway

Zoom performs better than expected: FY 2024 projections now call for $4,495 billion in sales and $1,743 billion in operating earnings. While the new calendar year is unlikely to bring a pivot in Zoom’s organic growth trajectory, there is little indication that suggests headwinds sizeable enough to justify a <9x EV/EBIT. I reiterate my “Buy” rating and revise my base case target price per share upwards to approximately $85.

Read the full article here