Rapid Recap

In my previous analysis titled “A Premium Price For Decelerating Growth Rates”, I said,

The issue I have is that aside from an alluring narrative, ZoomInfo (NASDAQ:ZI) Technologies Inc. stock already carries a premium valuation, while its growth rates appear to be decelerating.

[…] To sum up my thesis, what we [have here] is that in the past 3 months, the multiple that investors have been willing to pay for ZoomInfo has expanded by nearly 30% from a forward P/Sales of 6 to a P/Sales of 8 – and yet, I can’t see much justification for this expansion.

Along these lines, I continue. The only distinction is that I am now revising my rating downwards from a hold to a sell.

ZoomInfo’s Near-Term Prospects

Using a variety of company and key personnel data, ZoomInfo compiles comprehensive profiles of both people and organizations. They take great satisfaction in having current, accurate information on businesses and professionals’ contact details, which enables sales and marketing personnel to get in touch with potential prospects. In essence, ZoomInfo is a practical business-to-business platform for salespeople.

Moving on, the earnings call provided many different reasons why ZoomInfo’s near-term results are not living up to their compelling narrative. Here’s one quote that encapsulates the issue,

The ZoomInfo platform delivers a compelling ROI to our customers regardless of their growth environment, and we have not done a good enough job to date in demonstrating this value to them.

With this in mind, let’s discuss the biggest concern for investors.

Outlooks is Downwards Revised

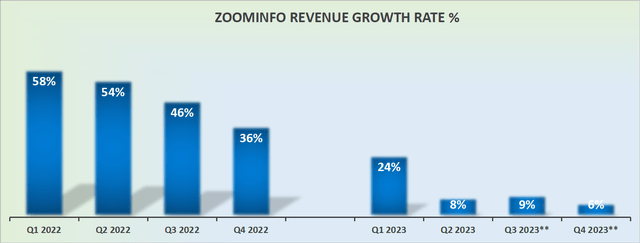

ZI revenue growth rates

A lot can be forgiven by a growth company. The company can be burning through cash or its profit margins can be moving in the wrong direction. What you cannot have is the company downwards revising its growth rates.

And that’s precisely what ZoomInfo delivered last night. ZoomInfo’s growth rates will exit 2023 with sub 10% CAGR. Even though ZoomInfo noted during its earnings call that 2023 will see revenue growth rates of approximately 12%. However, that CAGR is in large part held up because Q1 was still strong.

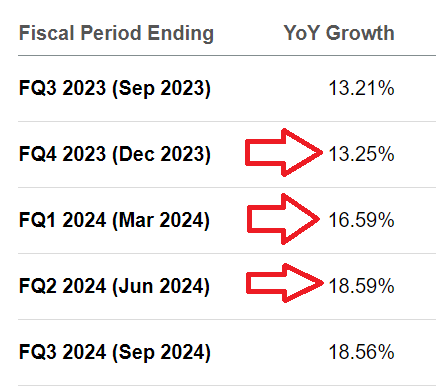

Now, as we look further ahead to 2024, I suspect that analysts will be busy in the coming hours and days downwards revising their consensus revenue estimates for ZoomInfo.

SA Premium

Simply put, ZoomInfo’s exit rates from Q4 point to around half of what analysts presently expect. Accordingly, I suspect that there’s little chance of ZoomInfo delivering more than 16% y/y growth rates for Q1 2024.

ZoomInfo is now a growth stock that has become ex-growth. And this will have dramatic implications for its multiple.

Coming Clean, I Was Wrong

Before we go further, I believe that it’s important to acknowledge when we are wrong. In my prior analysis, I was wrong to believe that ZoomInfo would stop repurchasing shares in Q2. Here’s an excerpt from my analysis,

Even though ZoomInfo did repurchase $25 million worth of stock in Q1 2023, I can’t imagine there will be significantly more buybacks coming. What makes me say so?

To answer that question, I believed at the time, as I believe today, that management has a fiduciary responsibility to invest in a business and not only deploy capital to repurchase shares in an effort to bolster the share price.

During Q2 2023 ZoomInfo repurchased shares at about $21.99. These repurchases were not substantial in absolute terms, at slightly more than $60 million, but I believed previously, as I do now, that ZoomInfo has bigger priorities for its cash than deploying even $1 towards share repurchases.

And to add further insult to injury, ZoomInfo now announces a new share repurchase program. Surely, better use of capital would be to deliver more value to their end customer and to stabilize its revenue growth rates?

After all, if ZoomInfo’s revenue growth rates stabilize, this will ultimately deliver shareholders more intrinsic value.

In conclusion, I don’t believe that ZoomInfo is a growth company anymore. And if it’s not considered to be a growth company, then investors will increasingly look beyond its revenue line and to its bottom line to support its valuation.

And on this line, having to pay 20x this year’s EPS for a company that sees its growth rates so substantially decelerate over a twelve-month period is not a bargain entry point for new investors. Avoid this name.

The Bottom Line

In my previous analysis, I expressed concerns about ZoomInfo Technologies Inc.’s stock valuation and its slowing growth rates.

The company’s forward P/Sales multiple had expanded by nearly 30%, from 6 to 8, without sufficient justification. Despite its compelling narrative, ZoomInfo’s near-term results are not meeting expectations.

The biggest concern for investors was the downward revision of ZoomInfo’s growth rates, with a projected exit from 2023 at sub-10% CAGR. As we look ahead to 2024, analysts are expected to revise their revenue estimates downward.

The stock’s exit rates from Q4 point to lower growth rates than analysts expected. I previously believed ZoomInfo would stop repurchasing shares, but the company announced a new share repurchase program, something I believe is ill-considered.

I concluded that ZoomInfo is no longer a growth company and that going forward investors will increasingly scrutinize its bottom line rather than revenue to support its valuation, making it an unattractive entry point for new investors.

Read the full article here