What’s a central banker to do? The only way to combat inflation is to reduce spending in the economy, private and government. It has no useful tool to impact government spending, so private spending must be the target and interest rates are the tool. The most immediately sensitive market is housing and construction. Mortgage rates respond quickly to increases in the Fed’s policy rate and this quickly dampens the demand for houses, new and existing, and all the related spending. Beyond that, the process is slower to unwind spending as credit costs rise and some projects are abandoned and asset prices fall, reducing wealth and related incomes and spending exuberance. Government spending is not impacted by the Fed directly, although with a massive federal debt to refinance, the interest cost to the government can rise quickly as interest rates rise from 2% to 5%. But the government can just let the deficit it runs get larger to cover it. Government spending creates jobs and income, and this feeds inflationary forces, making the Fed’s inflation fight much less effective.

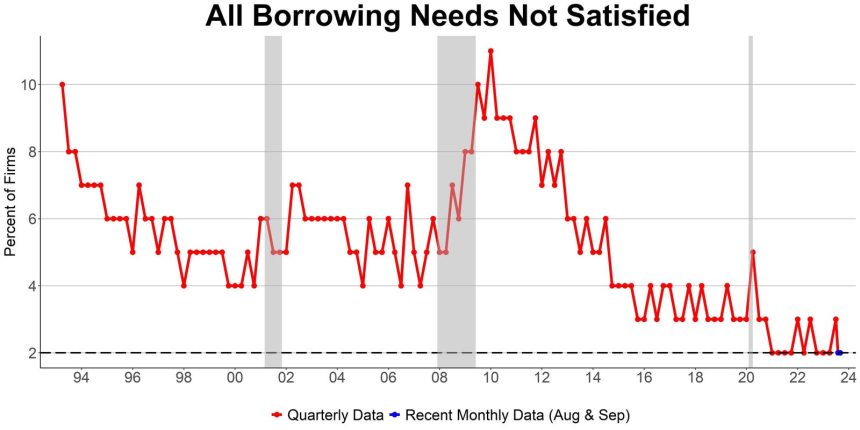

Small businesses have certainly felt the impact of the Fed’s interest rate policy. The average interest rate on loans reported has risen from 4.1% in July 2020 to 9.8% in September 2023. However, so far, lenders have been very accommodating. Complaints that borrowing needs for the firm were not satisfied have been at 50-year low levels until very recently, when complaints spiked upward (but historically still low).

The Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices indicated that standards have recently been tightened. Borrowers do report that loans are harder to get at the highest rate since 2012 (Chart 2), rising steadily since 2022.

And the percent of owners citing finance as their most important business problem popped up this year as well, reaching levels not seen since 2012 (Chart 3).

Inflation is still elevated above the Fed’s target of 2%. The Fed will continue their current path to further reduce the rate of inflation. This leaves small businesses to manage higher financing costs for some time to come.

So far, the impact of the Fed policy has not significantly impacted credit availability, the most important aspect of credit use for small firms. But all the near-term indicators predict a rougher road ahead. The NFIB Index of Small Business Optimism paints a gloomy picture (Chart 4). The Index clearly drops in anticipation of all recessions since 1973. And this most recent decline is a clear signal, there were a few quarters over the last 50 years with worse readings.

If history repeats itself (i.e., we keep making the same policy mistakes), there is a slow period ahead as things that are out of balance (deficits too high, inflation too high interest rates too high etc.) will get balanced the hard way, by recession, rather than sensible policy choices by all concerned.

Read the full article here