By Gargi Pal Chaudhuri

Gold is having a moment; one we believe is likely to continue. The precious metal has risen over 8% so far in 20231, thanks to a combination of positive factors. Here are three reasons gold has been moving higher and why investors may consider making a tactical allocation.

The end is near: There’s no guarantee, of course, but it’s likely the May rate hike will be the last of the Federal Reserve’s tightening campaign, which began in 2022. Expectations of a Fed pause have prompted weakness in the dollar, benefiting gold which is priced in dollars.

Concurrent with the dollar’s drop, inflation-adjusted 10-year yields have fallen by approximately 50 basis points2 from their late 2022 high. Falling real rates and a weaker dollar are a strong backdrop for gold.

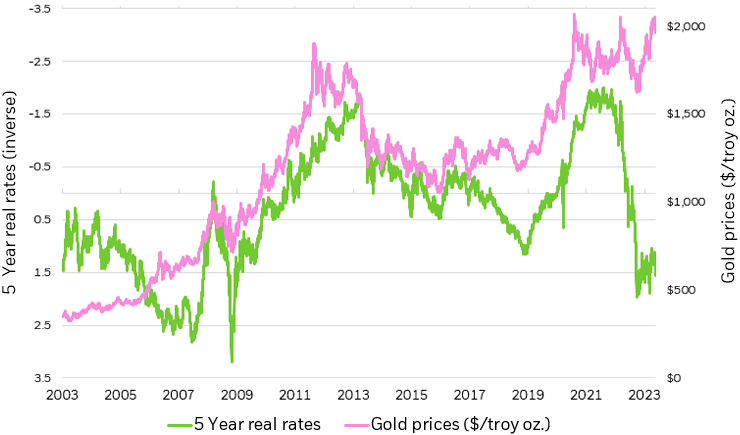

An analysis comparing 5-year real rates and spot gold prices showed a strong negative correlation over the past 20 years, meaning gold and real rates tend to move in opposite directions.3

Spot Gold vs. Real Rates

Source: BlackRock, Bloomberg. As of May 16, 2023. Chart by iShares Investment Strategy. 5 year real rates represented by US Generic Govt TII 5 Yr Index (USGGT05Y Index). Gold prices represented by XAUUSD Spot Exchange Rate – Price of 1 XAU in USD (XAU BGN Index). 20-year correlation from May 16, 2003 to May 16, 2023.

Chart description: Line graph showing 5-year real rate levels and gold prices from May 2003 to May 2023. The graph shows that in periods of consistently low real rates, gold prices tend to rise.

Gold prices spike as real rates fall

To be sure, we don’t share the consensus view that the Fed will be cutting rates in 2023, which presumably would accentuate the downward trends in the dollar and real rates. But the Fed staying on hold is our base case and that should support gold at current prices.

A body in motion: Falling real rates and a weaker dollar provide the fundamental backdrop to gold’s recent rally. There are also technical and psychological factors supporting the precious metal.

Gold has tended to perform well during periods of heightened market volatility. For example, when investor fear jumped in March amid regional bank failures, investors turned to gold as a relative ‘safe haven’. Year-to-date, exchange-traded gold funds have seen $2.7 billion of inflows, with most occurring in April after March’s volatility.4

Investors often turn to gold as a way to diversify portfolios amid financial market volatility. Gold historically has a low correlation with broad U.S. stock and bond exposures.

In the last 20 years, monthly price correlation between gold and the S&P 500 was 0.09, meaning there was virtually no correlation between stocks and gold; correlation between gold and the Bloomberg US Bond Aggregate Index was 0.38, showing little to no historical correlation.5

While it is unclear if and when another shock may hit, investors may choose allocations to gold as a potential hedge against future unrest.

Gold as a hedge

Many investors view gold as an inflation hedge when, in truth, the relationship between gold and inflation is nuanced. As noted above, gold has tended to trade in closer relationship to real rates and the dollar vs. inflation per se. Notably, spot gold prices were rangebound in 2021, when U.S. inflation rates surged.6

In fact, gold may be likely to perform better going forward if – as we expect – the U.S. economy continues to slow, perhaps falling into outright recession, and inflation declines. That’s because the Federal Reserve is unlikely to raise rates again if the economy – and inflation – are in retreat.

Historically, as rates rise, investors turn to fixed-income exposures where they can clip a higher yield. Since gold is a non-yielding asset, a rising rate environment tends to make gold unattractive. Now, as the Fed prepares for a likely pause, we see an environment where gold may perform well.

Secondly, the weakening U.S. Dollar makes gold more attractive to foreign buyers since gold is denominated in dollars. The gold market is largely supply and demand-driven, so, we can expect support for gold prices from elevated international demand.

Rather than an inflation hedge, gold can be viewed as a potential hedge against geopolitical risks.

With a contentious Presidential election in the offing, it’s unlikely U.S. political acrimony will subside anytime soon. That said, the big area of bipartisan agreement in U.S. politics centers on containing China’s growing economic and political clout. Gold seems likely to benefit, as it did when Russia invaded Ukraine in early 2022, if geopolitical tensions rise.

Conclusion

In the short to medium term, we see structural support for gold as we expect the Fed to pause rates at the next FOMC meeting.

Notably, gold fell from its May 3 high around $2050 per ounce amid expectations the U.S. would avoid missing the deadline to raise the debt ceiling.7

That said, the decline occurred after gold rallied nearly 30% from its 52-week low.8 If gold proves able to sustain a rally above its 10-year high of $2067, that may suggest another leg in the rally is likely.

Investors may consider a tactical allocation to gold in an environment of a slowing economy and stabilizing real rates. Exchange traded products provide a low-cost, efficient way to gain exposure to the price of physical gold.

© 2023 BlackRock, Inc. All rights reserved.

1 Source: Bloomberg, LBMA Gold Price as of May 19, 2023

2 Source: St. Louis Fed, as of May 10, 2023, 10 year real rates represented by US Generic Govt TII 10 Yr Index (USGGT10Y Index).

3 BlackRock, Bloomberg. As of May 16, 2023. 5-year real rates represented by US Generic Govt TII 5 Yr Index (USGGT05Y Index). Gold prices represented by XAUUSD Spot Exchange Rate – Price of 1 XAU in USD (XAU BGN Index). 20-year correlation of negative 0.985 from May 16, 2003 to May 16, 2023.

4 Source: BlackRock, Bloomberg. As of May 16, 2023. ETP groupings determined by Markit.

5 Source: BlackRock, Bloomberg. As of May 16, 2023. S&P 500 represented by S&P 500 Index, gold represented by XAU BGN Currency. 20-year correlation from May 16, 2003 to May 16, 2023.

6 Source: Bloomberg

7 Source: Kitco.com, LBMA Gold Price as of May 19, 2023

8 Source: BlackRock, Bloomberg. As of May 16, 2023. Gold represented by XAU BGN Currency.

This information must be preceded or accompanied by a current prospectus. Investors should read it carefully before investing.

Investing involves risk, including possible loss of principal.

The iShares Gold Trust Micro is not an investment company registered under the Investment Company Act of 1940, and therefore is not subject to the same regulatory requirements as mutual funds or ETFs registered under the Investment Company Act of 1940. The Trust is not a commodity pool for purposes of the Commodity Exchange Act. Before making an investment decision, you should carefully consider the risk factors and other information included in the prospectus.

Following an investment in shares of the Trust, several factors may have the effect of causing a decline in the prices of gold and a corresponding decline in the price of the shares. Among them: (i) Large sales by the official sector. A significant portion of the aggregate world gold holdings is owned by governments, central banks and related institutions. If one or more of these institutions decides to sell in amounts large enough to cause a decline in world gold prices, the price of the shares will be adversely affected. (ii) A significant increase in gold hedging activity by gold producers. Should there be an increase in the level of hedge activity of gold producing companies, it could cause a decline in world gold prices, adversely affecting the price of the shares. (iii) A significant change in the attitude of speculators and investors towards gold. Should the speculative community take a negative view towards gold, it could cause a decline in world gold prices, negatively impacting the price of the shares.

Buying and selling shares of ETFs may result in brokerage commissions.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cboe Global Indices, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA® ”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell, S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index, FTSE EPRA Nareit Developed Green Target Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

©2023 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH0623U/S-2916028

This post originally appeared on the iShares Market Insights.

Read the full article here