Another Fed meeting resulted in yet another rate hike, the 10th consecutive rate hike to be exact.

Many sectors react negatively to rate hikes, but one such sector that really does not react well is the REIT sector. REITs tend to rely a lot on debt as they acquire expensive properties to expand their portfolios. If the debt is not managed properly, and a REIT has a lot of variable debt, a rising interest rate environment would be detrimental to that particular company.

However, there are REITs that manage their debt properly and have strong credit ratings to show for it, which helps them attain better financing deals moving forward, which can be a huge competitive gain, especially within the REIT sector.

Back to the rate hikes though. 10 straight rate hikes is unprecedented and it has created some DEEP VALUE opportunities for long-term investors within the Real Estate Investment Trust sector. Rate hikes could continue for one more round, but it feels as if we are nearing the end of this cycle, with some economists predicting rate cuts in the back half of the year, a position I do not take.

However, rate cuts are not something to be cheered either because when rates are getting cut, that often signals issues within the economy. Nonetheless, we are going to look at 3 REITs that are trading at some great valuations here in the month of May.

3 REITs To Buy In May

REIT #1 – Global Medical REIT (GMRE)

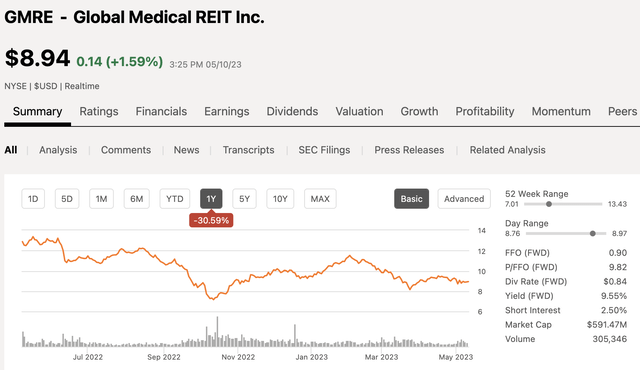

Global Medical REIT is a medical office REIT with a market cap of $591 million. Over the past 12 months, the stock is down more than 30% and down 6% in 2023. The REIT also sports a very high dividend yield of 9.5%.

Seeking Alpha

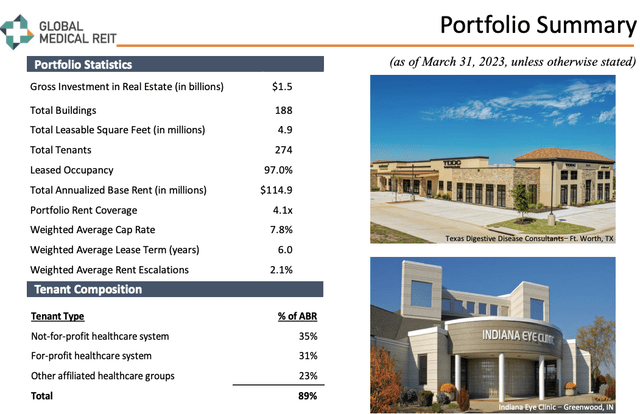

GMRE owns properties such as Medical Office Buildings (“MOB”), Rehab Facilities (“IRF”), and other specialized medical facilities.

The company’s portfolio is comprised of 188 properties amounting to nearly 5 million in leasable square feet. These properties are leased out to 274 tenants. As of the end of Q1, GMRE ended with an occupancy rate of 97.0%. The company has a weighted average lease term of 6.0 years with a weighted average lease escalator of 2.1%.

GMRE Q1 Investor Presentation

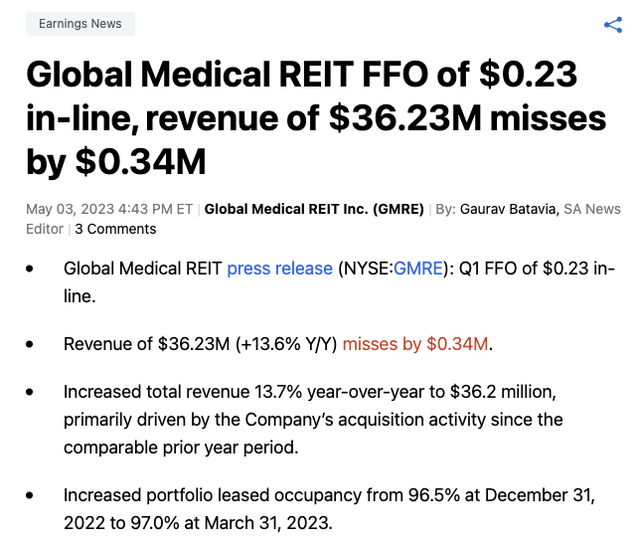

The company recently reported Q1 ’23 earnings which saw the company generate FFO of $0.23 per share and revenues of $36.23 million, which was a 13.6% increase from the prior year. The FFO came in-line with analyst expectations while revenues slightly missed expectations by $340K.

Seeking Alpha

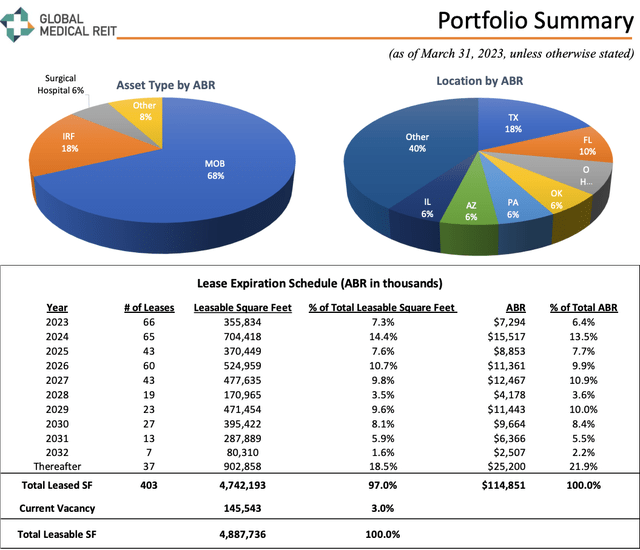

Looking more closely at the portfolio, you can see in the chart below that MOBs makeup 68% of GMRE’s annual base rent, making it the largest asset type within the portfolio by a wide margin. IRF facilities account for 18%, and Surgical Hospital’s account for 6% of ABR.

The other thing to note is that 13.5% of the company’s ABR is due to expire in 2024, which will give the company an opportunity to bring those leases up to market rent status. Many of those leases were signed prior to 2018, and rents have increased a lot since that time, even if you discount market rents in 2023 given the economic uncertainty. If managed properly, this could be a tailwind for the REIT.

GMRE Q1 Investor Presentation

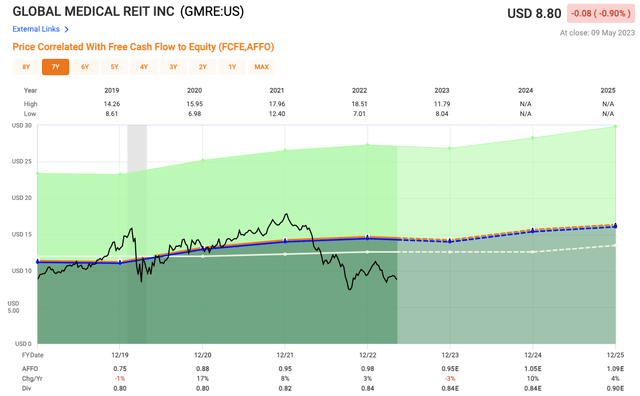

Given the decline in share price, shares of GMRE are looking quite intriguing at current levels. Sure, we could continue to see some volatility in the near-term, but GMRE continues to grow its portfolio and use cash in a strategic manner. Shares of GMRE currently trade at a 2023 AFFO multiple of 9.2x, which is well below their 5-year average of 14.7x. Compare GMRE to a close competitor like Physicians Realty Trust (DOC), and you will see them trading at an AFFO multiple of 14x.

Fast Graphs

REIT #2 – Realty Income (O)

Realty Income is known by many as “The Monthly Dividend Company” as they pay out their annual dividend in monthly increments. Realty Income by many is considered the gold standard within the REIT sector as they have navigated through various economic cycles during their time and always seeming to come out stronger.

Realty Income currently has a market cap of $42 billion and over the past 12 months, shares have dipped slightly by 1.5%. Realty Income currently pays a dividend that yields 4.9%, which is quite generous for them.

Seeking Alpha

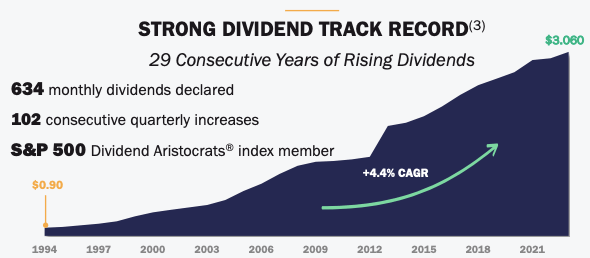

Speaking of the dividend, Realty Income is one of only three REITs on the prestigious dividend aristocrats list. The company has declared over 630 MONTHLY dividends and they have increased their dividend for more than 100 CONSECUTIVE quarters.

Realty Income Q1 Investor Presentation

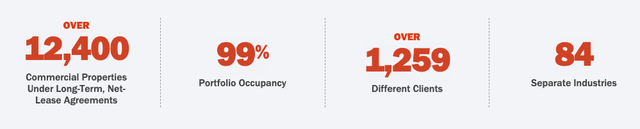

Realty Income has a portfolio of more than 12,400 properties that are leased out to 1,259 different tenants. As of Q1 ’23, the company had an occupancy rate of 99%.

Realty Income IR

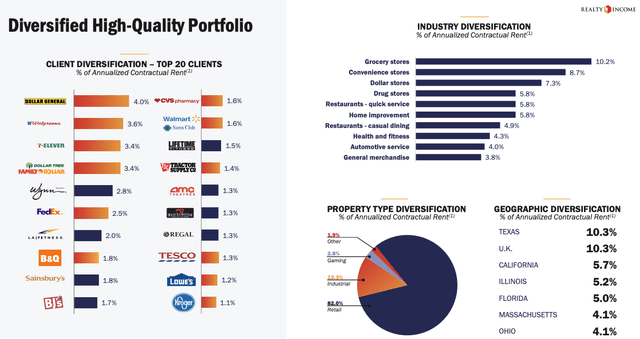

The company has a solid portfolio of properties that remain in demand. They lease these properties out to high-quality tenants, 41% being investment grade. Here is a closer look at the top 20 tenants as well as sector diversification.

Realty Income Q1 Investor Presentation

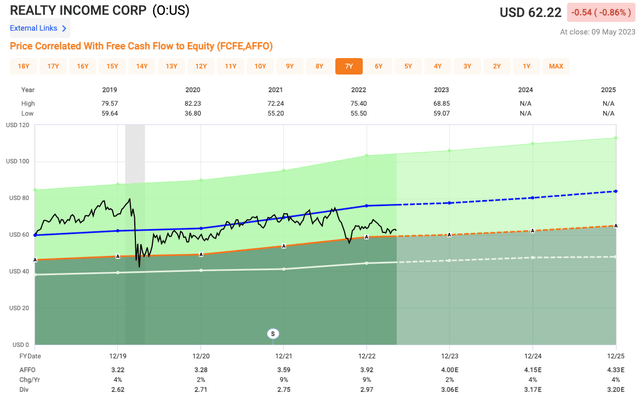

I have said in the past that any time Realty Income yields a 5% dividend, history has shown this to be a great time to add to the stock. We are right on the cusp of 5% right now and shares of O currently trade at a 2023 AFFO multiple of 15.5x, which is below their 5-year and 10-year averages of 19.4x and 18.8x, respectively.

Fast Graphs

REIT #3 – Simon Property Group (SPG)

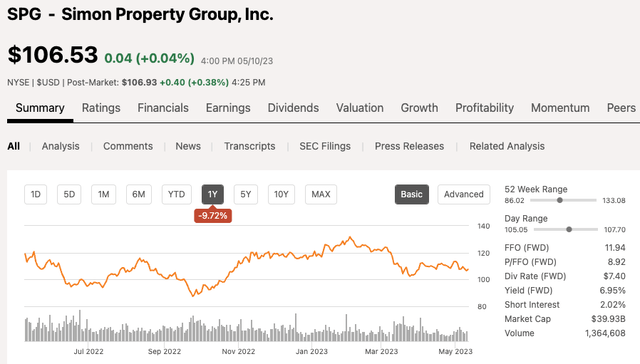

Simon Property Group is the premiere mall landlord here in the US, with a presence that expands outside of the border as well. SPG currently has a market cap of ~$40 billion. Over the past 12 months, shares of SPG have fallen nearly 10%, much of that taking place in 2023.

Seeking Alpha

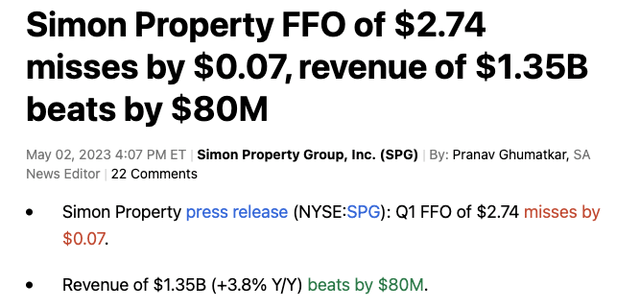

Simon Property Group recently reported Q1 ’23 earnings that showed the company generated FFO of $2.74 per share, which missed analyst expectations by $0.07 per share. The company also generated $1.35 billion in top line revenue, which beat expectations by $80 million.

Seeking Alpha

Domestic NOI for the quarter grew 4%, with the portfolio NOI growing 3.9%, year over year. The company ended Q1 with an occupancy rate of 94.4%, which was up from 93.3% a year ago.

Other key results I like to look at for SPG is the base minimum rent per square foot, as well as the reported retailer sales per square foot. This gives investors insights into how SPG is leasing and also the strength of the tenants.

For Q1, base minimum rent per square foot was $55.84, which was an increase of 3.1% year over year. Reported retailer sales per square foot was $759, an increase of 3.3% over the past year.

Also during the company’s earnings release, management announced an 8.8% dividend hike, which follows a 9% increase in ’22 and a near 30% increase in ’21. SPG shares currently yield a dividend of 6.95%, which is quite generous.

Investors will want to keep a close eye on the strength of retail sales within SPG’s malls as well as the occupancy, assuming we enter a recession over the next two quarters.

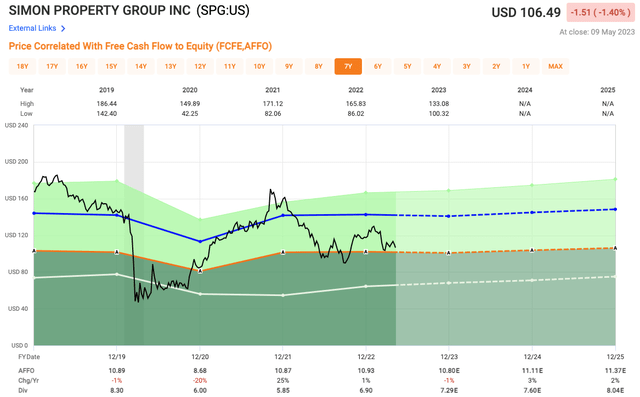

In terms of valuation, shares of SPG currently trade at a ’23 AFFO multiple of just 9.8x, which is well below their 5-year and 10-year averages of 13x and 16.3x, respectively.

Fast Graphs

Investor Takeaway

REITs are a sector with blood in the water, but with the end of the rate hike cycle nearing the end of the road, it may be worth your while to start nibbling at some high-quality REITs that are trading at sizable discounts to their historical averages.

These are not just any cheap REITs we are looking at, these are high-quality REITs with great management teams able to weather the economic storms ahead.

Read the full article here