Co-produced by David Ksir.

In a recent article, I highlighted two office real estate investment trusts, or REITs, and one mortgage REIT with heavy office exposure that will likely cut their dividend.

These are:

- Brandywine Realty Trust (BDN)

- Granite Point Mortgage Trust (GPMT)

- SL Green Realty Corp. (SLG)

This is hardly surprising given that offices have been hit by the perfect storm lately. Between work from home, high interest rates, a potential recession, and a likely credit crunch that will make refinancing difficult, it’s more important than ever for these REITs to preserve liquidity.

Even more so at a time when dividend yields are approaching 15-20% and the market isn’t giving the stocks any credit for their dividend. This is why I think those companies might as well go ahead and cut the dividend.

It’s wise to try to avoid REITs that are at high risk of cutting their dividend because no matter how low the price gets, a cut almost always results in further downside.

On the other hand, investing in REITs (VNQ) that hike their dividends consistently is one of the best ways to build income and wealth. This is why today I want to highlight 5 REITs that are likely to announce dividend increases in the near future, perhaps as soon as when Q2 2023 results come out.

Essential Properties Realty Trust, Inc. (EPRT)

EPRT is a net lease REIT that specializes in smaller properties around the $2 million mark. These are properties where you would typically find a fast-food restaurant, casual dining, a car wash, or a gym.

Seeking alpha picture library

The REIT enjoys two competitive advantages compared to its more established peer like Realty Income (O):

- It is much smaller in size, which allows it to be more selective with its new investments.

- And it focuses on middle-market businesses that don’t have as much access to capital as McDonald’s (MCD) or Walmart (WMT), for example.

These two characteristics enable the REIT to acquire properties at better prices and obtain above-standard lease terms. In particular, it enjoys 2% rent escalators that are built into very long-term leases (14 years on average).

On top of the guaranteed 2% increase, the REIT is also able to grow externally by acquiring properties via sale-leasebacks from their existing tenants at prices significantly below market value.

During the first quarter, the average cash cap rate on new acquisitions averaged 7.6%, while that of disposals stood at just 6.1%, despite the fact that the properties sold were below-average with rent coverage of just 2.3x compared to over 4x on the whole portfolio.

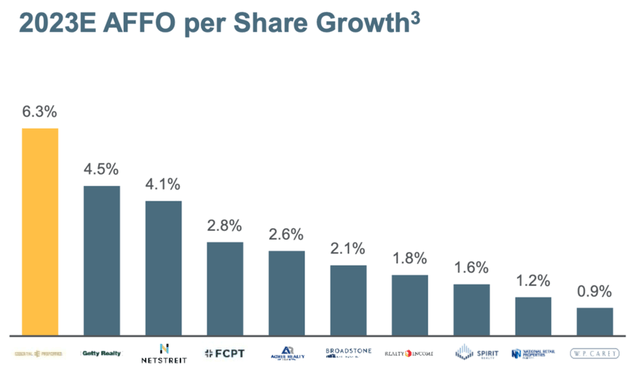

This is why management is confidently guiding towards a 6.3% YoY increase in adjusted funds from operations, or AFFO, this year, which is the highest growth of any major net lease REIT.

Essential Properties Realty Trust

With a healthy forward payout ratio of 70%, it’s very likely that the REIT will grow its dividend at least in line with AFFO growth this year.

Following a 1.8% increase in Q1, the quarterly dividend now stands at $0.28 per share, and I think it could easily increase by another 4% or so before the end of the year. I expect the next hike as soon as Q2 2023.

STAG Industrial, Inc. (STAG)

STAG is an industrial REIT with a heavy focus on secondary markets in the US, primarily in the Sunbelt and along the Mexican border. This distinguishes the company from peers such as Prologis (PLD), which tend to focus on more established port cities, such as Los Angeles.

These secondary markets have significantly less competition and directly benefit from the recent trend of onshoring or nearshoring as more and more imports are coming from Mexico (rather than from China) and companies look for warehouses in tax-friendly states such as Texas. Moreover, the company has a really good track record of acquiring distressed properties and turning them around by fixing issues and increasing rents. This puts the company in a very good place to grow their rents.

STAG Industrial

I also want to point out that rents are currently deeply below market as confirmed by recent Q1 cash rent spreads of 30.6%. Such high spreads, combined with 2.5% built-in rent escalators, are likely to drive significant FFO growth. For this year, the guidance calls for a 5% FFO per share increase.

STAG has somewhat of a reputation for not increasing its dividend, and rightfully so as the 5-year average growth rate of its dividend is a negligible 0.7%. But I think this might be a thing of the past.

You see, the company has kept its dividend the same for years because they were trying to deleverage its balance sheet and lower its payout ratio.

Both of these have now been accomplished.

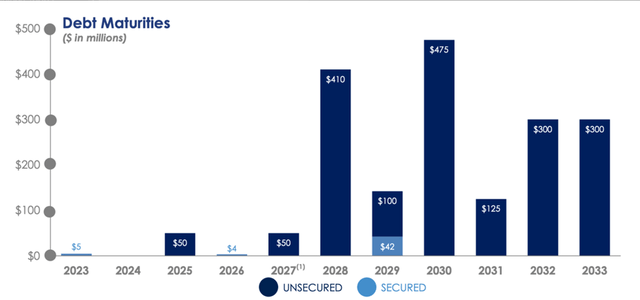

The company now has a BBB-rated balance sheet with a very reasonable net debt / EBITDA of 5x and well-spread-out maturities. Moreover, their forward payout has decreased to just 65% which means that the company is now able to grow its dividend in line with FFO growth.

Therefore, I see a 5% dividend increase for STAG as entirely possible this year. If the dividend were to increase, STAG could very easily re-rate higher so this is really one to watch closely.

Agree Realty Corporation (ADC)

Agree Realty is one of the safest net lease REITs out there. Their focus is on big box stores leased to very reputable tenants such as The Home Depot (HD) or Walmart (WMT). Consequently, the REIT has one of the highest proportions of investment-grade tenants at 68%.

Seeking alpha picture library

The tenant mix is spread across a number of sectors, many of which are recession and/or Amazon (AMZN) resistant. Think grocery stores, dollar stores, tire & auto services, and home improvements.

Moreover, ADC is also involved in ground leases which account for about 12% of their total rent. Ground leases are very safe, because the tenant is responsible for the construction costs of the building, and if he fails to make his rent payments, the landlord gets to keep the building free of charge. Since 87% of ADC’s land tenants are investment grade, default is highly unlikely and ground leases therefore make for very predictable cash flow.

Moreover, the company maintains a very strong investment grade balance sheet which is BBB rated and has a low net debt / EBITDA of 4.5x and no major debt maturities until 2028.

Agree Realty Corporation

Strong reputable tenants generally have a lot of bargaining power when negotiating their leases, which is why ADC is somewhat of a slower grower with 2023 FFO growth expected at just 2%.

But here’s the thing, the current monthly dividend of $0.243 per share corresponds to a payout ratio of 73% which is below the low end of management’s 75-85% target.

This means that there’s plenty of room for the dividend to grow beyond the 2% FFO growth. Historically, over the past 10 years, the ADC has grown its dividend at a CAGR of 6%. This year alone, even assuming the low-end payout ratio of 75%, the dividend could easily increase by 5%.

Invitation Homes Inc. (INVH)

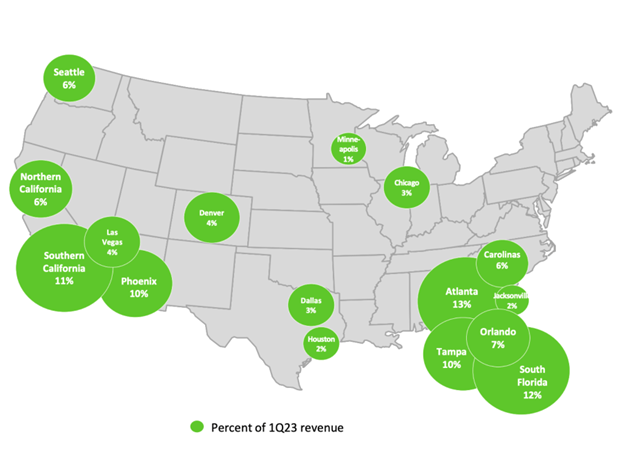

Invitation Homes is one of only two publicly traded REITs that focus solely on single-family housing. The REIT owns about 80,000 houses located primarily in high growth markets such as Arizona, Georgia, Texas, and Florida.

Invitation Homes

The company focuses heavily on the markets they know and understand, as they average over 5,000 houses per market, which allows them to achieve significant scale and efficiency. Their specialty is in-fill locations, which limits future competition in an area.

Compared to multifamily, single-family homes tend to be leased by older, more established tenants that are generally better off financially. This is confirmed by the high average annual income of new residents of $134,000 and strong rent coverage of 5.1x. With such strong tenants, Invitation Homes enjoys high collection rates of 98%+ and low tenant turn-over (4 years on average).

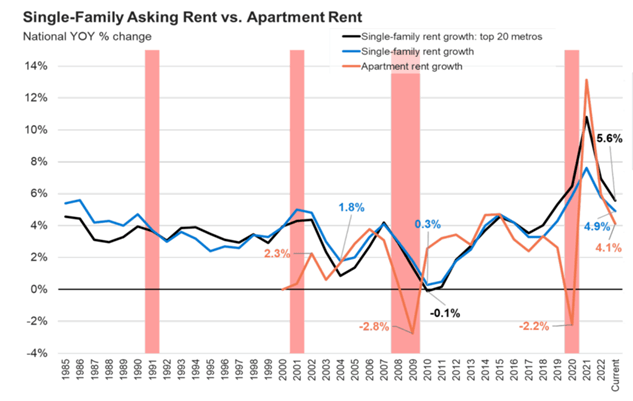

Thanks to financially stable tenants, single-family rents tend to be much more resilient during times of economic weakness, especially compared to multifamily. This was true during early 2000s, 2008, and especially during Covid, when single-family rents continued to grow while multifamily stagnated or went negative.

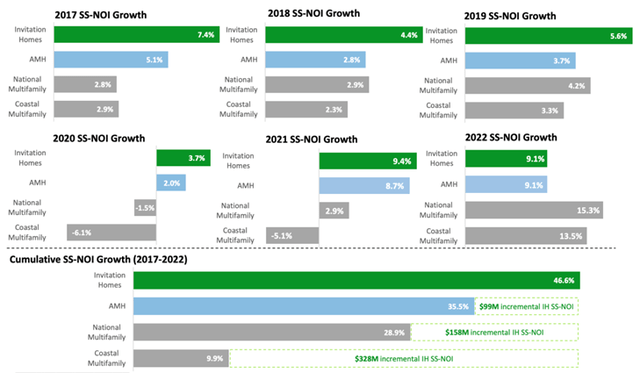

Invitation Homes

And there’s more. Not only have Invitation Homes’ rents been resilient, but they have also grown significantly over the past years, increasing by 46% since 2017 and outgrowing the national multifamily average almost by a factor of two.

Invitation Homes

During the first quarter of the year, same-store rents climbed by 7.3% YoY, and management has guided to a full-year AFFO increase of 4%.

The company’s balance sheet has recently been upgraded to BBB and shows no real weakness as all of their interest rate risk has been hedged and there are no debt maturities until 2026.

All things considered, with a reasonable forward payout ratio of 70%, I see a dividend increase of 3-4% as likely in 2023. Still, at a high multiple of 24x AFFO and with a dividend yield of just 3%, I see better total return opportunities elsewhere and will keep INVH on my watchlist for now.

VICI Properties Inc. (VICI)

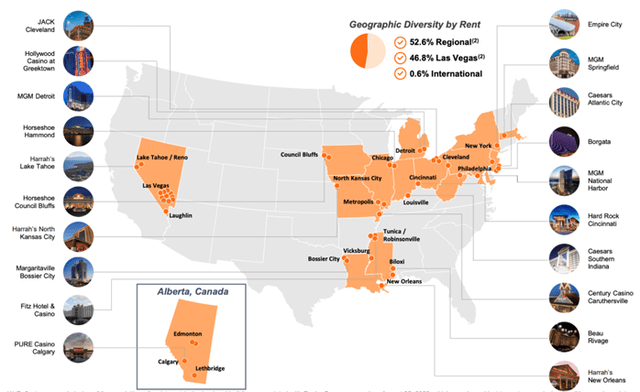

VICI is a unique REIT that owns gaming and entertainment properties. Half of their revenue comes from Las Vegas and the other half comes from regional casinos located primarily in the Northeast.

VICI Properties

VICI is one of only a handful of REITs that saw their stock price rise over the course of 2022. This might be surprising to many, but it’s for a good reason.

Firstly, it’s important to remember that the REIT is a landlord, not a casino operator. Therefore, its cash flows are much more insulated from potential recession risks.

Secondly, the main differentiator of VICI is its tenants and above-average lease terms.

Consider this:

- 76% of tenants are S&P 500 (SP500) companies

- 91% of rents are covered by either a master lease or a parent company guarantee

- the average remaining lease term stands at 42 years

- 43% of leases are CPI-linked with no caps

- an average minimum annual rent escalation of 1.9%.

VICI Properties

VICI has been growing its AFFO through acquisitions and has done a great job so far as AFFO per share increased by 11% in 2020 and 2021 and by 6% in 2022. For 2023, management has guided for another 10% increase.

Dividend growth has been equally impressive, and since the Q1 payout ratio stood right in line with management’s target of 75%, I expect that VICI will hike its dividend by another 5-8% this year as it increases its AFFO.

Historically, the hike has usually come with their Q3 earnings release.

Bottom line

Investing in REITs can be very rewarding, but it’s important to avoid REITs at risk of a dividend cut and buy those that have a high chance of a dividend hike. At High Yield Landlord, we try to do exactly that.

Read the full article here