Now that the debt ceiling debacle is behind us, investors can yet again turn to obsessing over the Federal Reserve.

Economic data remains lackluster and economists are split on whether the Federal Reserve will hike again during their June meeting or whether a pause is in order before one final rate hike. Regardless, it is evident that we are nearing the end of this rate hike cycle.

The Labor Force remains stable, although consumers are beginning to weaken based on record US credit card debt levels and a low savings rate that also shows the average American savings have been largely wiped away since the pandemic.

So all that said, its 50/50 on whether we fall into a recession.

The market’s favorite recession indicator happens to be the inversion of the yield curve, meaning the 2yr treasury bond has a HIGHER yield than the 10yr Treasury Bond, which has now been the case for over 220 consecutive days.

Investors are in a tough spot when trying to choose the direction the stock market will go over the near-term, but luckily for me, I am an investor and not a trader. As such, I look for high-quality stocks trading at great long-term entry points. Today, I will look at 5 of the Top Dividend Stocks To Buy in the month of June.

5 Top Dividend Stocks For the Month of June

Dividend Stock #1: Qualcomm (QCOM)

Qualcomm is a semiconductor company that has not partaken in the AI induced rally in 2023. The stock had fallen after their latest quarterly earnings release, but has since recovered nicely in recent days.

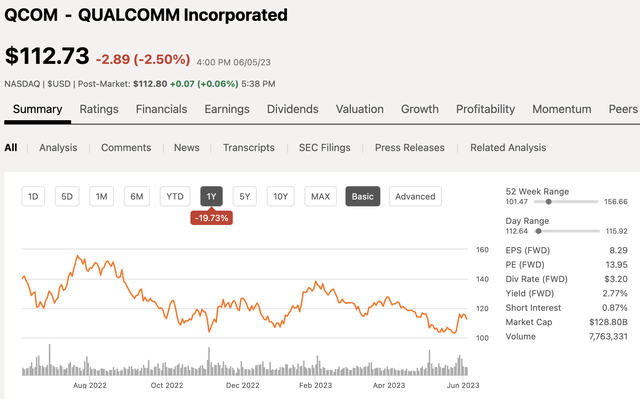

QCOM has a market cap of $129 billion and over the past 12 months, shares are down nearly 20%. Year-to-date however, QCOM shares are up 8%.

Seeking Alpha

By now you are probably aware of the AI craze that has gone on in 2023, that has seen stocks like NVDA and Meta Platforms double just in 2023 alone. One of Qualcomm’s closest competitors and a favorite dividend growth stock of mine is Broadcom (AVGO), has seen its stock rise over 40% in 2023 thus far.

So why is Qualcomm getting left behind?

#1 – The recovery in China has been slower than expected, not just for QCOM but for many US companies involved in the region. However, QCOM relies heavily on the Chinese region.

#2 – Handheld device chips were down 17%, which is attributable to China as well as the US.

When the company reported their Q2 earnings, they were actually in-line from an EPS standpoint and they BEAT on sales, but the company also gave light guidance

- EPS was $2.15 in line

- Rev $9.28B vs $9.1B expected

In terms of Q3 guidance, sales are expected to reach $8.5 billion, which is well below street expectations of $9.1 billion, which also contributed to pressure for the stock following the earnings release.

QCOM was also cash flow negative during the quarter, as their cash position decreased by $1.3 billion, however, they remain cash flow positive on the year thus far.

In terms of FCF, QCOM generated $3.7 Billion in FCF through the first half of the year compared to paying out dividend of $1.7 billion in dividends, which equates to a FCF yield of 46%, which tells me the dividend is plenty safe at the moment.

Speaking of the dividend, QCOM pays an annual dividend that yields 2.85% and over the past five years, investors have seen the company increase their dividend an average of 5.2% per year, so not a ton in terms of dividend growth, although the last two hikes have been ABOVE that average rate, increasing the dividend 7% and 10%, respectively, with those past two hikes.

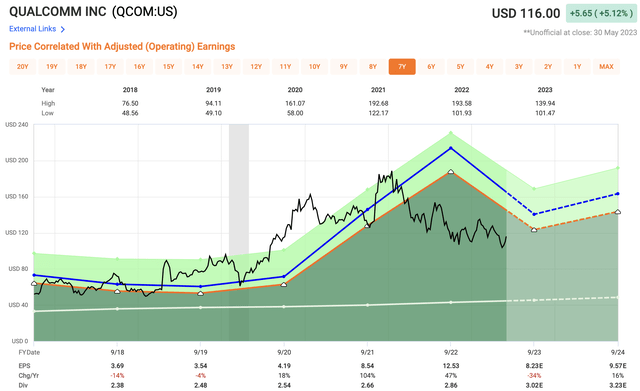

In terms of valuation, analysts are looking for FY 2024 Adj EPS of $9.57, which equates to an earnings multiple of 12.1x. Over the past five years, shares of QCOM have traded at an average earnings multiple of 17.1x and 15.7x over the past decade.

Fast Graphs

Dividend Stock #2: Johnson & Johnson (JNJ)

Johnson & Johnson has been a staple in many dividend portfolios over decades, but the company has been going through a reshuffle of sorts recently as the company spun off its consumer health segment into a separate public company called Kenvue (KVUE). JNJ still owns 90% stake in the new company for the time being, but now consists of the faster growing pharmaceutical and medtech segments.

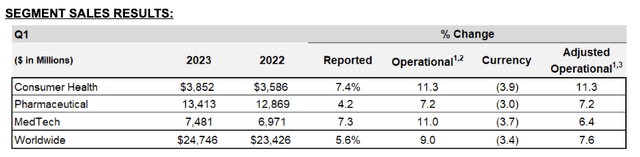

The company reported their latest quarterly results prior to the spin off of Kenvue, so you can see here how all three segments stacked up.

JNJ 10-Q

- Consumer Health accounts for 15% of company revenues

- MedTech accounts for 30% of company revenues

- Pharmaceuticals 55% of company revenues

JNJ has long been a major player in the pharmaceutical industry and that is expected to be even more of the case moving forward with the strength of not only their current portfolio, but also their strong pipeline.

Medical Devices is also expected to return to strong growth after the sector took a bit of a breather during the pandemic years when surgeries and specific procedures were put on the back burner.

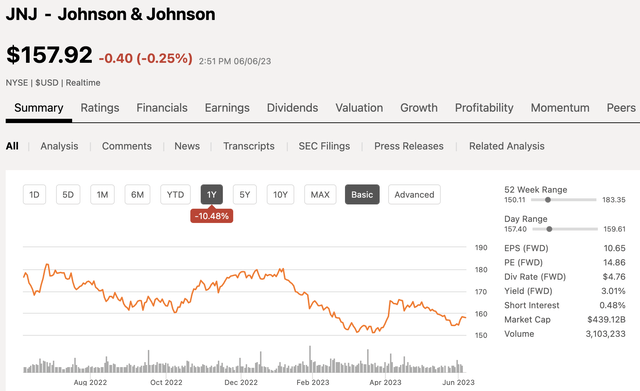

Johnson & Johnson currently has a market cap of $439 billion and the stock is down 10% over the past 12 months, with the majority of that coming in 2023.

Seeking Alpha

In terms of dividends, JNJ has paid a GROWING dividend for more than 60 years. The company currently yields a dividend of 3.0% and they have a five-year dividend growth rate of 6%.

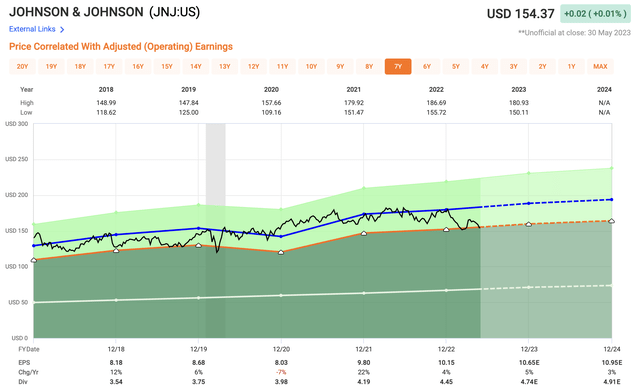

Analysts are looking for 2023 EPS of $10.65 which equates to a 2023 earnings multiple of 14.5x. For comparative purposes, JNJ has traded at an average multiple of 17.7x over the past five years and 17.2x over the past decade making now an opportune time to add to JNJ.

Fast Graphs

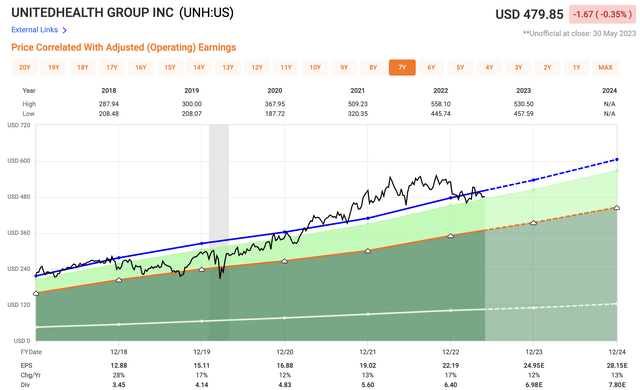

Dividend Stock #3: UnitedHealth Group (UNH)

UnitedHealth Group is one of the largest healthcare benefits company in the US today and the stock has the largest weighting within the Dow Jones Industrial Average Index. For those of you unaware, the Dow Jones Industrial Average is a price weighted index, meaning the stocks with the HIGHEST per share price have the largest weighting.

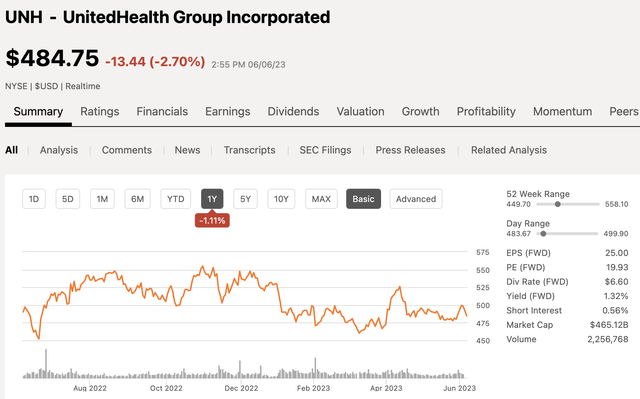

UnitedHealth Group currently has a market cap of Market Cap: $465 billion and the stock is essentially flat over the past 12 months.

Seeking Alpha

UNH is a behemoth in the industry, contributing 7.7% of U.S. healthcare spending today from their UnitedHealthcare and Optum segments.

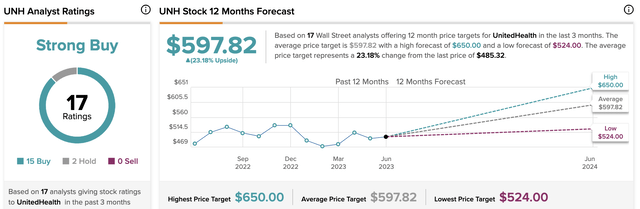

Piper Sandler recently initiated coverage on UNH giving it an “Overweight” rating, which is a fancy way of calling the stock a BUY. The analyst gave the stock a 12-mo Price Target of $580, which implies 20% upside from current levels. The Average price target on the street is $597, which implies 23% upside from current levels.

Tipranks

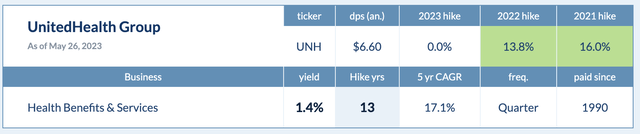

UNH currently yields a dividend of 1.4%, which is not all that much, but the intriguing part from a dividend standpoint is the 17% five-year dividend growth rate the company has. UNH has increased their dividend for 13 consecutive years.

Dividend Hike

In terms of valuation, analysts are looking for 2023 EPS of $24.95 which equates to a 2023 earnings multiple of 19.2x. For comparative purposes, UNH shares have traded at an average multiple of 21.5x over the past five years and 19.4x over the past decade.

Fast Graphs

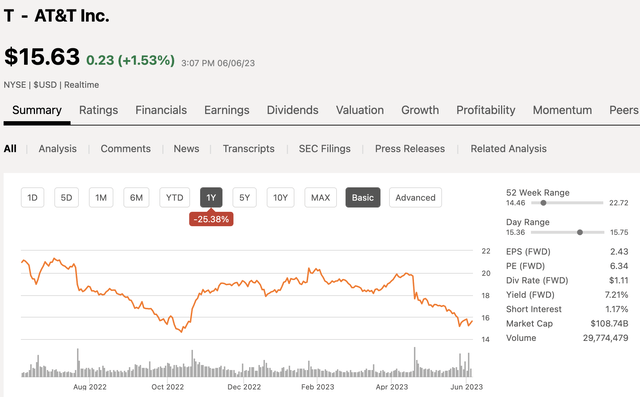

Dividend Stock #4: AT&T (T)

This selection might raise a few eyebrows considering how the stock has been in the dog house for a good while now. I had owned AT&T shares for a number of years before selling out in the low $30 range prior to the pandemic plunge. That was lucky in terms of timing, but I had my reasons for selling. Investors continued to lack confidence in the management team after numerous poor acquisitions.

Over paying for the likes of DirecTv when streaming and chord cutting were gaining momentum. Overpaying for WarnerMedia to transition more into the Media world was another.

Under the new leadership of John Stankey, the company has now rid themselves of those poor acquisitions, literally cut the cord on them, and are back to focusing on what made them a telecom behemoth.

5G continues to grow and data needs are at all time highs with this new work from home flex work environment we are in. AT&T and other telecom providers will play and do play a huge part in that growth.

There is still TONS of room for improvement, but these valuations are just dirt cheap, especially after the Amazon (AMZN) sale we got recently when Amazon announced plans for telecom service for Prime members. Entering the telecom industry requires huge capital, or they will gain service through one of these providers, which is what the reports suggest.

AT&T currently trades at a market cap of $109 billion with the stock down 25% over the past 12 months, and down 16% in 2023.

Seeking Alpha

When the 13-F filings came out a few weeks back, there were some notable money managers who either initiated a new position in AT&T or added to their existing stake. One of those was Ken Griffin of Citadel Advisors who added 27 million shares of T last quarter and Billionaire owner of the New York Mets Steve Cohen, who added 9.6 million shares of AT&T.

AT&T is known for having a high-yield dividend, even after they slashed it nearly in half back in 2022. The company made this difficult decision in the best interest of the business and shareholders, so they could put that money towards reinvesting back into the business and bringing down the mountain size of debt they have.

The dividend yield is still high at 7.2% and because of the dividend cut, there is no dividend growth at the moment.

With the stock selling off hard over the past 12 months, valuation is looking extremely cheap. Analysts are looking for adjusted EPS of $2.41 in 2023, which equates to a 2023 earnings multiple of 6.5x. That is INCREDIBLY low. For comparable purposes, over the past five years, shares have traded at an average multiple of 11.7x and 15.1x over the past decade if you can believe that, making AT&T a low floor play at these levels.

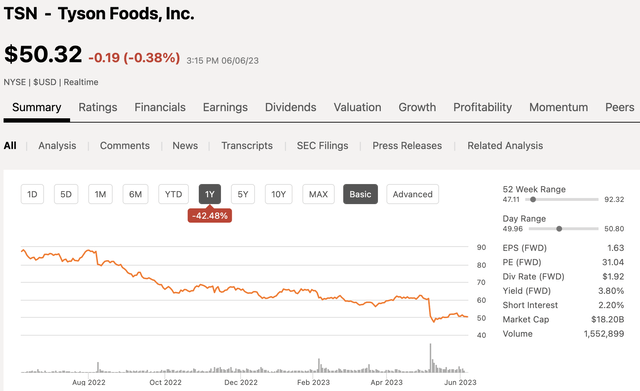

Dividend Stock #5: Tyson Foods (TSN)

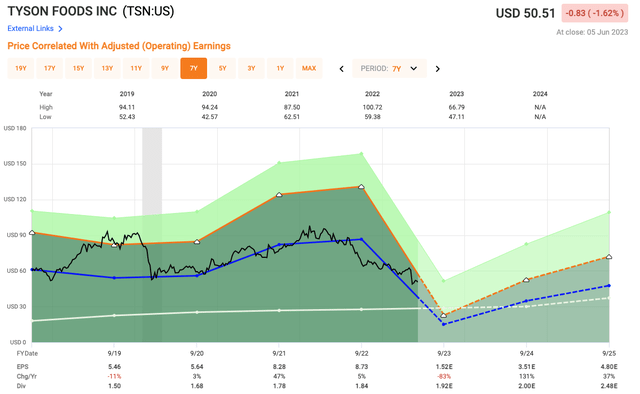

Tyson Foods is a well-known food provider that has come under some pressure lately after a weaker than expected quarter. The company currently has a market cap of $18 billion and over the past year, shares have fallen over 40% with a 20% decline in 2023 thus far.

Seeking Alpha

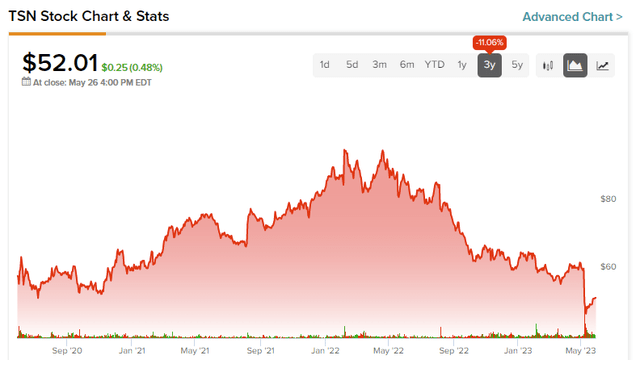

There is no other way to put it, but that is a nasty chart to look at. Concerns around the company have been focused on rising costs which have eaten (no pun intended) into profit margins as inflationary pressures have taken their toll on the company. Part of the reason for the decline, is due in part that tough comps over the past few years, which were some of the best revenue years in company history.

Looking at this chart below, you can see the company’s share price rise from the Summer of 2020 to new highs in the winter and spring of 2022, but since then it has been falling fast, with the latest quarter being a final straw for investors as the stock fell more than 15% after the earnings report.

tipranks

Tyson has been investing in becoming more efficient through both digital and automation, which is expected to make a huge impact in the next year, along with other cost cutting measures. Knowing this, and seeing the full fledged sell-off, it tells me this is likely another company going through some near term pain, but setting up for some long-term gains. These are the types of stocks I am consistently looking for as a long-term investor.

TSN shares currently yield a dividend of 3.8% with a five Dividend Growth rate of roughly 10%. Management has increased the dividend for 11 consecutive years.

In terms of valuation, with the stock selling off hard recently, shares of TSN now trade at a FY 2024 earnings multiple of 14.4x which is not all that great considering their 5 and 10 year averages are 11x and 12x, respectively. However, we know the cost cutting measures that are underway and profit challenges this year, but assuming the company can get back to its pre pandemic EPS, which is not all that crazy if you ask me, then we are talking about a stock trading in the single digits.

Fast Graphs

Investor Takeaway

These are my five dividend stocks to give a second look to for the month of June.

Qualcomm gives you that technology and AI exposure. Johnson & Johnson is the well-rounded pharmaceutical/healthcare company with a safe growing dividend. UNH is a massive health benefits company that has a low yield, but a fast growing dividend and the stock is trading at a reasonable valuation. The last two stocks, AT&T and Tyson Foods are definitely higher in terms of risk. Both stocks appear dirt cheap, but there is still a lot to work out between the two. If they can turn things around, it could provide for some nice long-term returns.

In the COMMENT SECTION below, let me know which of these 5 dividend stocks for June you like BEST at current valuations.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

Read the full article here