I initiated my first coverage of 8×8 (NASDAQ:EGHT) in 2020, where I assigned a buy rating for the stock on the basis of its growth potential through the shift to focus on cloud-based offerings.

The stock would continue to outperform and reach an all-time high of ~$35 per share in 2021, before seeing a gradual decline due to a worsening macro situation. It also plummeted further on the news of $500 million debt refinancing back in August last year. Down by ~28% YTD, 8×8 now trades at ~$3 per share.

In this coverage, I am downgrading 8×8 to neutral. 8×8 guided to a softer single-digit growth outlook for FY 2024 as it continues to face the lower enterprise IT spend headwinds and grapples with a higher debt servicing requirement under the high-interest environment.

Q4 2023 and Financial Highlights

The recap of 8×8 Q4 and FY 2023 results are as follows:

-

Q4 revenue increased 2% YoY to $184.5 million, including Fuze revenue of $26.9 million.

-

Q4 Service revenue increased 2% YoY to $176.6 million, including Fuze revenue of $26.7 million.

-

Q4 GAAP operating profit was $3.5 million, compared to a GAAP operating loss of $40.5 million in the fourth quarter of fiscal 2022.

-

Q4 Non-GAAP operating profit was $24.8 million, or 13.5% of revenue, compared to non-GAAP operating profit of $4.2 million, or 2.3% of revenue, in the fourth quarter of fiscal 2022.

-

FY 2023 revenue increased 17% YoY to $743.9 million, including Fuze revenue of $111.3 million.

-

FY 2023 Service revenue increased 18% YoY to $710.0 million, including Fuze revenue of $110.3 million.

-

FY 2023 GAAP operating loss was $66.3 million, compared to a GAAP operating loss of $154.1 million in fiscal 2022.

-

FY 2023 Non-GAAP operating profit was $62.4 million, or 8.4% of revenue, compared to non-GAAP operating profit of $10.6 million, or 1.7% of revenue, in fiscal 2022.

Overall, FY 2023 growth was modest for 8×8. The inclusion of Fuze’s ~$111 million revenue played a significant role in driving these gains, since without it, 8×8 practically experienced a revenue decline compared to FY 2022. The inclusion of Fuze revenue was able to produce 17% revenue growth for FY 2023.

As per the company’s near-term objective to restructure costs in the near term, the overall profitability significantly improved in Q4 2023, as we observe 8×8 realizing positive operating profit, on both non-GAAP and GAAP basis. In the same quarter last year, 8×8 was still unprofitable across both fronts.

While 8×8 still recorded an operating loss of $66.3 million in fiscal 2023 on a GAAP basis, it was already a substantial improvement from last year. On a non-GAAP basis, operating profit improved to $62.4 million, accounting for 8.4% of revenue.

Furthermore, the company also expects an FY 2024 revenue between $755 million to $763 million and a Non-GAAP operating margin of 12% to 13%. It appears that FY 2024 will still be a challenging year for 8×8, given the weak 2% – 3% growth outlook.

Risk

The significant impact of the enterprise slowdown has been felt strongly by 8×8. Excluding the additional $110 million in revenue from Fuze, 8×8 would actually experience a decline in revenue for FY 2023. Furthermore, the weak 2% growth outlook for FY 2024 indicates a lack of potential upward momentum in the near future, which may dampen the justification for a buy recommendation at this time.

In addition to the challenges posed by the slowdown, 8×8 is dealing with multiple internal factors that hinder its growth prospects. These include the implementation of a strategic cost realignment plan and servicing the interest payment, both of which limit the company’s flexibility to invest further for future growth at this time.

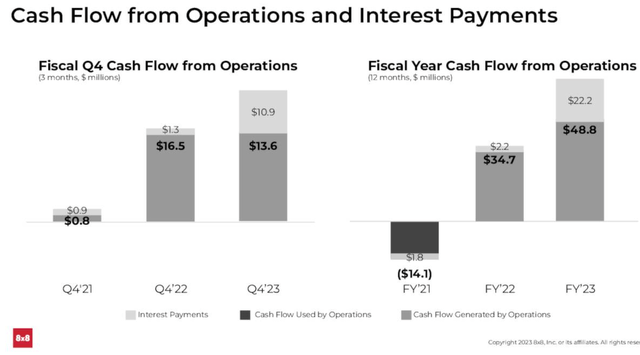

EGHT presentation

Given the current situation, there is no option for 8×8 other than to address these challenges at present. The $500 million debt refinancing was probably necessary, though, at the same time, it definitely has put added pressure on 8×8’s profitability and cash flow outlook. In FY 2023, 8×8 made ~10x higher interest payments than it did in FY 2022.

Catalyst

On the flip side, there is still a significant TAM and growth opportunity in the enterprise communication services market, and 8×8 can generate a lot of business with its comprehensive offering. 8×8 products today address the demand across four key areas:

- UCaaS (Unified Communications as a Service): UCaaS refers to Unified Communications as a Service, which combines various communication and collaboration tools into a single cloud-based platform. It integrates services like voice calling, video conferencing, instant messaging, presence, and file sharing, allowing businesses to streamline their communication and enhance collaboration. UCaaS is primarily focused on the internal communication within an organization.

- CCaaS (Contact Center as a Service): CCaaS stands for Contact Center as a Service, which provides cloud-based solutions specifically designed for customer service and contact center operations. It includes features such as interactive voice response / IVR, automatic call distribution / ACD, call recording, and analytics to support efficient customer interactions. CCaaS enables businesses to manage and optimize their contact center operations, improve customer experiences, and enhance agent productivity.

- CPaaS (Communication Platform as a Service): CPaaS refers to Communication Platform as a Service, which provides developers with tools and APIs to embed real-time communication capabilities into their own applications or services. CPaaS enables businesses to add features like voice calls, SMS, video chat, and authentication into their applications without building the underlying infrastructure from scratch. It empowers developers to enhance user experiences by integrating communication functionalities seamlessly.

- XCaaS (Experience as a Service): XCaaS, or Experience as a Service, is a broader term that refers to the blended capability of CCaaS and UCaaS to enable businesses to enhance their contact center operations with a more collaborative approach.

Despite the challenging macro environment, 8×8 has maintained a high level of customer retention, indicating resilience and validating demand strength. It is important to note that 8×8’s UCaaS and CCaaS offerings were also doing very well and still having quite a bit of momentum throughout 2021 and into the earlier half of 2022. 8×8 still produced an organic YoY revenue growth of ~20% in FY 2021. This is a stark contrast to the current outlook.

As such, there is a potential for growth reacceleration beyond FY 2024. As the enterprise and mid-market demand for UCaaS and CCaaS solutions reignites, 8×8 will be in a good position to serve those. Another growth opportunity also comes from the Microsoft Teams integration, which saw encouraging growth amid the slowdown, yet is still quite early in the initiatives.

Finally, there is the potential upsell and cross-sell activities from Fuze’s customer base, which I do not think was sufficiently explored just yet as the company is focusing on its cost improvement plan. Post FY 2024, this opportunity should represent a low-hanging fruit for 8×8.

Given the relatively fragmented market, there is also a potential for industry consolidation within the UCaaS/CCaaS market, with the prospect of 8×8 exploring acquisition offers or merger opportunities with its peers. Such consolidation could potentially drive an increase in the company’s share price. However, it is important to note that this speculative scenario is less likely to occur in the near term, given the 8×8’s debt situation and the relatively depressed market cap.

Valuation/Pricing

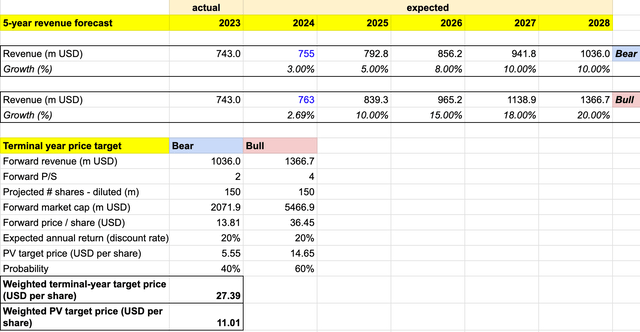

In estimating the price target for 8×8, I consider the following probability-weighted bull vs bear scenario-based 5-year revenue forecast:

- Bull scenario (60% probability) – I expect 8×8 to become a 20% grower in FY 2028, with a focus on organic growth. I expect the optimization plan to continue partially in FY 2025, though as the enterprise spending level picks up, growth should reaccelerate to 15%, driven by the continuing momentum of 8×8’s UCaaS and CCaaS solutions and Fuze client base expansion. As cost improvement initiatives go according to the plan and operating cash flow / OCF generation strengthens, the pressure from debt-servicing activities continues to soften over time.

- Bear scenario (40% probability) – Growth reaccelerates much later due to the prolonged enterprise slowdown. As 8×8 delays making more investments into its go-to-market and continues to focus on improving the bottom-line and servicing its obligation, it will only reach double-digit 10% growth in FY 2027.

I am assigning a P/S of 4 for the bull scenario, which is pretty much the level where its peers, such as Nice (NICE), Five9 (FIVN), and RingCentral (RNG), are trading at on average. I believe that the success in realizing the value from the Fuze acquisition and the better profitability outlook while being a 20% grower should warrant a significant multiple expansion.

For the bear scenario, I am assigning a P/S of 1, which means that 8×8 will also see a multiple expansion from the currently depressed P/S level, though it will be very minimal.

author’s own analysis

Consolidating all the information above into my model, I arrived at an FY 2028 weighted target price of ~$27 per share. Discounting that target price with a 20% discount rate, I arrived at a Present Value/PV weighted target price of ~$11 per share. The 20% discount rate represents the expected annual return.

The ~$11 per share is the highest price point at which investors can purchase the stock to realize a projected 20% annual return if 8×8 shares reach the FY 2028 target price of ~$27. Given that 8×8 currently trades at ~$3 per share, the model suggests that the stock is undervalued.

It is important to note though, that given the stock’s depressed level today, the stock would appear undervalued based on most target price models. I continue to lean on a more conservative side of things and would advise investors to watch 8×8’s progress in the next few quarters before making an investment decision.

As highlighted in my risk assessment, I feel that while the success in driving bottom-line improvements will be priced in, there may only be a considerable upward momentum on the stock once we begin to see an uptick in the enterprise IT spend activities, which are also driven largely by the improved macroeconomic situation.

Furthermore, I believe that a substantial price correction may occur if interest expense ends up outpacing 8×8’s OCF this year, which will negatively impact 8×8’s cost realignment plan. Given the rising interest environment today, the biggest downside risk to the stock remains the upward rate adjustment – interest expense already increased by ~10x YoY in FY 2023 and made up almost half of the OCF generation.

Conclusion

In this coverage, I am downgrading 8×8 to a neutral rating due to the challenged FY 2024 growth outlook. The company is expected to face higher debt servicing requirements and a lower enterprise IT spending environment.

There is still significant potential for growth in the enterprise communication services market, and 8×8’s comprehensive offering positions it well to capture business opportunities. I feel that it is also possible for growth to reaccelerate beyond FY 2024, especially as the demand for UCaaS and CCaaS solutions increases in the enterprise and mid-market segments.

It’s worth noting that despite 8×8 seemingly being undervalued based on the target price model, investors should closely monitor 8×8’s performance over the next few quarters before making any investment decisions. Sideways trading throughout the rest of FY 2024 is possible, as meaningful upward momentum is only likely to occur once there is an uptick in enterprise IT spending activities, driven by an improved macroeconomic situation.

Read the full article here