Overview

ABB Ltd (NYSE:ABB) offers electrification, motion and automation solutions. It caters mainly to commercial establishments like workshops and factories. ABB’s equity narrative centers on the fact that the company’s margins should keep growing thanks to its newly streamlined operating cost structure. Aside from that, ABB stands to gain from rising demand in niche markets like rail and the ongoing movement to reduce carbon emissions in construction and industry. I have high hopes for ABB’s performance in FY23 due to the impressive 1Q23 results, with orders and earnings far exceeding expectations, and the solid guidance for 2Q23, which lend credence to the full-year guidance. My only reservation is that, at 19x, the stock does not shout cheap. Therefore, until the valuation decreases and the risk to reward ratio improves, I am suggesting a hold rating.

1Q23 earnings

Here are some important numbers from 1Q23: EBIT of $1.28 billion on $9.45 billion in orders and $7.86 billion in sales. The company’s 1Q23 revenue, EBITA, and orders, were all better than expected. There was also a sequential improvement in the book-to-bill [BTB] ratio from a weak 4Q22 to a current level of greater than 1x, indicating robust underlying demand. All business units showed robust organic order expansion, with Process Automation and Motion exhibiting particularly rapid sequential expansion. Even though corporate costs were higher on a group level, margins still far exceeded expectations across all departments. In a significant move, management increased FY23 organic growth guidance from 5% to 10% while maintaining FY23 margin growth guidance at a positive increase. There should be an uptick in consensus numbers for FY23 as a result of this revised guidance. Given that management projected double-digit growth in revenue and margins to expand in 2Q23, I find it reasonable to believe that they can deliver on their revised forecast for the full year.

Operating performance

Orders were robust all through 1Q23, with activity levels remaining relatively constant from January to March, which was a welcome sight in the P&L. Normalizing for cancellation in the base makes the underlying base order growth of 3% look less impressive, but it is still a strong indicator of demand, nonetheless. However, I do think there are some minor worries and warning signs that need to be watched. Orders for robotics and automation were exceptionally strong due to the timing of some large orders, but the growth should be normalized for the easy comps last year. As such, looking at sequential growth rates might be a better indicator of demand. Growth rates for organic orders in the Electrification and Motion divisions are also leveling off, going from 20-30% in 1Q22 to just mid to high single digits in 1Q23. Net-net, while these are not immediate deal breakers, I believe it is important to take note. Finally, cash flow is also an important indicator to track. Management anticipates strong cash flow in FY23, which I anticipate will be driven in large part by the increase in net working capital seen in 1Q23.

China

China’s performance could have been stronger if the Lunar New Year hadn’t been so lackluster. Despite this, March’s high demand and management’s continued optimism about China in 2023, especially in the second half, keep me optimistic. As the BTB ratio has improved to over 1x from 4Q22’s lows, we can see the positive effects trickling down to the P&L. It’s crucial to note that management optimism is predicated on the idea that a post-COVID-like acceleration is not necessary, which implies that there is room for an upside surprise in China.

Valuation

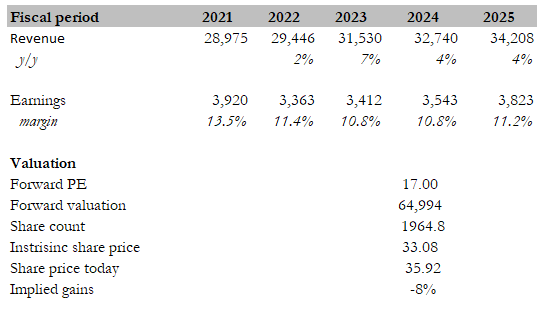

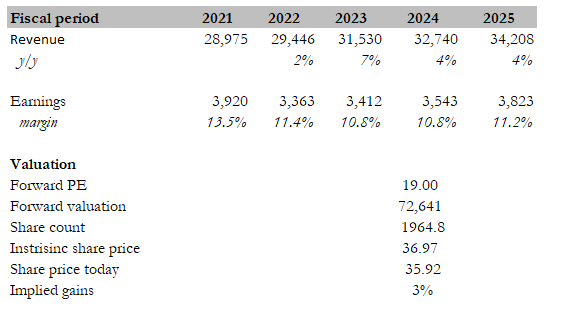

I believe the market has already priced in the increased guidance, as evidenced by the share price surge and elevated valuation (in comparison to its own history). While I agree that the optimism is well-deserved in light of the strong 1Q23 results and the highly credible FY23 guidance (as the 2Q23 guided figure further de-risked this), I’m not sure what the “fair multiple” to attach here is. On the one hand, ABB should trade at a higher multiple due to the restructuring’s higher margin profile. However, because interest rates are higher today, it should trade at a discount. My recommendation is to proceed with caution and assume that the fair multiple is at least 17x. At this multiple, I calculated a share price of $33 with an 8% downside. If we take this a step further and assume the new normalized multiple is 19x, we can conclude that the stock is currently fairly valued. As a result, based on consensus figures, my takeaway from my quick model is that the stock is either fairly priced or slightly overpriced.

Own model Own model

Conclusion

ABB has had a strong start to the year, with impressive 1Q23 results and solid guidance for 2Q23 and beyond. However, while management’s projection of double-digit growth in revenue and margins is encouraging, there are some minor concerns to watch, such as leveling off growth rates in certain divisions and the need to normalize for easy comps in orders for robotics and automation. Additionally, the stock’s valuation at 19x does not appear to be a bargain. Therefore, I recommend a hold rating until the valuation decreases and the risk to reward ratio improves.

Read the full article here