Abbott Laboratories (NYSE:ABT) is a global healthcare leader headquartered in Abbott Park that has played a key role in developing and commercializing branded generic medicines, diagnostic systems, and medical devices for many years. Despite increasing competition in the global medical diagnostics market, the company’s products are widely recognized and trusted among healthcare professionals worldwide.

In addition, the company has an extensive portfolio of nutritional products for children and adults, the demand for which continues to grow steadily after a disastrous 2022, when the closure of an Abbott Nutrition factory in Michigan led to a shortage of infant formula in the United States.

On the other hand, we believe Abbott Laboratories’ crown jewel is its Medical Devices segment, which comprises numerous pacemaker systems, electrophysiology products, continuous glucose monitoring systems, devices for treating cardiovascular disease and managing movement disorders, and more.

Over the past few quarters, Abbott’s Diagnostics segment has experienced a significant year-over-year decline in revenue. This decline is primarily linked to the continued drop in sales of rapid diagnostic tests following the ending of the acute stage of the COVID-19 pandemic. It’s important to note that the company’s dividend policy remains unaffected despite these challenges. Abbott has continued to increase its dividend payout for 51 consecutive years, garnering the popularity and trust of conservative investors.

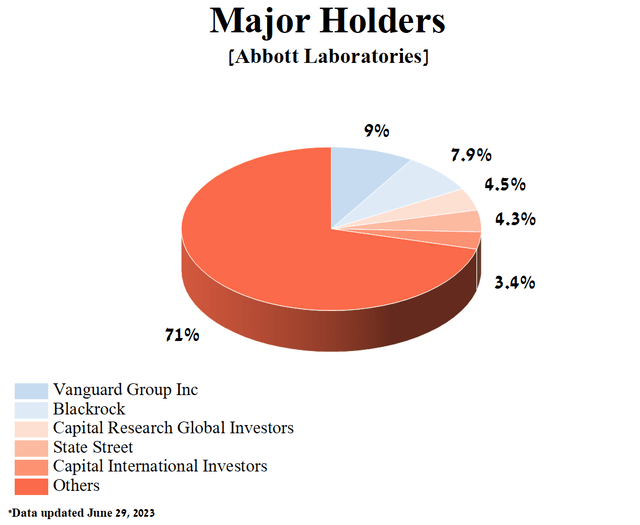

Furthermore, Abbott’s five most significant shareholders, collectively holding 29.04% of shares, have consistently included Wall Street mastodons, such as Capital Research Global Investors, Vanguard Group, BlackRock, State Street, and Capital International Investors. This is one of the factors demonstrating their unwavering faith in the company’s prospects even in the face of increasing competition in the global medical devices market.

Author’s elaboration, based on Yahoo Finance

Abbott Laboratories delivered excellent results for the second quarter of 2023. The company surpassed analysts’ predictions with higher-than-expected revenue and EPS. Additionally, the sales of Abbott’s Established Pharmaceutical Products segment continued to rise compared to the previous year despite facing intensified competition in the global generics market.

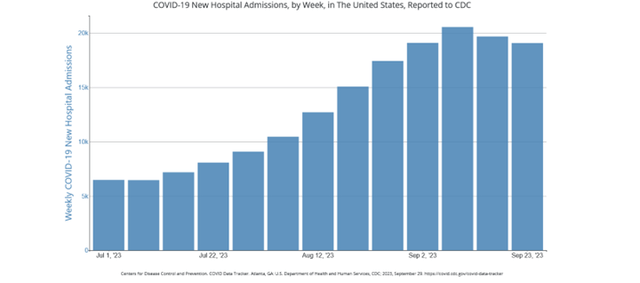

On October 18, 2023, the company will publish its third-quarter 2023 financial report, which we estimate should please investors due to continued double-digit growth in sales of diabetes care products and increased volume of laboratory-based molecular tests due to the COVID-19 wave that began in mid-July.

Centers for Disease Control and Prevention

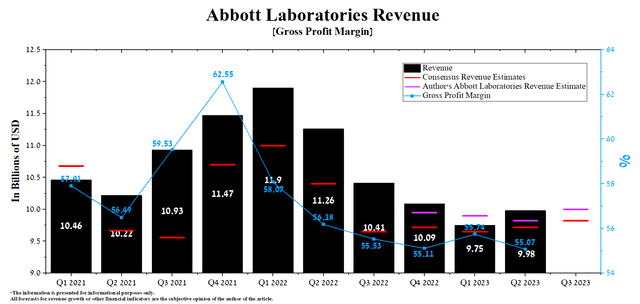

According to Seeking Alpha, the company’s revenue for the third quarter of 2023 is expected to be $9.69-$10.11 billion, down 5.7% year-over-year and up 1% from analysts’ expectations for the previous quarter. On the other hand, according to our model, Abbott Laboratories’ total revenue will be within this range and amount to $10 billion. The molecular diagnostics leader’s quarterly revenue growth will be driven by continued strong demand for infant formula and neuromodulation, electrophysiology, and structural heart products in North America.

Author’s elaboration, based on Seeking Alpha

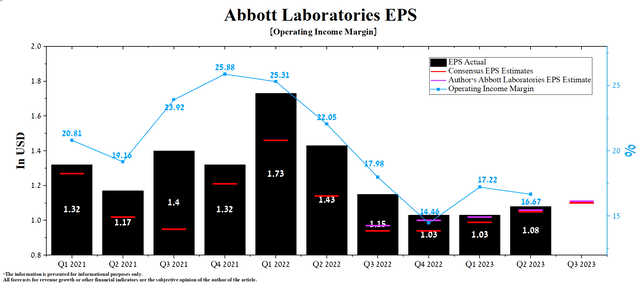

At the same time, we forecast that the operating income margin will reach 17.2% by 2023, and by 2024, it will increase to 19.1%, thanks to increased demand for medicines and pediatric nutritional products and also due to lower costs of components for the production of diagnostic systems and medical devices.

According to Seeking Alpha, Abbott’s Q3 EPS is expected to be $1.06-$1.12, up 4.8% from the Q2 2023 consensus estimate. At the same time, according to our model, Abbott’s EPS will be $1.11, slightly higher compared to the previous quarter.

Author’s elaboration, based on Seeking Alpha

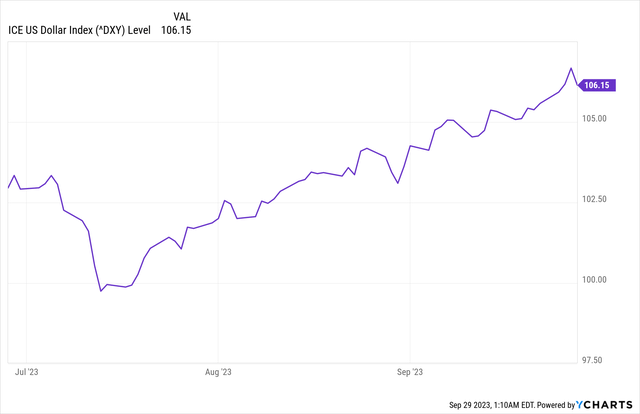

However, the company’s Non-GAAP P/E [TTM] is 22.43x, 23.76% higher than the sector average and 12.42% lower than the average over the past five years. Moreover, Abbott’s Non-GAAP P/E [FWD] is 21.87x, which is one of the factors indicating its slight overvaluation by Wall Street at a time when the strengthening US dollar begins to negatively affect the growth rate of its product sales in Europe and Japan.

YCharts

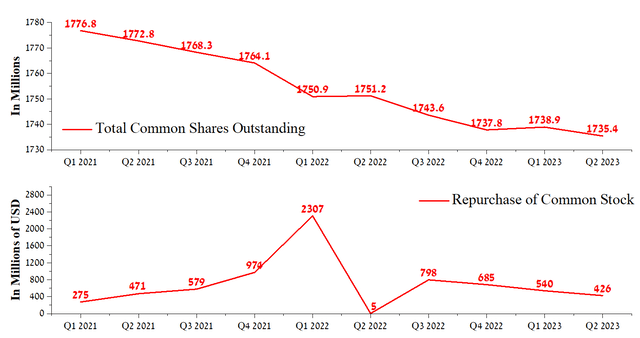

After a sharp decline in demand for COVID-19 diagnostic tests, which generated billions of dollars between 2021 and 2022, one of the main factors contributing to Abbott beating consensus EPS is its share repurchase program. Since the third quarter of 2022, the amount of cash flow allocated for this purpose has continued to decline, and for the three months ending in June 2023, Abbott Laboratories repurchased its shares for about $426 million.

At the same time, at the end of the second quarter of 2023, the remaining authorization to repurchase Abbott shares amounted to $1.709 billion. We believe this amount will be sufficient to mitigate the impact of short sellers on the company’s share price if the Federal Reserve decides to raise interest rates in early 2024.

Author’s elaboration, based on Seeking Alpha

Conclusion

Abbott Laboratories is a global healthcare leader headquartered in Abbott Park that has played a key role in developing and commercializing branded generic medicines, diagnostic systems, and medical devices for many years.

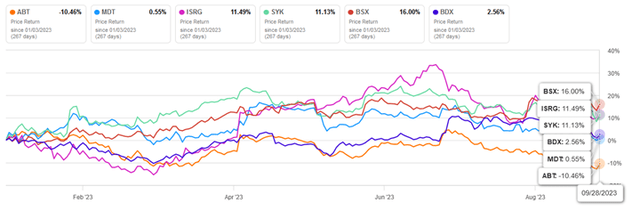

However, the ongoing downward trend in Molecular Diagnostics sales, primarily driven by the end of most COVID-19 testing programs, is negatively impacting the company’s quarterly revenue growth rate. As a result, Abbott’s share price has fallen by more than 10% since the beginning of 2023, underperforming major competitors in the healthcare sector, such as Medtronic (MDT) and Intuitive Surgical (ISRG).

Author’s elaboration, based on Seeking Alpha

Despite the challenges the company has encountered in recent quarters, we believe that with the recovery of its margins and the expansion of the range of diagnostic systems and medical devices, including those intended for treating cardiovascular diseases, it will attract even more interest from long-term investors. Moreover, Abbott has continued to increase dividend payments for 51 years, thereby becoming a member of the prestigious S&P 500 Dividend Aristocrats index.

As a result, we initiate our coverage of Abbott Laboratories with an “outperform” rating for the next 12 months.

Read the full article here