If you have been following our page for a while, you would know that our coverage of African Rainbow Minerals Limited (OTCPK:AFBOF) stock usually spans its entire value chain, with a particular focus on financial market variables instead of endogenous factors. However, today’s report drifts away from our traditional structure to discuss a hidden asset within the business, namely its Manganese segment.

Few know about the future application of manganese and the potential stronghold that African Rainbow Minerals might have over the market. As such, we are delighted to present a summation of our latest findings to you; let’s traverse into the body of the analysis.

African Rainbow Minerals’ Supply Side

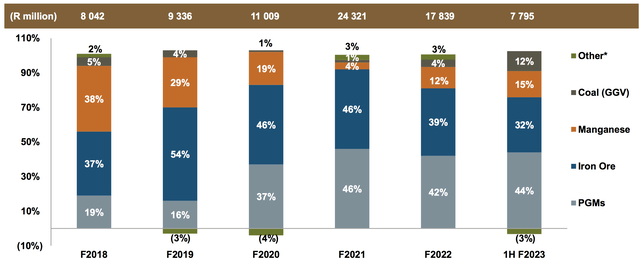

On a cyclical average, manganese spans 19.5% of African Rainbow Minerals’ EBITDA, illustrating the effects the commodity has on the company’s stock. As discussed later, Manganese provides a lucrative end market, which leads to the natural conclusion that the firm will be looking to scale its manganese production in the coming years. In fact, when asked about the matter in 2021, the company stated that it does not want to oversupply the market too quickly and that it is faced with transport capacity issues, which would require African Rainbow Minerals to endure a rigorous CapEx program before being able to scale up production.

Commodity % of EBITDA (African Rainbow Minerals)

For those unaware, the Kalahari Basin possesses approximately 80% of the world’s manganese reserves, with most reserves located in the Northern Cape area, which is renowned for iron ore mining while hosting dedicated railway lines to the nation’s largest export terminal, Saldanha Bay.

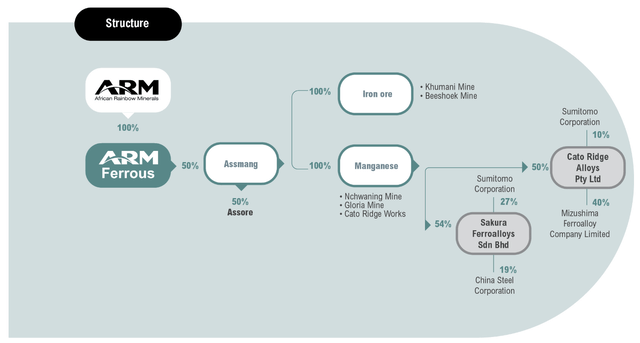

African Rainbow Minerals’ manganese exploits flow through majority ownership of up-to-midstream assets instead of majority-owned assets. IFRS accounting allows companies with majority ownership to practice full consolidation (instead of proportionate), therefore, lending a favor to the company’s book value.

Now back to the mining part…

African Rainbow Minerals accesses its Manganese ore via 50% ownership of Assmang Pty Ltd, which is a manganese and iron ore miner in the Northern Cape. Among other things, the deal includes the Nchwaning and Gloria mines, collectively known as “the Black Rock Mines.”

The latest available data suggests that Black Rock provides a potential mine life of 30+ years and a sustainable output of 4.6 million tonnes per annum. Moreover, price realization should not be an issue in years to come, as access to high-quality grades and a dominant market position could play a pivotal role.

Furthermore, the firm owns 50% of Cato Ridge Alloys, Mizushima Ferroalloy Company, and Sumitomo Corporation to provide it with access to a smelter capacity worth 409 000 tonnes. Moreover, it is worth noting that Cato Ridge is well-situated, with fast access to railways down to the Richards Bay Terminal, which typically serves the Asian market.

Manganese Structure (ARM)

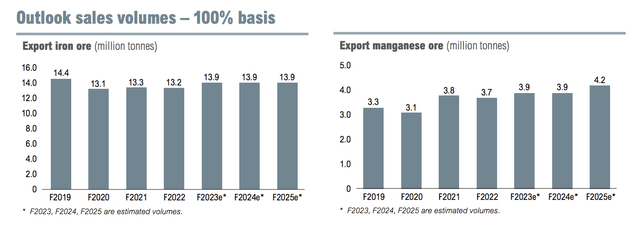

As the diagram below shows, African Rainbow Minerals anticipates its Manganese ore sales to grow linearly in the coming years. By assuming a 5-year cyclical average price of $4.5, along with the forecasted sales numbers below, we concluded that African Rainbow Minerals might realize $18.9 million in full-year segmental revenue by 2025 (at current exchange rates), which is approximately 22% more than it achieved in 2022 (at current exchange rates).

ARM

The End Market

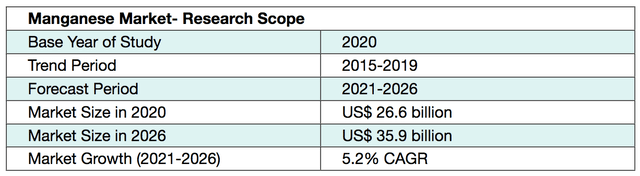

Manganese’s end market is set to grow at a compound annual growth rate of 5.2% until 2026, which is 1.7 to 2.5 times the amount of a developed nation’s target GDP rate. As the basic materials sector is a mature domain, we consider the anticipated growth rate significant.

Stratview Research

The core feature behind the push for manganese is its application as an alloy, which allows it to deoxidize steel. Steel’s application in modern infrastructure and industrial products is compelling as various nations across the globe are industrializing at scale. For instance, look at progress in China, India, Indonesia, and the ongoing momentum in previously underserved areas within the United States.

Furthermore, manganese is used as a stabilizing component in lithium car batteries utilized in electric vehicles (“EVs”). As such, an argument exists that the material might benefit significantly from an industry that is backed to grow at a compound annual rate of 17.8% in the next seven years.

The aforementioned used cases are merely two examples; for additional insights, visit the following article, which I believe provides a prompt yet comprehensive explanation of manganese’s used case.

Article Here.

Potential Risks

The first risk for investors to take note of relates to ESG. I know ESG is an unwelcome topic to many; however, it plays a critical role in this case, as African Rainbow Minerals might face a few “not in my backyard” issues.

Firstly, as mentioned before, South Africa’s manganese is found in the Kalahari Basin, which is situated in a scenic landscape occupied by some of the world’s most admired wildlife. Moreover, the region is home to the Khoisan, an indigenous tribe with no interest in connecting with the capitalist world. As such, a parsimonious outlook suggests that mineral exploration and mine sequencing will be challenging.

Furthermore, the Northern Cape has a water scarcity problem. The area doesn’t experience enough rainfall to maintain its own water infrastructure, which requires it to rely on extensive water pipelines primarily flowing from “Bloem Water,” which is costly and impractical to miners seeking to scale their operations.

Final Word

In our view, African Rainbow Minerals Limited’s manganese segment is a hidden asset. The segment might soon scale and unleash significant value, concurrently adding to African Rainbow Minerals’ net asset value. Although the segment should not be looked at in isolation when assessing African Rainbow Minerals’ stock, we think it will have material effects in the coming years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here