Investment Thesis

I reaffirm my buy rating on Koninklijke Ahold Delhaize N.V. (OTCQX:ADRNY) and update my revenue and EPS estimates following the company’s Q1 2023 results which beat the expectations of Wall Street analysts. Ahold continues to show resilient performance as growth remains strong and inflationary pressures had no overly huge effect on margins.

Koninklijke Ahold Delhaize N.V. is a global corporation that operates various supermarket chains, online grocery platforms, liquor stores, and the well-known European e-commerce company Bol.com, offering an alternative to Amazon.com, Inc. (AMZN). With a diverse portfolio of 21 brands, the company has established its presence in over 11 countries across Europe and the United States. In terms of revenue, approximately 60% is generated from the U.S., while the remaining 40% originates from Europe, primarily from The Netherlands and Belgium.

I have been bullish on Ahold before, as I rated the shares a strong buy in February after the company delivered excellent FY22 results. And I remain of the opinion that Ahold is one of the best-performing companies in its sector. This is driven by excellent diversification across leading regions as the company has solid performing operations in both the US and Europe, which means the company is not overly exposed to developments in the US or Europe as we have seen over recent years with lockdowns, high inflation, and a war. As a result, Ahold can deliver a relatively consistent performance under any circumstances.

Another leading factor in my investment thesis is the company’s strong collection of leading brands with loyal customers that position it well in both the U.S. and Europe to benefit from GDP and industry growth. In addition, Ahold boosts its customer loyalty by focusing on customer savings through personalized discounts and customer saving programs, making the customer experience more personalized and attractive.

As a result of these factors and its excellent management team with a drive for innovation, Ahold has shown excellent performance over recent years and will most likely outperform many of its peers over the next several years as well, as I expect Ahold to deliver steady EPS growth of between 3-6% over the next several years while growing the dividend (Yielding 3.2%) at a similar pace.

Meanwhile, despite a 12% jump in the share price over the last couple of quarters, shares remain valued at multiples below that of their peers, creating an attractive investment opportunity.

In this article, I will take you through the latest developments and financial results and update my estimates and view on the company accordingly.

Q1 Results show another steady performance from Ahold Delhaize

Ahold reported its first quarter results this morning and once again outperformed the analyst consensus as the business continues to be resilient in a challenging operating environment. Ahold reported net sales of €21.6 billion (approximately €100 million above the consensus) which was up 9.4%. With Ahold reporting in Euros and it deriving the largest part of its revenue from the U.S., the strong dollar functioned as a tailwind for the company over the last year, and this Q1 was no different as growth on constant currency was 6.3%, which is still really decent growth for Ahold.

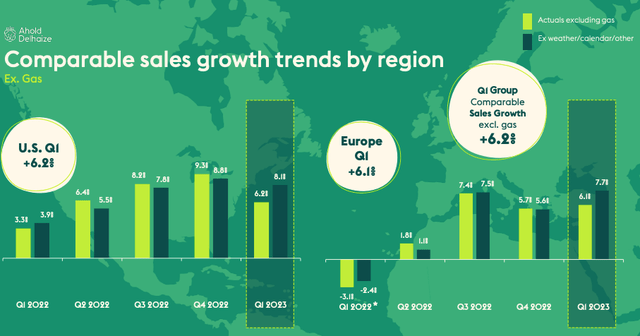

Growth was driven by solid results from both European and U.S. operations as sales in the U.S. came in at €13.5 billion, up 5.7% (constant currency), and Europe saw slightly faster growth of 7.2% as this totaled €8.1 billion. The solid growth rates in the U.S. were driven by an improved supply chain and better shelf availability. At the same time, Food Lion continues to be the leading brand with 42 consecutive quarters of positive growth. U.S. operations now accounted for 62.5% of net sales, in line with the last several quarters. I believe this excellent diversification of operations across multiple leading regions is an important factor in the investment thesis for Ahold as the company is not overly dependent on sales from a particular region.

Growth by region (Ahold Delhaize)

Net consumer online sales increased by 7.6% (5.9% on constant currency) and were €2.9 billion. This was primarily driven by impressive growth in online grocery sales as these grew 9.7% on constant currency. Also, growth in the U.S. was much stronger last quarter as growth in the US was 11.9%, while Europe only saw online growth of 2.5%. Meanwhile, Europe did still account for the largest part of online sales. This is in part due to the operations of the e-commerce platform Bol.com, which saw gross merchandise value come in at €1.3 billion, up 1.2% YoY. And while these are not very attractive growth rates for Bol.com, Ahold does expect this to accelerate over the following quarters as the business is done lapping the strong covid-19 impacted quarters from previous years.

Bol.com remains an attractive business segment for Ahold as it has the potential to see strong growth and benefit from the growing e-commerce market. Yet, it is not in as great of a position as it has been in previous years. Competition in Europe is heating up, primarily due to Amazon growing its operations on the continent and in the Benelux in particular. As a result, I do not think a possible IPO will happen before Bol.com sees a more positive trend and stabilization in its operations, which will not be anytime soon. Furthermore, outside of Bol.com, the solid growth in Ahold’s digital operation is a positive trend, especially in the US where the business still has a lot of ground to gain on the digital front.

Overall, Ahold was well able to offset inflationary pressures on its costs by increasing product prices while not scaring away its customers. Ahold remains focused on delivering the best value to its customers by providing personalized discounts and a strong performance in the Save For Our Customers program which should exceed €1 billion in savings in 2023.

As a result, the underlying operating margin was 4%, slightly above the consensus of 3.9%, but down 2 basis points from last year. This YoY decrease resulted from weaker margins in Europe which came in at just 2.8%, while US margins stood at 4.8%. European margins were impacted by continued high energy prices on the continent and the strikes that affected operations in Belgium. Therefore, margins in Europe should improve over the next few quarters as the Belgium strikes were a one-off, and energy prices in Europe are decreasing. Yet, just last week, Dutch supermarket chain Albert Heijn was hit by strikes in the distribution center, which could slightly impact revenue and operating income, although this should not be all that meaningful.

As a result, operating income was €864 million, up slightly from last year as operating income from US operations increased by 14.5% but a 13.2% decline in Europe largely offset this. Net income was €561 million, above the €542 million consensus, and resulted in EPS of €0.61, up a solid 10.5%.

Outlook & Ahold Delhaize stock valuation

Ahold reiterated its FY23 outlook and continues to guide for an operating margin of 4%, in line with last quarter, and EPS roughly in line with 2022 levels of €2.55. Free cash flow should come in right around €2 billion.

Let’s compare this to the analyst consensus prior to the Q1 results. This is roughly in line with management expectations as these guide for €89 billion in revenue, an EPS of €2.51, and a free cash flow of roughly €2.1 billion.

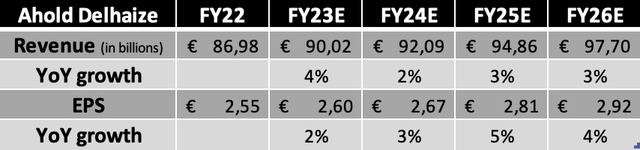

Following this guidance from management, my extensive research, and the excellent financial results delivered by the company in Q1, I now project the following results for the years until FY26.

Own Estimates

Briefly explaining these estimates, I now expect Ahold to report FY23 revenue growth of slightly below 4% and EPS growth of around 1.8%. This means my estimates are slightly above the midpoint of 16 Wall Street analysts, as I expect Ahold to report an underlying operating margin of closer to 4.2% for FY23 as a result of decreasing energy prices and easing inflation in the second half of 2023, which will have a positive effect on margins for Ahold. Also, considering Ahold tends to overdeliver and upward revise the outlook after the second quarter, I believe there is plenty of room to be slightly more optimistic, especially considering the ongoing industry trends.

The only real threat to this outlook seems to be the potential of a more severe recession, which could impact sales and margins as a result. For the coming years, I project consistent low-single-digit growth for Ahold, in line with industry expectations and a more normalized rate of inflation. Finally, EPS for the next several years is slightly above revenue expectations. Ahold has plenty of room to further improve margins towards the 4.5% mark and continued share repurchases will boost EPS.

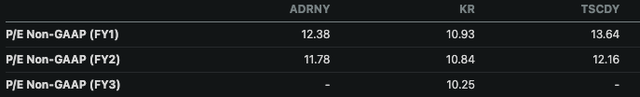

Moving to valuation, we can see that Ahold is valued roughly in line to slightly below most of its peers with a forward P/E of 12x, above The Kroger Co. (KR) P/E of 11x and below the 13.64x P/E of British Tesco PLC (OTCPK:TSCDY). Yet, I believe Ahold is in a slightly better position than these peers due to better diversification, stronger growth expectations, and superior margins. (Please note that Ahold is currently valued at a forward P/E of 12x based on most recent data.)

Peer comparison (Seeking Alpha)

Therefore, I believe Ahold is currently trading around to slightly below fair value and deserves to be valued at a forward P/E of closer to 13-14. In order to remain somewhat conservative, for now, I will assume a 13x forward P/E (down from a previous 14x). As a result, based on my EPS estimates for FY24, I calculate a target price of €35 ($38), leaving an upside of 11.5% from a current share price of €31.4. (Please note, this target price is solely based on its forward P/E and is only for indicative purposes.)

For comparison, based on data from TipRanks, 8 Wall Street analysts maintain a price target of €33 combined with a buy rating.

Conclusion

Q1 was another solid quarter for Koninklijke Ahold Delhaize N.V., as the business is able to largely offset the impact of an economic downturn and high inflation. Of course, margins are impacted somewhat, primarily in Europe, but strength in the U.S. made sure that the underlying operating margin was still in-line with its historical range at 4%

Overall, there were not many surprises in the earnings report, which for a defensive holding like Ahold is exactly how you want these reports to be. As a result, my investment thesis from before and as explained in the introduction of this article has not changed and I remain bullish on the shares. The company is in a great position to deliver consistent growth over the next several years. This, combined with share buybacks and steady dividends, should ensure decent shareholder returns.

Following the company’s strong quarterly results, outlook, and my own estimates, I calculate a price target of €35 ($38) for Koninklijke Ahold Delhaize N.V., leaving enough upside to warrant a buy rating on the shares as these remain slightly undervalued at prices below €32 per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here