Introduction

The main event is that Alibaba’s (NYSE:BABA) board has approved a full spin-off of Cloud Intelligence Group through a dividend distribution to shareholders. At the same time, the conference call in this part was absolutely uninformative, not a single specific question from Western analysts was answered by Chinese executives. From the specific mechanism of spin-offs to what stakes they want to retain in the spin-off companies. Prior to the spin-off, they plan to include outside strategic investors in Cloud Intelligence Group through private financing. Cloud Intelligence intends to become an independent public company and complete a public listing within the next 12 months.

Second, the board approved Freshippo’s plan to launch an IPO process, where an initial public offering will be completed in the next 6-12 months. At Cainiao, an initial public offering is scheduled to be completed in the next 12 to 18 months. In addition, a controlling stake in the business groups remains in the ownership of Alibaba Group. Alibaba International Digital Commerce Group will explore the possibility of raising external capital to support business expansion in the global market. There will be a permanent buyout of shares. Taobao and Tmall Business, which will be the main holding company and will be 100% owned by the company, will be the main source of funds in the future. In addition to spin-offs, we see a reduction in losses in absolutely all of the unprofitable segments, and this is primarily due to an increase in their efficiency, rather than a reduction in expenses, which remain roughly the same. And, it speaks to working business models, which is much more important than temporary spending cuts.

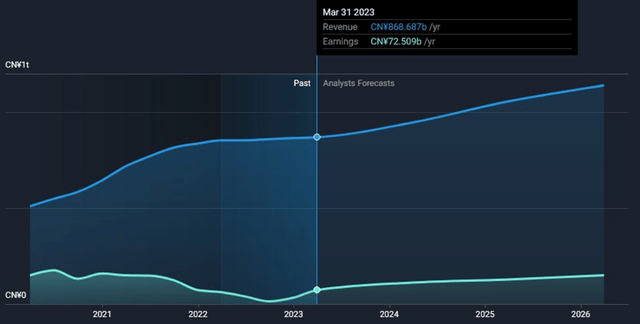

Growth Perspective (Simply Wall St)

Product development and Market overview

Assessing the macro environment in China and around the world, they see both challenges and opportunities in the uncertainty for economic recovery. At the same time, they see market opportunities in China’s post-pandemic consumption recovery and the rapid development of artificial intelligence. Nevertheless, consumer confidence and purchasing power still need a boost. At the same time, competition among different platforms remains fierce, and each is trying to meet the growing demand with products and services with better value for money. Focus on the following areas in such a competitive marketplace. First, attracting and retaining quality users; second, maintaining the consumer mindset of the platform; and third, creating new demand through supply-side innovation. In cloud computing, advances in industrial digitization and the emergence of AI have created greater demand for computing power, and basic models have expanded the application of AI in all aspects of life. Alibaba Cloud will focus on leveraging these historic opportunities to maximize its market potential.

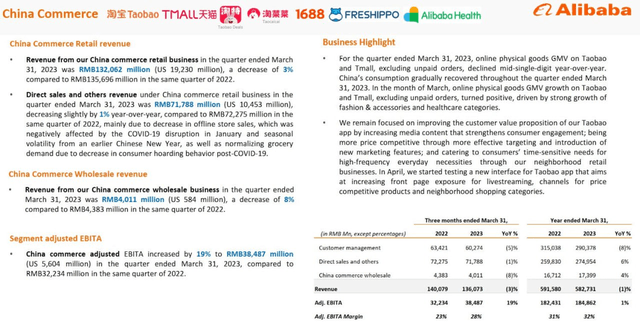

China Commerce info (company presentation)

Financials

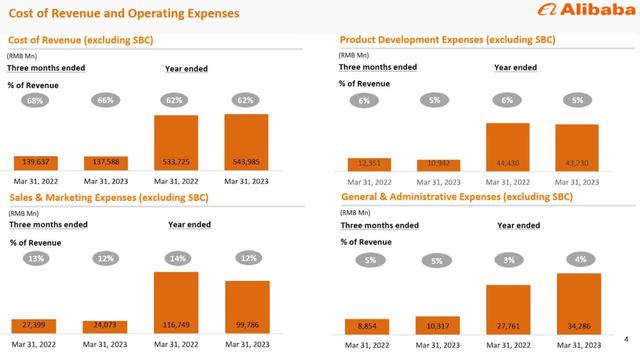

Stable report, closer to weak. Revenue was 208.2 b¥, +2% YoY, driven by international trade segment revenue up 29% to 18.5 b¥, Cainiao segment revenue up 18% to 13.6 b¥ and local consumer services segment revenue up 17% to 12.5 b¥. Adjusted EBITDA increased 37% to 32.2 b¥. The increase was due to higher trading profits in China as well as lower losses from local consumer services, digital media and entertainment. Adjusted EBITDA margin increased 4 p.p. YoY to 15%. Adjusted net income rose 38% to $3.98, with EPADS adding 35% YoY. We should note that most of the growth in net income and adjusted EBITDA was due to the positive revaluation of the company’s investments, while operating profit decreased by 9% YoY, and the margin also slipped by 1 p.p. to 7%. Cash flows remain normal, but not without help from investments either: for example, operating cash flow included a dividend from Ant Group. FCF was $4.7 b compared to an outflow of $2.1 b last year. The balance sheet is good, with very significant negative net debt.

We see a reduction in losses in absolutely all negative segments, and this is primarily due to an increase in their efficiency, rather than a reduction in costs, which remain roughly the same. Therefore, the company has a working business model, which is much more important than temporary cost-cutting. The company’s core segment, Trading in China, will probably continue to grow slowly, but still have good margins and generate strong cash flows.

For example, it is worth noting the strong annual FCF of $25 b, which is only 2 times less than the annual FCF of, for example, Microsoft (MSFT), but it has a capitalization 11 times larger. Including the cache on the balance sheet, the market values BABA at only $167 b, with Cainiao’s annual revenue alone at about $8 b, it brings in 9% of total revenue, and the segment could be valued at about $35-40 b at IPO, not $15 b based on its revenue contribution.

company financials (the company presentation)

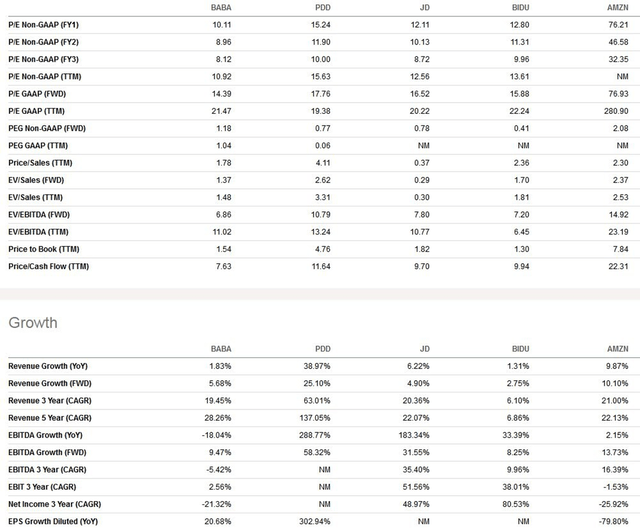

Valuation

By multiples, Alibaba looks 30% cheaper than industry average multiples and still cheaper than most core competitors. On a historical basis, close to the lower end of the ranges, 3-year revenue GAGR of 19%, but expected to grow 9% this year. The big news is the spin-off of the cloud segment through spin-offs and the IPO of first Freshippo and then Cainiao. At the same time, the conference call in this part was absolutely uninformative, not a single specific question from Western analysts was answered by Chinese executives. From the specific mechanism of spin-offs to what shares they want to keep in the spin-off companies. In our opinion, spinning off loss-making units is the right decision for both the parent company and the newly public companies. Alibaba will disclose the value of operating and growing subdivisions, getting real money for it here and now, getting rid of some financial losses and the need to finance their development independently. And the companies that get publicity will get an influx of capital for faster development, which again will benefit the parent company, which will continue to hold stakes in these businesses. In theory, this should increase the capitalization of BABA itself, because the value of the spun-off units may be significant (especially Cainiao), and the market is not fully laying it in the valuation of Alibaba itself (there was growth back in March, but quotes have rolled back). Also, the spin-off should improve profits and EPS due to the above-mentioned withdrawal of some losses to the balance sheet of new companies.

financial valuation (multiples )

Bottom line

From an investment point of view, we maintain a positive view of the company, still consider all levels below $90 to be undervalued. Now in addition to the low valuation there is a positive factor of separation of divisions. Probably, when the valuations of the divisions will be announced, the market can start revaluating the company.

Read the full article here