The Alibaba Group (NYSE:BABA) is a global technology conglomerate founded in the late 20th century by Jack Ma and eventually nicknamed the “Chinese Amazon.” However, the business of one of the world leaders in e-commerce and cloud computing is more like a mix of PayPal (PYPL), Amazon (AMZN), and eBay (EBAY), allowing it to benefit from the synergies of its subsidiaries. Jack Ma’s innovative approach to business development and vast ecosystem has made Alibaba a key player in the digital economy, driving retail trends and providing technologies that improve the quality of life for hundreds of millions of people.

Since the rapid spread of COVID-19, the Chinese authorities have adopted a zero-tolerance policy, which has led to massive lockdowns and other restrictive measures, positively affecting online sales and significantly increasing interest in cloud services from large companies. On the one hand, the pandemic allowed Alibaba to increase its dominance in the market, but on the other hand, the company’s growing influence on the Chinese economy has become one of the reasons for regulatory pressure on the industry from the Chinese authorities.

On October 24, 2020, at the Bund Finance Summit, Jack Ma added fuel to the fire by criticizing the Chinese authorities and pointing out the need for reforms for the benefit of China. The criticism did not go unnoticed by the founder of Alibaba, and the Ant Group, which at the time was seeking to go public, was hit hardest. Ant Group is an affiliate company of Alibaba that provides customers with various financial services, and more than 1.2 billion people use its Alipay payment platform. In 2021, the Central Committee of the Communist Party released a plan by the end of 2025, calling for regulation in large part of the economy. Ant Group became one of the companies the Chinese regulator looked at, which ultimately led to its restructuring and spinning off the consumer loan business into a separate structure.

Realizing that the fight against the ‘red emperor’ was useless, Ma returned to China after more than a year of exile in March 2023, which may indicate the end of a sharp conflict between him and the government. In addition, the return of the founder of Alibaba to his homeland may increase business confidence in the actions of Xi Jinping after his recent election as the general secretary of the CCP for a third term.

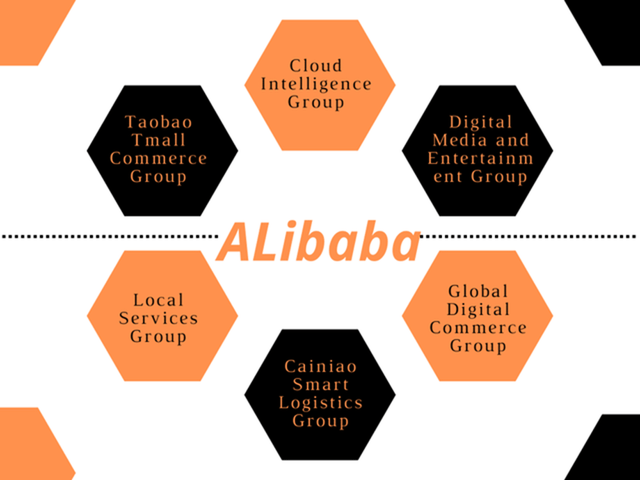

We can already see the billionaire taking steps to develop the tech conglomerate and his desire to increase shareholder value. So, at the end of March 2023, Alibaba announced plans to divide its empire into six business divisions.

Created by author

Alibaba is seen by many investors as a mature e-commerce business with many subsidiaries and projects that generates negative cash flow and marginal revenue, ultimately hurting its margins and share price.

We believe that the potential split of Alibaba and the holding of initial public offerings of each business division would significantly increase the company’s market capitalization, which is currently at near multi-year lows. A prominent representative who was helped by corporate restructuring through a spin-off is General Electric (GE). Over the past year, GE’s share price has jumped by more than 100%, and criticism and apathy from investors who have long negatively assessed the future of the American company have faded.

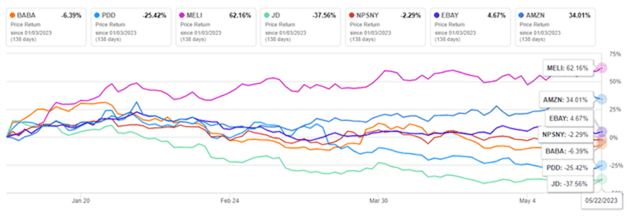

On May 18, 2023, Alibaba released its financial results for the fourth quarter of fiscal year 2023, which, despite beating Wall Street analysts’ expectations and increasing year-on-year net income, showed a decrease in revenue in the Chinese commercial segment, which is a crucial segment in the company’s structure. As a result, since the beginning of 2023, Alibaba’s share price has shown a decrease of about 6.4%, but at the same time, share prices of such key competitors in the retail industry as MercadoLibre (MELI), eBay and Amazon were able to demonstrate more favorable dynamics.

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of Alibaba with a “hold” rating for the next 12 months.

Alibaba’s Financial Position

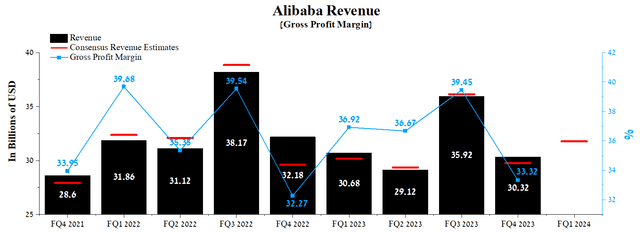

Alibaba’s revenue for the first three months of 2023 was $30.32 billion, down 15.6% from the previous quarter and 5.8% from the fourth quarter of fiscal 2022. Since the start of 2021, Alibaba’s revenue has been fluctuating around a median of $31.97 billion, and it’s far from always able to beat consensus analyst estimates, ultimately leading to continued downward pressure on the company’s share price.

Author’s elaboration, based on Seeking Alpha

The main reasons for the company’s decline in revenue are the slow pace of the Chinese economic recovery and stricter competition from e-commerce companies such as Pinduoduo (PDD) and JD.com (JD). Daniel Zhang’s initiatives, such as the development of two platforms Taobao Deals and Taocaicai, which operate on a manufacturer-to-consumer model and continue to expand the range of products, still do not significantly contribute to increasing the overall sales of the China commerce segment.

Overall, Alibaba’s revenue is expected to recover and be $29.95-32.47 billion for the first quarter of fiscal year 2024, up 6.3% from analysts’ expectations for the fourth quarter of fiscal year 2023. However, we believe actual revenue will be lower than the consensus due to negative trends in the Chinese economy.

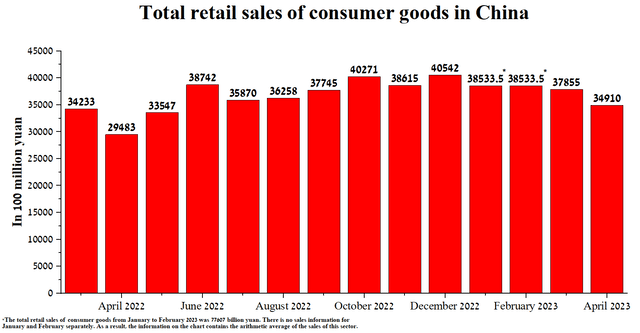

According to the National Bureau of Statistics of China, the total retail sales of consumer goods amounted to 3,491 billion yuan in April 2023, down 7.8% from the previous month and reaching the lowest level in the past ten months. Even after the COVID-19 zero-tolerance policy ended, consumers do not tend to switch from savings behavior and start spending excess savings more actively.

Author’s elaboration, based on the National Bureau of Statistics of China

What’s more, a Bloomberg article published on May 22 reports the start of a new wave of COVID-19 in China, and according to senior health adviser Zhong Nanshan, the number could reach 65 million cases a week as early as June. As a result, the virus could further slow down the recovery of consumer activity in China. On the one hand, this will have a positive impact on reducing global inflation, but on the other hand, it will slow down the recovery of the Chinese economy, which will ultimately harm the revenue of the China commerce segment.

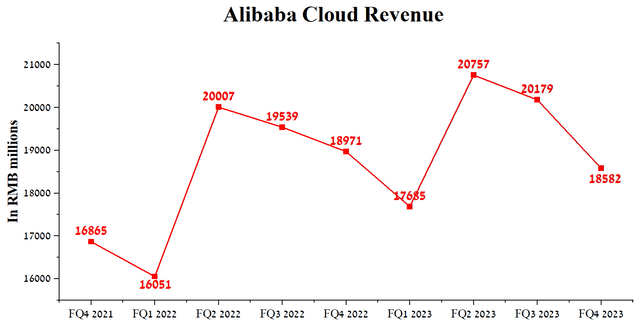

At the same time, over the past quarters, the revenue of the cloud segment, which Alibaba management is counting on and is one of the most diversified and promising segments, continues to decline and, more importantly, so far does not meet investors’ expectations.

Author’s elaboration, based on quarterly securities reports

At the quarterly call for the fourth quarter of fiscal year 2023, the CEO of Alibaba stated the following.

The external factors include the impact from a top customer using our Cloud service and switching to self-build infrastructure for its international business.

As a result, we believe that as hybrid cloud projects are delayed, and one of Alibaba’s largest customers also leaves, cloud segment revenue will show mixed trends over the next 12 months.

Alibaba’s gross margin was 33.32% in the first three months of 2023, up slightly from the previous year, thanks to lower production costs and the global supply chain crisis resolution. We forecast that by the end of 2023, the company’s gross margin will increase slightly to 35.5%, and by 2024 it will increase to 36.7%, thanks to the ongoing recovery of the global economy.

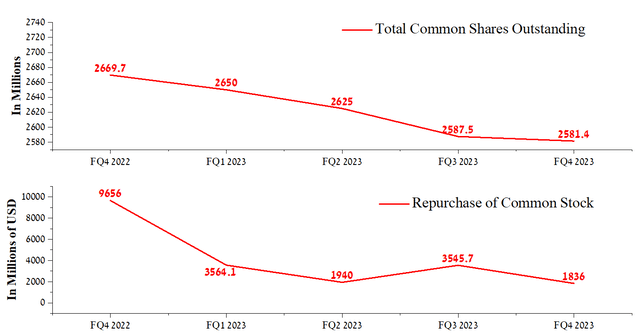

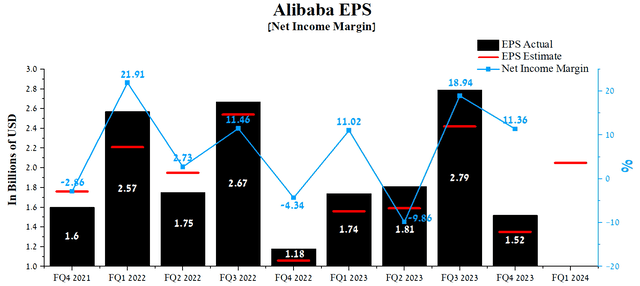

Unlike major Alibaba competitors such as JD.com, MercadoLibre, and Amazon, the company’s net income margin is much higher than theirs, and in the 4th quarter of fiscal 2023, it was 11.36%, down 7.58% from the previous quarter. Alibaba’s EPS for the first three months of 2023 was $1.52, up 28.8% year-over-year, and just as importantly, it has continued to beat analyst consensus estimates in recent quarters. The active use of Alibaba’s share repurchase program is one of the key reasons that positively impacted the emerging trend. Over the past six months, Alibaba has repurchased its shares for about $5.38 billion, while Daniel Zhang still has the option of repurchasing the company’s shares up to $19.4 billion, which, in our opinion, is enough to support the price of Alibaba shares during a period of possible geopolitical upheavals in Asia.

Author’s elaboration, based on Seeking Alpha and quarterly securities reports

Alibaba’s Q1 EPS is expected to be in the $1.59-$2.33 range, up 48.5% on average from the Q4 FY 2023 consensus estimate. At the same time, Alibaba’s Non-GAAP P/E [TTM] is 10.55x, which is 11.96% less than the average for the sector and 61.28% less than the average over the past five years, which is one of the factors indicating the undervaluation of the company by Wall Street.

Author’s elaboration, based on Seeking Alpha

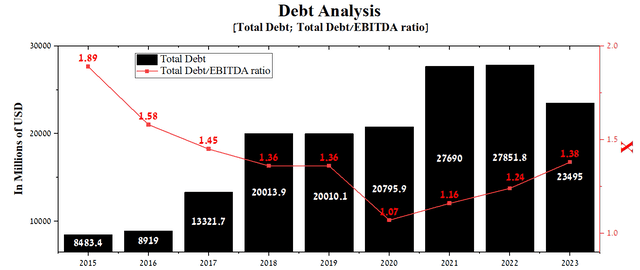

At the end of March 2023, Alibaba’s total debt was about $23.5 billion, down about $4.2 billion from 2021. But due to the recent decline in the company’s EBITDA, the total debt/EBITDA ratio has increased uncritically for Alibaba’s financial position from 1.16x to 1.38x.

Author’s elaboration, based on Seeking Alpha

With a total cash and short-term investment of $76.37 billion, we do not expect Alibaba to have any problems paying off senior notes and bank borrowings, and the company will be able to continue to pursue an active share buyback program and invest in the cloud sector.

Conclusion

The Alibaba Group is a global technology conglomerate founded in the late 20th century by Jack Ma and eventually nicknamed the “Chinese Amazon.” Jack Ma’s innovative approach to business development and vast ecosystem has made Alibaba a key player in the digital economy, driving retail trends and providing technologies that improve the quality of life for hundreds of millions of people.

Despite Jack Ma’s return to his homeland after a year-long exile caused by a conflict with the Chinese government, Alibaba’s share price has been under downward pressure since 2020 for several reasons. The first of these is the decrease in revenue and net income margin of the company, despite the implementation of various initiatives by Daniel Zhang, which still do not bear fruit. In addition, in recent quarters, the likelihood of a military conflict between China and Taiwan is growing, and in this case, we expect a sharp drop in the total volume of retail sales of consumer goods and a decline in Chinese economic activity, which will ultimately lead to a significant deterioration in the financial position of Alibaba.

Also, we believe that the US presidential election, scheduled for November 5, 2024, will lead to stricter rhetoric from US politicians, who will likely choose to contain China as one of the main topics in their election campaigns. The reason for this is public opinion, according to which most Americans consider China a severe threat to the United States. As a result, the steps taken by the company’s management to further develop the technology conglomerate and its desire to increase shareholder value may not lead to the desired results. So, at the end of March 2023, Alibaba announced plans to divide its empire into six business divisions, followed by IPOs for each of them. However, increased regulation by the Chinese Communist Party and increased tensions between the US and China may only dampen the appetite of large investors to invest in the tech conglomerate.

We initiate our coverage of BABA stock with a “hold” rating for the next 12 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here