Investment thesis

Our current investment thesis is:

- ANTA Sports Products (OTCPK:ANPDY) is incredibly attractive due to its strong growth trajectory and impressive margins.

- Relative to Western peers, the company significantly outperforms, implying its fundamentals are unchallenged.

- Industry tailwinds have supported its growth, with the expectation for this to continue.

- The Chinese economy is weak and the signals for improvement are mixed. We believe soft growth is likely, with scope for more.

- ANTA is attractively priced, although investors need to consider what their risk conditions are for such an investment.

Company description

ANTA Sports Products is a leading Chinese sportswear company, specializing in the design, development, manufacturing, and marketing of athletic footwear, apparel, and accessories.

ANTA distributes the following brands: FILA, FILA KIDS, FILA FUSION, KINGKOW, KOLON SPORT, ANTA, DESCENTE, and ANTA KIDS.

With a strong presence in China and an expanding global footprint, ANTA is recognized for its innovative products and commitment to performance excellence.

Share price

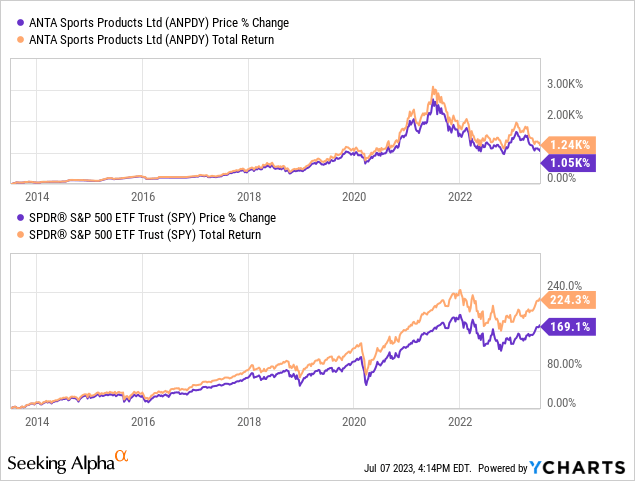

ANTA stock price has performed exceptionally well in the last decade, returning over 1000% to shareholders. This is a reflection of the company’s incredible growth trajectory, substantially increasing returns.

Financial analysis

ANTA financials (Capital IQ)

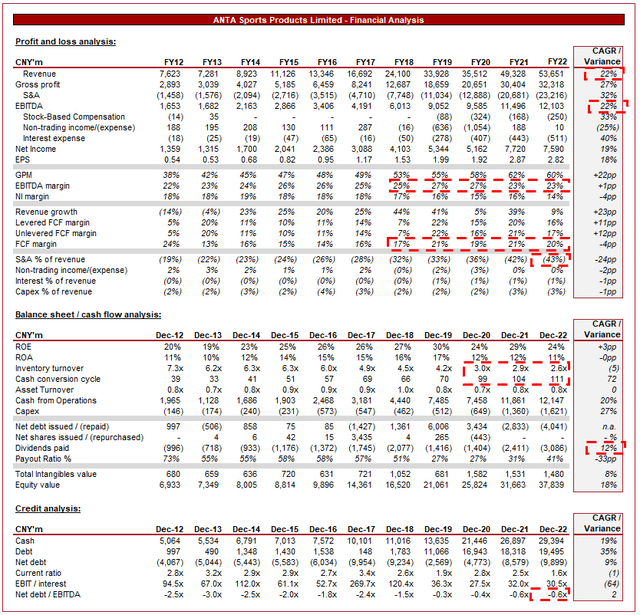

Presented above is ANTA’s financial performance for the last decade.

Revenue & Commercial Factors

ANTA’s revenue has grown at a CAGR of 22% in the last 10 years, an impressive level. Growth has been highly consistent, with 8 consecutive years of >20% growth in the lead-up to Covid-19. This has slowed somewhat but is a reflection of the macro impact.

Business Model

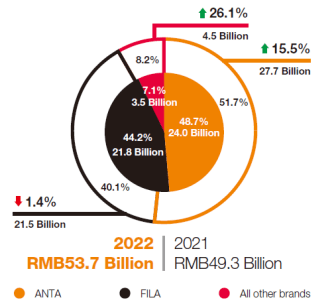

ANTA owns multiple brands, including ANTA, FILA, DESCENTE, and SPRANDI, catering to different consumer segments and sporting categories. ANTA’s position in China is similar to that of Nike in the West, it is the undisputed leader in the athletic apparel space. ANTA’s rapid growth trajectory is a reflection of its relative positioning in the market, with competitive pricing, breadth of product and reach, and strong marketing. The incorporation of FILA has assisted growth, as it provides ANTA with exposure to a Western brand, leveraging the interest in this segment. Revenue is primarily generated from the ANTA brand, although a large portion is also from FILA.

Revenue (ANTA)

ANTA’s focus in recent years has been improving its brand awareness, as well as targeting high-spending consumers. This is part of the company’s strategy to develop into a brand-led business, rather than a product one. ANTA is innovation-led, however, this creates pressure and risk associated with consistent, high-quality innovation. Being brand-led allows for a multitude of benefits, including reduced sales volatility and increased spending across product lines.

ANTA operates a vertically integrated operational model, encompassing product design, research and development, manufacturing, distribution, and retail. This provides the business flexibility over the development of products, as well as its responsiveness to changing consumer trends, allowing ANTA to stay ahead. This is critical given the size of the company and its geographical reach in China.

ANTA operates an omnichannel approach, with an extensive retail network, comprising company-owned stores, franchise outlets, and e-commerce platforms to reach a broad consumer base. This allows the business to position itself well relative to its peers, as the company offset the convenience proposition of e-commerce only business by providing the flexibility to e-commerce in conjunction with stores.

Stores (ANTA)

ANTA strategically partners with professional sports teams and athletes to enhance brand visibility and credibility, similar to the approach taken by Western brands. Most recently, ANTA conducted a successful marketing campaign during the Beijing Winter Olympics. It is estimated that this drove a revenue increase of 16%, as well as contributed to the premiumization of the brand, as ANTA experienced increased sales of its high-end products.

Competitive Positioning

ANTA has three key competitive advantages in our view.

Firstly, ANTA’s portfolio of well-established brands. This allows the business to enjoy high recognition and loyalty among Chinese consumers. The push to develop the brand upmarket will only further improve its perception among its core customer base while opening it up to new consumers.

Secondly, the company’s investment in research and development has delivered technologically advanced and performance-enhancing products. This is the foundational capability of the business and remains a key area that ANTA must focus on.

Finally, its broad retail footprint. This allows for wide market coverage and accessibility, a requirement in the Chinese market given its size and cultural differences. This allows the business to efficiently market the various brands, as well as exploit Western markets (FILA), maximizing operational investment.

Apparel Industry

Brands differentiate through product design and marketing strategies in particular, as well as pricing and reach.

ANTA faces competition from domestic and international sportswear brands, including Nike (NKE), adidas (OTCQX:ADDYY), Li Ning (OTCPK:LNNGF), and Under Armour (UA).

Investment in Sports by the Chinese Government, including the various Olympic events in the country over the last few decades, has contributed to increased interest in sports and fitness activities. This is driving demand for sportswear and athletic products, especially when positioned to be worn flexibly. The flexibility is a reflection of the athleisure trend, where consumers are looking for athletically-functional products that can also be worn casually.

Further, the online sales channel continues to grow rapidly, as technological incorporation in society increases, offering opportunities to reach a wider customer base and also generate lucrative returns (reduced overheads associated with sales). Growing its e-commerce channel has been a focus for ANTA, with percentage sales through this channel increasing to 34.3% in 2022 compared to 28.6% in 2021.

Expanding into global markets, especially in Southeast Asia and emerging economies, to diversify revenue streams represents a key opportunity for the business. ANTA has made clear this is a key focus for the business, utilizing its operational expertise to gain a foothold in new markets. ANTA currently has exposure to global markets through its ownership of Amer Sports (Owner of Wilson tennis rackets) and is rumored to be considering a listing of this business.

Introducing new product categories, such as accessories and outdoor gear, also represents a key growth opportunity for the business. In the West, we have seen increased limited-run partnerships, such as Nike & Travis Scott. Replicating this approach with its products could generate near-term hype, contributing to cross-selling.

Economic & External Consideration in China

The Chinese economy has had a difficult few years. Following the onset of the Covid-19 pandemic, the country has struggled with various lockdowns, as the Government remained stubborn with maintaining its zero-Covid policy. This was finally stopped in 2022, which was followed by a rapid increase in cases, but conditions look to be normalizing.

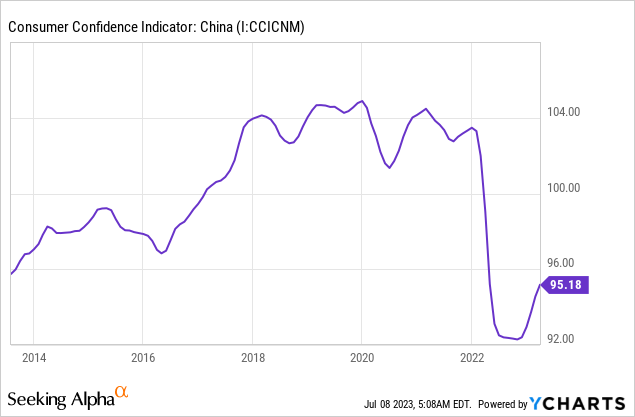

As a result of this, Consumer Confidence has been low, as illustrated in the below graph. Consumers have been defensive with their finances, and lack a reason for purchasing outerwear. This is likely a primary reason for the reduced growth in recent years, with only 9% (only relative to past) growth in FY22.

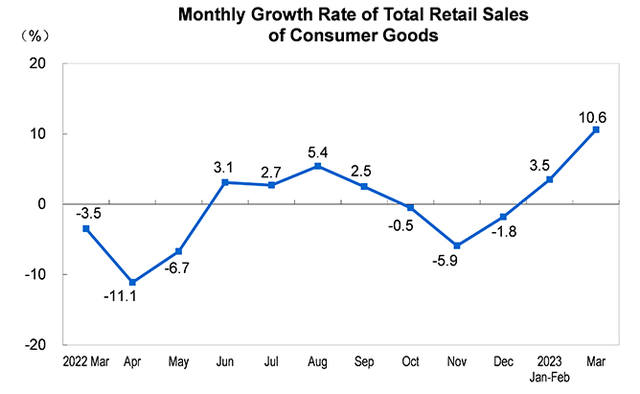

The improvement in economic conditions is reflected below, with monthly growth in retail sales picking up since Dec22. This is almost certainly a resurgence in the belief that the impact of Covid-19 is now over, and greater freedom to return to a normal way of life. We believe this trend should continue in the coming quarters, similar to the growth spurt the West experienced post-lockdowns.

Retail Sales of Consumer Goods (NBS China)

These factors should support healthy near-term performance, with a scope for double-digit growth in FY23.

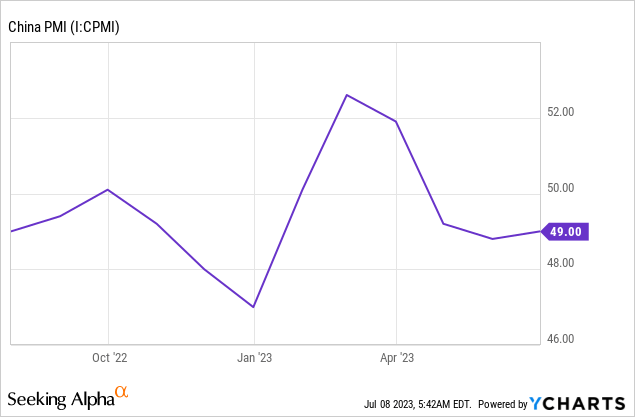

This said, it is worth highlighting that the Chinese PMI has unexpectedly declined from its Mar23 level, implying inherent weakness in the Chinese market. The country still has progress to be made before returning to its strong growth trajectory.

Further, we believe the changing attitudes of the Chinese Government could support growth in the coming years. As part of Xi’s Common Prosperity drive, there has been increased focus on the Chinese developing the Chinese, to prosper together. This involves a crackdown on various industries that are deemed harmful to the public, as well as an increased focus on supporting domestic industries. We do not think it’s coincidental that Western brands have seen slowing growth, as ANTA believes consumers are increasingly choosing to shop for Chinese-branded products.

Margins

ANTA’s margins are highly impressive. The company has a GPM of 60% and an EBITDA-M of 23%. Margins have trended up in the last decade, although has experienced a recent decline.

The strong margins are a reflection of its impressive supply-chain capabilities in the country, allowing the business to exploit cheap labor.

The margin slippage in recent years is due to a number of factors. ANTA has faced supply disruptions, increased discounting, and increased costs due to the development of premium products. We suspect these pressures will subside in the coming quarters.

Balance sheet & Cash Flows

ANTA is conservatively financed, with a ND/EBITDA ratio of (0.6)x. This provides the business with sufficient capacity to conduct M&A to expand its global presence.

Inventory turnover has noticeably declined in recent years, contributing to an increase in its CCC. This is a purposeful increase in inventory held, in order to satisfy its direct-to-consumer strategy.

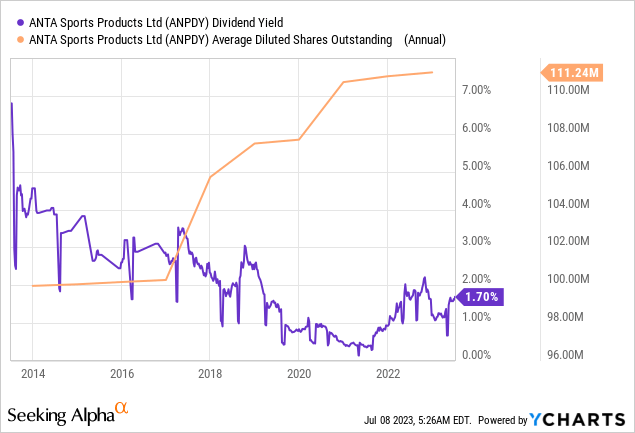

Despite this, FCF has improved during the historical period, reaching a substantial level. Management has been conservative with distributions, contributing to a large accumulation of cash.

Industry analysis

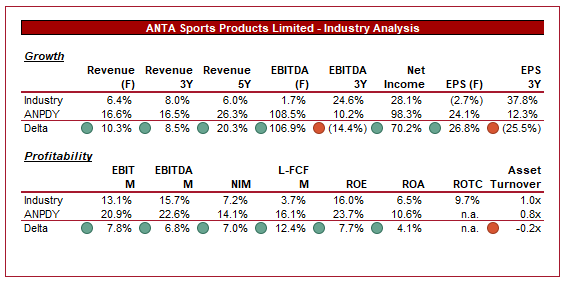

Apparel industry (Seeking Alpha)

Presented above is a comparison of ANTA’s growth and profitability to the average of the Apparel, Accessories, and Luxury Goods industry, as defined by Seeking Alpha.

ANTA performs extremely well, significantly outperforming based on both growth and margins. This is a reflection of its core competencies (and less competition), with the business operating at a significantly lower production cost, in conjunction with its strong brand presence in China. Critically, ANTA is efficiently allocating resources relative to the peer group, with a substantially higher ROE and ROA.

The business is superior relative to its Western peers.

Key risks with our thesis

Usually, we would discuss the key risks to our thesis at the end of this paper, but with a business like this, it must be discussed beforehand as it will materially impact ANTA’s valuation.

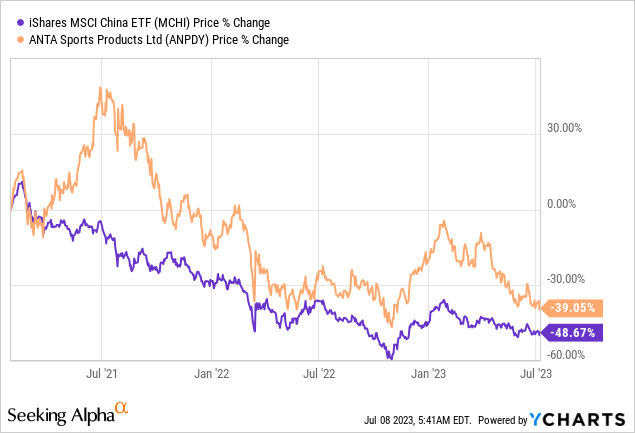

Chinese stocks, especially those with Western listings, have taken a battering in the last few years, due to fears around Government regulation, the continuation of the Chinese economy’s trajectory, and a fear of de-listing/Western regulation. ANTA is currently listed in Hong Kong.

According to a BlackRock analyst, “There is a confidence problem in China”. Westerners are far more hesitant with investing in the country given the issues in recent years. A factor that would drive investors back is a slowdown in aggressive regulation and a return to prosperity. In our view, the former has occurred. The Chinese Government saw the impact of its crackdown on the housing market and now likely understands that a heavy hand will kill any hope for growth. More recently, it looks like a resolution to the Alibaba (BABA) and Ant Group situation is ahead, improving sentiment.

Given the power of the Government in the economy, no amount of communication can derisk the concerns around Government action. For these reasons, it is significantly more risky to invest in Chinese stocks.

Valuation

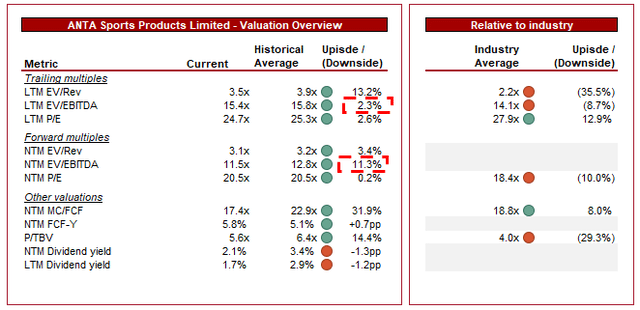

Valuation (Capital IQ)

ANTA is currently trading at 15x LTM EBITDA and 12x NTM EBITDA. This is a discount to its historical average. Further, ANTA is trading at a small premium to the peer group we have chosen.

Based on this, we believe ANTA is attractively priced. Compared to its “historical” position, ANTA has significantly improved, namely through greater scale at similar margins, and the development of its brand.

Relative to peers, the business deserves a premium due to its clear financial superiority. The business is substantially outperforming these businesses.

The key consideration is the value deduction attributable to the risks around China. Based on its financial performance, we believe a c.25% premium is justifiable to its peer group. Based on this, there is currently a c.35% upside before reflecting this risk. Investors should consider their own risk appetite but we believe the stock market concerns with Chinese stocks have likely peaked.

Final thoughts

ANTA is a highly attractive business. The company is highly profitable, growing incredibly well, and its brand is developing positively. We expect a continuation of its current trajectory and a premiumization of the business, supporting its strong returns. The key risk with the business is the actions of the Chinese Government. At its current price, however, we believe the stock is attractive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here