Investment Summary

Antero Resources Corporation (NYSE:AR) is an independent firm that explores and produces natural gas and oil properties, mainly situated in the Appalachian Basin. The company’s approach involves developing and managing top-notch assets with a cost-effective structure and operational efficiency, all while maintaining a robust financial position which has helped them maintain a buyback program.

The buyback program for the company which was announced to increase in size also is perhaps one of the main drivers behind a long-term position in the company being intriguing. The volatility in commodity prices has led to revenues being a little inconsistent. In 2022 the company had just shy of $9 billion in revenues and directed 50% of FCF to buy back shares. For 2023 I think it’s fair to estimate that the revenues will be lower, as oil prices are unlikely to see the highs of $120 if there isn’t a catalyst to set it off. Where I see the value in AR and the reason I will be rating it a buy is because of the long-term value I see an investor can get from such a dedicated share repurchase program. FCF should be continuously generated as the need for natural gas and oil will be here for a long time, and margins in the business remain high.

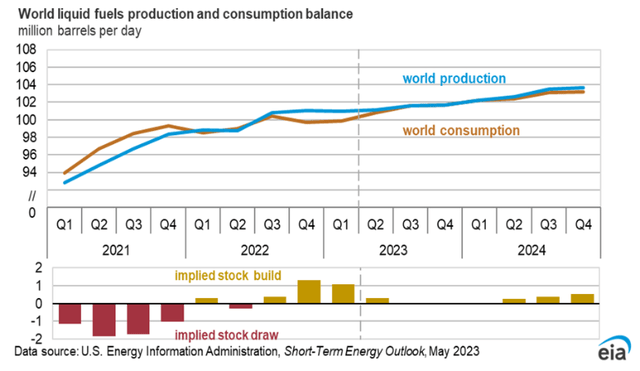

Natural Gas And Oil Demand Will Recover

As previously mentioned, it is unlikely that we will completely transition away from oil and natural gas in the near future, as several major trends still need to shift. However, emerging markets such as India may provide new sources of demand for these resources, even if demand in the US slows down. While AR may not necessarily set up projects in India, there will likely be continued global demand that keeps the company in business, both the Chinese and the American markets will still heavily be consumers of oil. Additionally, natural gas demand in the US is set to recover in the coming years as production is reaching new record highs, contradicting the notion that we are moving towards a greener society.

Oil Outlook (IEA)

To capitalize on this trend, Antero Resources is allocating a lot of capital to shareholders through buybacks. While the environment may be shaky, estimates suggest that oil will recover even if sentiments remain negative, as people want to rid themselves of the need for non-renewable energy sources. Antero Resources is also positioning itself to get ahead of the trend that eventually we won’t need oil and gas in our societies, but as mentioned, this is still far away. One of the current ways the company has set itself apart is the diversification of its production and exports which leads to the possibility of a premium pricing for the company. They also have one of the lowest breakeven prices in the industry, sitting at $2.51 right now for natural gas, which makes them a great company to be in when times are tough and prices are less favorable. But this also means they have more upside for margins too when prices see a rise.

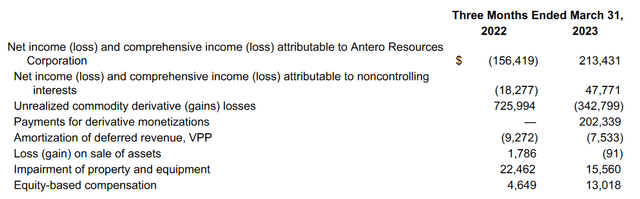

Quarterly Result

Looking at the last earnings report from the company they did see quite a big decrease YoY in terms of the adjusted net income, which came in at $156 million, compared to $360 million the year prior. Some of the main reasons for this was that the previous year the company had $169 million in “tax effect of reconciling items” which helped boost the adjusted net income to $360 million in the end. One of the bonuses for this last quarter though was the company’s ability to generate $342 million in “unrealized commodity derivatives”, which greatly helped keep the bottom line positive.

Income Statement (Earnings Report)

The company did with everything the laureate had a great job at keeping up margins despite the lower oil prices. The CEO Paul Rady has the following to say, “Our first

quarter results highlight the outstanding execution by our employees and the strength of our

asset base. Antero’s consistent and repeatable operating performance reflects the high-quality acreage position that we have built over the past decade”. The company has truly been able to build up a solid business framework that doesn’t budge against commodity prices.

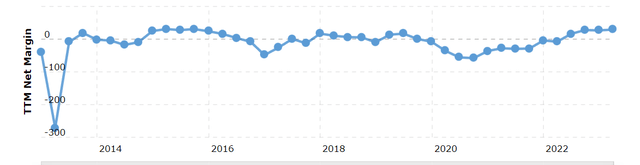

Net Margins (Macrotrends)

Moving forward I think it will become extremely important to see the cash flows and estimate how they will develop. Seeing as the main driver for appreciation in investment was the share buyback, the cash flows will be a direct reflection of how much share repurchases we might see. Historically the company has dedicated 50% of it to this cause. A decrease could mean a slide in the share price but an increase could help be a catalyst. Although the p/e sits quite in line with the overall sector right now at around 13 – 14.

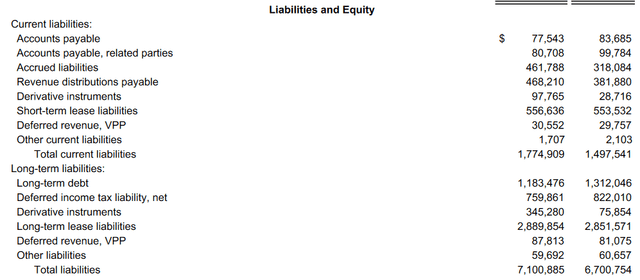

Financials

Looking at the financials of the company, they have seen a slight decrease in the total assets of the company, going from $14.1 billion to $13.8 billion. Primarily due to a decrease in the accrued revenues of the company, which went from $707 million to $379 million, a fact caused by the decrease in oil prices over the last 12 months. But fluctuations like this haven’t done much to harm the ROA of the company, which still sits at around 16%.

Company Liabilities (Earnings Report)

Moving over to the long-term debt the company holds, it has been increasing on a YoY basis by around $200 million, reaching $1.3 billion. Although this number is trumped by the long-term lease liabilities sitting at $2.8 billion. For the debt specifically, I do not see a risk of the company defaulting on any, as the FCF for the last 12 months was over $800 million, and as oil prices are expected to recover slightly as said in a segment above here, I think the sheer cash flows the company has will help keep debt at bay. As with a lot of companies in this sector, they tend to hold a lot of assets compared to liabilities and AR is no different, more the 2x as many assets as compared to liabilities. I want to highlight the solid financial state a bit further by mentioned the net debt/EBITDA for the company right now is just 1.18. As I said before I expect 2023 to be a decline for the company in terms of revenues which of course will make this number go up as it uses the TTM information. The ceiling is 3 and I don’t think there is a strong chance of the company hitting this anytime soon. All in all, AR seems to be in a very solid state financially and I expect them to be able to keep up the buyback program and divert cash there.

Valuation & Wrap Up

I mentioned before that the valuation of the company remains quite in line with the industry with the forward p/e sitting at 13. It’s a lot higher than the TTM p/e of 4, but it’s a result of the less favorable oil and natural gas prices for 2023 and perhaps in 2024 as well compared to what we experienced in 2022.

Stock Chart (Seeking Alpha)

Where there still is value to be had is the p/b sitting at 0.92 on a forward basis. Where I will be looking in the coming quarters is the cash flows and how well the company does at keeping margins up. So far the net margins have been stabilizing around 25 – 27% margin which does leave room for a drop if prices become even less favorable. But where I find reassurance in the long-term prospects of the company is the stability and uptrend the margins have had over a long period of time. As mentioned, the cash flows will be a key indicator of the possibility of a return by investing as the company is diverting 50% of it to buy back shares. But I believe in the quality of AR and that they will benefit from a continued demand as oil and natural gas won’t leave us for a very long time.

Read the full article here