By Robert Carnell, Regional Head of Research, Asia-Pacific

Since February, Asian exchange rates have not been tracking EUR/USD as closely as they did last year. We look for economic answers to this conundrum and consider how long this may last.

What’s up with Asian FX?

We spend a lot of time and effort forecasting individual Asian currency pairs against the US dollar. But most of the time, if you have a good idea where EUR/USD is headed, that’s all you really need to know.

However, this year, Asian currencies have been showing more individuality and bucking the major EUR/USD trend, which has taken the USD erratically weaker.

If we can figure out why, then we have a shot at answering whether this recent trend will continue, or whether Asian FX will revert to the broader FX theme of USD weakness.

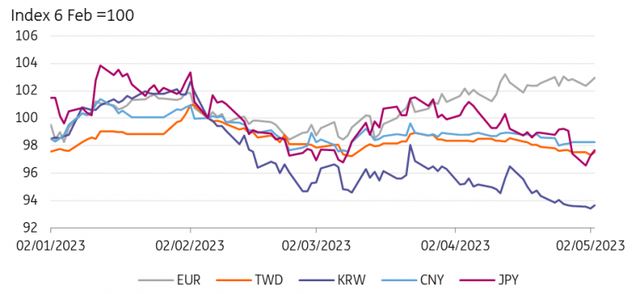

Asian FX versus EUR/USD

Source: CEIC, ING

The really obvious explanations don’t fully stack up

The first thing to note is that this is mainly a North Asian phenomenon. Unlike the euro, most of the currencies of North Asia are today no stronger, and usually somewhat weaker, against the US dollar than they were in February. In contrast, Indonesia’s rupiah has actually outperformed the euro over the same period.

The timing of this is also worth considering. Using the high-beta Korean won as our benchmark for the region, the FX weakness looks as if it started in early February.

Though in fact, the real divergence with the euro for North Asia’s major currencies occurred between 23 February and 3 March. This is important, as some have suggested that what is going on is a function of the problems in US banks (Silicon Valley Bank was closed on 10 March).

It is quite possible that the banking crisis may be compounding an existing issue, and it is also entirely possible that the rise in risk aversion has resulted in emerging market Asian outflows – but mainly from North Asia?

If anything, we’d imagine that this, and also concern about the US debt ceiling, would be more likely to lead to these large current account surplus economies selling US Treasuries and bank stocks and repatriating – hardly the stuff of currency weakness.

All of this also predates US Federal Reserve Chair Jerome Powell’s short-lived threat to keep hiking rates at 50bp increments (7 March), as well as confirmation and most of the preamble surrounding Bank of Japan’s (BoJ’s) appointment of Kazuo Ueda as the new Governor (10 March).

That said, there has been some simmering down of BoJ policy speculation that took off at the end of 2022 and implied Japanese rates have declined over this period.

This will have helped keep the Japanese yen soft during the early part of 2023 as Ueda has proved to be patient with respect to the BoJ’s existing policies. It may also have weighed on currencies such as the Korean won.

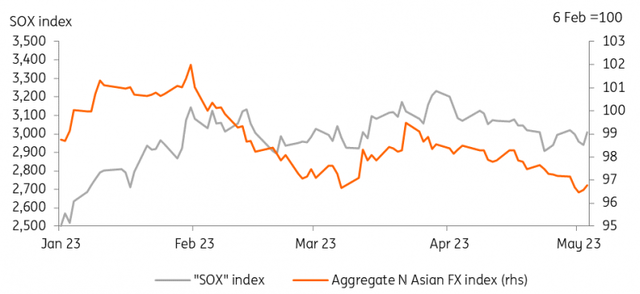

“SOX” and aggregate North Asian FX index

Source: Asian FX versus EURUSD

Is geopolitics playing a role?

There has also been a lot of geopolitics at the beginning of this year. The US offered a major arms deal to Taiwan. And China’s Two Sessions meeting in early March didn’t deliver any major stimulus pledges, disappointing markets.

At a sectoral level, the global semiconductor industry (which brings the focus back towards North Asia), has also been struggling over this period (see the Philadelphia semiconductor index chart).

Sales have been falling globally, with rising inventories and falling prices, not helped by incremental sanctions on Chinese high-tech companies and the cross-border restrictions on third countries which build on the 2022 Chips Act.

For at least part of the period we are concerned about, the SOX index does seem to move closely in line with an aggregate index of North Asian currencies, so this is probably part of the answer, though we doubt it is the whole story.

Where do we go from here?

The conclusion we seem to be drifting toward is that no single factor accounts for the deviation of North Asian currencies from their South and South-East Asian counterparts or benchmarks like EUR/USD. And though this makes it a little trickier to determine a turning point, we can offer a few thoughts on the likely path ahead.

The BoJ’s rates policy may prove to be pivotal especially when you consider the scale of Japan’s US Treasury holdings and the prospects for some end-of-year Fed easing.

The JPY is also a major currency anchor in the region for currencies such as the KRW. We don’t think the BoJ will lift its negative rates policy until next year though, but as we get closer to 2024, speculation may well lift the yen.

The China macro story is also looking somewhat weaker into the end of the year, though, at some stage, construction is likely to offer more of a lift to the industrial sector than it is currently doing.

Optimistically, this is a second-half 2023 story, and the same goes for the semiconductor cycle (most relevant for the Taiwan dollar and Korean won), which we expect will also bottom at some point in the second half of the year.

That said, we see little prospect of a decline in US-China tensions or ratcheting back of the tech war, and overcapacity in the semiconductor industry may also become an issue going into 2024.

Putting all this together, it is probably right to be a bit more constructive for North Asian FX over the second half of the year, but equally, any rebound looks likely to be fairly modest by previous standards.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here