Investment Thesis

Ball Corporation (NYSE:BALL) produces aluminum packaging for the beverage, personal care, and household goods industries in the United States, Brazil, and worldwide. Due to the current inflationary scenario, the organization has recently borne the brunt of reduced customer spending. Rising costs and supply-chain problems are also weighing on company profit margins. However, volumes will likely increase in the future due to customers’ increased preference for aluminum over plastic.

Besides the inflationary environment, BALL is experiencing another major headwind with its high debt level. I believe these headwinds, both the inflationary environment and the debt levels, pose a major investment risk to this stock. However, with the optimism that comes with the changing consumer preference for aluminum packaging, I expect demand for its products to grow; hence, sales will likely increase. For the debt problem, the company is exploring selling its aerospace unit in a bid to raise more than $5B, which would be used to lower its debt. Should this transaction go well, the company’s debt would improve significantly, lowering the debt risk. In light of these developments, I am optimistic about the company’s long-term prognosis, but until this major transaction takes place, I am skeptical about investing here.

The Rise Of Aluminum Packaging: A Potent Symbol Of Rising Demand

Moves to reduce plastic packaging to protect the environment are increasing demand for aluminum packaging. The aluminum industry is striving to persuade food and other packagers that aluminum is a more environmentally friendly alternative to plastic. Due to its superior recycling capabilities and distinctive brand-building qualities over other materials like plastic and glass, aluminum is a popular choice for food packaging. It is infinitely recyclable compared to plastic and paper while being lighter and sturdier than glass. Additionally, aluminum has a number of benefits when used for packaging; one of its best attributes is its high degree of barrier protection.

Even as a very thin foil, aluminum creates a perfect barrier against moisture, light, and oxygen. This uses relatively little material while maintaining the quality, safety, and aroma of food goods that are packaged within it. Aluminum packaging protects food from bacterial contamination, oxidation, moisture, and light, all of which can damage the integrity of the product.

The Aluminum Cans Market is estimated to increase at a CAGR of 3.93% between 2023 and 2028, from $54.62 billion in 2023 to $66.23 billion by 2028. Further, there are regulations which have been put in place aimed at ensuring environmental sustainability, which in my view, bodes well for the adoption of aluminum as a packaging material in the long run.

The Debt Situation

When determining how risky a stock is, it is critical to consider debt because too much debt may sink a corporation. Businesses get into trouble when they can’t pay off their debts and other liabilities with cash on hand or by cheaply acquiring capital. A corporation could go bankrupt if it cannot meet its debt obligations. However, it is more common (though still costly) for a firm to dilute shareholders at a low share price to get their debt under control.

Of course, debt has its advantages, as it can represent low-cost capital, especially if it allows a company to avoid dilution while still retaining access to lucrative investment opportunities. The good thing about debt, of course, is that it can be a cheap source of capital, especially when it replaces dilution in a company and lets it spend at high rates of return. When figuring out how much debt a business has, the first step is to look at its cash and debt in tandem.

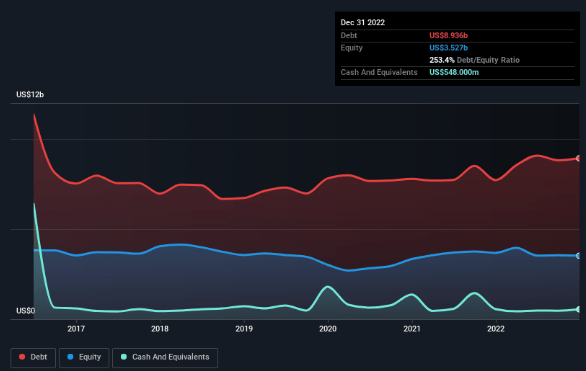

Ball’s debt was $8.94b as of December 31, 2022, up from $7.72b a year earlier. The company had cash of $548.0m, resulting in a net debt of about $8.39b.

Wallstreet

Ball had $7.01b in obligations due within a year and $9.37b in liabilities due beyond that, according to its balance sheet data. However, it had $548.0m in cash and $2.59b in receivables that were due within a year. In other words, its outstanding obligations were $13.2 billion more than its cash and short-term receivables add up to.

When compared to its massive market value of $15.7b (as of December 31), this shortfall is huge, and therefore investors should keep an eye on its usage of debt. If the corporation urgently needed to shore up its balance sheet, this would indicate that shareholders would be substantially diluted. Debt likely can’t be paid from book profits; thus, it’s important to see how much of EBIT is supported by free cash flow. Ball’s free cash flow has been significantly negative during the past three years. This makes the debt significantly riskier, yet it may be the outcome of growth-oriented spending.

In conclusion, its performance in turning EBIT into free cash flow fell short of expectations. Furthermore, the entire amount of its liabilities does not inspire confidence. I believe that its balance sheet poses a significant threat to the company.

A Prospective Sale Of Aerospace Unit: A Possible Solution To The Debt Problem

Ball is considering selling its aerospace and national defense hardware division, which includes sensors and antennas, for more than $5 billion. Its aerospace division accounted for 13% of consolidated net sales in 2022, so selling it off would help the company refocus on its beverage packaging operations while reducing its $9 billion in debt. The aerospace division has been auctioned by the company in recent weeks, drawing interest from huge defense corporations like BAE Systems (OTCPK:BAESY) and Textron (TXT) and private equity firms.

In Friday afternoon New York trade, its stock jumped 7% to $58.57, valuing the company at over $18 billion. This increase can be attributed to optimism over the company’s anticipated unit sale, which, if completed, will likely assist in reducing its debt load.

Dividends

This company’s latest announced dividend stands at $0.20. Even a modest dividend yield can be appealing if it is stable over a long time period. Earnings were sufficient to fund the dividend prior to the announcement, but free cash flows were negative. It may be difficult, if not impossible, to return capital to shareholders if there are no cash flows, which could put a strain on the balance sheet. With the current payout ratio of 29.63%, I find the company’s dividend policy sustainable since most of its earnings are retained for development.

The dividend payment history of the corporation is stable and long-lasting. In 2013, the annual payout was $0.20; in the current year, it was $0.80. This amounts to an average annual growth rate [CAGR] of about 15% within that time frame. Positive dividend growth and a lack of dividend cutbacks over a lengthy period of time are encouraging.

In spite of the fact that the dividend wasn’t reduced this year, I don’t think this company is a fantastic dividend stock. Earnings are sufficient to meet obligations, but cash flows are insufficient to support growth. If you plan to rely on the dividends from this investment, I would advise some caution.

My Final Thoughts

Although this company has a very promising future harbored in the rising demand for aluminum packaging and the potential sale of its aerospace unit, it has some major risks, especially its worrying financial obligations amid a very weak cash flow trend. Additionally, its dividend policy, though stable and sustainable, as a result of the absence of sufficient cash flows make it unreliable in the long run. Much as I may agree that the potential sale of its unit may revert some of these worrying aspects, the deal is nowhere near completion, and therefore the status quo prevails. Further, the current inflationary environment disrupts supply chains and makes operating costs more expensive, resulting in low margins. Should these headwinds persist, things could worsen for the company, potentially causing a plunge in its share prices. In light of these adversities preceding an optimistic outlook, I think waiting for the company to stabilize would be an excellent move to mitigate these risks.

Read the full article here